BREAKING: Europe’s massive money laundering and corruption problem; crime gangs exploit fintech, vIBANs and DeFi, Europol warns in report

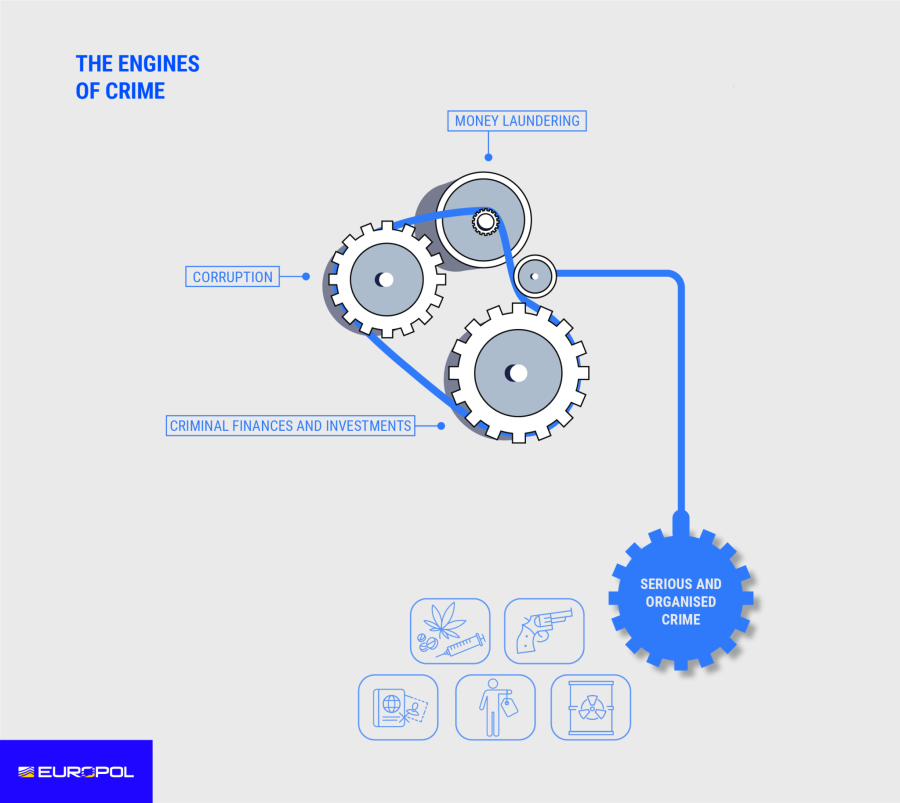

ALMOST 70% of criminal networks operating in the EU make use of one form of money laundering or the other to fund their activities and conceal their assets, a Europol report released today (Monday) said.

Starkly, the report also find that more than 60% of the crime gangs operating in the EU use corruptive methods to achieve their illicit objectives.

Other key findings include:

- 80% of the criminal networks active in the EU misuse legal business structures for criminal activities.

- The criminal landscape in this area is fragmented, with key players often located outside of the EU.

- The techniques and tools used by the criminals advance quickly, as they take advantage of technological and geopolitical developments.

Today’s report is Europol’s first ever threat assessment on the topic. Entitled ‘The other side of the coin: an analysis of financial and economic crime in the EU’, the authors say it “sheds a light on this system which, from the shadows, sustains the finances of criminals worldwide.”

The report is based on a combination of operational insights and strategic intelligence contributed to Europol by EU Member States and Europol’s partners.

It analyses all financial and economic crimes affecting the EU, such as money laundering, corruption, fraud, intellectual property crime, and commodity and currency counterfeiting.Europol’s Executive Director Catherine De Bolle said: “Organised crime has built a parallel global criminal economy around money laundering, illicit financial transfers and corruption. With modern technology, they have diversified their modi operandi to evade detection,” said Europol’s director Catherine deBolle.

“The report presents Europol’s expertise in financial and economic crimes, detailing how the current threats are manifesting themselves and how these crimes impact the wider society. It serves as a roadmap to foster cooperation that will derail the world of criminal finances, intercept illicit profits, and – above all else – Make Europe Safer,” she said.

The European Commissioner for Home Affairs Ylva Johansson said: “Financial and economic crime, and its scale, is a corrosive force in society.

“Europol and the European Financial and Economic Crime Centre are part of the solution. This report sets out the increasingly sophisticated methods of organised crime and the European law enforcement successes in fighting back. If EU Member States work together even closer on this fight, we can achieve great results,” she added.

Asset recovery as a powerful deterrent

The report finds that asset recovery remains one of the most powerful tools to fight back.

“It deprives criminals of their ill-gotten assets and prevents them from reinvesting them in further crime or integrating them into the mainstream economy.Increasing efforts are being made by EU legislators, Member States and law enforcement to corrode the economic power of serious and organised crime through the recovery of confiscated assets,” the authors say.

“Yet the amount of captured proceeds still remains too low – below 2% of the yearly estimated proceeds of organised crime, according to a data collection carried out on seized assets for the purpose of the report.”

Report Highlights:

“Rapid technological advances in the financial sector have been taken on by criminals as opportunities. Fintech (a portmanteau of ‘financial technology’) integrates technology to improve financial services, which drives innovation, expands financial inclusion and reduces operational costs.

Fintech is now integrated into traditional banking, but also in non-bank and non-financial organisations. Yet, it provides many opportunities for criminal abuse.

Other developments in finance have led to the arrival of digital banking, or neo banks, which are virtual financial institutions with no physical branches. Such banks are increasingly popular, often growing quickly and at the expense of proper compliance processes, which risks disproportionate rates of financial fraud and money laundering offences.

In this context, the use of digital payments for money laundering purposes

has been observed in all Member States, and this practice appears to be growing at

varying rates. Virtual IBANsI (vIBANs) enable fast international payments that mask the identity of the master account, the issuer and country of origin, making it harder to detect suspicious transactions, and adding an extra step to investigations.

The misuse of vIBANs has been observed in recent criminal investigations into various fraud types.

Buy now pay later (BNPL) financing, also known as point-of-sale instalment loans, has also grown recently and criminals have been exploiting current weaknesses in the BNPL application process for theft.

Since BNPL services do not conduct formal credit checks, offenders can often pass the algorithmic checks and use legitimate users’ accounts to illicitly order items. Machine learning, artificial intelligence (AI) and deepfake technology can be used for virtually all types of financial and economic crime.

Chat-bots based on AI, such as ChatGPT, could be easily used in online fraud

schemes5. Deepfake technology can help circumventing remote on-boarding

measures. CEO fraud is a particular risk, as information on high-profile figures at

financial institutions is publicly available.

Decentralised finance (DeFi)II involves using blockchain technology to supplement or replace the traditional centralised financial system. The decentralised blockchain

technology promises greater independence and security, as sensitive information can be protected more robustly.

However, the lack of regulation of this new area leaves openings for economic crime, since criminals hold illicit assets on DeFi platforms. The use of cryptocurrencies for criminal schemes is also increasing in line with their overall

adoption rate (however their criminal use still represents less than one percent of the overall transaction volume).

Offenders appear to be deterred by their high volatility and by some high-profile law enforcement successes in tracing criminal cryptocurrency transactions. However, cryptocurrencies are still largely targeted in fraudulent investment schemes and are also used for a wide range of criminal activities, ranging from trade of illicit goods to fraud and money laundering. Non-fungible tokens (NFTs)

are unique digital identifiers that are recorded in a blockchain.

They have grown significantly in popularity in recent years, and many cryptocurrency exchanges now offer NFTs directly on their platforms. NFTs are frequently abused for fraud: fake NFTs are sold by criminals and legitimate ones are sold multiple times.

NFTs also pose a significant risk of money laundering, due to their instant trading feature across borders.

The metaverse is a set of open and interoperable digital spaces which can be used for many aspects of daily life. The financial sector has been an early adopter, and many actors have established a presence in the metaverse. Criminals will certainly exploit it further as this new virtual environment develops, with cases of fraud, theft, and other crimes already being reported.

The current research into new decentralised web platforms and applications based on peer-to-peer (P2P) interaction rather than on centralised data hosting services could be exploited by organised crime and constitute a further challenge for investigations.

Europol’s European Financial and Economic Crime Centre

The report was produced by the European Financial and Economic Crime Centre (EFECC), founded in June 2020, is Europol’s answer to the growing threats to the economy and integrity of our financial systems.

EFECC’s dedicated specialists and analysts support law enforcement and relevant public authorities in their international financial crime investigations and aims at improving the recovery of criminal assets. In 2022, EFECC supported 402 investigations, with the demand for its skills and services increasing every year.