Bitcoin price drops to US$42,000: Unraveling the causes of this huge change in the crypto market

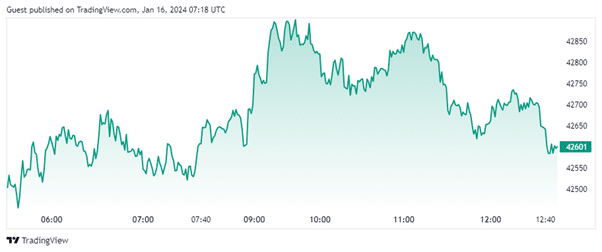

In crypto news, changes in the bitcoin price are a popular subject. The performance of Bitcoin, a well-known cryptocurrency, frequently affects the crypto price as a whole. Everyone interested in the fascinating world of cryptocurrencies must stay up to date on these changes. Its price dropped dramatically during the past week, from US$49,000, the peak it reached two years ago, to around US$42,000, or roughly 15%, Bitcoin is now the largest cryptocurrency in the world by market capitalization. What causes this abrupt decline in value, and what does it portend for bitcoin going forward?

The Bitcoin ETF Hype and the Sell-the-News Effect

The “sell-the-news” effect, in which traders liquidate their holdings following a highly anticipated event, is mostly to blame for the most recent decline in the Bitcoin price. The event in this instance was the approval of multiple Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission. Bitcoin’s price surged as a result of these ETFs, which were viewed as an indication of widespread acceptance and an optimistic mood in the market.

The market’s response upon approval, though, was less favorable. Some exchange-traded funds (ETFs) are based on Bitcoin futures contracts, such as the ProShares Bitcoin Strategy ETF and the Valkyrie Bitcoin Strategy ETF. These might come with increased costs and risks for investors, and they could not correctly represent the price of Bitcoin.

The current price of Bitcoin, which is established by averaging the prices of many cryptocurrency exchanges, serves as the basis for other exchange-traded funds (ETFs), such as the VanEck and WisdomTree Bitcoin Trusts. The quality and dependability of the pricing data may be impacted by the different liquidity, security, and regulatory requirements of these exchanges.

Furthermore, the Grayscale Bitcoin Trust, an established product with a lower expense ratio and a higher market share, is a competitor of both ETFs. Some investors sold their holdings of Bitcoin due to dissatisfaction with the ETFs’ performance and quality, which set off a chain reaction and drove down the price of Bitcoin.

The Negative Market Sentiment and the Regulatory Uncertainty

Several reasons have contributed to the recent decline in the price of Bitcoin. The demand for riskier assets like cryptocurrency may have decreased as a result of the ongoing COVID-19 outbreak and its effects on the world economy. The buying power of fiat currencies may be diminished by rising inflation and interest rates, which would raise borrowing costs and have an impact on cryptocurrency investors and enterprises. Better Bitcoin substitutes, including quicker, less expensive, and more scalable coins, or more sophisticated and user-friendly platforms, might be introduced via more competition and innovation in the cryptocurrency space.

Government oversight and regulation of the cryptocurrency market are becoming more prevalent, which may lead to further limitations and regulations on cryptocurrency-related activities and lower the appeal and accessibility of Bitcoin. Some investors may have reduced their exposure to Bitcoin or left the market as a result of these causes, which may have also exacerbated anxiety and uncertainty about Bitcoin’s future and dampened the excitement of the crypto community, adding to the price decrease.

The Conclusion and the Outlook

The sell-the-news effect that followed the approval of the Bitcoin ETF, regulatory uncertainty, and unfavorable market sentiment are some of the reasons behind the recent decline in the price of Bitcoin. Nevertheless, these variables don’t always point to a long-term downward trend in Bitcoin prices.

The approval of the Bitcoin ETF may yet be advantageous for the cryptocurrency sector, drawing in additional funds and investors, improving price discovery effectiveness and liquidity, and bolstering the reputation of Bitcoin. Additionally, it may encourage greater innovation and rivalry in the cryptocurrency space as multiple issuers compete to provide better and more varied goods and services.

On the other hand, the unfavorable mood in the market and the lack of clarity around regulations may serve as a stimulant for the cryptocurrency sector, promoting increased study, cooperation, and adaptability. It may also put the community’s resiliency to the test, upending fans’ preconceived notions and inspiring them to embrace Bitcoin’s mission.

As a result, the recent decline in the price of Bitcoin might not be cause for alarm but rather for caution and optimism. It offers the cryptocurrency sector both benefits and threats. In the unpredictable world of cryptocurrency, investors should as always conduct due diligence, make wise choices, and be ready for everything that may happen.