While Americans have seen the adoption of Bitcoin (BTC) spot and futures ETFs, the situation in Europe is different.

Bitcoin ETFs have been a hot topic for many months, as the approval of ETFs based on actual Bitcoin in the U.S. could potentially lead to an influx of funds from Wall Street institutions, possibly pushing the price of Bitcoin to new heights.

How do Bitcoin ETFs work?

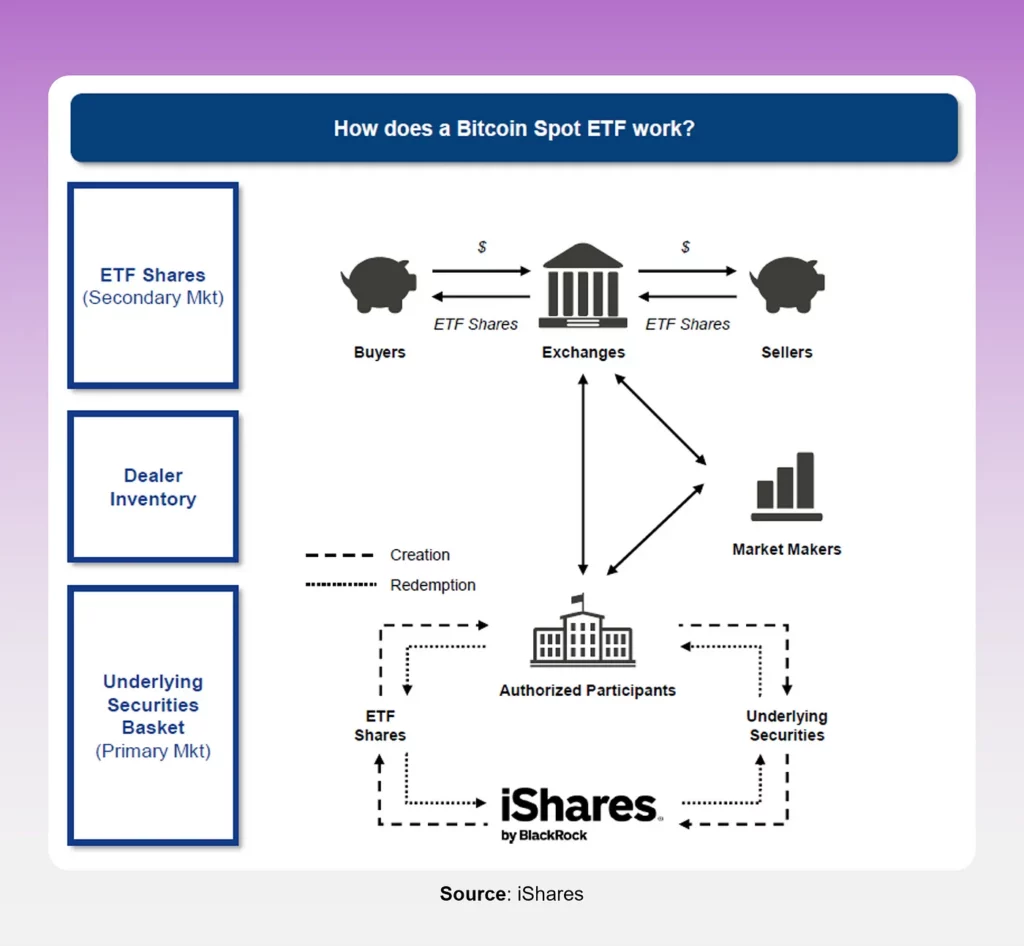

Like traditional ETFs, Bitcoin ETFs are issued by financial institutions that invest in Bitcoin and manage the fund on behalf of investors. A Bitcoin ETF can be structured in various ways. For example, it may hold Bitcoin futures or “physical” Bitcoin as the underlying asset, managed by the ETF issuer on behalf of the investor.

In the case of funds with a Bitcoin base, the issuing institution buys BTC and holds it. Subsequently, it issues shares of the fund on a securities exchange, tracking the asset’s price. Investors directly own a portion of the underlying Bitcoin, and as the cost of BTC fluctuates, the value of the ETF changes accordingly.

One notable advantage of Bitcoin ETFs is their trading on regulated securities exchanges, providing accessibility to various investors and eliminating the need for technical knowledge in securely storing crypto assets.

As a result, investors new to cryptocurrencies can gain exposure to Bitcoin without requiring a crypto wallet or engaging in trading on a cryptocurrency exchange platform.

Bitcoin ETP: not to be confused with ETF

In addition to ETFs, exchange-traded products (ETPs) exist in the regulated investment markets. ETP stands for exchange-traded product, representing an investment product available on a stock exchange.

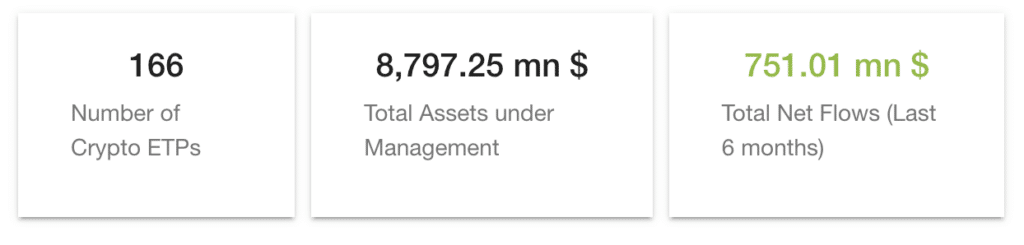

As the value and opportunity of the digital asset market grows, more cryptocurrency ETPs are coming into circulation, including ETPs for Bitcoin, Ethereum (ETH), and Litecoin (LTC).

What is known about ETP in Europe

Spot Bitcoin ETPs have existed in Europe for a long time, providing investors with access to digital tokens. Europe is much more progressive in terms of cryptocurrency products.

In May 2015, Swedish vendor XBT AB announced the authorization of Bitcoin Tracker One (a CoinShares product). It was the very first BTC-based security available on a regulated exchange. In October 2015, the company launched the euro-denominated Bitcoin Tracker EUR security system, available through Nasdaq Nordic.

About $9 billion is currently allocated to ETPs in Europe, according to ETFbook, with much of the asset collection and earnings over the past year driven by a flood of news related to expected ETF approvals in the U.S.

Bitcoin ETF in Europe

The first Bitcoin ETF in Europe, the Jacobi FT Wilshire Bitcoin ETF, was launched in August 2023 on the Euronext Amsterdam exchange under the ticker BCOIN.

Jacobi FT Wilshire Bitcoin ETF, a green ETF from Jacobi Asset Management, aligns its goals with the European Union’s aspirations for sustainable blockchain innovation. This is a significant first step towards introducing ETFs in Europe as other asset management firms look to invest in the region’s blockchain industry. The tool has a built-in solution for renewable energy certification. According to the company, it allows “institutional investors to access the benefits of Bitcoin while achieving ESG goals.”

The firm received the Guernsey Financial Services Commission’s approval to launch the product in October 2021. According to Jacobi’s plans, the Bitcoin fund was supposed to appear in July 2022, but it was postponed due to the collapse of Terra.

However, the fund’s approval did not cause much excitement. The leading cryptocurrency entered an upward trend only towards the end of the year in anticipation of the acceptance of spot Bitcoin ETFs in the United States.

There are some obstacles to developing cryptocurrency ETFs, primarily the Undertakings for Collective Investment in Transferable Securities Directive 2009 or UCITS. Crypto, like gold and other commodities, is not included in the European Commission’s Eligible Asset Directive for UCITS funds.

Will there be analogs of spot Bitcoin ETFs in Europe?

Despite the cryptocurrency situation in Europe becoming more progressive with the launch of the Market in Crypto Assets (MiCA) regulation, it is unlikely that the European Union will follow the path of the United States soon.

Firstly, cultural differences between Americans and Europeans should be considered. While Americans are often seen as bright representatives of capitalism, unafraid to invest and try new financial instruments, Europe has a somewhat different approach.

Particularly, due to the more conservative investment approach of Europeans, it is unlikely that spot Bitcoin ETFs in Europe will replicate the success seen in the United States. Moreover, exchange-traded products (ETPs) are already familiar on the continent, with asset managers like CoinShares, 21shares, WisdomTree, and VanEck offering ETPs that behave like ETFs.

However, the emergence of spot Bitcoin ETFs in Europe cannot be entirely ruled out. If the American market sets a positive example, perhaps Europeans will follow suit.