Surprise, surprise! The US Federal Reserve raised the by 25 basis points, resulting in a new target range of between 5.25% and 5.5%. Markets had already anticipated the move and as such, there was little volatility in both equities and the crypto market.

The went on to note that “recent indicators suggest that economic activity has been expanding at a moderate pace.”

Nonetheless, the Fed intends to continue assessing lagging economic indicators and new information before finally deciding whether or not it will implement any more rate hikes this year.

On the brighter side, even as the macro picture remains slightly uncertain, the Fed staff is no longer forecasting a recession which means inflation could eventually come down without more significant downturns to the global economy.

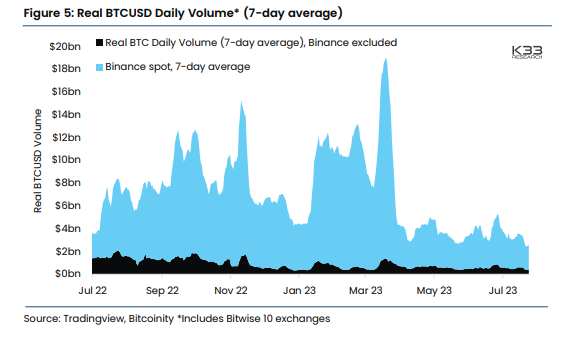

Crypto Market Volumes at Multi-Year Lows

Crypto market liquidity has been drying up after last year’s cascading liquidations that wiped out major players and dampened the market sentiment.

Bitcoin’s 7-day average trading volume hit a 30-month low last week, plunging to levels that were previously witnessed before BTC broke $20K back in December 2020. Clearly, market participants remain largely inactive.

Image Source: K33 Research

But on the other hand, low activity periods like this have marked accumulation phases. Several on-chain metrics reveal that the current market trends are reminiscent of the onset of previous bull markets.

-

Bitcoin whales holding 1K to 10K BTC are stacking sats aggressively.

-

Bitcoin holders are taking their coins off exchanges.

-

The accumulation score is at 0.6, which historically is a sustainable zone.

Noteworthy Mentions

The first half of 2023 was quite eventful for the crypto market, from banking crises, and regulatory crackdowns, to the shifting landscape of crypto hubs. In our latest article, we took a step back to reflect on the events of H1 2023 and share our view on which trends will likely dominate the second half.

Industry Shakers

- Putin Signs Digital Ruble Bill Into Law

Russian President Vladimir Putin has authorized a new law, granting legal tender status to the “digital ruble.” The Bank of Russia, the country’s central bank, will act as the platform operator for the central bank digital currency (CBDC) and conduct tests starting August 1, following Putin’s approval. The bill also provides legal definitions for users and sets guidelines for banks under this framework.

-

House Financial Services Committee Votes in Favor of Crypto, Blockchain Bills

On Wednesday, the House Financial Services Committee pushed forward to resolve the details of two bills aimed at establishing a cohesive legal framework for cryptocurrencies and addressing blockchain-related matters. A majority of lawmakers voted in favor of H.R. 4763, the Financial Innovation and Technology for the 21st Century Act, and H.R. 1747, the Blockchain Regulatory Certainty Act. Both bills have been referred to the full House of Representatives for voting.

-

Kuwait bans crypto and virtual asset transactions

Kuwait’s main financial regulator, the Capital Markets Authority (CMA), issued a circular addressing the supervision and issuance of virtual assets within Kuwait on July 18. The circular explicitly reaffirmed the “absolute prohibition” on various cryptocurrency use cases, including payments, investments, and mining. Additionally, it forbids local regulators from granting licenses to firms intending to offer virtual asset services as commercial enterprises.

-

World Coin Launch Receives Mixed Reactions

Sam Altman’s recently launched World Coin has received mixed reactions, with some praising the Proof-of-Personhood (PoP) concept, while others, including ‘s co-founder Vitalik Buterin, have raised concerns about its privacy, security, centralization, and accessibility. Nonetheless, people are still signing up for the Iris scanning in return for the 25 WDC reward, especially in lower-income countries where people could really use the reward money and have little data protection laws.