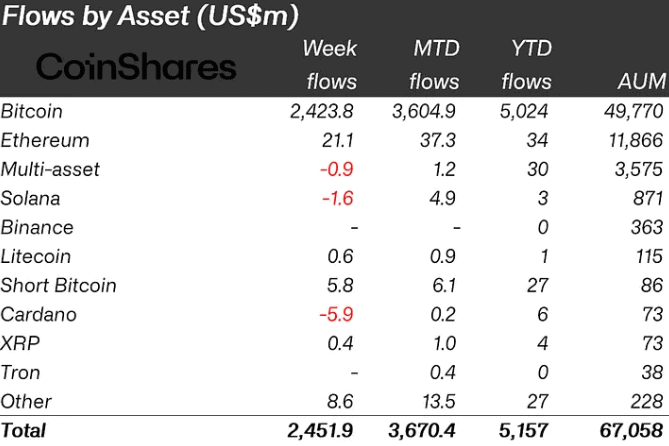

Crypto investment products experienced a record $2.45 billion of inflows last week. This has pushed year-to-date inflows above $5.2 billion, according to the latest industry report by CoinShares.

The notable inflow came almost exclusively from U.S. investors piling into spot crypto ETFs amid swelling enthusiasm.

- The United States delivered 99% of total weekly inflows at $2.4 billion.

- U.S. spot ETF interest growth is distributed widely amongst providers.

- Bitcoin accounts for 99%, but altcoins also see capital inflows.

The U.S. grabbed a 99% share of last week’s inflows, at nearly $2.4 billion. “This represents a significant acceleration of net inflows, distributed widely among various providers, indicating an increasing interest in spot-based ETFs,” the report stated.

Read more: Revolut Building Dedicated Crypto Exchange For Advanced Traders

That aligns with the SEC allowing spot Bitcoin ETF trading and major asset managers like BlackRock launching crypto offerings.

The combination of validating regulatory steps and household financial brand backing appears to be driving investor comfort.

Bitcoin accounts for 99% of crypto inflows

The lion’s share continues flowing into Bitcoin funds, commanding over 99% of last week’s volumes. Ethereum also witnessed $21 million inflows.

Alongside, altcoins like Avalanche, Chainlink, and Polygon saw millions in inflows as well. The report notes that certain altcoins have scored weekly investor capital every week in 2024 so far.

Read more: Jupiter Blocks XRP ETP Amid Regulatory Confusion: FT

Apart from the U.S., Germany and Switzerland also experienced an inflow of $13 million and $1 million, respectively. However, Sweden experienced an outflow of $26 million.

The asset under management bounced back to $67 billion, which marks the highest level recorded since December 2021.