(Bloomberg) — Crypto startups are suffering from this year’s mass selloff of digital currencies. Venture capital investment in the industry sank to its lowest level in more than a year during the third quarter, according to data from research firm PitchBook.

Most Read from Bloomberg

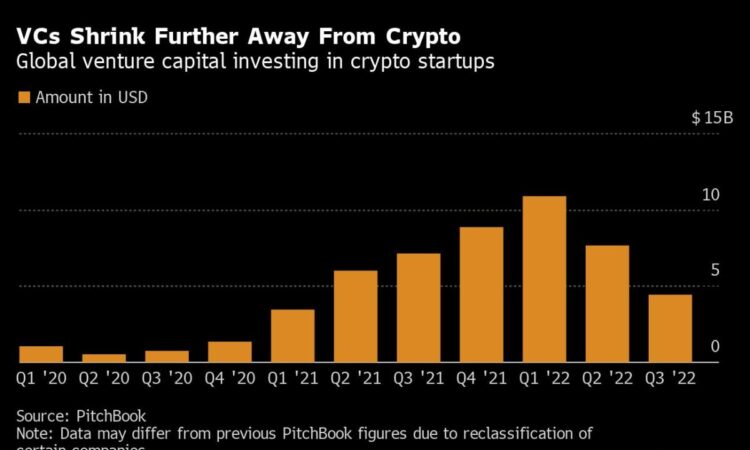

Globally, VC firms invested $4.44 billion in crypto startups in the quarter, a 37% decline from the same period in 2021, the PitchBook numbers show. The funding drop is even more severe compared with the highs of the first quarter, when venture capitalists poured a record $8.83 billion into crypto and blockchain companies.

The pullback mirrors declines in technology investing more broadly, according to PitchBook analyst Robert Le. But crypto has seen a sharper downturn due to the high risk associated with the asset class and plunging cryptocurrency prices. Bitcoin, the largest digital currency by market capitalization, is worth less than $20,000 apiece, having lost more two-thirds of its value since reaching an all-time high of more than $67,000 in November.

“We’re in the depths of crypto winter, so investors are not really excited about crypto, especially generalist investors,” Le said.

The crypto industry had been riding high before the crash. As investors amassed millions, even the most elite venture capital firms were spinning up crypto investment funds and rushing to back the hottest startups. “Last year, a lot of capital was raised with companies that don’t even have use cases yet,” Le said. Now, PitchBook has found that once sky-high valuations have fallen, and deals aren’t closing as quickly.

But there are exceptions. Dedicated crypto funds are continuing to back startups in the space, and many founders are committed to their companies’ decentralized visions. Quadrata Inc., a startup that developed a nonfungible token passport for accessing blockchain-based services and games, raised $7.5 million in funding in July. Co-founder and President Lisa Fridman said the round drew a mix of investors from both crypto and traditional finance, such as Dragonfly Capital and Franklin Templeton.

“There is still a lot of support for the potential of blockchain,” she said.

Investors are also interested in gaming platforms, where the use case for web 3 technology is more immediate. For example, two gaming companies that use NFTs, Improbable and LootMogul, each raised more than $100 million in September. Investors are excited about advertising opportunities in the virtual worlds being built by gaming companies, Le said. “A lot of investors think that that is going to be the next area where eyeballs are.”

Andrew Steinwold, managing partner at Sfermion, a VC firm that specializes in NFT and gaming investments, said his team is doing the same amount of deals that it was before crypto winter and that there’s still interest in the potential for NFTs in the metaverse. “Things are happening, but it’s not as flashy it was before,” he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.