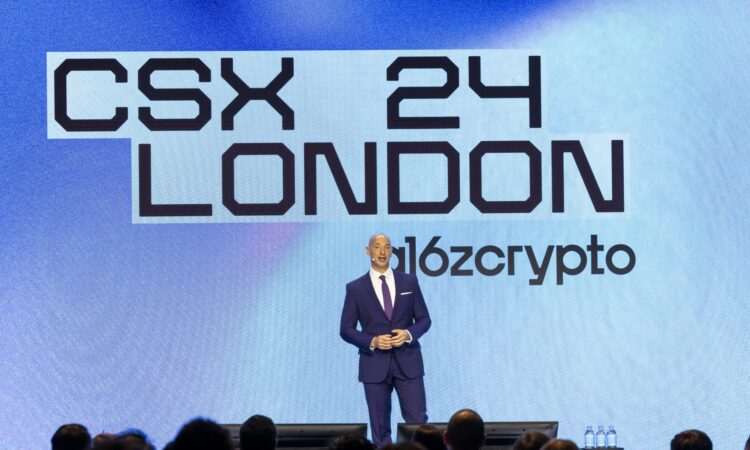

Silicon Valley VC giant Andreessen Horowitz’s (a16z) London charm offensive is well underway, following its first overseas demo day for its crypto startup accelerator in the UK capital.

The event last Tuesday saw a cast of founders, investors and journalists descend upon an underground basement venue in the capital typically known for playing host to musicians like Charli XCX, Nia Archives and Kaytranda.

The demo day marked a glitzy opening to the firm’s long-term commitment to the UK, which has seen three of its partners — Sriram Krishnan, Jay Drain and Liz Harkavy — permanently move to the country after setting up shop in London last June.

Spectators sat in front of a stage backed by a towering 8k screen in front of which 25 crypto founders were tasked with presenting their startups to the 100-strong audience of press, investors and limited partners. To coincide with the occasion, a16z’s crypto division also held its offsite in London last week.

While it may have been the founders in the spotlight, the proceedings often felt like an engineered bid to not only course-correct perceptions around the asset class but also to solidify the VC firm’s belief in the UK as a crypto hub.

The founder of a16z’s $7bn crypto fund, Chris Dixon, kicked off proceedings by underlining how the firm chose London to “tap into all of the talent in the UK and throughout Europe and to help accelerate crypto over here”.

Crypto’s regulatory winter

When the fund announced its decision to host its crypto accelerator programme in London last year it came amid a bruising crypto winter. VC investment globally had plunged from $21.2bn in 2022 to $4.1bn in 2023 as regulators in the US clamped down on crypto.

“Historically, regulation and policy weren’t something as a startup founder you need to focus on, but in crypto that hasn’t been the case,” the accelerator’s head Jason Rosenthal says.“One of the reasons we opened an office in the UK is that we’re excited about the regulatory prospects for the industry here.”

This year saw key legislative changes rolling out globally, notably January’s approval of eleven bitcoin ETFs in the US, the introduction of the EU’s Market in Crypto Assets (MiCA) regulatory framework and two weeks ago, the first major crypto bill cleared one of the chambers of US congress.

Although they’re yet to set trading volumes afire, last month saw the UK’s first crypto exchange-traded notes — investment products similar to exchange-traded funds — list on the London Stock Exchange.

A break from the norm

He argues that regulatory progress has paved the way for crypto startups that would have been a harder sell last year. He highlights how the demo day kicked off with the UK’s Playmint, a blockchain gaming startup with a team from legacy gaming brands such as Electronic Arts and Unity.

He also cites Roux, a “food culture network” led by an early employee at restaurant reservation Resy that uses blockchain to enable the ownership and monetisation of food recipes online. Similarly, Tata Bazaar, a startup looking to use digital product passports sold with fashion items to increase brand engagement (e.g. by rewarding wearers on the amount of time a garment is worn or tracking secondary sales of a specific item).

“I think those companies would have been very hard to do even a year ago because the infrastructure wasn’t there,” he says. “But I think we’re at a time and place where not only does that make sense but I would also be very bullish on their prospects, what they’re building and their ability to raise capital.”

Another notable break from the norm is the inclusion of female founders — out of the 25 that took to the stage, Sifted counted five women. A study this year of the 50 leading crypto companies identified only three female crypto CEOs, a meagre 6%.

A UK charm offensive?

All of the startups that presented at the demo day took part in a ten-week-long programme where founders were schooled in a16z’s London office every Wednesday by a who’s who in digital assets. Some names invited to speak included a16z CTO Eddie Lazarin, Alex Blania, the CEO of the company behind Sam Altman’s eyeball-scanning crypto project Worldcoin and Ben Rubin, the founder of pandemic favourite Houseparty who’s since founded a startup in web3 social media.

The evening activities were taken up by social excursions to Bletchley Park, the site of the UK’s codebreaking team during WWII, and dinner at the UK Parliament.

“Because a16z has good relationships with policymakers and those policymakers are excited that a16z is bringing business, there’s a symbiotic relationship,” says Playmint founder David Amor.

And a16z is only trying to build on those relationships. Head of policy Brian Quintenz says he was in Manchester last week for a roundtable discussion with Labour mayor Andy Burnham hosted by US crypto exchange Coinbase.

He points out that a16z doesn’t have a UK-incorporated entity and is precluded from engaging in political activity including direct donations.

“Our message over here is that we can help deliver on growth ambitions for whoever’s in charge of government,” he says.

Rosenthal was also confident in the UK’s approach over the EU’s MiCa, a regulatory framework for the crypto industry currently being rolled out across Europe. He says the bloc’s approach to viewing regulation as a source of innovation “doesn’t make a good environment for doing new transformative projects”.

The UK economic secretary Bim Afolami, who’s made a public push for stablecoin regulation, was set to make a keynote speech during demo day but pulled out when the UK general election was announced last month. Some industry watchers now worry that the bill pushed by Afolami may fall by the wayside if he’s not reelected.

Labour shadow economic secretary Tulip Siddiq, on the other hand, has urged reform is needed to prevent Britain from becoming the “Wild West” of cryptocurrencies.

Still, a16z’s Quintez doesn’t seem worried by the prospect of a Labour government, describing them as “open-minded” to crypto.

“They just want to handle it responsibly and I think that’s exactly the right position they should be taking,” he says.

And while Rosenthal suggests crypto has grown up, the sector’s sometimes childish sense of humour was on display with some presentations using memes of Kabosu, the late Shiba Inu dog known as the face of the Dogecoin cryptocurrency, to capture the audience’s attention. But what demo day did make clear was that a16z is committed to the UK — no matter the result of next month’s election.