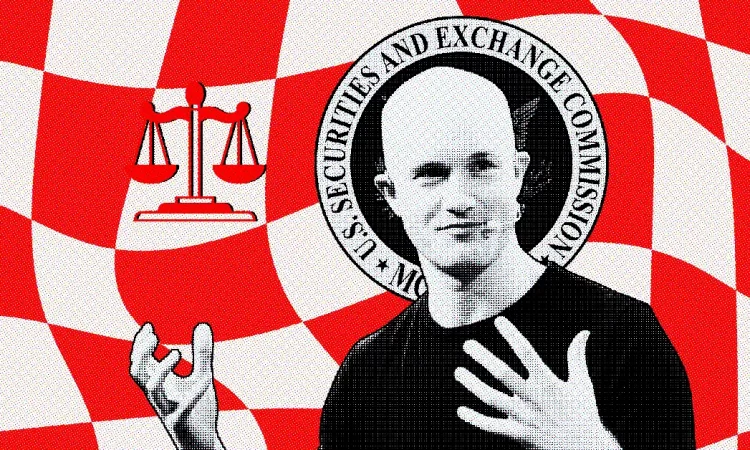

Coinbase Charges U.S. SEC with Legal Violations for Dismissing Cryptocurrency Regulation Proposals

Coinbase’s legal team has now filed an opening brief in the Third Circuit Court of Appeals, seeking a review, overturn the SEC’s denial, and an order to initiate the rulemaking process.

SEC’s Denial and Coinbase’s Appeal

Coinbase, a leading crypto exchange firm has asserted that the SEC is attempting an overreach of authority by enforcing new regulations on the ever-evolving digital assets industry.

The exchange argues that the SEC has overstepped its authority by enforcing its resolutions without giving a regulatory framework for these coins and that it violates its jurisdiction.

The legal team of Coinbase maintains that the lack of a clear regulatory framework is problematic for the industry, as crypto firms would be required to comply with the yet unknown rules and regulations.

The SEC decided by Commissioners vote that was 3 to 2 on denying the petition of rulemaking made by Coinbase in December 2023. SEC Chairman Gary Gensler asserted that rejecting Bitcoin ETFs did not require new rules, since the Bitcoins are already under current rules and regulations.

But Commissioners Hester Peirce and Mark Uyeda in a joint dissenting opinion have underlined the need to deal with new technologies and innovations, which suggests that their attention should be drawn to the fact that it is the role of the SEC to deal with issues that are being raised by new crypto technologies. Coinbase immediately filed an appeal along with this claim that the SEC’s decision was “abuse and contrary to law” and was against the Administrative Procedure Act.

Coinbase’s legal filing points out a regulatory “Catch-22” for digital asset firms. The SEC mandates compliance without undertaking the necessary rulemaking to establish feasible regulations. Coinbase has argued that this regulatory uncertainty hinders the industry’s growth and leaves firms in a precarious position.

Parallel Development

Simultaneously, Coinbase faces another legal challenge from the SEC in New York.

In June, the SEC sued Coinbase, alleging the operation as an unregistered broker, exchange, and clearing agency. The legal proceedings are ongoing, with Coinbase presenting oral arguments in January related to its motion to dismiss the suit.

The presiding Judge Katherine Polk Failla is yet to rule on the motion.