Europe is well-positioned to become a powerhouse in crypto trading volume, according to a CoinWire study released Friday that forecasts major expansion for the cryptocurrency market.

Global Crypto Trading Volume Forecast With Europe Dominance

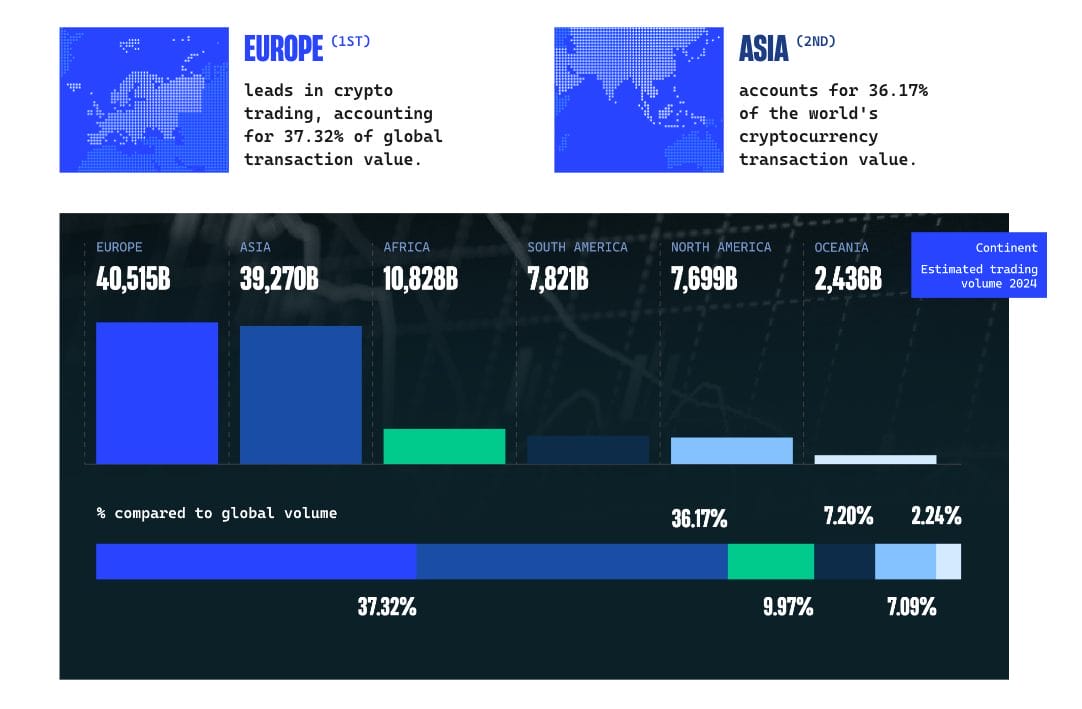

The study projects global crypto trading volume to surpass $108 trillion by the end of 2024.

This estimate represents a 90% increase from 2022 levels, signaling that the crypto trading industry is on the cusp of explosive growth.

Crypto trading volume forecast to exceed $108T in 2024! Europe is taking the lead in this incredible journey.

#CryptoNews #Trading #Europe

— A2ZCrypto : SWAP INR with Crypto (@crypto_a2z) July 12, 2024

The United States is tipped to lead in terms of individual country trading volume, projected to exceed $2 trillion in 2024. However, Europe emerges as a dominant force in global cryptocurrency trading.

The study shows Europe accounts for 37.32% of global cryptocurrency transactions. Trading volume in Europe in 2024 is projected to reach $40.5 trillion, a substantial 270% increase from its $15 trillion volume in 2022.

Europe’s increasing role in the crypto market is partly due to a proactive approach to regulation. The region has been at the forefront of defining its cryptocurrency industry with clear guidelines.

One such guideline is the landmark Markets in Crypto-Assets Regulation (MiCA), launched in 2020 and signed into law by EU officials in October 2023.

Additional regulations for crypto asset service providers are set to be implemented in December, solidifying the EU’s position as a leader in crypto regulation.

Asia follows closely behind Europe with 36.17% of global cryptocurrency transactions.

The study analyzed top centralized exchanges on CoinGecko, considering factors like web traffic by country, supported languages, headquarters location, and trading time zones.

Binance leads the market in over 100 countries with a trading volume of $2.77 trillion.

Global crypto trading volume is forecasted to exceed $108 trillion in 2024, with Europe leading in transaction value.

Binance maintains its position as the leading global exchange. #cryptonewstoday pic.twitter.com/MTslj3Qape

— Ether Adventurer (@tokentraverrse) July 12, 2024

Other major exchanges also commanded a strong global presence.

OKX operates in 93 countries and has a substantial trading volume of $759 billion, while Cex.io maintains a strong presence in 92 countries and boasts a trading volume of $1.83 billion.

Coinbase is not far behind. It has established operations in 90 countries and a trading volume of $662 billion.

Bybit rounds out the list, operating in 87 countries and a trading volume of $1.14 trillion.

Future Implications and Recent Market Dynamics

When looking toward the future of cryptocurrency, consider recent market trends.

CoinEx Research’s latest report on June crypto trends provides insights into where the industry is heading.

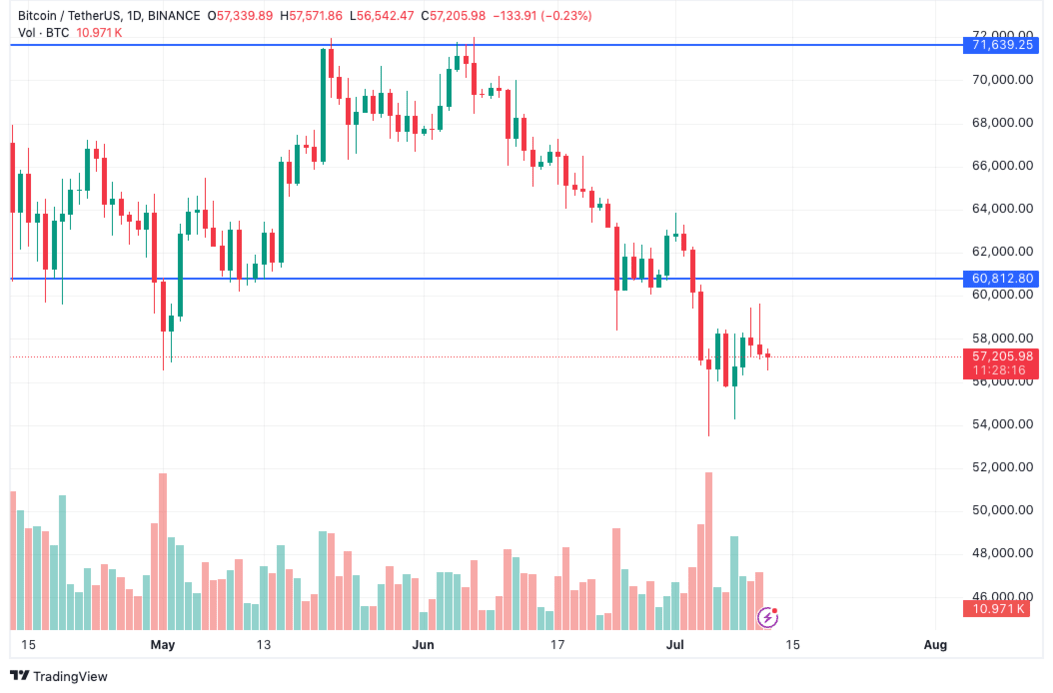

The report highlights Bitcoin’s recent range-bound trading behavior, oscillating between $60,800 and $71,700 throughout June.

This consolidation phase, coupled with steady ETF inflows totaling approximately $666 million for last month, suggests a maturing market that is finding its footing amid global economic uncertainties.

The anticipation of Ethereum’s ETF approval drives market sentiment. However, the decline in gas prices and on-chain activity raises questions about the network’s immediate future.

The launch of layer-2 solutions like ZKSync and Blast is part of Ethereum’s ongoing efforts to address scalability issues, a critical factor for its long-term viability.

Solana’s recovery after a brief dip below $138 shows the market’s responsiveness to institutional interest, shown by VanEck’s filing for the first spot Solana ETF.

These developments, along with projected increases in global trading volume, paint a picture of a changing market.