However, National Australia Bank – which operates the popular nabtrade platform – said it was still considering whether it would list the ETFs.

“There’s no reason why we wouldn’t list it like any other ETF,” said SuperHero chief executive John Winters. “There have been other derivative-type options floating around, but this really opens it up as a financial product.”

Financial advisers, who have long fielded requests from clients on how to best gain safe access to bitcoin, are also bracing for a wave of interest, although there remain uncertainties on how advice for investing in cryptocurrencies is regulated in Australia.

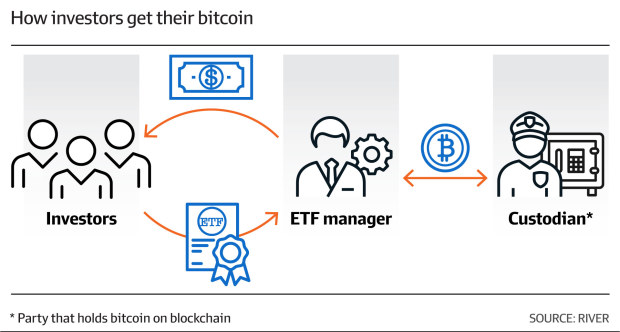

Institutional and retail investors have long waited for a way to have bitcoin exposure without needing to manage cryptographic keys, bitcoin wallets or to interact with unregulated crypto exchanges.

“This provides the on-ramp for institutional capital that bitcoin has longed for in recent years, with retail investors broadly already owning this asset,” Josh Gilbert, market analyst at eToro, an online broking firm, said.

“Today’s approval is a milestone moment for bitcoin and cryptocurrencies more generally,” said Jonathon Miller, managing director of Kraken Australia, a cryptocurrency exchange.

“An ETF makes bitcoin accessible to a much broader range of investors and signifies tacit acknowledgment that the crypto asset class is here to stay.”

The New York Stock Exchange, Nasdaq and Cboe Global Markets have all received permission to list the spot-bitcoin ETFs. BlackRock, Fidelity and Grayscale have already announced their fee plans for investors, marking the start of a fierce battle to attract investor money to the new asset class.

But SEC chairman Gary Gensler warned that the approval does not reflect a broader acceptance of cryptocurrencies by the regulator. He noted that the underlying assets of other exchange-traded funds, such as metals, have consumer and industrial uses.

“In contrast, bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing,” he said.

“While we approved the listing and trading of certain spot bitcoin [ETF] shares today, we did not approve or endorse bitcoin.”

Bitcoin topped $US47,000 and ethereum jumped more than 10 per cent.

Swyftx, a local cryptocurrency exchange, said early trading volumes had jumped more than 80 per cent while bitcoin trade volumes on the exchange in the fourth quarter had almost doubled from a year earlier period.

“Local investors clearly believe the ETF approvals are a landmark event that will drive significant additional demand,” Jason Titman, Swyftx’s chief operating officer, said.

“You don’t need to be an existing bitcoin user to understand the importance of it controlling a place in Wall Street portfolios. We think it unlikely the market will get upended overnight, but signals are important and this is a significant institutional vote of confidence in the future of digital assets.”

Independent Reserve, another exchange, also confirmed that trading volumes had doubled throughout Thursday as investors digested the news.

The decision comes after months of intense industry lobbying. The focus has been on spot price ETFs, which means the institutions directly hold bitcoin, rather than derivatives contracts that are tied to the bitcoin price.

Australia is set to allow a local spot bitcoin ETF in the first half of this year.

The Australian Financial Review revealed yesterday that Brisbane-based Monochrome Asset Management has an approval timeline confirmed with the Australian Securities Exchange for an impending launch.