Bitcoin hits new ATH above $72k, could challenge gold’s position in ‘non-confiscatability’

Another day, another new record high for Bitcoin (BTC) as the top crypto has officially entered price discovery mode since first breaching its ATH last Tuesday.

And in true Bitcoin fashion, volatility accompanied the move higher as bears attempted to break the back of support at $68,000 in the early hours on Monday but were fended off by bulls, who drew ample reinforcements above $67,000.

Once the bear threat was neutralized, bulls pushed the price action, lifting Bitcoin to a new high above $72,000 for the first time in history, topping out at $72,630 on Coinbase.

BTC/USD Chart by TradingView

At the time of writing, Bitcoin trades at $72,400, an increase of 4.42% on the 24-hour chart.

The ongoing climb by the top crypto comes as tailwinds continue to increase, with the latest positive development being a statement from the UK Financial Conduct Authority (FCA) that they will allow exchanges to list cryptocurrency-linked exchange-traded products in the UK for the first time.

“Today’s surge in Bitcoin’s price to a new all-time high above $72,000 coincides with the UK’s FCA opening doors for cryptocurrency-linked exchange-traded products,” Mikkel Morch, founder of the digital asset investment fund ARK36, said in a note shared with Kitco Crypto. “It seems that the UK could finally be poised to catch up with the rest of Europe, the Middle East, and the USA in embracing digital assets.”

“This significant regulatory shift not only reflects London’s intention to remain a key player in the financial world but also signals a broader acceptance and institutionalization of cryptocurrencies,” he said. “The FCA’s move is particularly timely, as the cryptocurrency market anticipates the upcoming Bitcoin halving event, a fundamental mechanism that historically has had a bullish impact on Bitcoin’s price due to the reduced supply of new coins entering the market.”

“Furthermore, the positive momentum in the cryptocurrency space is further bolstered by the impact of spot Bitcoin ETFs in the USA, with very substantial funds continuing to flow in,” Morch added. “This development, alongside the UK’s regulatory advancements, also shows the growing recognition of cryptocurrencies by Western financial authorities.”

“As London seeks to bridge the gap with its European, Middle Eastern and USA counterparts, the confluence of regulatory acceptance, the halving event, and the influence of spot BTC ETFs could herald a new era of growth and mainstream adoption for cryptocurrencies,” Morch concluded. “The cumulative effect of these factors is likely to sustain the rally and foster a more robust and diversified investment landscape for digital assets.”

Gold 2.0

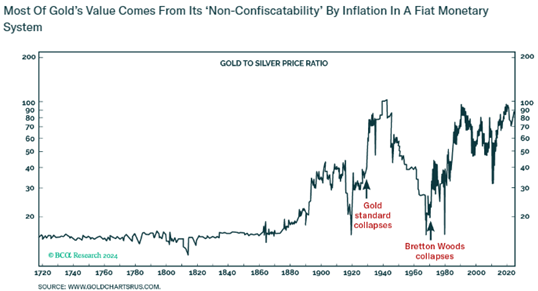

According to Dhaval Joshi, Chief Strategist at BCA Research, the increasing prominence of Bitcoin is stealing some of gold’s thunder as the top crypto offers a digital version of one of the yellow metal’s most beneficial properties: resistance to confiscation.

“The intrinsic value of Bitcoin is that it cannot be confiscated by the state, either through monetary inflation, or through bank failure, or through outright expropriation,” Joshi said in a note shared with Kitco Crypto. “Most of gold’s value also comes from its non-confiscatability, either through monetary inflation or through bank failure.”

He noted that “The total market value for non-confiscatability is $15.3 trillion, of which gold comprises 89 percent and cryptocurrencies just 11 percent,” and said that in the next few years, “as the non-confiscatability market grows to around $20 trillion and cryptocurrencies increase their share to around 20 percent, the Bitcoin price could rise to well north of $100,000.”

“While we should expect a near-term countertrend move, the structural uptrend in Bitcoin that started in November 2022 is still intact,” he said. “As cryptocurrencies gradually displace gold in the non-confiscatability market, the real price of gold is likely to stay in the sideways range that it has been in for the past ten years.”

For this reason, Joshi said “The structural uptrend in Bitcoin is still intact, while the real price of gold will trend sideways,” and gave a tactical recommendation to “Short gold.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.