Crypto firm moved $4.2m of assets to digital wallet linked to alleged Russian arms dealer

A U.K. cryptocurrency firm transferred digital assets worth more than $4.2 million to a crypto wallet belonging to a member of an alleged Russian arms-dealing network who was later sanctioned by the United States, ICIJ and The Guardian can reveal.

Details of the transactions involving the prominent cryptocurrency firm Copper Technologies raise questions about whether United Kingdom laws governing the cryptocurrency industry have adapted quickly enough to keep pace with a rapidly-evolving sector that has come under increasing scrutiny over the level of anonymity it can provide.

Last year, The Guardian reported that Copper Technologies was involved in a share sale worth more than $19 million that benefited a U.S.-sanctioned Russian banker.

Now, an analysis of cryptocurrency transactions by the International Consortium of Investigative Journalists and The Guardian highlights a connection between Copper and Jonatan Zimenkov, an Israeli-born Russian national.

Zimenkov, 29, was sanctioned by the U.S. in February 2023 for allegedly assisting the Russian military with the invasion of Ukraine, as part of the “Zimenkov network,” an arms-dealing and sanctions evasion network headed by his father, Igor Zimenkov.

Records show that Copper transferred millions of dollars worth of digital currency in May 2021 to a wallet that has since been identified as belonging to Zimenkov. He was sanctioned 19 months later. Copper, which recruited Philip Hammond, the United Kingdom’s former Chancellor of the Exchequer, the ministerial equivalent of the U.S. Treasury Secretary, as an adviser in October 2021, was based in London at the time but has since moved to Switzerland. Hammond is now the chairman of the company.

Zimenkov was not sanctioned when the transfer took place. But the U.S. Treasury Department’s Office of Foreign Assets Control has said that it believes the network had been active “over several years” by the time it imposed restrictions on 22 individuals and entities in multiple countries.

In its announcement, Treasury said the Zimenkov network was involved in multiple deals for Russian cybersecurity and helicopter sales abroad, as well as attempts to supply weapons to an unnamed African country.

There is no suggestion that Copper has breached any sanctions or any other regulations in place at the time of the transaction.

However, the revelation shines a light on the opaque world of cryptocurrency and the anonymity it can offer, and raises questions about how digital assets and transactions of digital assets should be regulated within the wider financial system.

“Copper takes its compliance, legal and regulatory obligations very seriously, and has acted in full compliance with all applicable regulatory standards, including all applicable sanctions prohibitions, in the UK,” a spokesperson for the company said.

ICIJ and The Guardian understand that Zimenkov was not a client of Copper, meaning it did not have a regulatory obligation to check his identity. The company did not answer specific questions about the nature of its relationship with Zimenkov.

Financial companies have the option to file a suspicious activity report when a transaction raises any so-called red flags, even when the rules are not obviously breached. It is not clear if Copper filed a SAR, which must be sent to a law enforcement body such as the U.K.’s National Crime Agency.

And according to guidance issued in 2020 by the finance industry’s Joint Money Laundering Steering Group, it was considered “good practice” for crypto firms to gather information about the recipients of transfers, to assess potential risks.

But it was not until late 2023 that the U.K. adopted a “travel rule” obliging cryptocurrency companies to carry out checks on funds transferred to external parties, following concerns from regulators that this risk was being overlooked.

The U.S. government said last year that it had identified Zimenkov as part of what it labeled a “sanctions evasion network,” active over several years.

Transfers of digital currency such as bitcoin and ethereum are logged on blockchains, the digital ledgers that underpin the cryptocurrency ecosystem.

While transactions are recorded, they can also provide anonymity to people trying to disguise financial relationships because funds are held in online “wallets” that do not have to be matched to the holder’s identity.

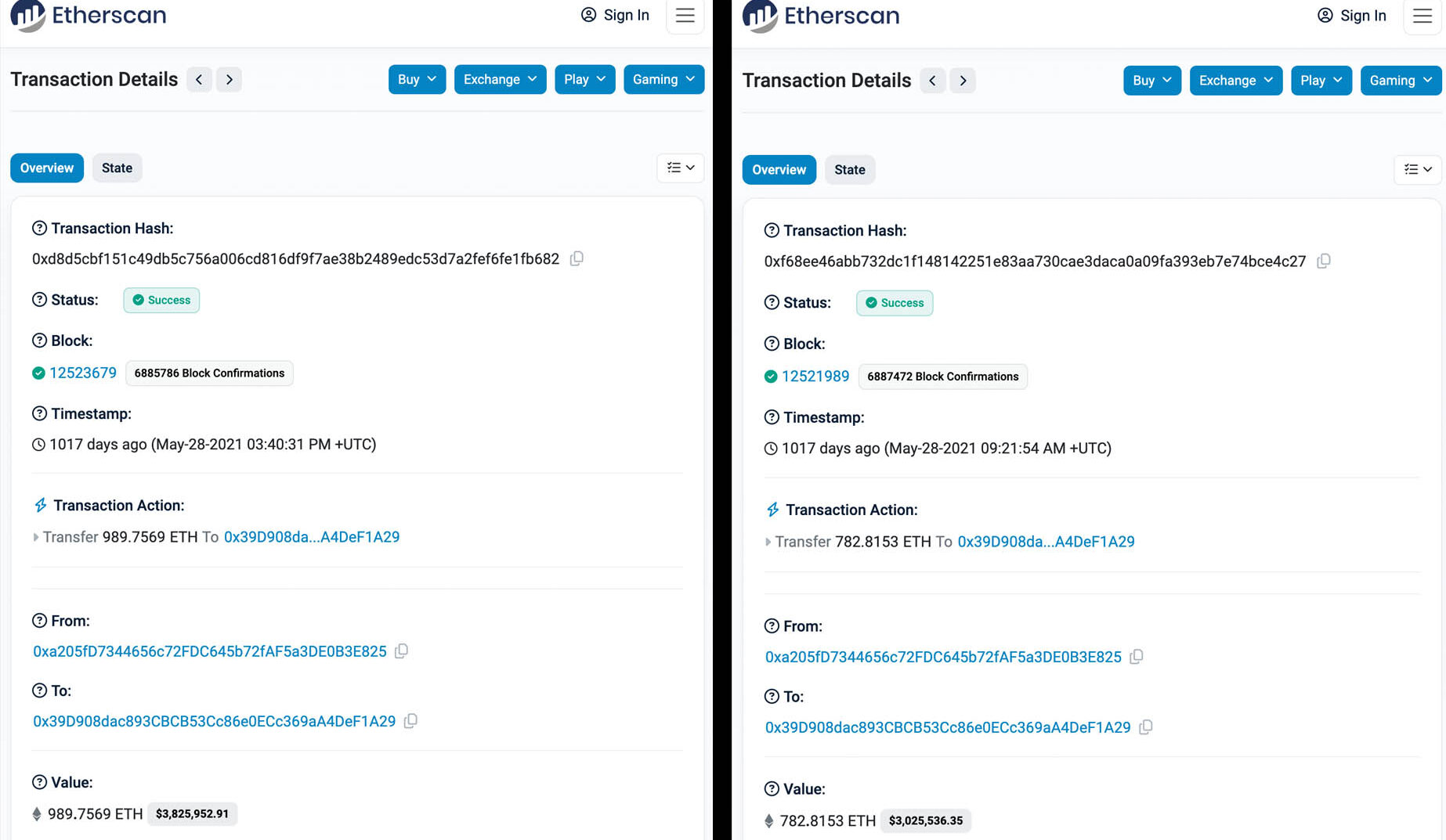

Blockchain logs show that in May 2021 Copper transferred more than 1,700 units of the cryptocurrency ethereum, worth more than $4.2 million at the time, to Jonatan Zimenkov. They were transferred in two transactions on the same day, according to the blockchain analytics platform Etherscan.

The purpose of the transactions — and the original source of the digital assets — is unclear. Zimenkov did not return any requests for comment.

The owner of the wallet that received the ethereum transactions is not named in blockchain records, which only show their digital currency address — a string of letters and numbers.

However, that same digital currency address was included in a Treasury announcement from February 2023, detailing sanctions against the Zimenkov network.

The address was listed as belonging to Jonatan Zimenkov, who holds Russian, Israeli and Italian citizenship, according to U.S. authorities. The connection was identified in a report provided to ICIJ by ChainArgos, a cryptocurrency analysis company.

Data from Arkham Intelligence, a separate cryptocurrency analysis company, shows that Zimenkov’s wallet was liquidated and stopped transacting on Feb. 7, 2022, a year before OFAC publicly identified it.

Zimenkov attended high school and university in London, according to a private school brochure. His father, Igor Zimenkov, was accused by the U.S. government of leading the alleged arms-dealing network.

Treasury claims the Zimenkovs “engaged in projects connected to Russian defense capabilities, including supplying a Russian company with high-technology devices after Russia launched its full-scale invasion of Ukraine.”

In its sanctions announcement, Treasury said the Zimenkov network supported Russian defense exporters Rosoboronexport and Rostec, both of which are also sanctioned in several jurisdictions. Rosoboronexport and Rostec were sanctioned by the U.S. in 2014.

According to Treasury, Igor Zimenkov worked closely with his son and others “to enable Russian defense sales to third-country governments.” Jonatan Zimenkov has “maintained power of attorney” for companies in the network on behalf of his father, the department noted.

Both men are alleged to have corresponded with sanctioned Russian defense firms and to have taken part in “multiple deals for Russian cybersecurity and helicopter sales abroad.”

The sanctions also apply to several companies that the U.S. says have been involved in the arms trade.

One such company is GBD Limited, located in Cyprus, described as a “Zimenkov network company that has attempted to supply weapons systems to an African government and has sent millions of dollars to Igor Zimenkov over a period of years.”

Files from the Cyprus Confidential investigation, a project published by ICIJ in November 2023, show Igor Zimenkov appeared as a director of that company as far back as 2016.

Russian public corporate records show that Jonatan Zimenkov was registered as an “individual entrepreneur” in the country in 2019, conducting business activities including “wholesale trade of ships, aircraft and other vehicles.”