Bitcoin saw some recovery in this morning’s Asia trading hours after a bearish Monday that saw BTC/USDT dip nearly 3% to US$29,780.

At the time of writing, the pair had added 1% to US$29,800.

30k is naturally the bulls’ target, where Binance’s order book shows the most amount of selling pressure, and also the psychological price point coveted by investors long on BTC.

Bitcoin (BTC) recovers from bearish Monday – Source: currency.com

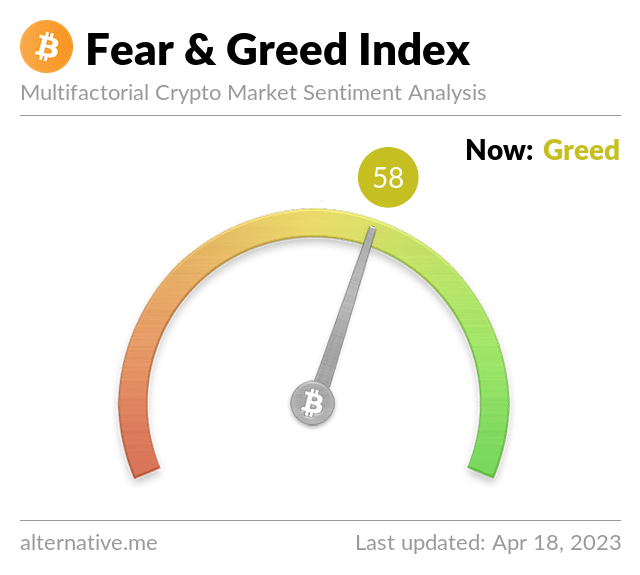

Sentiment appears firmly on the buy side, though the Crypto Fear & Greed Index, which tracks volatility, market momentum, social media coverage and bitcoin dominance, moved down from 68 points to 58 points overnight.

Speaking of dominance, bitcoin’s share of the market has fallen by two percentage points – from 48.85% to 46.85% – in the past seven days, mainly due to the tear Ethereum (ETH), the world’s second-largest cryptocurrency, has been on.

Since the Shanghai upgrade six days ago made Ethereum’s staking protocol full active, ETH/USDT has rallied over 11%, bringing the pair to US$2,100 at the time of writing.

ETH climbed as high as US$2,141 in recent days, but Monday’s sluggish -2% performance pared the crypto-asset back a little.

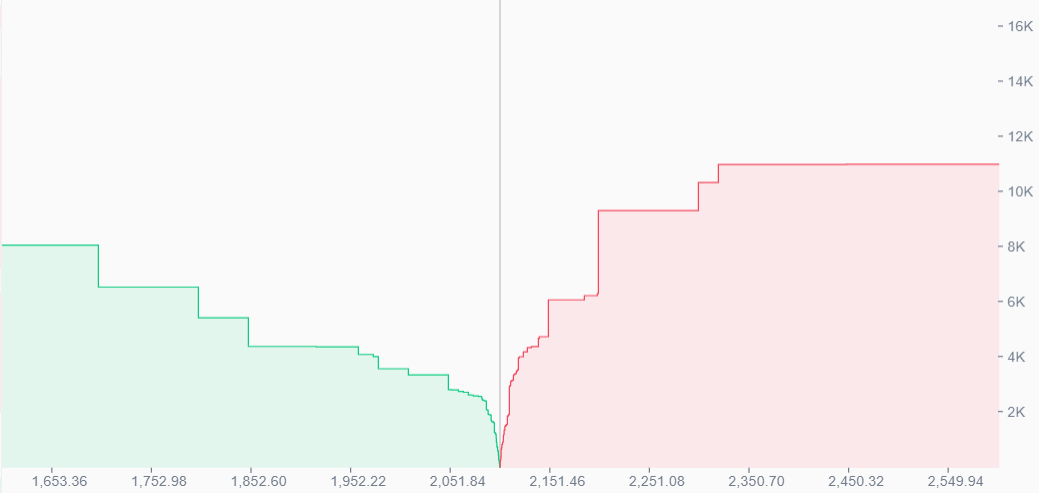

Binance’s order book shows a significant sell wall at US$2,200, making a move higher a challenge for ETH bulls.

Order books are a good way of finding where selling pressure creates resistance – Source: binance.com

Ether’s bullishness is most evident in the ETH/BTC pair, which has rallied 13% since the Shanghai upgrade.

Week-on-week, ETH remains 9% in the green while bitcoin fell into the red zone in the past day.

Among the altcoins

Arbitrum (SRB) is on a rip, adding 10% in today’s trades to bring the recently launched Ethereum Layer-2’s market capitalisation to an all-time high of US$2.27bn.

Arbitrum, which serves as a scaling solution for Ethereum, clearly enjoyed a strong bounce following the Shanghai upgrade.

Another Layer 2, Optimism (OP), is also performing well by adding 15% week-on-week.

In the blue-chip altcoin space, Solana (SOL) and Avalanche (AVAX) have added double digits to their respective market caps in the past seven days, while Cardano (ADA) and Dogecoin (DOGE) are both around 8% to 9% higher.

Binance’s BNB coin and Polygon (MATIC) are at the bottom of the pile with low-single-digit gains.

Global cryptocurrency market cap stayed flat at US$1.27tn overnight, while total value locked in the decentralised finance (DeFi) space also stayed flat at US$53.2bn.