China’s crypto craving: back-door Binance traders look more important to exchange’s future in wake of US conviction

Beyond just the US – where both the company and CZ, who stepped down as CEO, pled guilty to charges that included lax anti-money-laundering enforcement – Binance has been forced to defend itself in a variety of markets including the UK, Germany, Japan and Singapore. It withdrew a licence application in Germany this year and revived one in Singapore. Most recently, the Philippines’ Securities and Exchange Commission moved to block the platform.

In China, the exchange has maintained steady business with little-to-no enforcement action in the country, which has banned commercial crypto activity. While claiming not to officially operate in the country, Binance’s sizeable presence in the local industry comes from a widely-used workaround whereby users sign up from within mainland China by listing their location as Taiwan. Beijing claims the self-governing island as part of China.

A global affiliate programme further incentivises existing users to bring even more people on board. Binance did not respond to repeated requests for comment and questions regarding its operations in China.

With the regulatory landscape shifting around the world, China remains a critical market for Binance. In May alone, China-based customers accounted for a fifth of crypto traded on the platform, valued at US$90 billion, according to a report by The Wall Street Journal, which excluded some very large traders as outliers.

Binance behind Hong Kong crypto exchange seeking virtual asset licence: sources

Binance behind Hong Kong crypto exchange seeking virtual asset licence: sources

Online crypto services in China received US$86.4 billion in cryptocurrency in the period of July 2022 to June 2023 based on web traffic data, according to a recent Chainalysis report.

“Two possible reasons for this are that the ban is loosely enforced, and the second being that crypto bans, in general, are just not very effective,” said Chengyi Ong, head of APAC policy at Chainalysis, adding that the full impact of the ban on exchanges like Binance is not entirely clear.

“Using crypto [in China] is a bit like using a VPN [virtual private network]; it could be illegal, but they’ve never really cracked down on it, and there is a grey area,” said a Chinese-British crypto trader and online influencer, who asked the Post to be referred to by his social media moniker, CryptosLaowai.

For traders in China, Binance’s scale is its clear advantage over rivals like OKX and HTX, formerly Huobi, all of which were started in China.

“Binance is not as easy to use as OKX and Huobi,” said one crypto trader in Shenzhen, who spoke with the Post over the Telegram messaging app. “I like Binance because its depth is the best, not its ease of use.”

Binance’s 60 million visitors are about twice the number of its nearest rivals Coinbase, at 35 million, and OKX, at 27 million, according to CoinGecko. That makes it easy to always find buyers and sellers, the person explained.

Users and former employees who spoke to the Post about Binance’s continued ties to mainland China did so on the condition of anonymity because of sensitivities around trading crypto in the country.

Despite warnings on its site that Binance services are not meant for mainland China or Hong Kong, mainlanders determined to use the exchange can still get around know-your-client (KYC) provisions with workarounds. An account created by the South China Morning Post on the mainland using a mainland identification card was approved in less than an hour, despite the inputted personal information – including name, birth date and address – not matching an uploaded image of the ID.

Top exchanges by normalized 24-hour trading volume, December 22, 2023

| Exchange | 24h trading volume |

|---|---|

| Binance | $9,018,890,598 |

| OKX | $3,073,244,999 |

| Coinbase | $2,896,401,594 |

| Bybit | $2,881,531,587 |

| DigiFinex | $2,191,155,699 |

Source: CoinGecko

A report from CNBC in March found that people identifying themselves as Binance employees and trained volunteers called Angels, had been coaching people on how to get around geographic restrictions from China. Binance told the news organisation at the time that it has “taken action against employees who may have violated our internal policies including wrongly soliciting or making recommendations that are not allowed or in line with our standards. We have strict policies requiring all users to pass KYC by providing us with their country of residence and other personal identification information.”

The Post confirmed that people continue to offer such advice in chat groups, where tens of thousands of Chinese speakers congregate to get tips on how to use the app.

Multiple people in the group could be seen recommending that new users download the app on iOS using a Taiwanese account, noting that Taiwan can also be used for ID checks.

Binance also runs an affiliate programme that rewards members with a commission of 41 per cent of referrals’ spot trades when a person onboards 10 new users who trade 50 bitcoin worth of crypto, according to the company’s website. That goes up to 50 per cent when a person onboards 100 new traders who generate 500 bitcoin in trading volume.

Many of the affiliates are Chinese, and that can come with other perks. CryptosLaowai, a Binance affiliate with 70,000 followers on X, formerly Twitter, said that a recent Binance workshop in the Maldives was held just for Mandarin-speaking affiliates and influencers, most of whom are based in mainland China.

Several attendees could be seen posting photos from the event this month under the hashtag #binancecampus on X. Binance said in a tweet that the event was for “affiliates from Asia”.

For a select few, the affiliate programme can be highly lucrative. Binance’s top affiliate member in 2019 earned US$10.5 million, the exchange previously posted on X.

The Post reviewed screenshots of a WeChat group consisting of other Chinese crypto influencers, where CryptosLaowai said staff sometimes offered influencers merchandise and other paid sponsorship opportunities. The company has never asked an influencer to promote a crypto asset, he added.

Officially, Binance says it has no presence in China. But its status in the country has shifted over the years, according to views expressed by former employees.

According to company lore, Binance was chased out of China less than two months after its founding in Shanghai. After a 2017 crackdown on crypto exchanges, the Chinese government “blocked our platform behind the Great Firewall”, CZ wrote in the same blog post last year. “At this point, most of our employees left China. Only a small number of customer service agents remained by late 2018.”

One former employee said that before he left in August this year, Binance held a team-building event that drew between 200 and 300 local workers. There is no data available on how many, or if, people still work for Binance in China as it officially claims not to operate there. Several LinkedIn profiles still show people claiming to work for the exchange from within the mainland.

When that person joined Binance, he said he signed with an entity in China, but months later he was told to remotely contract with a separate entity based in Singapore.

After the 2021 crypto ban, Binance quickly rolled out a “globalisation strategy” after the government announcement, the former employee said. Most Chinese employees were “encouraged” to relocate, with many who did not agree eventually being laid off, the former employee said. By this year, new Chinese employees were required to agree to a relocation plan at the time, he added.

“Only like two or three weeks after this plan was announced, maybe half of my Shanghai office quickly flew off to Dubai,” the person said. Soon after, the company began shutting down its network of clandestine offices in China, asking employees not to publicise their roles at Binance, he added.

But a strict crackdown or large-scale investigation into Binance never came. Even claims that China blocks Binance are only partially true. Meanwhile, although Binance’s main website is blocked by the Great Firewall in China – its app can be freely used within China without a VPN, as is the case with OKX and HTX.

The main website is blocked by the Great Firewall, but like OKX and HTX, Binance’s app can be freely used within China without a VPN.

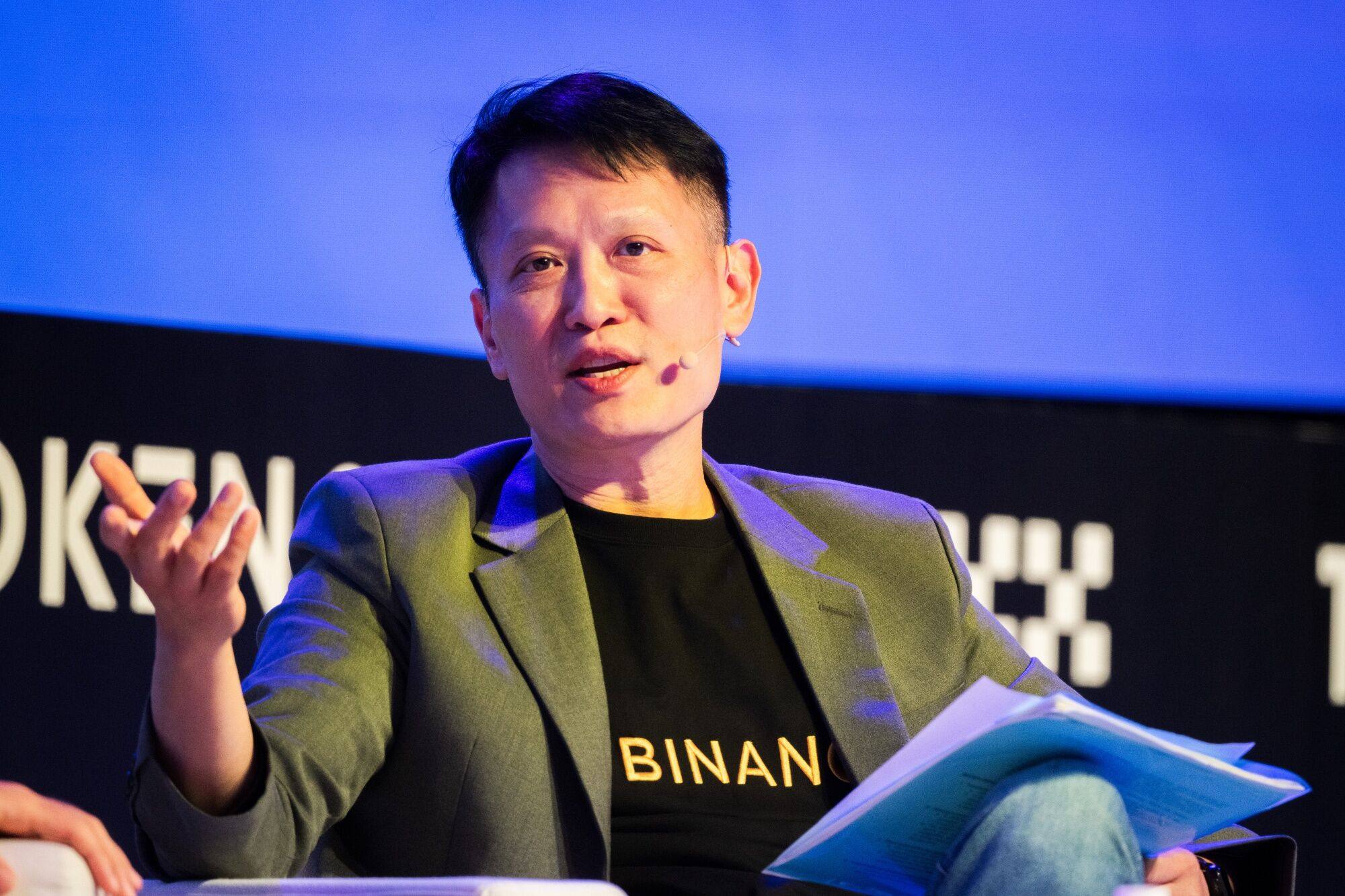

As Binance navigates the new landscape of global crypto regulations, all eyes are on newly appointed CEO Richard Teng, a former Singaporean regulator. Will the company, which has never named an official headquarters location, finally put down roots and clear up any ambiguity about where it operates and by whose rules?

Teng has so far shown no sign that the company is on the verge of greater transparency. He previously told Bloomberg TV that the company’s “core team” remains intact. When questioned by the Financial Times at its Crypto and Digital Assets summit in London this month, he refused to share the location of the company’s headquarters and questioned why anyone would “feel entitled” to that information.

However the company’s future plans shake out, China could be too important a market to ignore. And Beijing has so far been tolerating a fair amount of measurable activity in the market.

“The ban hasn’t been completely ineffective, but it has been shown to be highly porous,” Chainalysis’ Ong said, “and we’re still seeing a very material amount of activity in China.”

Additional reporting by Coco Feng.