The United States Federal Reserve maintains the stance that crypto poses no threat to the stability of the United States dollar.

This assertion coincides with Bitcoin reaching nearly two-year highs, with a price point of $52,096.

Fed Governor Asserts US Dollar’s Ability to Withstand Crypto Challenge

A recent report states that the United States Federal Reserve views the ascent of China and the expansion of cryptocurrencies as non-threatening to the stability of the United States Dollar. Fed Governor Christopher Waller believes that the USD will remain strong.

“The status of the US dollar as the world’s reserve currency is likely to continue, despite threats posed by China’s rise and the growth of cryptocurrencies.”

The recent surge in Bitcoin’s price suggests to many industry insiders that we’re in a bull run. Bitcoin has seen an impressive 8.09% increase in the last five days, reaching $52,168. Similarly, Ethereum has surged by 13.45% during the same period, reaching $2,845.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

However, Waller contends that since the US dollar has not experienced significant impacts over the past 20 years or more, it should be fine this time around.

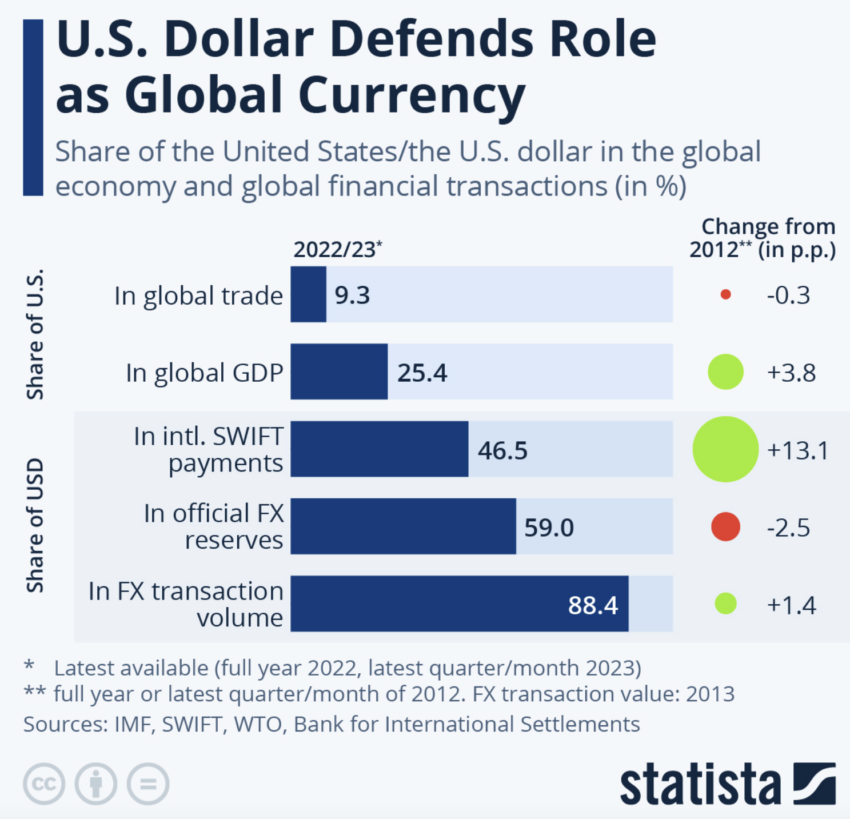

“By standard measures of an international currency’s use, there has not been any notable erosion in the dollar’s dominance over the past couple of decades.”

Statista recently reported that the US dollar maintains its leadership position among global currencies. Last year, it constituted 9.3% of global trade transactions and accounted for 46.5% of international SWIFT bank payments.

Crypto Poses Little Threat to the United States Dollar

The United States government has been drawing comparisons between the dollar and cryptocurrencies for some time now.

On February 8, BeInCrypto reported that the United States Treasury Department believes traditional cash transactions are favored by criminal organizations over cryptocurrencies, especially in regard to money laundering.

Read more: Crypto.com vs. Coinbase: Which Crypto Exchange Is Right for You?

Despite the increasing worries regarding the illicit use of crypto, a thorough risk assessment report emphasized that conventional cash remains the cornerstone of financial crime networks.

The report highlights bulk cash smuggling as one of the oldest yet most effective methods. This entails physically transporting US dollar banknotes across borders and depositing them into foreign bank accounts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.