Big Crypto’s struggles with basic accounting and economics — by Martin Walker – Attack of the 50 Foot Blockchain

Guest post by Martin Walker

The leaders of “Big Crypto” seem to have a huge problem understanding the basic concepts of conventional finance — such as balance sheets, auditing and cash flows.

Changpeng Zhao, a.k.a. “CZ”, of the Binance cryptocurrency exchange, recently described how they managed over $580 million of FTT crypto tokens: “We never touched it, we actually kind of forgot about it.” Sam Bankman-Fried has expressed endless confusion about the management of assets by the FTX cryptocurrency exchange and the Alameda hedge fund.

Even before the collapse of FTX, Sam had some unusual ideas about the methods the crypto industry uses to generates value:

… the smart money’s like, oh, wow, this thing’s now yielding like 60% a year in X tokens. Of course, I’ll take my 60% yield, right? So, they go and pour another $300 million in the box and you get a psych and then it goes to infinity. And then everyone makes money.

Cynical people, like most of the mainstream media and the Securities and Exchange Commission (SEC), have finally started coming around to the idea that much of Big Crypto is run by people who are recklessly incompetent and/or criminal. Perhaps some of them are. But it is worth trying to understand how the billionaires (and recently ex-billionaires) developed their ideas about the financial world.

Back in 2016 I co-wrote a paper that pointed out that cryptocurrencies such as Bitcoin are “an asset without a liability.” In other words, “created out of nothing defying the laws of double entry bookkeeping.” Financial assets are always someone else’s liability. If they are not another party’s liability, who is going to pay the returns on the asset that ultimately gives it value? Nobody, hence they have no fundamental value.

Big Crypto firms have been buying and selling “nothing” for so long, mostly in return for different lumps of “nothing”, that many have genuinely come to believe that taking nothing, giving it a name — and sometimes a story — combined with a little bit of trading back and forth with friends, gives “nothing” enormous value.

Whether huge valuations for “nothing” tokens came from simply pumping up the market price of old school cryptocurrencies or creating complex DeFi (Decentralised Finance) structures, the belief in the value of nothing makes is easy to lose sight of the fact of the underlying reality: it is the inflow of real money rather than “the technology”, “the community”, “the network” or “freedom” that gives crypto assets value.

A crypto enthusiast struggling with the idea that financial assets have matching liabilities must find the concept of a balance sheet quite mind blowing. Unfortunately, the misunderstanding of basic bookkeeping is reinforced by fundamental misunderstandings about banking and economics.

The leaders of Big Crypto, including those regularly interviewed on the likes of CNBC, mostly seem to learnt about banking and finance by repeating fairy tales to each other ultimately based and ancient tweets and blogs about Austrian economics. Most of them seem to genuinely believe that banks “create money out of thin air”, selfishly enriching themselves and defrauding the public by creating inflation. If they had some understanding of balance sheets, they might comprehend how making a loan creates both an asset for the bank (the loan) and a liability (the funds placed in the borrower’s account) and that the bank is not creating money for itself out of nothingness, with even the amount credit creation controlled by the requirement to have sufficient capital.

Strangely, given the contempt for inflation generating fiat money, Big Crypto genuinely does create “money” out of thin air. Their preferred way of dealing with the resulting dissonance is based on further misunderstanding. They believe having a fixed supply of any given token — representing “nothing” — protects against inflation. Even as some major cryptocurrencies such as Ethereum and Dogecoin do not have a fixed supply.

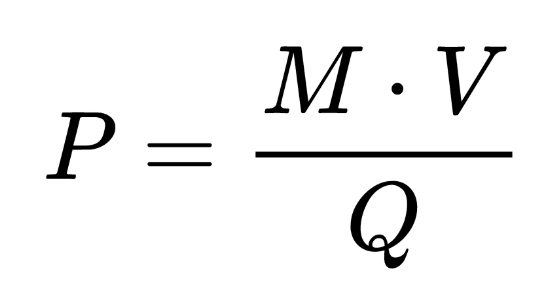

Perhaps if they studied some basic monetary economics and learnt all four letters of the Quantity Theory of Money equation:

In plain English, the price level (P) is only kept constant — i.e., no inflation — if the speed at which money (V) is spent is constant and there is real expenditure on goods and services (Q). Since there is no real expenditure of crypto on goods and services, it really does not matter if the money supply is fixed.

Which takes us to the crypto industry’s struggle with the concept of auditing. CZ stated about audit firms that “Many of them don’t know how to audit crypto exchanges.” With the crypto industry largely living outside the fundamental laws of finance and economics, what hope do auditors have to apply their old-fashioned ideas about assets, liabilities and balance sheets? Very little — but not just because of the crypto industry’s struggle to understand the basics.

One of the tenets of the Crypto faith is that everything is transparent “because it is on the blockchain.” Audits are not really necessary, and, if they have to be done, they involve complex mathematical analysis. Unfortunately, blockchains do not make things transparent in the old-fashioned way auditors like. A certain amount of crypto may be held at a particular address on the blockchain — but that does not mean it is under the control of the party being audited. An auditor cannot simply see an asset in the accounts and reconcile it to a bank statement.

In the crypto world, the best guarantee that you own the crypto you clam is to move some crypto from an address to another and hopefully back again — as Craig Wright notoriously failed to. Unfortunately, even this gives limited assurance. A conventional audit can check who has authorisation to move funds from a bank account. In the crypto world, anyone who has seen the private keys related to crypto funds can take them, and there is no central party to ask if they are authorised or even reverse the transaction.

Hopefully now the reader has a little more sympathy with the poor confused leaders of Big Crypto. If any of them do sadly end up in prison, the least society could do for them is provide some basic accounting and economics course to them. Something sure to aid rehabilitation. Perhaps taking the right courses could be made a condition of parole to encourage more diligent study.