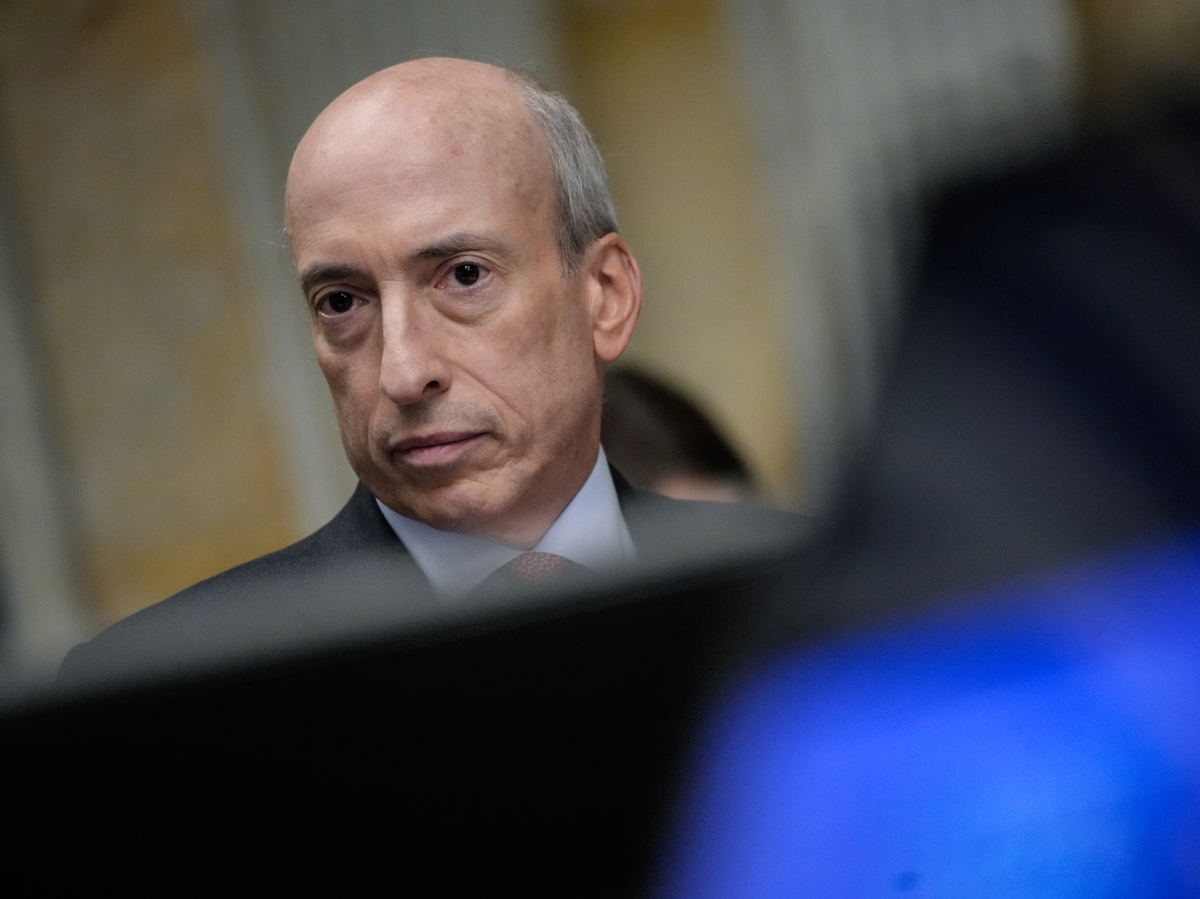

The Securities and Exchange Commission, under Chair Gary Gensler, has approved several spot bitcoin exchange-traded funds, which will track the cryptocurrency’s price.

Drew Angerer/Getty Images

hide caption

toggle caption

Drew Angerer/Getty Images

The Securities and Exchange Commission, under Chair Gary Gensler, has approved several spot bitcoin exchange-traded funds, which will track the cryptocurrency’s price.

Drew Angerer/Getty Images

Bitcoin is on a tear. In the past year, the top cryptocurrency has gained more than 150%.

The massive run-up has come despite months of negative headlines, the successful prosecution of one of the biggest players in crypto, and after financial regulators and law enforcement targeted a long list of investors and promoters, executives and companies.

Now, crypto is getting a big boost. On Wednesday, Wall Street’s top cop, the Securities and Exchange Commission (SEC), approved almost a dozen bitcoin ETFs, investment funds that will track bitcoin prices, and will pave the way for more of the public to buy it.

Steven McClurg, the co-founder of Valkyrie Investments, which successfully applied for a spot bitcoin ETF, says the SEC’s decision will widen the appeal of cryptocurrencies.

“It gives them the opportunity and ability to invest in bitcoin through a regulated, structured security,” he said. His Valkyrie Bitcoin Fund was one of several applications the SEC approved.

ETFs are less costly than mutual funds

ETFs, or exchange-traded funds, have become extremely popular with regular investors. These funds usually track the prices of stocks and bonds and trade on exchanges. That makes them easy to buy, and they’re less costly than mutual funds. Today, ETFs are a $7.7 trillion industry.

In recent years, sites like Coinbase and Kraken have made it easier for people to buy and sell bitcoin and other cryptocurrencies. But according to McClurg, there are still big barriers to entry.

“In the case of bitcoin, it’s difficult for some people to learn how to buy it and store it on their own,” McClurg says. “A lot of people are still uncomfortable with the technology, and want to have the ability to invest in it. And the best way to do that is really through an ETF.”

No need for a “private key” to cryptos

According to Bryan Armour, director of passive strategies research for North America at Morningstar, these new funds are going to be seen as a safer way to buy and sell cryptocurrencies.

“There’s no signing up with a crypto exchange, managing a wallet, God forbid losing your private key to whatever bitcoin you own,” he says. “It certainly will get bitcoin into more people’s hands.”

ETFs are regulated by the SEC, and that is a big reason why Wednesday’s decision by the agency is so significant. Regulatory clarity is important, and so is the SEC’s imprimatur.

“We’re finally at the point where the regulator is willing to give us clear guidance in terms of what’s legal and what’s not,” says Sarit Markovich, a professor in the Kellogg School of Management at Northwestern University.

The list of approved approved spot bitcoin ETFs includes some lesser-known investment firms, which primarily focus on cryptocurrencies. But it also includes several major money managers, including BlackRock, Fidelity and Invesco.

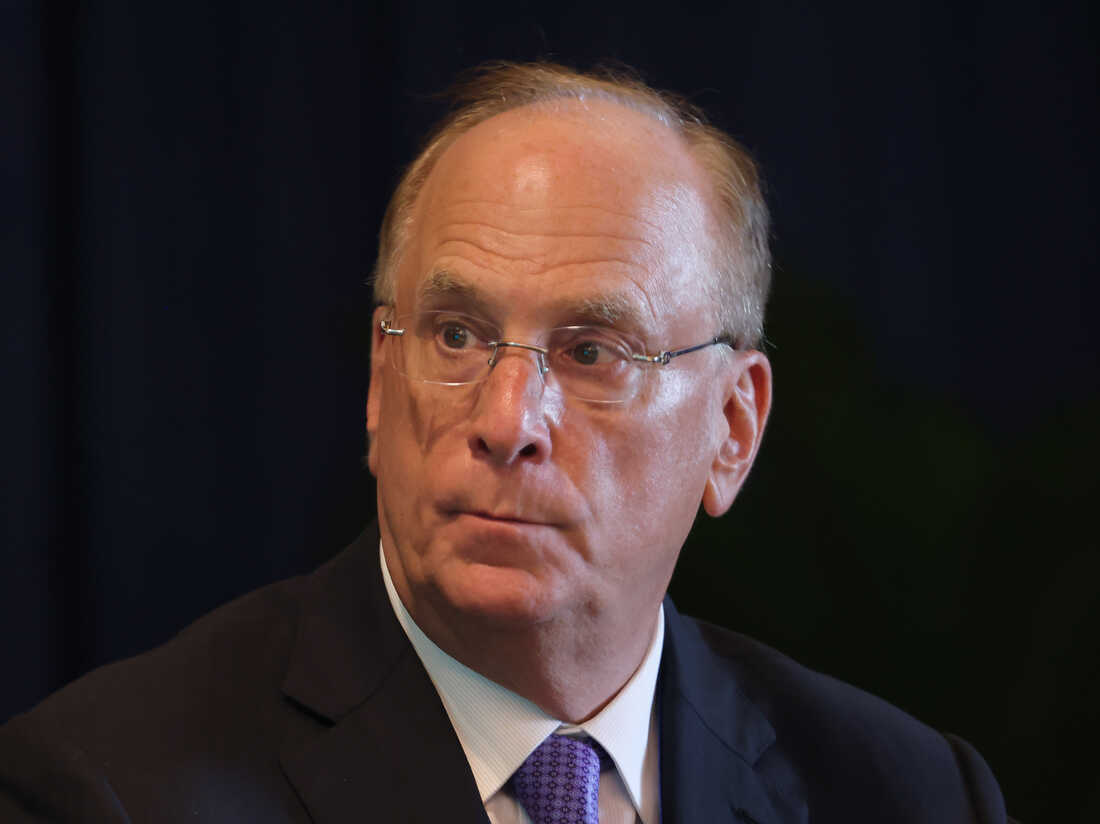

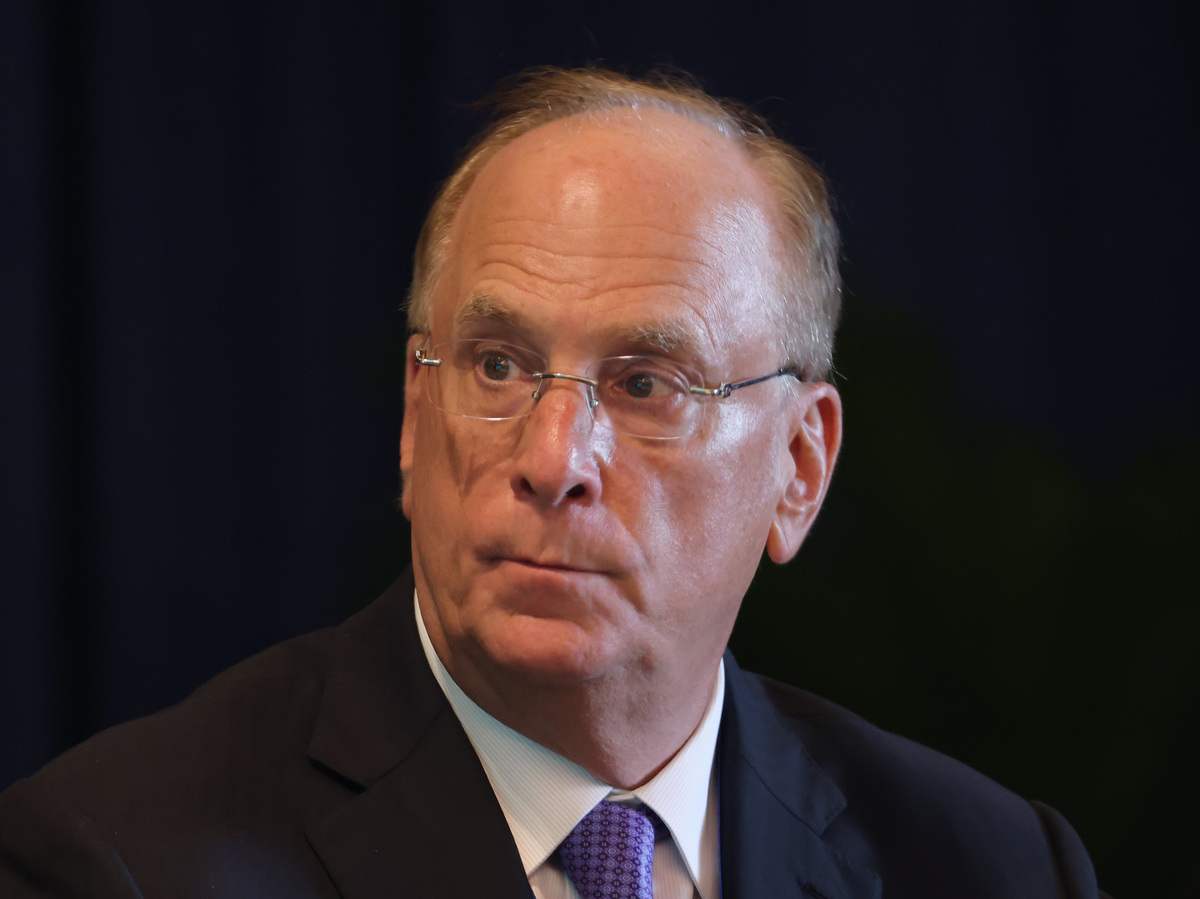

In 2017, Larry Fink, the CEO of BlackRock, called bitcoin an “index of money laundering.” Soon, BlackRock will have its own spot bitcoin exchange-traded fund.

Sean Gallup/Getty Images

hide caption

toggle caption

Sean Gallup/Getty Images

In 2017, Larry Fink, the CEO of BlackRock, called bitcoin an “index of money laundering.” Soon, BlackRock will have its own spot bitcoin exchange-traded fund.

Sean Gallup/Getty Images

According to Henry Hu, who teaches banking and finance at the University of Texas Law School, the involvement of these big investment firms will burnish the perception of cryptocurrencies.

“BlackRock’s involvement in this market helps give the market more legitimacy,” he says.

The approval of spot bitcoin ETFs will appeal to regular investors, but it is also likely to make the cryptocurrency something that more institutional investors can buy into. (Many funds are restricted from buying into non-regulated investments.)

This is the first time the SEC has approved investment funds that track the price of bitcoin. It gave the go-ahead to ETFs that track the futures market for bitcoin.

Re-evaluating the “Wild West”

For years, the SEC rejected applications from money managers, citing concerns about how bitcoin is valued and held. In 2018, Dalia Blass, who was then the director of the SEC’s division of investment management, raised a series of questions about spot bitcoin ETFs in a letter to two industry groups.

“There are a number of significant investor protection issues that need to be examined before sponsors begin offering these funds to retail investors,” she wrote.

In the years since, the crypto world has evolved and expanded, and the SEC conceded companies had adequately responded to many of Blass’ questions. But until recently, regulators remained concerned about the potential for market manipulation.

SEC Chair Gary Gensler, who famously said crypto is like “the Wild West,” has spent most of his tenure cracking down on it. Without new, crypto-specific from congress, he has asserted most cryptocurrencies are securities, and therefore, they fall under the SEC’s purview.

In a statement after Wednesday’s announcement, he again sounded a warning about crypto.

“Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” Gensler said.

In August, the crypto industry became more optimistic regulators would approve a spot bitcoin ETF after the investment firm Grayscale won a victory in a federal appeals court.

The company has operated a different kind of investment product, called a bitcoin trust, and it had asked the SEC for permission to convert that into an ETF. The SEC rejected that application, and the judge ruled that was unfair.

After the decision, the SEC was forced to reevaluate Grayscale’s application — and consider others, bitcoin’s price jumped on the news.

On Wednesday, Gensler said that, in light of the decision, he decided “the most sustainable path forward” was to approve the bitcoin ETFs.

It continued to rise after the Federal Reserve released its latest summary of economic projections at the end of December, indicating policymakers anticipate cutting interest rates in 2024. When interest rates are lower, investors are more comfortable making riskier bets.

On Tuesday, a post from the SEC’s official account on X, the social media site formerly known as Twitter, appeared to indicate the agency had given spot bitcoin ETFs its blessing. Almost immediately, bitcoin’s price spiked by more than $1,000.

But a spokesperson for the SEC said the account had been compromised, and the commissioners hadn’t made a decision. Hours later, X’s safety team confirmed the account was hacked, noting it didn’t have two-factor authentication enabled.

Bitcoin’s recent rally has been astonishing, in part because it coincided with so much negative news about crypto.

In 2023, the SEC and other financial regulators brought a series of lawsuits against crypto companies and investors, and the U.S. Department of Justice won its case against disgraced crypto mogul Sam Bankman-Fried, who is scheduled to be sentenced in March.

The U.S. government soon after announced a multibillion-dollar settlement with Binance and its founder, CZ, who pleaded guilty to violating anti-money-laundering laws.

Bitcoin’s biggest boosters and crypto companies are glad to turn that page.