The cryptocurrency market is one of the most popular in the world, particularly among Generation Z. Crypto exchanges have been the talk of the crypto community for several months. The failure of multiple crypto exchanges and crypto lending companies over the past several months has left investors unsure of whom to trust.

DeFi‘s market expansion has been spectacular, with only a decade separating the rise of Bitcoin and the altcoins. Investing in cryptocurrencies comes with a number of pitfalls. The greatest of these is the sector’s volatility, as prices are determined only by sentiment and not by the underlying asset’s value. Whom can you trust to manage your funds amidst the crypto market’s many risks?

Also read:

Types of crypto exchanges

Generally speaking, there are two types of cryptocurrency exchanges: centralized and decentralized. Each category has its perks and downsides. Globally, there are close to 600 cryptocurrency exchanges where investors can trade bitcoin, Ethereum, and other digital assets. However, costs, quality, and safety might vary greatly.

- Decentralized crypto exchange

Decentralized crypto exchanges (DEX) spread the duty of facilitating and validating crypto trades. Similar to how cryptocurrency blockchains function, anyone who wishes to join a DEX network can verify transactions. This promotes accountability and transparency.

TA single entity operates centralized cryptocurrency exchanges (CEX) problem is that decentralized exchanges are far less user-friendly, both from a UI and currency conversion aspect. Decentralized exchanges, for example, do not always permit users to deposit dollars and swap crypto or use a centralized exchange to acquire cryptocurrency for use on a DEX.

In addition, you will likely engage in peer-to-peer transactions. This indicates that it may take longer to locate a buyer for what you’re selling. Moreover, if liquidity is limited, you may be required to accept price concessions to purchase or sell low-volume cryptocurrencies rapidly.

- Centralized crypto exchange

A single entity operates centralized cryptocurrency exchanges (CEX). Centralized exchanges facilitate entry into crypto trading by enabling users to transfer fiat currencies, such as dollars, directly into cryptocurrencies. The majority of cryptocurrency trading occurs on centralized exchanges.

Some crypto enthusiasts oppose centralized exchanges because they contradict the cryptocurrency’s decentralized spirit. Even worse, in the opinion of certain crypto users, the corporation or organization may force users to comply with Know Your Customer (KYC) regulations. In order to combat money laundering and fraud, these require each user to disclose their identity, much like opening a bank account.

Hacking is an additional concern with centralized exchanges. With a CEX, the exchange holds the cryptocurrencies transacted on its platform – at least temporarily, while trades are processed — increasing the danger of hackers stealing assets.

In recent years, centralized crypto exchanges have increased security in response to this issue. Among other measures, they now store the majority of customer assets offline and purchase insurance to cover crypto losses in the event of a hack. If you like the convenience of a centralized exchange, you can lower your risk by transferring your crypto to a hot or cold wallet located off-exchange.

Factors to consider when choosing a crypto exchange

Beyond fees, take into account security, trading volumes, instructional materials, and whether an exchange lists the cryptocurrencies you’re interested in purchasing when selecting the best cryptocurrency exchange for your needs.

Security

As crypto has become more popular and valuable, hackers have made it their primary focus. Leading cryptocurrency exchanges such as FTX, Binance, and KuCoin have been hacked, resulting in losses of tens of millions of dollars. While exchanges frequently compensate those whose coins are stolen, no one wants to be in this position in the first place.

Spreading crypto purchases over various exchanges can help you reduce your risk exposure. Alternately, make it a practice to transfer your cryptocurrency assets from an exchange’s default wallet to a personal, secure “cold” wallet.

Available coins

Examine the accessible cryptocurrencies on a certain exchange with care. You may be alright using a cryptocurrency exchange that trades merely a few coins. In contrast, if you are a crypto enthusiast, you could desire access to all of the more than 600 cryptocurrencies offered on Binance.

Daily trading volume

The availability of coins alone is insufficient if no trades are taking place. You should verify that your target coins have sufficient trading volume to provide liquidity, allowing you to easily trade your currencies and dollars.

Low-volume markets can be detrimental to sales. You might purchase at a greater price or sell at a lower price than desired. Slippage is when validators place an order when there is insufficient demand.

If you are a skilled crypto trader, you might wish to ensure that your desired exchange offers the trading kinds and margin you like, such as limit orders, which can minimize slippage by setting a fixed price. Remember that trading kinds including the latter are still evolving in the United States, thus the offerings of different exchanges may alter over time.

Guiding materials

If you are new to cryptocurrencies, you should seek a user-friendly platform with a wealth of instructional materials to assist you to comprehend this complex, rapidly evolving market.

Location accessibility

Lastly, do not assume that an exchange is accessible in your country or state simply because you can visit its website. Numerous state and federal governments are currently determining how they will legally and financially manage cryptocurrencies.

Best Crypto Exchanges in the U.S

There are currently countless crypto exchanges functioning on the market. This study outlines and recommends just the finest crypto exchanges operating in the United States. As with any other sort of trade, you should do your own research (DYOR) to be sure.

- Coinbase Global, Inc. (NASDAQ: COIN)

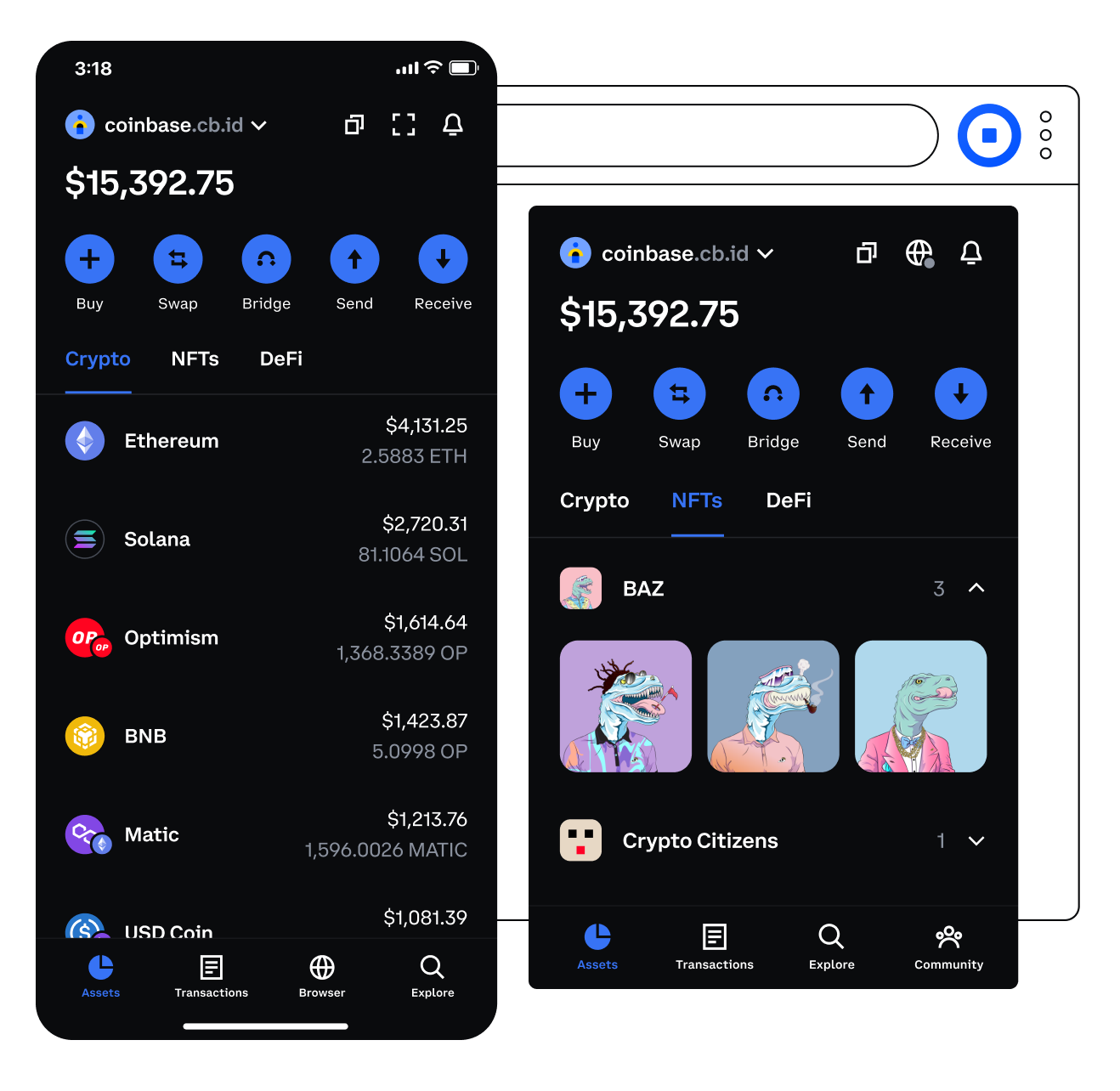

The American exchange Coinbase Global, Inc. (NASDAQ: COIN) is headquartered in San Francisco, California. The company was founded in 2012 and provides numerous products and services. Coinbase is ideal for crypto newcomers who seek a simple purchasing and selling experience without the hassle of external wallets and decentralized exchanges. Coinbase tops the list of the best cryptocurrency exchanges.

Customers of Coinbase Global can use a wallet, an NFT marketplace, an asset trading platform, a smartphone application, and an API enabling retailers to accept cryptocurrency payments. ARK Investment Management, led by Catherine D. Wood, is the largest investor in Coinbase, with 7.7 million shares worth $497 million.

- Kraken

Kraken is an American bank and crypto exchange. The company was founded in 2011, and it is one of the world’s most valuable crypto exchanges. Kraken’s main office is located in San Francisco, California.

Kraken’s cryptocurrency exchange supports close to two hundred countries, has more than nine million customers, and facilitates a quarterly trading volume of more than $200 billion. Kraken is a wonderful option for novice and experienced investors and traders in cryptocurrencies seeking minimal trading costs and access to a large variety of coins.

- Bitmart

Bitmart, headquartered in the Cayman Islands, provides digital assets and investment services. It provides services to over nine million consumers in over 190 countries. Bitmart is one of the world’s major crypto exchanges in terms of cryptocurrency support.

BitMart provides items for staking and savings. Bitmart offers a straightforward buy/sell crypto function that allows newcomers to purchase Bitcoin and other digital currencies using a variety of payment ways with a few clicks.

The exchange also offers spot and futures trading for currencies. In addition, Bitmart asserts that its users are protected by an advanced system that combines hot and cold wallets with multi-signature technologies.

- Bitget

Bitget is a Seychelles-registered private financial services company. The company was founded in 2018. The Bitget exchange supports USDC derivative margin and allows customers to trade without token conversion. Moreover, Bitget enables both spot trading and futures trading.

In November 2022, the company partnered with soccer legend Lionel Messi for a marketing campaign. In terms of security, Bitget asserts that it distinguishes between hot and cold wallets and has gotten high marks from multiple companies. Bitget has a $300 million reserve to safeguard its assets and operations against cybercriminals.

- Blockchain.com Exchange

Blockchain.com is a British cryptocurrency company that was founded in 2011 and provides a range of services. The company is based in York, United Kingdom. The Blockchain.com Exchange offers more than ninety trading pairings, including BTC and cryptocurrencies.

In addition to a wallet and an explorer, Blockchain.com also provides financial products for institutional investors. The explorer platform lets users view transaction details if they have the transaction’s hash code. Additionally, Blockchain.com allows institutional investors to lend, borrow, and trade cryptocurrencies.

- Binance.US

Binance.US is the American subsidiary of Binance, the world’s largest crypto exchange. The startup was founded in 2017 when the U.S. government banned its parent company. The new company intends to adhere to all regulations necessary for crypto exchanges to function in the United States.

Binance.US and its parent firm have been a voice of reason in the wake of the collapse of large crypto exchanges such as Voyager Digital, Celsius, 3AC, and FTX. Binance.US is an active participant in the U.S. crypto market. Additionally, the organization has established a Political Action Committee (PAC).

- Crypto.com Exchange

Crypto.com Exchange was founded in 2016 and is situated in Singapore. In addition to exchange, Crypto.com provides a wallet, a mobile application, and a market for non-fungible tokens (NFTs). Several companies have joined with Crypto.com in order to use cryptocurrencies for their products.

The Crypto.com Exchange facilitates trading over forty distinct derivatives and over two hundred pairs. In November 2022, the firm’s Cronos token lost market value following the collapse of FTX, despite the CEO’s assurances that FTX and Crypto.com Exchange are unrelated.

Best Crypto Exchanges Global

- Gemini Trust Company, LCC (Gemini)

In 2014, Tyler and Cameron Winklevoss, who had trouble finding a secure location to store their cryptocurrency, created Gemini in New York. Its main goal at the time was to enable users to buy and trade Bitcoin. It expanded, though, and now has more cryptocurrencies in its portfolio.

In 2016, Gemini Trust Company, LLC (Gemini) obtained a license to operate an Ethereum exchange in the United States. The exchange is also subject to the New York Department of Financial Services regulation (DFS). Over 100 different assets are accessible to purchase, sell, and trade on the exchange. The platform offers robust account security and compliance safeguards in addition to a limited range of cryptocurrencies.

In addition to clearing services, Gemini provides settlement services, a mobile wallet, a credit card, and a mobile application. The company also offers institutional solutions to corporations, hedge funds, fund managers, and asset managers, among others.

- Bitstamp USA, Inc.

Bitstamp is one of the oldest cryptocurrency exchanges, established in 2011 in Slovenia. The exchange now has more than four million customers globally. Currently, they have offices in several major financial hubs, including the United Kingdom, the United States, Singapore, and Luxembourg. Bitstamp USA has its headquarters in New York.

Bitstamp USA, the American branch, has a separate chief executive officer, whereas Bitstamp, the corporation as a whole, is led by a global CEO. Bitstamp USA, Inc. enables trading in the U.S. dollar fiat currency.

In addition, it is one of the seven companies that sought approval from the New York State Department of Financial Services (DFS) in order to achieve operational compliance. DFS grants compliance only when an exchange demonstrates its ability to meet liquidity standards.

In addition, these exchanges should have implemented anti-money laundering and other measures to deter illegal behavior on their platforms. Bitstamp, the primary exchange operated by Bitstamp USA, Inc., operates in over 100 countries and has over four million customers.

- bitFlyer

bitFlyer is a Japanese company founded in 2014 with headquarters in Tokyo. The company is one of the most stable exchanges in the world since its trading platform has never had an outage or disruption. Additionally, bitFlyer stores all of its cryptocurrencies in cold storage for protection.

bitFlyer’s cost structure and features make it an excellent option for crypto novices. It also offers a professional active trading platform with a different pricing structure. bitFlyer’s cryptocurrency exchange allows users to trade with one another or with the exchange itself.

In 2021, bitFlyer’s transaction volume reached a staggering $180 billion, and its average weekly users numbered 402,066. The majority of its trades involve derivatives. These financial products enable investors to wager on whether a commodity’s price will climb or fall. The company also allows customers to purchase cryptocurrency with credit cards or loyalty programs.

Best crypto apps in the United States

A crypto app is a program that generates a blockchain-based transaction. Investors commonly use crypto apps for financial transactions and gaming. The top cryptocurrency apps enable users to deposit fiat promptly and at cheap fees, deposit fiat through various payment options, trade cryptocurrencies at no or low cost, and withdraw cryptocurrencies at no or low cost.

The best crypto apps or exchanges offer consumers to invest in other ways, like mining, staking, and institutional custody. Good apps also enable traders to monitor prices in real-time, establish real-time alerts, and do advanced charting in order to make more profitable trading decisions.

- Robinhood

Developers designed Robinhood to help give ordinary people easy access to the financial markets and pioneered the concept of commission-free stock trading when it debuted in 2015. But Robinhood offers much more than just free trading.

Investors wanting a mobile app to invest in stocks, ETFs, options, fractional shares, and cryptocurrency might consider this stockbroker. Investors looking for an IRA account or mutual funds should go elsewhere.

In 2018, Robinhood broadened its appeal by adding cryptocurrencies to its trading platform, once again paving the way among major brokers to become one of the first to offer a simple way to buy virtual coins without transaction fees. Robinhood went public in 2021 in one of the most anticipated IPOs of the year and now trades under the symbol HOOD.

- eToro

In addition to traditional financial products such as equities and ETFs, eToro offers a vast selection of cryptocurrencies. It has a unique social trading function that allows you to mimic deals made by other investors. Compared to the top cryptocurrency exchanges, eToro’s selection is limited.

Investors in the United States have access to approximately 25 different cryptocurrencies, while non-U.S. investors have access to over 75. On their platforms, other big U.S.-based exchanges provide hundreds of cryptocurrencies. However, if you wish to invest in leading cryptocurrencies alongside stocks and manage all of your assets in one location, eToro may be the platform for you.

Best Crypto Exchange Classified

Top Picks for the Best Crypto Exchanges

- Coinbase – Best for Beginners

- Binance.US – Best for Low Fees

- Crypto.com – Best for Security

- Bisq – Best Decentralized Exchange

Best in Security Crypto Exchange; hence, Most Trusted

Toss up according to other additional security features:

- eToro

- Coinbase

- Kraken

- Binance

- Bitbuy

- CoinSmart

- Bitstamp

Bottom Line

In decentralized finance, crypto exchanges have assumed the function of banks. Just because there have been unscrupulous actors in the crypto ecosystem does not indicate that there is no hope for other crypto exchanges to do well on the market. Do your own investigation before placing your faith in these organizations.

Coinbase is a publicly traded company meaning it has undergone extra financial and security examinations to reach that status. Upon deleting your account, Coinbase gives users the ability to request the information they gave to Coinbase in the first place. You can also request that Coinbase deletes the information from their servers. Coinbase gets extra points for properly handling and discarding users’ personal information.

In choosing an exchange, monitor their performance in the market as a whole and comment on their social media platforms, especially Twitter. If you find a discrepancy, you should always be prepared to withdraw your money.