Recently several cryptocurrency mining companies sued the U.S. Energy Information Administration (EIA) rather than respond to a survey on their energy use. After several instances in which energy-intensive proof-of-work cryptocurrency mining threatened to destabilize the grid and led to price spikes, the EIA, an agency of the Department of Energy, initiated a provisional survey of electricity consumption for U.S. cryptocurrency mining companies in February 2024. That initial survey was halted by the industry lawsuit, but the EIA will now proceed with a public comment process on reporting requirements for cryptocurrency miners, the first step toward establishing permanent requirements that miners report their energy use data.

Every other major energy-using industry reports this type of data to the EIA, so that the EIA can produce studies and reports to help utilities, grid operators, and regulators with their energy planning. As the EIA recognized, there is a compelling need for the cryptocurrency industry to begin to account for its growing energy demands, which have threatened to overwhelm current systems for ensuring reliable electricity service and raised electricity prices in states where they have significant operations.

Earthjustice and partners urged the EIA in 2022 to collect such data because the lack of transparency and regulation of these highly polluting and energy intensive operations means the public and regulators cannot fully understand the true impact of their operations on the grid and local communities.

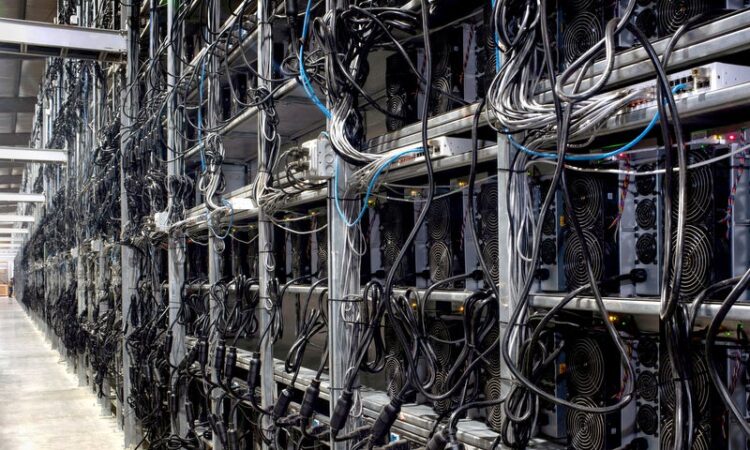

Cryptocurrency operations are huge and hard to track

Cryptocurrency mining is an extremely energy-intensive process that threatens the U.S.’s ability to maintain the stability of our grid and electricity rates, as well as our ability to reduce our dependence on climate-warming fossil fuels. In its February 2024 analysis, EIA estimated that cryptocurrency mining in the U.S. may represent up to 2.3% of total U.S. electricity demand.

Although cryptocurrency mining operations have become increasingly specialized, concentrated, price-sensitive, and capital intensive — and thus identifiable as a distinct class of business and energy user — it is difficult or impossible to find information about the scale, location, or fuel source of many cryptocurrency mining operations in the United States.

Cryptocurrency mining is largely invisible to U.S. regulators with little-to-no reporting requirements at either the state or federal level. Currently, the primary sources for publicly available information about cryptocurrency’s energy usage and environmental impacts are local journalists, company press releases, and Securities and Exchange Commission (SEC) filings for publicly-traded cryptocurrency mining companies. Among those the few companies that do file reports with the SEC, many do not disclose the locations or fuel sources associated with the miners listed in their financial reports, or when they do — provide only partial, selective, or misleading information, such as describing their energy supply as “environmentally beneficial,” “reliable, renewable” or as having “high emissions free content.”

The EIA has the legal authority to collect data on energy use from cryptocurrency miners, as it does from the manufacturing industry and other industries, in order to provide reports to inform energy planning decisions throughout the country. The reporting burdens are minimal.

Regulators and the public have the right to know this information because — as EIA noted — in times of peak demand such as cold snaps or heat waves, the energy demands of cryptocurrency miners can affect grid operations and cause blackouts and brownouts. It is not only appropriate for EIA to collect information on such a large consumer of electricity, but such collection is necessary for utilities and the public to have the information they need to appropriately assess the grid, climate, price, and local implications of the cryptocurrency mining industry in additional to individual operations.

If EIA does not collect and publicly release these data, existing impacts to the grid and to ratepayers will only worsen

Cryptocurrency mining threatens the grid

Take it from the grid operators themselves: last summer, the Texas state grid operator, ERCOT, warned that cryptocurrency miners “exhibited inconsistent behavior during resource scarcity events” that brought the grid perilously close to failure. ERCOT noted that lack of transparency and coordination about cryptocurrency miners’ energy consumption during both Winter Storm Uri and Elliot, and during heat waves, has impacted ERCOT’s ability to adequately forecast energy demand and response. ERCOT explicitly noted that crypto miners “have exhibited inconsistent behavior during Resource scarcity events” and if crypto miners “had not voluntarily curtailed on June 20, 2023 ERCOT would have been forced into Emergency Operations.”

The Tennessee Valley Authority (TVA), which covers large areas in seven states, has had to make significant adjustments to accommodate the growth of cryptomining and its impacts on electricity service and rates.

Last year in Kentucky, the Public Service Commission denied a proposed discounted electricity rate contract for a cryptomining facility out of concern that it could not be relied upon to curtail its load if needed during peak energy periods and that its demands on the grid would increase costs for all of the utility’s customers.

A government report on Winter Storm Elliott found that one of the major factors leading to deadly blackouts during the storm was the failure of utilities to reliably predict demand. ERCOT noted that lack of transparency and coordination about cryptocurrency miners’ energy consumption during both Winter Storm Uri and Elliot impacted ERCOT’s ability to adequately forecast energy demand and response. ERCOT is projecting that cryptocurrency mining will consume 37 GW by 2028.

Utilities and grid operators must have reliable, up-to-date information on cryptocurrency mining operations in order to maintain the stability of the grid, especially when energy generation may be scarce. Indeed, EIA has determined that there is an urgent need for this information, requesting emergency review and citing national grid monitor NERC’s 2023 Long-Term Reliability Assessment which warned that cryptocurrency mining has a significant effect on the grid.

Cryptocurrency mining threatens ratepayers

As cryptocurrency mining operations expand in the U.S., electricity prices spike for other ratepayers. We documented examples of this in Washington, New York, Kentucky, and more.

In Texas, Bitcoin mining has already raised electricity costs for non-mining Texans by US$1.8 billion per year, or 4.7%, according to conservative estimates from consulting firm Wood Mackenzie.

Similarly, a BloombergNEF report, ERCOT Market Outlook: Everything Depends on Bitcoin, found that energy prices in Texas will soar for consumers if Bitcoin mining continues its rapid expansion. Models show peak energy prices increasing by 30% in one scenario in which the amount of cryptomining peak load roughly triples, and increasing by around 80% in a scenario in which the amount of cryptomining peak load increases around sixfold. The report states, “ERCOT power prices will be a function of new bitcoin mining facilities.”

Ratepayers should not be left on the hook for the massive energy consumption of cryptocurrency mining. The EIA should collect this information to give grid operators, electric service providers, and the public full access to information about the size, location, and characteristics of cryptocurrency mining operations in the US.

The public deserves to understand the pollution impacts of cryptocurrency mining

In addition to impacting grid stability and electricity rates for customers, cryptocurrency mining keeps coal and gas plants online, causing local air and water pollution and long-term climate harm. Due to the lack of transparency surrounding information on cryptocurrency mining operations and how they procure power, it is impossible to precisely assess the emissions intensity of cryptocurrency mining operations in the U.S. The EIA consistently tracks and reports on the emissions intensity of power generation in the U.S., and it is appropriate for them to collect emissions-related information from cryptocurrency mining operations too. Earthjustice urged the EIA to collect the data both by expanding its Manufacturing Energy Consumption Survey (MECS) to include cryptocurrency mining, and by ensuring that its surveys of electricity generators capture information about direct service or behind-the-meter electricity diversion to cryptocurrency miners.

In addition to air and water pollution, cryptocurrency mining operations create substantial noise pollution in local communities, resulting in health impacts as reported in Arkansas and Texas. The public deserves information about these operations that impact their everyday lives.

The EIA must proceed with its efforts to gather and publish this information publicly so that host communities can accurately understand how their local environment may be impacted by cryptocurrency mining operations and so that the climate risks of this industry can be accurately assessed.

EIA must finalize requirements that companies report these data

EIA must move swiftly to collect and analyze this data as soon as possible. EIA announced that it will now seek public comment on data collection. This could proceed fairly quickly over a few months, but only if the agency prioritizes it. Cryptocurrency mining operations cannot be allowed to continue to conceal their energy use. Cryptocurrency miners’ inconsistent behavior during times of peak energy demand has brought the grid perilously close to failure in Texas, nearly forcing blackouts.

The EIA must move forward with requiring this reporting as quickly as possible, to protect public health and safety. Utilities and anyone who depends on reliable, affordable electricity should support the EIA’s effort to bring some transparency to this industry.