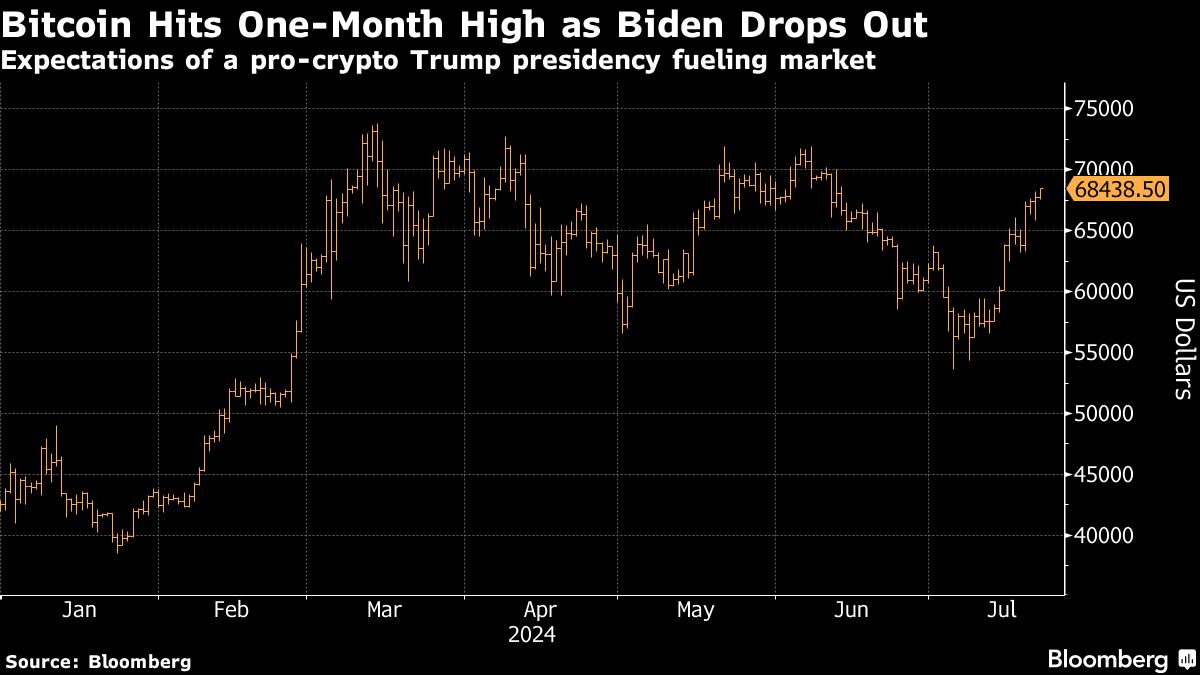

(July 22): Bitcoin edged up to the highest level in over a month, as traders evaluated the implications of US President Joe Biden’s decision to abandon his re-election bid.

The largest digital asset recovered from earlier losses to hover around US$68,300 (RM319,815) as of 8.42am in Singapore on Monday, as markets reacted to the possibility of a match-up between pro-crypto Donald Trump and Kamala Harris.

The move higher is a “reflection in the market’s eyes that the Democrats under Kamala Harris cannot overtake Trump in the race for the White House, and that a new dawn is emerging for bitcoin under a pro-crypto US President”, said Tony Sycamore, a market analyst at IG Australia Pty Ltd.

“We expect the market to become a lot more investible under a Trump administration,” Benjamin Celermajer, a co-chief investment officer of Magnet Capital, told Bloomberg News. He said he expects that tokens with “real value drivers” would perform well, citing as examples the coins linked to the Maker, Aave and Lido protocols.

Trump, who has taken a notably pro-crypto turn over the last several months, is scheduled to speak at a major bitcoin conference in Nashville on July 27.

The Republican presidential candidate will also host a fundraiser on the heels of the conference, for which prospective attendees have been asked to contribute US$844,600 per seat.

By contrast, “what we don’t yet know is Harris’ views on crypto”, said Caroline Bowler, the chief executive officer of BTC Markets. “On something like crypto where it could end up being a make or break election subject for either of the candidates, we could see some more insights into her views in the coming weeks.”

Over on X, where Elon Musk sported an avatar featuring the laser eyes often considered to be a signifier of bitcoin enthusiasm, popular crypto accounts celebrated the burgeoning rally.

Teong Hng, the chief executive of crypto investment firm Satori Research, said activity in the over-the-counter options market suggested bitcoin might revisit its all-time highs soon.

Rising interest in December 2024 calls with a strike price of US$100,000 suggest institutional investors are becoming more bullish. Hng said he is “expecting a strong year-end rally punctuated by a Trump win”.

Bitcoin’s relatively strong performance over the past week, as calls for Biden to withdraw increased in both frequency and intensity, diverged from the weakness in stocks.

Further, the underlying momentum behind recent inflows into bitcoin-backed exchange-traded funds suggests “we could see another tilt at US$70,000”, Chris Weston, the head of research at Pepperstone Group, wrote in a note.