Coinbase prides itself on being a company born in the United States, and that hasn’t changed even as its operations come under pressure from regulators. Yet for all of its pride in its American roots, Coinbase is now looking more toward Europe for smoother sailing.

In the last month alone, Coinbase has announced a new talent center in Germany, an anti-money laundering license in Spain, and probably most crucially, a regulatory hub in Ireland. For Coinbase, setting itself at the front of the line in Europe is a way to tap into a massive market while at the same time innovating with new products beyond trading.

Neither of these is easily doable at home in the U.S., where Coinbase has found itself in the crosshairs of the Securities and Exchange Commission. Over the summer, the SEC filed a lawsuit against Coinbase, accusing it of offering unlicensed securities products and of being an unregistered exchange, something Coinbase denies. The company’s stock has not been heavily dented by the lawsuit, but analysts continue to cite its possible outcomes as a source of uncertainty.

Coinbase’s moves in Europe come at a time of increased pressure on its operations in the U.S and its executives bemoan the lack of clarity around how to stay within the bounds of the law. In contrast, the clarity it is looking for exists in the European Union after it adopted the Markets in Crypto Assets Regulation (MiCA) in April.

“Having bad rules is better than having no rules at all,” said Oliver Linch, CEO of cryptocurrency exchange Bittrex Global. “The uncertainty that permeates through the U.S. right now means that you just don’t know what you can and can’t do.”

The MiCA framework was designed to adapt existing rules to regulate cryptocurrency and has been widely welcomed by the crypto industry for providing clarity on how to do business in the bloc. With clearer rules of the road on the books, the E.U. gains a distinct “competitive advantage” over the U.S. for crypto firms, said Linch.

After going through a rough spell in 2022, characterized by a sharp decline in cryptocurrency values after the collapse of the Terra Luna stablecoin and the implosion of crypto exchange FTX because of rampant fraud, Coinbase is expected to end 2023 in better shape.

Analysts estimate Coinbase will reduce its net loss to $218.8 million from the $2.6 billion it ended with last year. Meanwhile, revenues are expected to hit $2.8 billion, 9.2% lower than the $3.14 billion a year earlier, a byproduct of lower volatility and trading levels ongoing in the crypto market. This year has seen a strong performance for Coinbase’s stock, which is up by 224% this year and currently stands at $109, but it remains well below its $381 price when it went public two years ago.

With its recent moves abroad, Coinbase is working to squeeze more revenue out of overseas markets after relying principally on the U.S for growth. In its filings with the SEC, Coinbase reports that no single country outside the U.S. accounts for more than 10% of its total revenue. The company did not return a request for comment on how much revenue it draws from the EU as a whole, but the amount appears to be significant.

“In recent quarters, Coinbase has earned as much as 15%, or even 20%, of top-line revenue from across Europe,” said Paul Grewal, Coinbase’s chief legal officer, in an interview with CNBC on Oct. 19.

Coinbase is no stranger to operating in the EU, having maintained a presence in the bloc since 2014. However, the EU has taken on more importance for Coinbase as part of its “Go Broad, Go Deep” strategy for international expansion, which is designed to deepen its footprint in jurisdictions that offer regulatory clarity.

New regulations aren’t the only reason the EU may be a ripe market for Coinbase to access. After North America, EU countries make up the second largest cryptocurrency economy in the world, with 17.6% of global transaction volume occurring among them, according to a recent report by blockchain analytics firm Chainalysis.

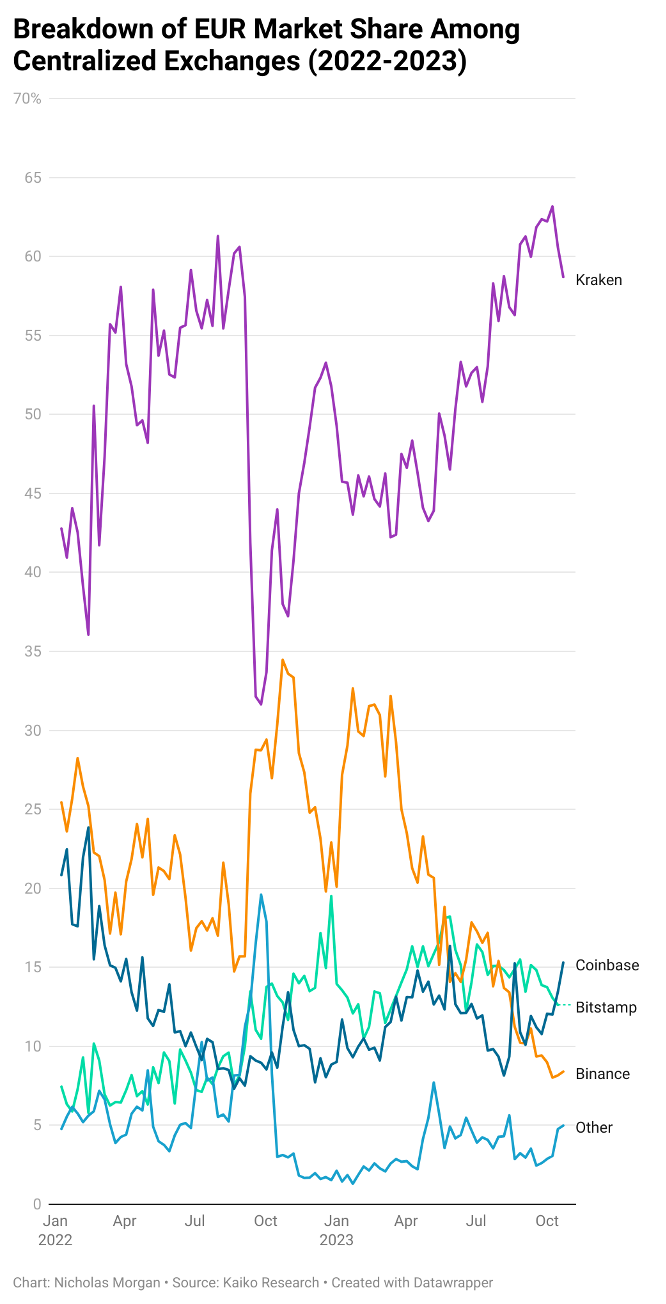

Shake-ups among its main competitors have also created space to grow. The disappearance of FTX in Europe removed a big player that held almost a fifth of the EU market share. Binance, the world’s largest exchange, has struggled to get registered in more than one European state, and it has pulled back on some operations after losing a key banking partner.

The last year of upheaval in crypto markets has left traders and investors more focused on the risks associated with the exchanges they use, said Mads Eberhardt, a cryptocurrency analyst at Steno Research in Copenhagen. This, he adds, has been an advantage for “regulated and respected” exchanges like Coinbase, which leans into marketing itself as a firm that goes out of its way to work with regulators.

“The lower inherent risks with onshore exchanges largely offset the often higher fees and lower liquidity on these platforms relative to offshore exchanges for many market participants,” said Eberhardt.

In contrast to Binance’s woes, Coinbase has run into fewer problems getting a hold of new licenses in the EU. Though still not licensed in all EU countries, Coinbase has been setting itself up to get around that with the Ireland hub. Under MiCA, a firm that gets licensed in one member state will get a “passport” to operate across the entire bloc.

Coinbase’s international ambitions have also been warmly greeted by investors because of the opportunities they see lying overseas

“If you think about the U.S. market, it’s just a small part of the global market,” said Bo Pei, chief financial analyst at Tiger Securities. “Binance is strong because they are global, so if Coinbase wants to grow to the size of Binance, it will have to go global.”

To be sure, Coinbase isn’t the only U.S. crypto company looking to expand in Europe.

Kraken, another U.S. cryptocurrency exchange, has found itself winning the lion’s share of the European market left open by Binance’s pullback. In January, Kraken accounted for about 46% of Euro-based trade volume in the bloc, but this figure rose to nearly 60% by the end of October, according to data from market research firm Kaiko Research. In contrast, Coinbase has only seen its market share increase from 10% to 15% in the same period.

The situation in Europe is something of a role reversal between where Coinbase and Kraken stand in the U.S. market. There, Coinbase stands as the largest exchange with about 55% of the U.S. market share, and it is followed by Kraken, which has about 26%, according to a recent report by Kaiko.

But this may have as much to do with history than any more fundamental differences between the exchanges, said Eberhardt from Steno.

“Kraken was one of the first crypto exchanges to focus deeply on European countries, so they realized a first-mover advantage relative to competitors,” explained Eberhardt. “The decade-long presence of Kraken in Europe, coupled with its better liquidity in Euro pairs, is the primary reason why it stands out relative to Coinbase in the past year.”

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.