This is an Insight article, written by a selected partner as part of GIR’s co-published content. Read more on Insight

In summary

Cryptocurrency – it’s the hottest thing in investing. Or it was. With the values of cryptocurrencies plummeting, regulations tightening and high incidences of fraud, what can investors do to protect themselves and what are the emerging trends to be aware of?

Discussion points

- What are crypto assets?

- How big is the fraud problem?

- How are investors defrauded?

- Can investors protect themselves from fraud?

- What were the major factors impacting crypto in 2022?

- How are countries dealing with crypto regulation?

Referenced in this article

- China’s tough stance on crypto

- Global regulatory developments

- Asia regulation

2022 – the crypto winter

With a steady stream of calamities resulting in a significant downturn in asset prices, burnt investors are fleeing the cryptocurrency market and it is clear that the industry is witnessing a major slump. The term ‘crypto winter’ was first used in 2018 when the cryptocurrency market experienced a considerable downturn, and it made an appearance again in 2022. The past year has seen the price of popular digital assets such as Bitcoin and Ethereum slide from record highs. The decline started with the meltdown of TerraUSD (UST), when its price plunged to 10 cents and, along with its sister coin, Luna, lost almost US$40 billion of value in a week. Before the crash, Luna was one of the top 10 largest cryptocurrencies on the market. This event was the catalyst for a severe decline in cryptocurrency prices, with most tokens losing 50 per cent of their market valuation.

As the prices of various currencies witnessed a free fall, many front runners of the crypto industry faced collapse. Crypto lender Celsius froze all account withdrawals, while Babel Finance suspended withdrawals, citing unusual liquidity pressures. The crypto hedge fund Three Arrows Capital (3AC), which had invested heavily in UST, defaulted on its loan payments to the crypto lender Voyager and subsequently filed for bankruptcy in July 2022. Voyager, along with other lending platforms such as Genesis Trading, incurred substantial losses and significant withdrawals leading it to eventually file for bankruptcy. An article by CoinDeskin November 2022 stated that cryptocurrency exchange FTX Trading Ltd(FTX) had significantly overvalued its token, which accounted for a large portion of assets at Alameda Research, its sister trading platform. After a failed attempt by Binance to rescue FTX, the exchange collapsed due to a surge in customer withdrawals, and FTX filed for bankruptcy within days.

Amid all this turmoil, in January 2023 crypto market capitalisation faced one of its worst declines, falling 65 per cent from all-time highs in 2021. The result was an urgency among regulators to tighten legislation and crack down on corrupt and delinquent digital currency firms. In February 2023, the Securities and Exchange Commission (SEC) launched a series of enforcement actions against several operators, including Genesis and Gemini, over violating investor protection laws. The SEC also charged the founder of UST and Luna of misleading investors, and Sam Bankman-Fried, the founder of FTX, with additional criminal counts.

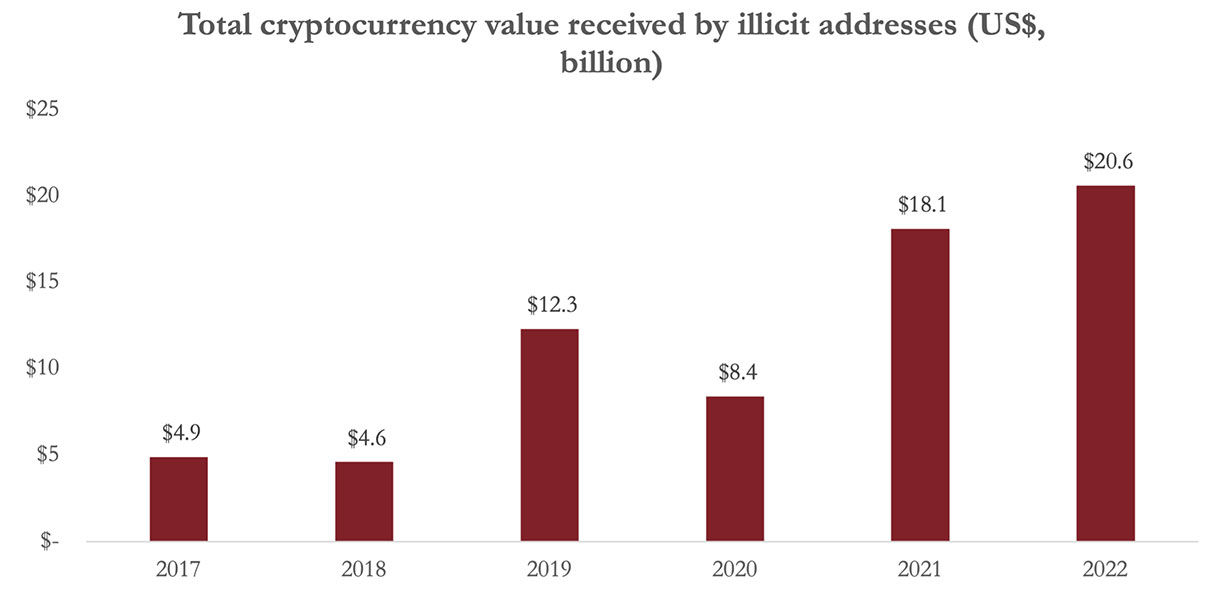

Crypto-related crime grew significantly, with the volume of transactions related to criminal activity sharply increasing. Illicit use of cryptocurrencies hit a record US$20.1 billionin 2022 as transactions involving companies targeted by US sanctions skyrocketed, making up 44 per cent of the year’s illicit activity. To combat this, the EU has drawn up an extensive set of new regulations for governing crypto, while other nations, such as the US and the UK, are still considering their options. In Asia, Singapore has established a stronger regulatory regime, while Hong Kong attempts to tread a fine line between protecting investors and offering crypto groups a business base.

Is this the death of crypto?

It seems not, as Bitcoin rebounded to over US$30,000 in April 2023, currently settling around US$26,000.The surging price comes at a time of deep uncertainty. There are theories that the price rise is a function of manipulation and propping up. Fears still continue to surround the security of customer funds, and new crypto investors are pivoting to crypto exchange-traded funds (ETFs) as a safer entry point to digital assets.

ETFs retain the allure for those investors interested in cryptocurrencies but are new to the asset class, aiming to give retail investors exposure to changes in digital asset values without the need to buy or hold them directly. Another trend grabbing the crypto industry is the use of artificial intelligence (AI) crypto tokens. AI cryptocurrencies are tokens that power AI blockchain platforms such as The Graph and SingularityNET.Users pay with tokens to use the platforms and access the benefits of the integrated AI systems. Identification technologies are also being explored, as is evident from the news that the CEO of Open AI,Sam Altman (who is working to obtain funding to create a secure global cryptocurrency called Worldcoin) is using eyeball-scanning technology to create a global identification system. These developments suggest that crypto prospects still hold promise.

What are crypto assets?

Cryptographic assets are transferable digital representations, designed in a way that prohibits their copying or duplication. The technology that facilitates the transfer of cryptographic assets is referred to as a ‘blockchain’. Blockchain is a digital, decentralised ledger that keeps a record of all transactions that take place across a peer-to-peer network, enabling the encryption of information. Cryptographic assets and the underlying technology provide opportunities to digitise a variety of ‘real world’ objects. Cryptocurrencies are the most commonly known subset of crypto assets, with Bitcoin being the most prominent.Today we have different kinds of crypto asset, such as non-fungible tokens (NFTs), synthetic assets, stablecoins and utility tokens.

The pace of development in the crypto industry has far outstripped regulators’ ability to respond. With social media, online forums, trading applications and many crypto exchanges, the potential is high for inexperienced investors to get burnt.

BitConnect, OneCoin, Bitclub Network, Axie Infinity, Pincoin, Thodex, Mining Capital, SushiSwap

These are some of the largest crypto scams in history, with more than 46,000 people reportedly losing over US$1 billion in crypto to scams between the beginning of 2021 and the first quarter of 2022, according to the Federal Trade Commission. Crypto scams are cons in which scammers use some tried and some new tactics to steal cryptocurrency. One of the most common scams is the investment scam, whereby fraudsters trick their victims into buying cryptocurrency and sending it to them. Among other tactics, scammers impersonate businesses, government agencies and love interests.

Criminals not only steal cryptocurrency, but they also use it to fund illicit activity. According to the 2023 Crypto Crime Report by Chainalysis, issued in February 2023, illicit transaction value rose for a second consecutive year in 2022, hitting a record US$20.6 billion. The Report classified a wide range of activities as illicit, including transactions linked to child sexual abuse materials, human trafficking, ransomware, stolen funds, terrorism financing, scams, cybercriminal administrators, darknet markets and sanctions.

Figure 1: Total illicit transaction value 2017–2022

Source: The 2023 Crypto Crime Report by Chainalysis

Fraudsters are attracted to cryptocurrency transactions as they are pseudonymous and generally perceived to be difficult to recover.

Typical cryptocurrency transaction methods include:

- purchasing cryptocurrency through a cryptocurrency exchange;

- receiving cryptocurrency as payment for legal or illegal transactions;

- purchasing cryptocurrency for cash at a cryptocurrency ATM; and

- exchanging fiat currency for cryptocurrency through informal peer-to-peer transactions.

Cryptocurrency transfers cannot be reversed, making them difficult to trace, and with most of the general public still unfamiliar with how crypto works, cryptocurrencies present a number of opportunities for fraudulent activity. Some of the most common types of crypto scams are as follows.

Bitcoin investment schemes

Scammers contact investors claiming to be seasoned investment managers. They are basically Ponzi schemes whereby managers claim to have made millions investing in cryptocurrency and request an upfront fee from potential investors.

Ransomware or blackmail and extortion scams

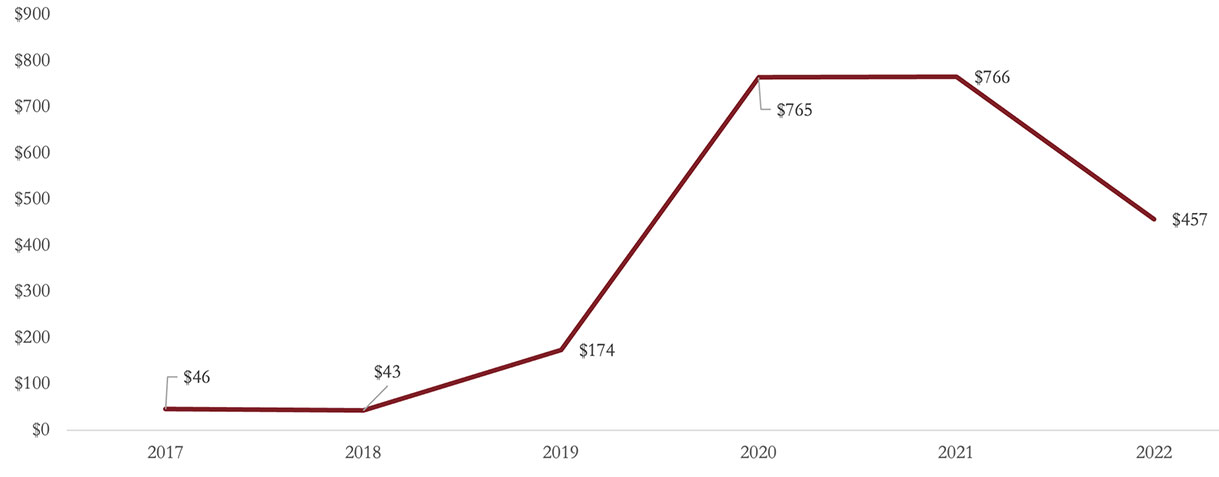

Ransomware starts with cybercriminals entering a system and encrypting data, then offering a decryption key if the victim agrees to pay a ransom through cryptocurrency. Extortions by ransomware attackers were down 40.3 per cent to US$456.8 million in 2022 from US$765.6 million in 2021.However, the decline is not attributed to a drop in attacks but rather on account of victims refusing to pay ransomware attackers.

Figure 2: Total ransomware value 2017–2022

Source: The 2023 Crypto Crime Report by Chainalysis

Rug pull scams

Rug pull scams occur when investment scammers pump up a new project, NFT or coin to get funding and promise massive returns to draw in hefty investments. However, the game changes as the funds from the project are drained abruptly. This type of scam is dubbed a ‘rug pull’. A total of US$26 billion was lost in over 600 cases to cryptocurrency and NFT rug pulls between the beginning of 2011 and June 2023.

Romance scams

There has been a recent increase in romance scams, in which the fraudster contacts the victim online, builds their trust, then solicits personal information.

Fake job listings

Scammers will impersonate recruiters or job seekers to get access to cryptocurrency accounts. The ‘jobs’ they are hiring for are often in the crypto field, including crypto mining and recruiting other crypto investors. The job seeker will have to make a payment in crypto to get started.

Fake cryptocurrency exchanges

Fake and unregulated cryptocurrency exchanges act as a legitimate exchange to commit a scam. When a victim attempts to withdraw funds, obstacles appear, such as unannounced fees and taxes to be paid.

Flash loan attacks

Flash loans are loans for short periods of time with the money-making trades carried out in one transaction and then the flash loan is repaid. These loans are popular in the cryptocurrency market as traders use funds to buy tokens on one platform with a lower price, and then sell that asset immediately on a different platform to make money. In February 2023, Platypus Finance was victim to a flash loan attack, resulting in a US$8.5 million loss.

Is consumer protection possible?

There are some ways to protect current or future investments.

- Trustworthy digital payment token service providers: investors should research their cryptocurrency exchanges before they buy crypto on them. Key parameters for choosing an exchange include that it: should provide relevant risk disclosures to retail consumers and follow proper segregation of customer assets; has processes for complaints handling; has not been hacked; and maintains high availability and recoverability of its critical systems.

- Secure crypto wallets:storing crypto in a secure wallet should offer protection. Other security strategies include maintaining strong passwords, spreading cryptocurrencies across different wallets, keeping the seed phrase safe in an offline location, using two-factor authentication and, if technical skills allow, holding both hot and cold wallets.

- Blockchains: there is constant risk of a 51 per cent attack, which means if a miner or a group of them get more than 50 per cent of the networks, they can control the mining hash rate.

- Know-your-customer (KYC) requirements: many countries now require currency exchanges to comply with KYC requirements or at least maintain records of customers’ identities. This allows fraud examiners and legal advisers to track the money through court orders or subpoenas.

- Regional regulation: the absence of a unified global regulatory frameworkis also appearing to be a threat. While the EU has enacted strict regulations to limit the use of cryptocurrencies, some countries (such as El Salvador) have fully embraced cryptocurrencies.

- Comprehensive white papers:investors should review every cryptocurrency’s white paper before investment. The white paper details the standard for every currency, the crypto’s use cases and scalability and the creator’s plans for the future.

The crypto crisis of 2022

UST

Terraform Labs endeavoured to utilise blockchain technology to construct a decentralised finance network. Do Kwon, a Stanford University graduate and a former engineer at Apple and Google, launched UST as an algorithmic stablecoin in 2018.

UST was supported by Luna, which functioned as a parallel floating rate cryptocurrency and was responsible for maintaining a peg of US$1. In March 2022, the value of Luna reached a peak of approximately US$120 per token, propelled by the potential of the UST/Luna ecosystem amid a surge in the cryptocurrency market.

In early May 2022, investors simultaneously withdrew their funds due to a loss of confidence in the tokens. Within a fortnight, the Terra stablecoin and Luna token continued their steep decline, leading some media sources to classify it as a potential Ponzi scheme or rug pull scam.

Whether a massive UST sell-off was a reaction to rising interest rates or there was a malicious attack on the Terra blockchain, is a matter of contention. A research report by Nansen, a company that analyses blockchain data, investigated the UST death spiraland it dispels the notion that a solitary attacker was responsible for the depeg. Do Kwon acknowledged the potential of blockchain and decentralisation, motivating him to reorganise the coin and launch a new version.

In September 2022, South Korea issued an arrest warrant for Kwon, while Interpol reportedly issued a ‘red notice’ for him. The SEC began an investigation of Terraform Labs in June 2022 to determine whether the marketing of the UST stablecoin violated federal regulations.

In September 2022, a US$56.9 million class action was filed in Singapore against Kwon, Terraform Labs, Nikolaos Alexandros Platias and the Luna Foundation Guard. In February 2023, US financial regulators charged Do Kwon and TerraForm Labs with ‘orchestrating a multi-billion-dollar crypto asset securities fraud’.

Ethereum fusion

Following UST’s demise, Ethereum, the dominant blockchain for smart contracts, underwent a significant transformation by switching from a proof-of-work to a proof-of-stake consensus system. This change reduced energy consumption by a remarkable 99.5 per cent, addressing concerns about blockchain’s environmental impact and improving network efficacy..

However, the shift to proof-of-stake also exposed Ethereum to potential regulatory challenges, as proposed bills in the US Congress sought to impose strict regulations on this type of blockchain. This severely impacted Ethereum’s innovation potential as a leading blockchain hub.

3AC collapse

3AC was launched in 2012 by classmates Su Zhu and Kyle Davies, focusing on emerging market currency trading.At one stage, the fund had an estimated US$10 billion under its management.

As of the end of 2020, 3AC became the largest holder of Grayscale Bitcoin Trust (GBTC) shares, with a position then worth US$1 billion,as the hedge fund could buy shares at a discount in exchange for Bitcoin.Shares were sold to ordinary traders at a premium price. However, with the advent of ETFs on Bitcoin in Canada, GBTC lost significant value.

3AC had invested in a wide range of instruments and projects, so its success was directly dependent on the growth of the crypto market. In addition to investor funds, other loans were also applied, which were invested in Luna and other less liquid coins.

As a result of these extremely unsuccessful transactions and the collapse of UST and Luna, a liquidity crisis arose. Kyle Davies tried to take out a new loan from Genesis in mid-June 2022 to cover his obligations. Sam Callahan of the BTC Savings Plan suggests that, at some point, the crypto fund turned into a Ponzi scheme, as the founders resorted to finding new investors and lenders as losses mounted.

3AC was ordered to liquidate in June 2022 by a court in the British Virgin Islands,and on 1 July 2022 it filed for bankruptcy in a New York court, owing over US$3 billion to creditors.

FTX collapse

In early November 2022, CoinDesk published an article that cast serious doubts on the stability of the FTX crypto exchange.The article referred to a confidential document obtained by the news site, revealing that approximately 40 per cent of the assets held by Sam Bankman-Fried’s personal hedge fund, Alameda Research, consisted of FTT tokensissued by the FTX exchange. Alameda’s total assets sat at US$14.6 billion, with the FTT tokens representing nearly 90 per cent of the company’s net assets.

Given the limited marketability of such a large amount of FTT tokens (in excess of US$5.8 billion), any liquidity requirements for repayments could lead to a run on Alameda’s balance sheet and probable bankruptcy.

What did FTX have to do with Alameda?

Both FTX and Alameda Research were majority-owned by Sam Bankman-Fried. With the collapse, previously undisclosed details regarding the relationship between these two companies came to light.

Lucas Nuzzi, head of research at Coin Metrics, conducted an analysis using open blockchain data and determined that the FTX exchange provided Alameda with US$4 billion in emergency funding using FTT tokens (conveniently issued by FTX itself).If Alameda were to face bankruptcy, the repayment of loans issued by the FTX exchange would be highly uncertain.

Panic ensued among FTX clients, with withdrawal volumes from the crypto exchange reaching US$6 billion by 8 November 2022.The FTT token had already experienced an 80 per cent decline since the beginning of the month. The exchange imposed restrictions on withdrawal amounts.

FTX’s largest competitor, Binance, announced its decision to liquidate the remaining FTTon its books, although within a few days it also said it wanted to fully acquire FTX.com.However, after a review of FTX’s finances,Binance withdrew its offer.

Alarming revelations included reckless lending practices, with FTX’s founder channelling over US$10 billion of customer funds into high-risk bets, while the CEO of Alameda Research displayed a lack of understanding regarding due diligence and risk management.

Further misconduct occurred behind the scenes, as nearly US$500 million was discreetly transferred out of the FTX exchange, indicating premeditated actions by those involved.The failure of FTX triggered investigations by the Justice Department and the SEC into whether FTX inappropriately utilised customer cash to prop up Alameda. Sam Bankman-Fried was detained in the Bahamas on 12 December 2022 for defrauding investors and lying to them. He faces eight criminal charges and up to 115 years in prison if convicted.

Impact on Bitcoin price

Between 7 November and 8 November 2022, Bitcoin plunged by 22 per cent in less than a day as investors struggled to gauge the impact of a potential FTX collapse. It fell below US$16,000 multiple times in the subsequent weeks.

Regulators are rushing to keep up

As cryptocurrency has evolved from a speculative investment to a new asset class, it has prompted governments to explore ways to regulate it. Different countries have different approaches, adding to the lack of clarity surrounding crypto regulation.

In the US, the crypto regulations are full of complications, as there are several regulators in charge of overseeing crypto companies. The Biden administration signed an executive order in March 2022 calling on federal regulators to assess the broad risks and benefits offered by cryptocurrencies. In January 2023, the administration released a roadmap to mitigate crypto risks.

The SEC has already moved towards regulating the sector with its widely publicised lawsuit against Ripple, alleging that it raised more than US$1.3 billion by selling its native token, XRP, in unregistered securities transactions. More recently, the SEC has been targeting exchanges such as Coinbase and Binance over their crypto products.

The EU has been more forward looking. It recently ratified the first cross-jurisdictional regulatory and supervisory framework for crypto assets.The law aims to ensure that crypto transfers can always be traced, and suspicious transactions blocked, as is the case with any other financial operation.

The UK is planning to introduce a sweeping new regulatory regime that aims to bring rules governing crypto tokens in line with those already in place for traditional financial assets such as stocks and bonds. However, the Financial Conduct Authority’s current regulatory remit over crypto is limited to making sure that crypto firms that operate in the UK comply with anti-money laundering and counter-terrorism legislation.

What about Asia?

In contrast to the rest of the world, countries in the Asia-Pacific region have demonstrated widely differing attitudes to the regulation of crypto assets.

China’s crypto shutdown

China’s crypto ban in September 2021 targeted three areas of digital asset dealing:

- Bitcoin mining: after China banned Bitcoin mining, it became illegal for Chinese residents and businesses to mine cryptocurrencies;

- crypto trading and transactions: Chinese investors are not permitted to buy, sell or transact in digital currencies such as Bitcoin or Ethereum; and

- employment in the crypto sector: if any tech companies or entrepreneurs deal with cryptocurrencies, they could face significant penalties.

Although it is illegal to use and buy crypto in China, there are no specific policies against holding digital assets such as Bitcoin, Dogecoin or Ethereum. However, it seems that Bitcoin is still being mined in China. The Cambridge Bitcoin Electricity Consumption Index noted that mining activity in China appeared on Bitcoin’s network in September 2021. In early 2022, China accounted for more than 20 per cent of Bitcoin’s hash rate, which is second only to the US. Mainland China was also the world’s fourth-largest crypto market in the year up to July 2022.

China has also been working on its ‘digital yuan’ currency, a state-sponsored virtual currency to track all currency movements. The digital yuan will be distributed by the People’s Bank of China to commercial banks, and commercial banks will be responsible for taking the digital currency into the hands of consumers. Consumers will have a service whereby they can exchange coins for digital yuan.

Is Hong Kong the new frontier for crypto?

According to the Worldwide Crypto Readiness Report, Hong Kong was the most ‘crypto-ready’ in 2022, topping all categories including the number of blockchain start-ups per 100,000 people and the number of crypto ATMs proportional to the population. Notably, this ranked it ahead of the United States and Switzerland.

The Hong Kong government has been relatively supportive of the sector and is more ‘crypto friendly’ than mainland China. The Hong Kong government ‘is very serious about building an international virtual asset centre’, said Xiao Feng, chair of Hong Kong crypto exchange HashKey, which saw 13,000 people attend the first day of its Hong Kong Web3 festival.

HashKey received a licence to operate in Hong Kong in November 2022, making it one of two licensed crypto exchanges in the city (alongside rival exchange OSL). Other companies that plan to establish or expand their presence in Hong Kong include exchanges KuCoin, Gate.io and Huobi, which announced plans in February 2023 to move its headquarters from Singapore.

The Hong Kong government also announced its funding support to the industry by earmarking US$6.4 million for developing its Web3 ecosystem. Hong Kong’s financial secretary, Paul Chan, also announced the formation of a task force dedicated to the development of virtual assets, composed of members from the policy bureau, regulatory bodies and the industry.

Acceptance of crypto as a currency in Gatecoin

In a ruling in March 2023,the Hong Kong High Court confirmed that cryptocurrencies constitute ‘property’ under Hong Kong law and are capable of being held on trust. The ruling was made in a legal dispute involving the crypto exchange Gatecoin, which collapsed in 2019. The court said that crypto assets have property attributes and are ‘capable of being held on trust’.

In light of the recent high-profile collapses of some major cryptocurrency exchanges, this decision provides helpful clarity on the legal treatment of cryptocurrencies in Hong Kong, particularly in a winding-up scenario. Law firms have noted that the new ruling could provide insolvency professionals with more clarity on crypto assets and means that crypto has property characteristics similar to other assets such as stocks.

As Hong Kong pushes to position itself as a global virtual asset hub, disputes surrounding crypto assets and associated technologies will only become increasingly common.

What did Singapore do?

The Monetary Authority of Singapore (MAS) is focused on building a responsible and innovative digital asset ecosystem.Its goal is to reduce potential consumer harm from cryptocurrencies and associated services by attracting businesses with excellent risk management capabilities and value propositions.

MAS encourages the growth of the digital asset ecosystem by supporting initiatives such as tokenisation and distributed ledgers, but also warns against the risky practice of speculation on cryptocurrencies. However, MAS is also taking measures to manage the risks of digital assets and restrict retail access to cryptocurrencies.

Cryptocurrency is not money

A recent judgment in Singapore involving 3AC set a precedent for the legal status of cryptocurrencies. Algorand Foundation filed an application to wind up 3AC in the Singapore High Court, seeking to recover US$53.5 million in cryptocurrency. The central issue was whether cryptocurrency could be considered a sum of money, which would determine Algorand’s status as a creditor and the validity of the application. However, the court rejected Algorand’s argument, stating that cryptocurrency is not considered ‘money’ for the purposes of a winding-up application, as determining its status would require extensive examination and was not appropriate in the context of insolvency.

Conclusion

As a result of the recent crises and collapse of some of the largest independent crypto exchanges, investors have lost billions of dollars. This has had a drastic impact on consumer business acceptance of new ideas and on the choice of businesses and investments, and has implications for policy and regulations. The majority of the bad actors have been taken out, and the price and market structure of Bitcoin had rebounded to a solid place as at the time of writing.

The failures of FTX, Celsius and Terraform Labs helped differentiate unregulated, centralised players that ran faulty and fraudulent businesses. It also signified the industry’s maturation, which will continue to advance as more regulations are implemented.

Many of the eruptions of 2022 would not have occurred if the digital assets sector had appropriate corporate governance structures in place. The absence of transparency and weak governance, together with a belief that crypto is fundamentally unique and therefore cannot be addressed with time-tested approaches, are major contributors to the industry’s downfall.

With the domino effect of the crypto crises resulting in crypto-service companies filing for bankruptcy, there is a need for the crypto ecosystem to align its activities closer with that of the traditional finance industry, benefiting from the lessons learned over centuries.

The major disruption caused in the past year has sparked an interest from market regulators to ensure monetary and financial stability as these assets become more widely adopted. The choices for regulators include an opt-in or pilot regime, a risk-based regime, a catch-all regime or a blanket ban. While a risk-based regime is likely the preferred approach, the common objective across all jurisdictions is the protection of users, market stability, the minimising of regulatory arbitrage, and a nimble and agile regulatory framework that efficiently accommodates the rapid market development and financial innovation that is prevalent in the class of crypto assets. Despite a troubled 2022, digital assets continue to evolve and remain a potent source of innovation, and market participants anticipate greater integrity in the crypto asset market in 2023.