Biden’s 2025 Budget proposal seeks to tax capital gains at 45%, eliminate crypto tax loopholes

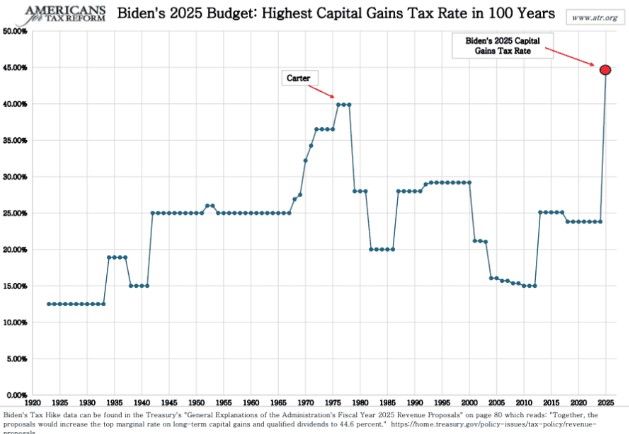

(Kitco News) – Wealthy investors could be in for an unpleasant surprise the next time they do their taxes as President Biden has proposed the highest top capital gains tax in over 100 years in his 2025 budget proposal.

“Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent,” the proposal said.

Based on this figure, the combined federal and state capital gains tax would exceed 50% in many states, including California (59%), New Jersey (55.3%), Oregon (54.5%), Minnesota (54.4%), and New York (53.4%).

The increased tax rate would join the unofficial tax – inflation – and since capital gains are not indexed to inflation, the actual rate that many will pay will be higher than the figures provided in the proposal indicate.

If approved, the budget means that high-earning stock and crypto investors could see their investing proceeds significantly diminished, as the capital gains tax is added on top of the current federal income tax of 22%.

The budget proposal also seeks to increase the corporate income tax rate to 28%.

According to John Kartch, an analyst with Americans for Tax Reform, “The proposed Biden top capital gains tax rate is more than twice as high as China’s rate… and puts the United States in uncharted territory.”

“Biden’s proposed capital gains tax hike will also hit many families when parents pass away,” Kartch said. “Biden has proposed adding a second Death Tax (separate from and in addition to the existing Death Tax) by taking away stepped-up basis when parents die. This would result in a mandatory capital gains tax at death – a forced realization event.”

The budget also proposes eliminating a special tax subsidy for cryptocurrency and other transactions.

Crypto investors are currently subjected to rules that differ from investments in stocks and other securities, including the ability to sell a crypto asset at a loss, claim the losses to reduce their tax liability, and then repurchase the same asset shortly afterward.

The Budget looks to end this tax subsidy by updating the tax code’s anti-abuse rules to treat crypto assets similarly to stocks and other securities.

This aligns with a new draft tax form released by the Internal Revenue Service (IRS) that proposes tracking specific crypto transactions.

The Digital Asset Proceeds From Broker Transactions draft shows that taxpayers will be required to fill out Form 1099-DA, which collects trader identification and detailed transaction data from crypto “brokers.”

“I don’t think crypto will be pseudo-anonymous or privacy-preserving anymore, at least in the US,” said Shehan Chandrasekera, a crypto accountant and the head of tax at CoinTracker, in response to the draft form. “Brokers (CeFi exchanges, certain DeFi exchanges, and wallets) will be required to generate this form for each sale transaction and submit that info to the IRS and you (similar to stock brokers) starting 1/1/2025.”

Chandrasekera said that while the form includes “unsurprising” data requests, such as date acquired, date sold, proceeds, and cost basis of crypto assets sold, it also requires “the collection and reporting of additional data points (especially wallet addresses) to the IRS at scale [which] could lead to major privacy and security concerns.”

These data points include “Sale transaction ID (TxID); Digital asset address from which the units were sold; Number of units sold; Transfer-in TxID number; Transfer-in digital asset address; and Number of units transferred in,” he said.

“Furthermore, in the new draft Form 1099-DA, the IRS has included ‘unhosted wallet provider’ as a check box,” Chandrasekera said. “This further signals the IRS’s intention to include unhosted wallets under the broker definition despite the industry feedback.”

He said that going forward, crypto traders “will likely have to provide KYC information before creating an unhosted wallet and/or when interacting with platforms via unhosted wallets,” warning, “This could drastically change how users interact with crypto platforms. They will change ‘DeFi’ as we know it today.”

According to Jessalyn Dean, VP of Tax Information Reporting at Ledgible, the draft 1099-DA represents “the first major material step to tax information reporting for digital assets.”

“As expected, the look and feel is similar to the Form 1099-B for reporting sales of traditional financial products (e.g. equities),” Dean said. “Most of the boxes line up as expected with the required information as listed in the proposed regulations from August 2023.”

She said, “The inclusion of a ‘wash sale loss disallowed’ Box 1i does not mean that crypto is subject to wash sale rules. It is included for purposes of digital assets that are also stock or securities already subject to wash sale rules (e.g. certain tokenized equities).”

The form also includes a box to indicate “that a sale is not recorded on the distributed ledger,” she said. “This is necessary because very often digital asset addresses or transaction IDs cannot be provided because transactions occurred within internal record-keeping systems.”

Dean said the one area that needs clarification is Box 5, which “is for a broker to indicate that a loss is non-deductible due to a ‘reportable change in control or capital structure’ and references Form 8949 and Schedule D Instructions.”

“Neither of those instructions give any guidance on what kind of events in crypto and digital assets could apply in these circumstances,” she said. “They defer to the broker to simply figure it out in the dark with the further statement that ‘The broker should advise you of any losses on a separate statement.’”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.