Table of Contents

In the dynamic world of cryptocurrency, the recent green hues on trading screens are a stark contrast to the looming threat of interest rate hikes by the US Federal Reserve. This display of resilience, defying the cautionary stance of Fed Chair Jerome Powell, suggests a maturing market that’s increasingly detaching from traditional economic influences. This trend is not only a sign of the market’s growing autonomy but also highlights digital currencies as increasingly legitimate investment assets.

In this evolving crypto landscape, marked by continuous innovation and speculation, ScapesMania stands out as a clear guide. This platform simplifies the complexities of the crypto world, providing an accessible and engaging experience for both enthusiasts and newcomers. With its user-friendly interface and comprehensive resources, ScapesMania is crafting a new chapter in the digital currency narrative, making the intricacies of cryptocurrency more approachable for everyone.

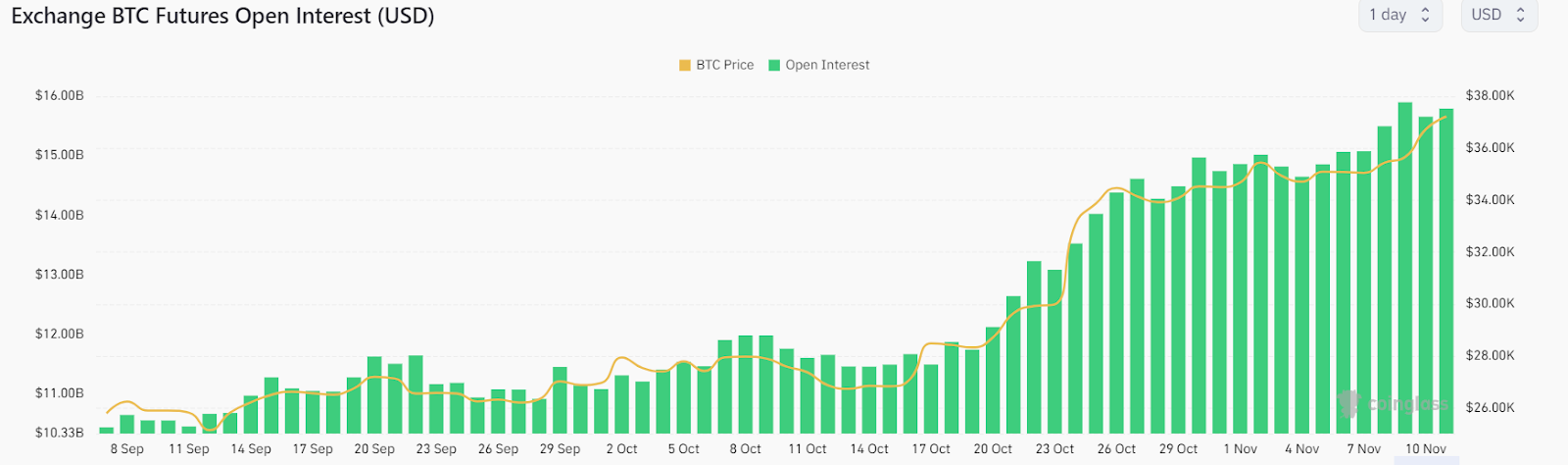

Central to comprehending the current market’s behavior is the relationship between Bitcoin (BTC) prices and Futures Open Interest. A surge in BTC prices often leads to a rise in Open Interest, revealing a growing enthusiasm for futures trading parallel to the ascent of BTC.

Recent data from CoinGlass underscores this trend, showing BTC with an Open Interest of $15.83 billion. This interest is significantly driven by major exchanges like Binance, which contributes $3.92 billion, and CME, leading with $4.05 billion. These figures not only highlight the importance of these exchanges in the Bitcoin futures market but also reflect the overall market activity and investor confidence in BTC.

An intriguing observation is the stability of Open Interest during periods of BTC price volatility. This pattern suggests that traders are opting to hold onto their positions through these fluctuations, rather than reacting hastily to short-term price changes. This behavior points to a more strategic and long-term approach in futures trading. Over time, both BTC prices and Open Interest have witnessed substantial growth, signifying an increasing interest in BTC futures. This trend also mirrors the broader acceptance and recognition of BTC as a sound investment asset, further cementing its role in the modern financial landscape.

ScapesMania: Pioneering the Next Wave of Crypto Innovation

While some are facing an uncertain future, the trajectory of a presale project is far easier to predict. ScapesMania (MANIA) is a well-balanced, meticulously designed project that acts as a gaming ecosystem. Through DAO governance, backers will be able to influence and benefit from a multi-billion-dollar industry. A wide range of features paired with the best technology, a professional team, and a long-term, highly ambitious vision can make ScapesMania the next big thing in crypto. Presale discounts and stage bonuses only add to the project’s appeal.

Presale is Live Now – Join Now for a Chance to Benefit with MANIA

Backed by an award-winning developer crew, ScapesMania stands for transparency: every member’s social media profile is public. The project can achieve this not just by bringing big innovation to the game, but by putting its community front and center. Driving customer engagement and making sure that everyone benefits through great tokenomics and generous rewards is what makes ScapesMania the project with a bright future ahead.

Presale is Live, Learn More About Major Benefits

Ripple (XRP) Fundamental Analysis

Ripple’s fundamental analysis reveals a story of strategic expansion and resilience in the face of regulatory challenges. At the core of Ripple’s growth strategy is its focus on expanding its payment services globally. A significant milestone in this expansion is Ripple’s partnership with Onafriq, a mobile payments provider.

This collaboration is set to establish efficient payment corridors across 27 African countries, utilizing Ripple’s blockchain technology for fast and low-cost remittances and business payments. This initiative not only extends Ripple’s reach but also enhances financial inclusion in these regions. Furthermore, Ripple’s growth is not limited to Africa. The company has been actively upgrading its Ripple Payments service in several European countries, the Middle East, and Africa, despite the ongoing legal battles with the US Securities and Exchange Commission (SEC).

Another crucial development for Ripple is the approval of XRP by the Dubai Financial Services Authority (DFSA). This approval paves the way for XRP’s integration into digital asset services within the Dubai International Financial Centre (DIFC), a major financial hub in the Middle East. This move could potentially extend XRP’s reach to 72 countries in the Middle East, Africa, and South Asia (MEASA) region, encompassing some of the world’s key financial centers.

Ripple’s CEO, Brad Garlinghouse, has emphasized the company’s commitment to regions with a more welcoming regulatory environment for cryptocurrencies, contrasting with the more challenging US landscape. Despite these challenges, Ripple’s determination remains steadfast, with Garlinghouse expressing readiness to escalate legal battles if necessary. This fearless approach, combined with significant developments like large whale transactions and the movement of millions of XRP between exchanges and wallets, continues to keep Ripple at the forefront of market discussions.

Ripple (XRP) Technical Analysis

The Ripple (XRP) technical landscape reveals a compelling narrative of growth and potential shifts in market dynamics. Over the past year, XRP has experienced significant gains, with a year-to-date gain of over 90%. This positive momentum is mirrored in shorter time frames as well, with over 30% rise month-to-month and over 50% increase in the last six months.

The first support level for XRP is identified at $0.50925, while the first resistance level stands at $0.65546. Further layers of support and resistance are observed at $0.41852 and $0.71094, respectively.

The 10-day Simple Moving Average (SMA) of XRP is currently at $0.65180, indicating a bullish trend in the short term. However, the 100-day SMA at $0.54455 suggests a need for caution regarding the long-term trajectory.

The Relative Strength Index is at 65.90, below the overbought zone but still indicative of substantial buying interest in the market.

Ripple (XRP) Price Forecast

If XRP continues to maintain its position above the 10-day SMA and challenges the resistance levels, especially at $0.65546 and at $0.71094, we could witness further upside. A sustained move above these levels could potentially lead to a retest of the 52-week high of $0.922366. This bullish outlook is supported by the strong buying interest as indicated by the RSI and the overall positive trend seen in the short-term price movements.

The bullish scenario also envisions a world where Ripple’s strategic partnerships and expansion lead to widespread adoption, driving prices to new heights.

The bearish view, haunted by regulatory shadows and market volatility, suggests a future where XRP struggles to maintain its foothold and falls below its key support levels, particularly at $0.50925, signaling a shift in market sentiment. This could lead to a retest of the 1-month low of $0.475014 and the 13-week low of $0.459625. In this scenario, a careful watch on the 100-day SMA would be crucial to gauge the extent of the bearish trend.

Conclusion

In the ever-shifting world of cryptocurrency, the resilience and innovative strides of Bitcoin and Ripple (XRP) stand as testaments to the growing maturity and autonomy of the digital currency market. XRP showcases a narrative of strategic expansion and adaptability. Its global outreach underscores its commitment to broadening the scope of digital payments. The technical analysis of XRP, reflecting significant gains and a positive market sentiment, further aligns with its fundamental strengths. However, the future of this digital asset remains delicately poised between bullish optimism and bearish caution, dependent on market dynamics, regulatory developments, and technological advancements.

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.