Before crash, FTX deals with alleged binary options operatives could have raised flags

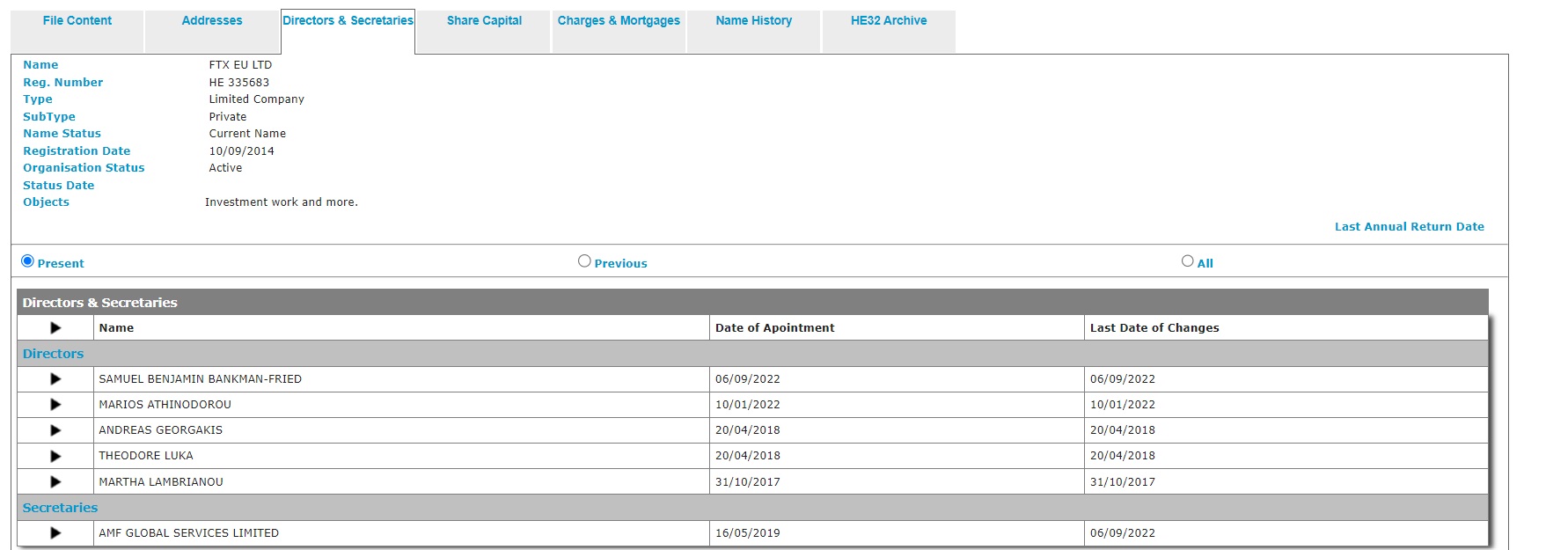

Days before its spectacular $32 billion collapse in November 2022, behemoth cryptocurrency exchange FTX completed a fairly benign corporate filing, changing the name of a Cypriot subsidiary it had bought to FTX EU Ltd.

For the better part of a year, FTX and its now-infamous founder Samuel Bankman-Fried had been describing the acquisition as part of FTX Europe, crowing in a March 2022 press release that it could now offer trading to the 27-nation European Union under a Cypriot license.

By acquiring the already-licensed K-DNA Financial Services, FTX had bought its way around onerous regulatory filings needed to open up shop in the 27-nation bloc. Aside from (eventually) changing the name, the soon-to-be bankrupt crypto-behemoth left much of K-DNA unchanged, keeping its C-suite in place, minus its Israeli director and and controlling shareholder Asher Afriat, and reusing much of the language in K-DNA’s legal documents laying out its contractual relationship with customers.

But the shortcut came with hefty baggage: According to court documents and first-hand testimony, K-DNA and its former director and controlling shareholder Asher Afriat are alleged to have owned a binary options firm and had significant links to major players in the binary options world, largely tied to Israeli criminals.

“It would appear they did not bother to conduct any genuine due diligence,” said Mikhail Reider-Gordon, an anti-money laundering expert with US-based Affiliated Monitors, an integrity monitoring company, and a professor at the International Anti-Corruption Academy in Austria.

“They bought this company and couldn’t be bothered to review the policies. They just cut and paste.”

K-DNA’s questionable history was not a well-kept secret. In December 2018, a Times of Israel article detailed K-DNA’s links to the banned binary options business. It also noted K-DNA’s close ties to Aviv Talmor, an entrepreneur who at the time of the acquisition was on his way to being convicted of defrauding investors out of millions.

Now, Bankman-Fried is accused of running what prosecutors have alleged is “one of the biggest financial frauds in American history.”

The former entrepreneur, whose trial is set to start October 2, declined to comment for this article.

Nor did FTX’s new chief executive, John Jay Ray III, respond to a request for comment.

FTX founder Sam Bankman-Fried (C) is led away handcuffed by officers of the Royal Bahamas Police Force in Nassau, Bahamas on December 13, 2022. (Mario Duncanson / AFP)

Regulators and law enforcement can see bank statements and financial flows that ordinary citizens cannot. Had they been paying closer attention, the FTX merger with K-DNA could have raised red flags, pointing to possible links between the internationally feted $32 billion company, and a multibillion-dollar scam industry that had been disgraced and outlawed, though not quashed, five years earlier.

Secret takeover

When FTX first purchased a stake in K-DNA Financial Services in November 2021, the company was 90 percent owned by Afriat, 54, an Israeli attorney who specializes in real estate and commercial transactions.

Afriat does not appear to have any social media accounts, and the only online photo of him is on his law firm’s website. In order to piece together his involvement in K-DNA, the Times of Israel pored over hundreds of pages of Israeli court documents that have had little-to-no public exposure until now.

He started K-DNA nearly a decade ago, on the advice of a friend, he said. Afriat saw money to be made in websites offering investors exotic, high-risk trading instruments, many of which turned out to be scams.

“Forex wasn’t my area of expertise but in 2014 or so a lawyer friend of mine suggested I go into it,” Afriat told an Israeli court in 2021. “I learned about it through him, I got involved in it with him and I invested money and got a license for a company in Cyprus, K-DNA Financial Services.”

The years 2014-2016 were boom times for the forex industry in Cyprus and Israel. The industry consisted of websites that offered high-risk, fast-paced day trading to mom-and-pop investors. The most legitimate of these websites were high stakes and could lead unlucky investors to financial ruin. The least legitimate of these, particularly those that sold a financial instrument called binary options, were outright fraudulent. They were also highly secretive about who owned them.

Afriat registered K-DNA Financial Services in September 2014 and got a Cypriot license in April 2015. Business was slow at first, he testified at the subsequent criminal trial of entrepreneur Talmor, but by the end of 2015, Afriat and an unnamed business partner had four or five call centers up and running in Cyprus, Bulgaria and elsewhere.

According to Afriat’s testimony, K-DNA was looking for new tech to expand business, a search which brought him into contact with Talmor.

At the time, Talmor was in trouble with Israeli authorities. A former film student, he had claimed to develop a trading robot that would make investors rich, and eventually presided over an empire of forex and binary options companies that targeted investors all over the world.

But in late 2015, the Israel Securities Authority raided his offices in Israel, and in September 2022, Talmor was convicted by an Israeli court of defrauding local investors out of NIS 77 million ($22 million) and sentenced to four years in prison. Whether and how much he may have taken from people abroad was not part of the indictment against him, although prosecutors said they suspected many of his foreign companies were fraudulent as well.

By far the most important company in Talmor’s stable was known as Binary Call Center. It was located in a glass tower in Ramat Gan and housed the servers, the trading desk, the technology and the employees that had made Talmor’s whole empire run.

The special administrator of Talmor’s bankrupt Israeli companies wanted to keep Binary Call Center running so he could use profits from Talmor’s foreign companies to pay off Talmor’s Israeli creditors.

But by January 2016 the special administrator of Talmor’s Israeli company Utrade accused Afriat and a man named Daniel Azougy of having secretly taken over Binary Call Center and ordering its employees to start working for K-DNA Financial Services, according to court filings. Azougy denied this, saying he was merely a consultant to the real owner of Binary Call Center.

Afriat also denied owning the company. He said he had planned to make a deal with Talmor whereby K-DNA would take over some of the activity of Binary Call Center but had dropped the idea.

Talmor did not respond to The Times of Israel’s request for comment.

On its website, K-DNA said it specialized in contract for difference, or CFD, trades. Like binary options, the high-risk CFD vehicle essentially lets investors bet on how a security’s price will move, without their owning the actual asset in question; many shops offering CFDs are closely linked to purveyors of binary options and forex investments, though some mainstream trading sites like E-Trade also offer the financial product. According to K-DNA’s own website, “95 percent of retail investor accounts lose money when trading CFDs.”

K-DNA also operated a domain, Londonfx.com, which was the subject of an investor alert from the British Financial Conduct Authority in November 2015.

In late 2017, the Knesset banned the binary options industry, as a direct result of The Times of Israel’s investigative reporting, which began with a March 2016 article entitled “The wolves of Tel Aviv: Israel’s vast, amoral binary options scam exposed.” Many of the Israeli firms have since relocated overseas and continued the scam. German prosecutors, who have led efforts to crack down on the industry, estimate losses to this shadow economy of scams to be in the billions of dollars each year.

Wrong guess

Like Talmor, FTX’s Sam Bankman-Fried also struck the big time thanks to a highly touted trading algorithm — in his case, one that arbitraged the differences in prices of cryptocurrencies on different exchanges, to the tune of tens of millions of dollars for his crypto hedge fund Alameda Research.

But according to a December 31 investigation by The Wall Street Journal, Alameda Research was a money-losing venture.

While Alameda did make between $10 million and $30 million in profits on the Japanese-US price arbitrage, according to an unnamed source who spoke to the newspaper, “Alameda’s trading algorithm, which was designed to make a large number of automated, rapid-fire trades, was losing money by guessing the wrong way on price moves.”

The FTX logo appears on Naomi Osaka’s outfit during the Miami Open tennis tournament, April 2, 2022, in Miami Gardens, Fla. (AP Photo/Wilfredo Lee)

But according to an SEC complaint filed in December, FTX, which was founded in 2019 as “a cryptocurrency exchange built by traders, for traders,” was a fraud from the very beginning. Its purpose was allegedly to raise funds from the public to fund the trading activities of Alameda Research, as well as Sam Bankman-Fried’s personal expenses.

“Bankman-Fried and [co-founder Gary] Wang placed billions of dollars of FTX customer funds into Alameda. Bankman-Fried then used Alameda as his personal piggy bank to buy luxury condominiums, support political campaigns, and make private investments, among other uses,” the complaint said.

If FTX had any concerns about K-DNA’s past dealings or links to the binary options industry, it didn’t disclose them publicly, nor did it seem to take issue with hiring from the world of alleged financial fraud.

FTX EU’s directors, prior to its bankruptcy. Click to enlarge (Source: Cyprus Registrar of Companies)

An employee whose LinkedIn profile described him as FTX EU’s senior anti-money laundering officer, had spent time in the binary options industry, working from 2015 to 2017 as a back office assistant at Spot Capital Markets, a Cypriot sister company of SpotOption, one of the biggest players in the binary options world.

By the time it collapsed in November 2022, the exchange would have a valuation of $32 billion, with $1.8 billion raised from investors. Bankman-Fried alone had an estimated net worth of $16 billion and he and his company had become media darlings, with high-flying celebrity endorsements and flashy ads, including during the Super Bowl.

“Everyone was like, Sam Bankman Fried is a genius and he’s brilliant and he’s such a great business success,” prominent short seller Marc Cohodes told The Times of Israel after FTX fell apart. “No. He’s a cold-blooded criminal.”

Why K-DNA?

FTX is not the first massive, ostensibly legitimate crypto company that collapsed and was revealed to have ties to the binary options industry. The chief revenue officer of Celsius Network, Roni Cohen-Pavon, founded a company with a convicted money launderer and binary options operative, as reported last year by The Times of Israel.

Celsius told The Times of Israel at the time that it took regulatory requirements very seriously, had not violated any laws or regulations, and was not required to disclose information about its top executive’s side businesses to US regulators. The company’s top officials have since been indicted for fraud by the US Department of Justice.

On November 4, James Block, a 30-year-old Michigan psychiatrist who investigates cryptocurrency as a hobby, wrote a post expanding on a Coindesk report raising questions about FTX’s financial soundness. Block’s post, which claimed that much of Alameda’s and FTX’s assets consisted of FTT, a token that FTX itself had issued, eventually ended up helping sparking a run on the digital coin that would lead to FTX’s collapse within days.

A month later, Block published again, this time raising questions about the now defunct FTX’s purchase of K-DNA.

“It seems odd that FTX would end up buying such an obscure company at random … there are few traces of K-DNA online,” he wrote. “How did FTX even find this firm in the first place? And what other links between FTX and the binary options industry have yet to come to light?”

According to Reider-Gordon, the money laundering expert, the decision to buy K-DNA may not have been mere happenstance.

“So he bought this company, no questions asked. And he kept everyone in place,” she said. “Why? Because they have the contacts, they know how it runs. If one company goes down, the relationships don’t disappear.”