Bitcoin ATMs Installations in Europe hit an all-time high Regardless of MiCA Regulation

- The United States has the highest number of crypto ATMs Globally.

- Austria has the maximum number of functional crypto ATMs in Europe.

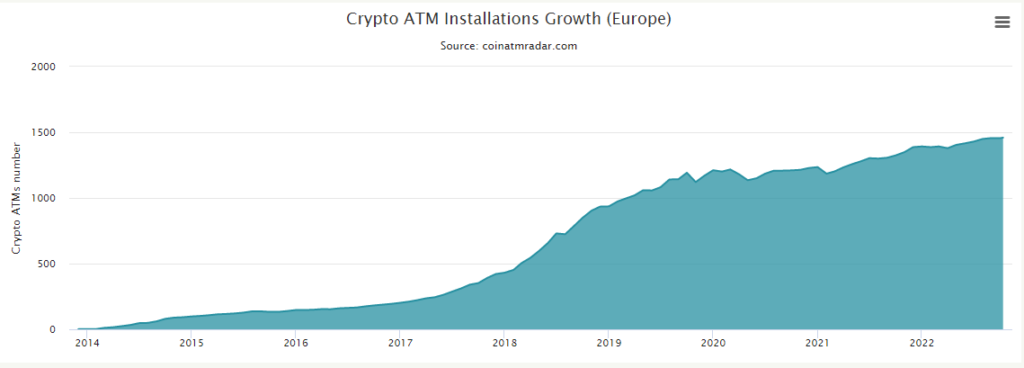

According to data from Coin ATM Radar, the total number of Bitcoin ATMs in Europe crossed 1400, and the fresh data of 12 October says that the number of functional BTC ATMs is around 1,459, with 38,604 installations worldwide.

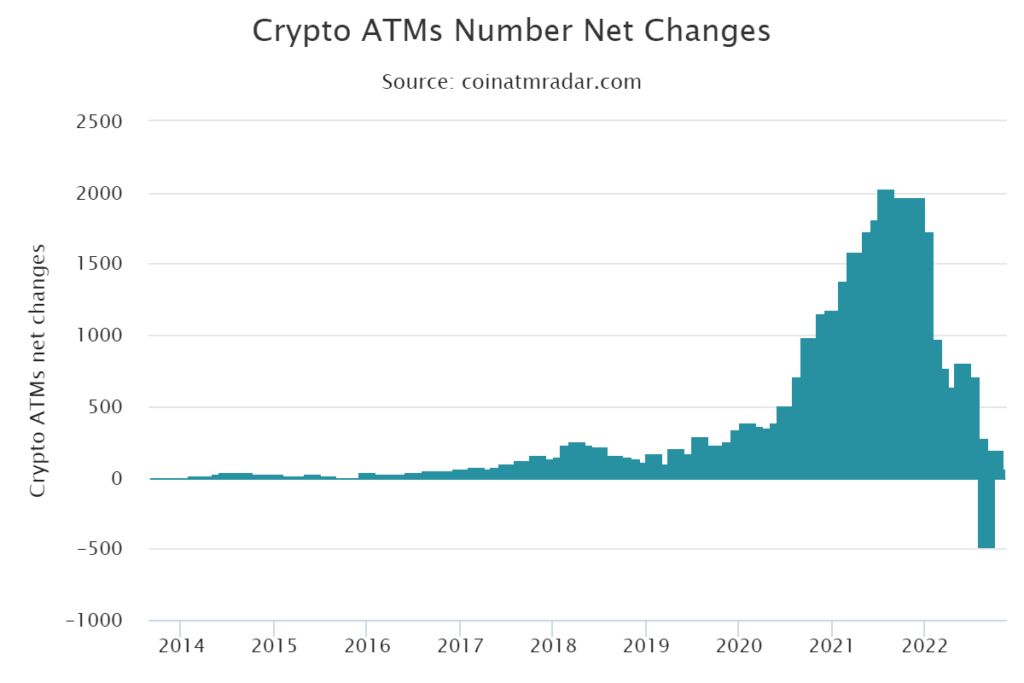

The all-time high in bitcoin ATM installations comes when the European Union is all set to ratify the milestone MICA regulations.

An impressive hike is being seen in the installations of crypto ATMs in Europe, and from the start of 2022 to till date 5% hike has been seen. If we compare years wise 10% hike is seen in the last year, and last year at the same time, the number of ATMs was around 1,324.

It is being observed that in the last few years, the use cases of crypto and Bitcoin ATMs have been increasing rapidly; mostly, the functioning is seen in Europe and Greece. The country has a total of 66 ATMs/Tellers, among which 64 ATMs are functional, and most tourists use these ATMs.

European Country Austria is among the most crypto ATMs holder, and at the time, there are around 134 crypto ATMs, including the ATMs of all sorts of cryptocurrency.

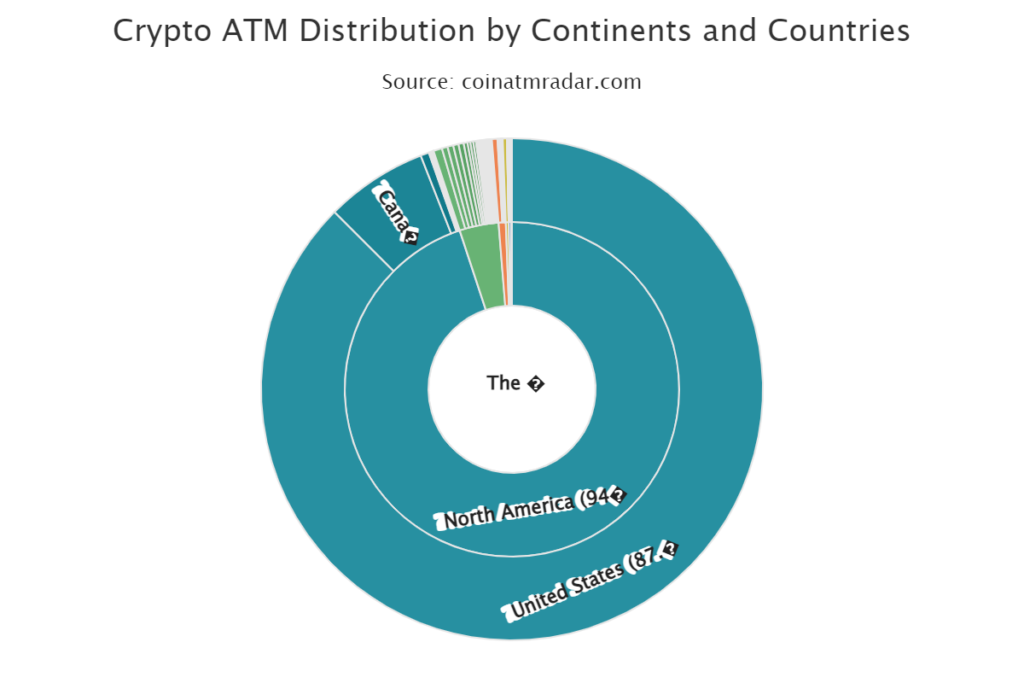

The United States is the first country in the world to have 30K plus crypto ATMs, and the exact number is around 34,196 ATMs. Canada holds the second position in this list of most crypto ATMs, with around 2629 ATMs.

The latter may still be distant from other countries but is of noticeable interest, as in Greece.

In the above data indication chart is clearly seen that the major portion of crypto ATMs sector is held by few countries like United States,North America,Canda and few countries of Europe.

On 3 October 2022, The United States Federal Bureau of Investigation underlined that crypto ATMs are mostly used to commit fraud with users. The fraud may be Ten to millions of dollars.

A historic regulation known as the Markets in Crypto-Assets (MiCa) framework, which offers direction for crypto asset service providers (CASPs) to operate inside the Europe zone, was recently approved by European Union officials.

However, not everyone agrees that the recent change in EU rules would have a favorable impact for the area.

The European Union wasted a chance to reclaim the market share it lost in Web2 due to advancements in Web3, according to Seth Hertlein, the global head of policy at wallet company Ledger.