If you want to be a part of this financial revolution, you’ll love the latest piece of research from the crypto-enthusiasts at CoinKickoff. Based on cryptocurrency-related job data collected from LinkedIn, it lists the best places in the world to start a career in crypto.

You can check out all the locations on the maps below. But first, let’s start with an overview of the crypto industry.

The rise of a new digital industry

The cryptocurrency industry has undeniably evolved from its nascent stages into a more established and increasingly mainstream sector. Initially viewed as a fringe technology championed by tech enthusiasts and libertarians, cryptocurrencies have steadily been gaining broader acceptance, not just among individual investors but also within the corporate world and even governmental bodies.

One of the key indicators of this shift towards the mainstream is the increased regulatory attention the sector has been receiving. Financial watchdogs globally are now formulating frameworks to govern digital currencies and blockchain technology, replacing the earlier wild-west feel of what critics called a lawless digital frontier.

Beyond regulation, institutional involvement has soared. Major corporations are allocating portions of their treasuries to cryptocurrencies, and investment funds specializing in crypto-assets are becoming commonplace. This institutional buy-in is a confidence booster, signaling to smaller investors that the asset class is maturing.

Traditional financial companies are also launching cryptocurrency-related products and services, such as exchange-traded funds (ETFs) and futures contracts, allowing for more conventional avenues of investment.

A growing number of merchants now accept digital currencies for goods and services, either directly or through third-party payment processors.

Celebrities and influencers openly advocate for digital currencies, sometimes even launching their own tokens. While these endorsements bring controversies and skepticism, they undeniably broaden the audience paying attention to the crypto industry.

Innovation brings new opportunities

The emergence of the cryptocurrency industry has created a variety of career opportunities.

On the technical side, Blockchain Developers are at the forefront, building the underlying architecture for new cryptocurrencies and decentralized applications. The average salary for blockchain developers in the United States ranges from $150,000 to $175,000 annually.

Cryptography Experts, who focus on the security aspects of blockchain, also command high salaries, often well above six figures.

Cryptocurrency Analysts who dissect market trends and investor behavior have emerged as invaluable assets for investment firms and media outlets. These roles often offer salaries comparable to traditional financial analysts, typically around $80,000 to $100,000 per year.

Similarly, Compliance Officers specializing in crypto regulations are increasingly needed to help companies navigate the evolving legal landscape. Salaries for these roles can vary widely but generally start at $90,000 per year.

Other emerging roles include Crypto Journalists covering the industry’s fast-paced developments, Token Economists designing token models for new cryptocurrency projects, and even Customer Support Representatives specializing in crypto services.

Finding a job in the industry

Navigating the job market in the cryptocurrency space can be both exciting and daunting. However, there are proven strategies to land a role in this exciting field.

Education is key. Familiarize yourself with the basics of blockchain technology, cryptocurrencies, and decentralized finance. There are numerous online courses, webinars, and articles that provide a good starting point. Specialized knowledge in smart contracts, cryptography, or regulatory compliance can give you a competitive edge.

Networking plays an essential role in finding opportunities. Consider attending industry conferences, webinars, or local meetups to connect with like-minded professionals. Online forums and social media platforms like Twitter and LinkedIn are excellent ways to engage with industry leaders and keep abreast of job openings.

Consider starting with an internship or freelance project to gain practical experience.

Where to go to find crypto jobs

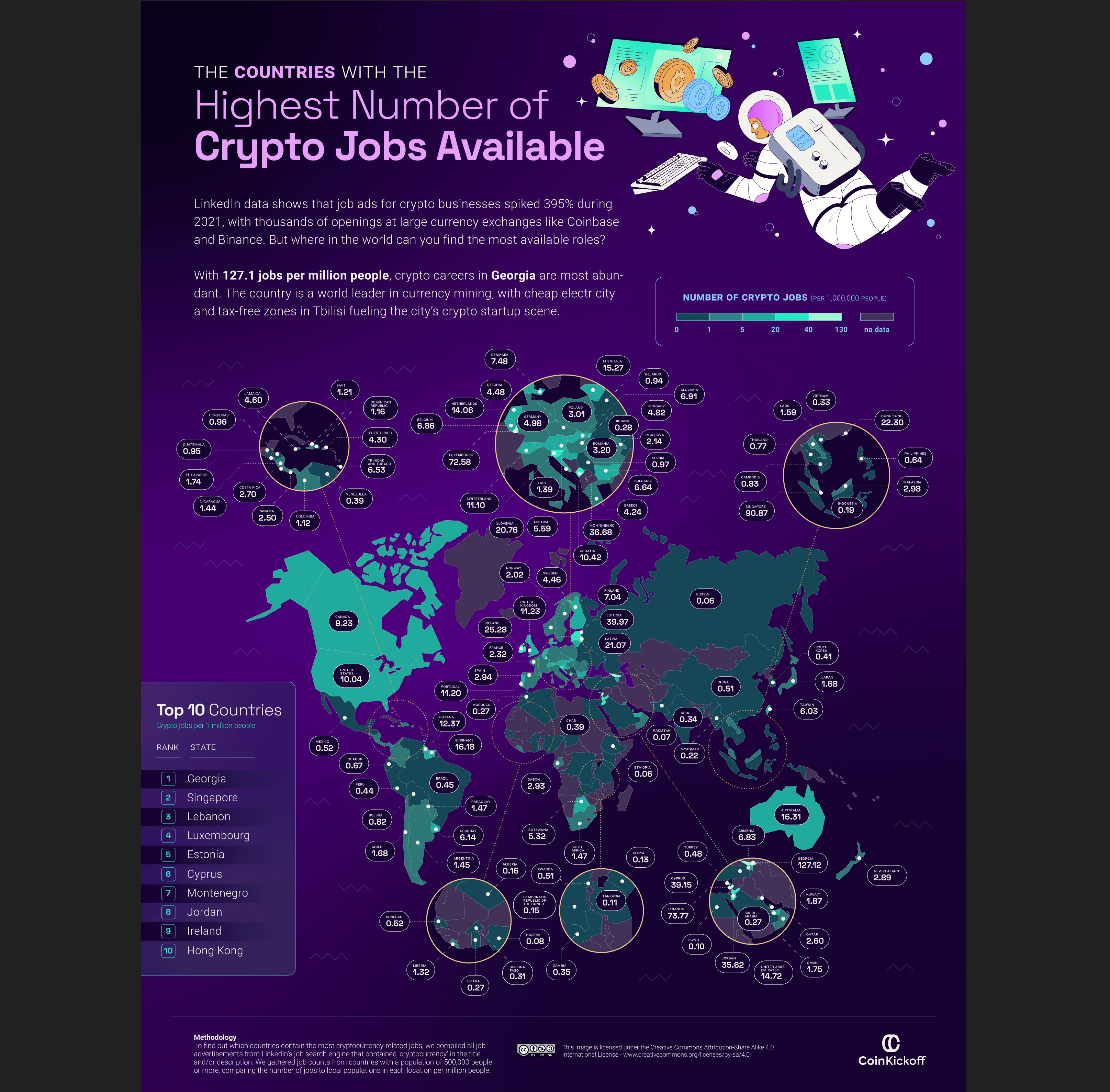

If you’re committed to finding a job in this booming industry, it’s worth relocating to a crypto-friendly nation that has fully embraced the digital money of the future.

According to the CoinKickoff study, Georgia should top your list of potential destinations. The former Soviet republic, which sits at the intersection of Europe and Asia, has the world’s highest concentration of crypto jobs on the planet (127.1 jobs per million people).

The majority of these roles are in the blockchain mining industry, due to Georgia’s access to vast amounts of cheap electricity. However, Binance is about to launch a new cryptocurrency development hub in Georgia, creating hundreds of jobs in design, development, compliance, and marketing.

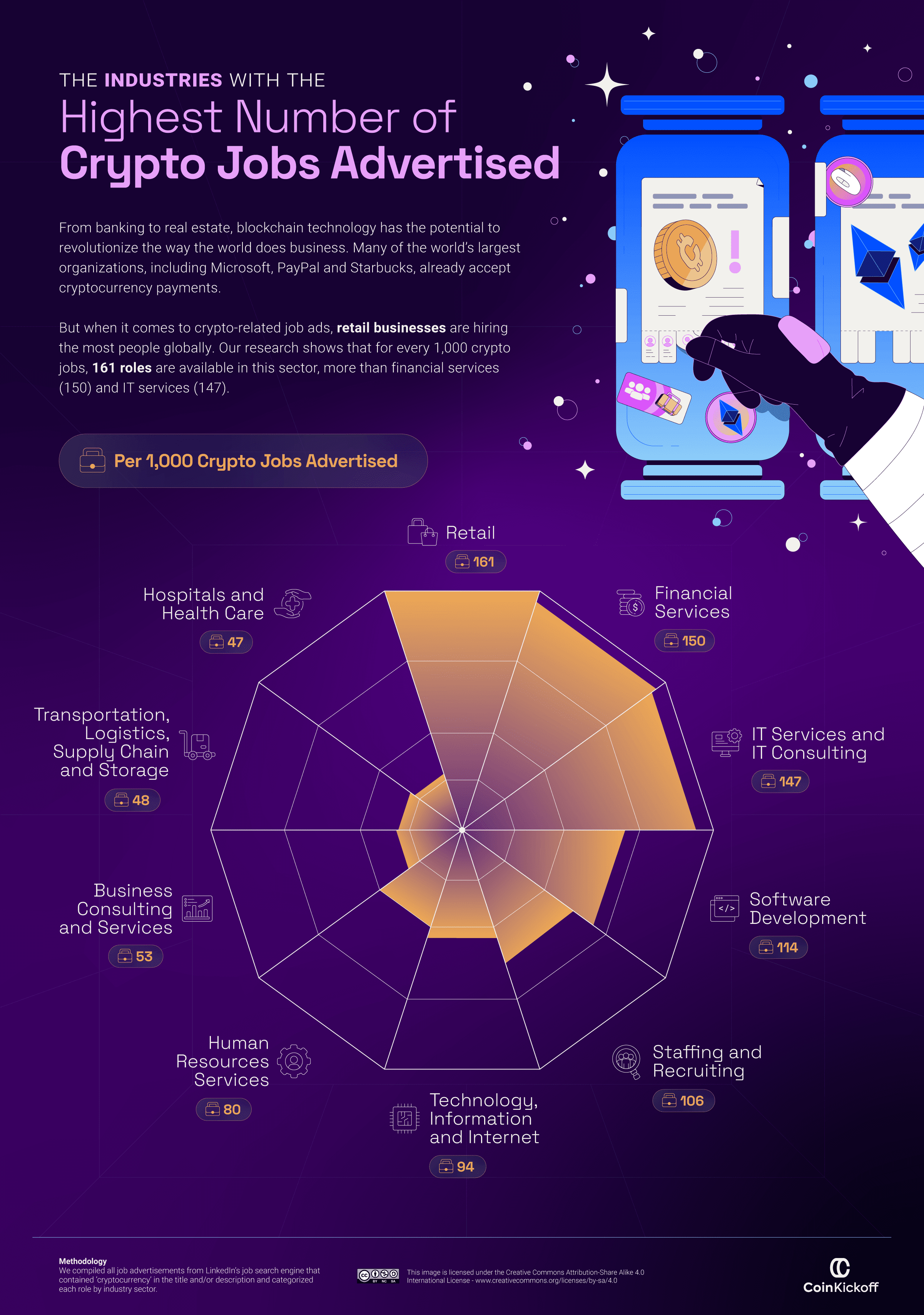

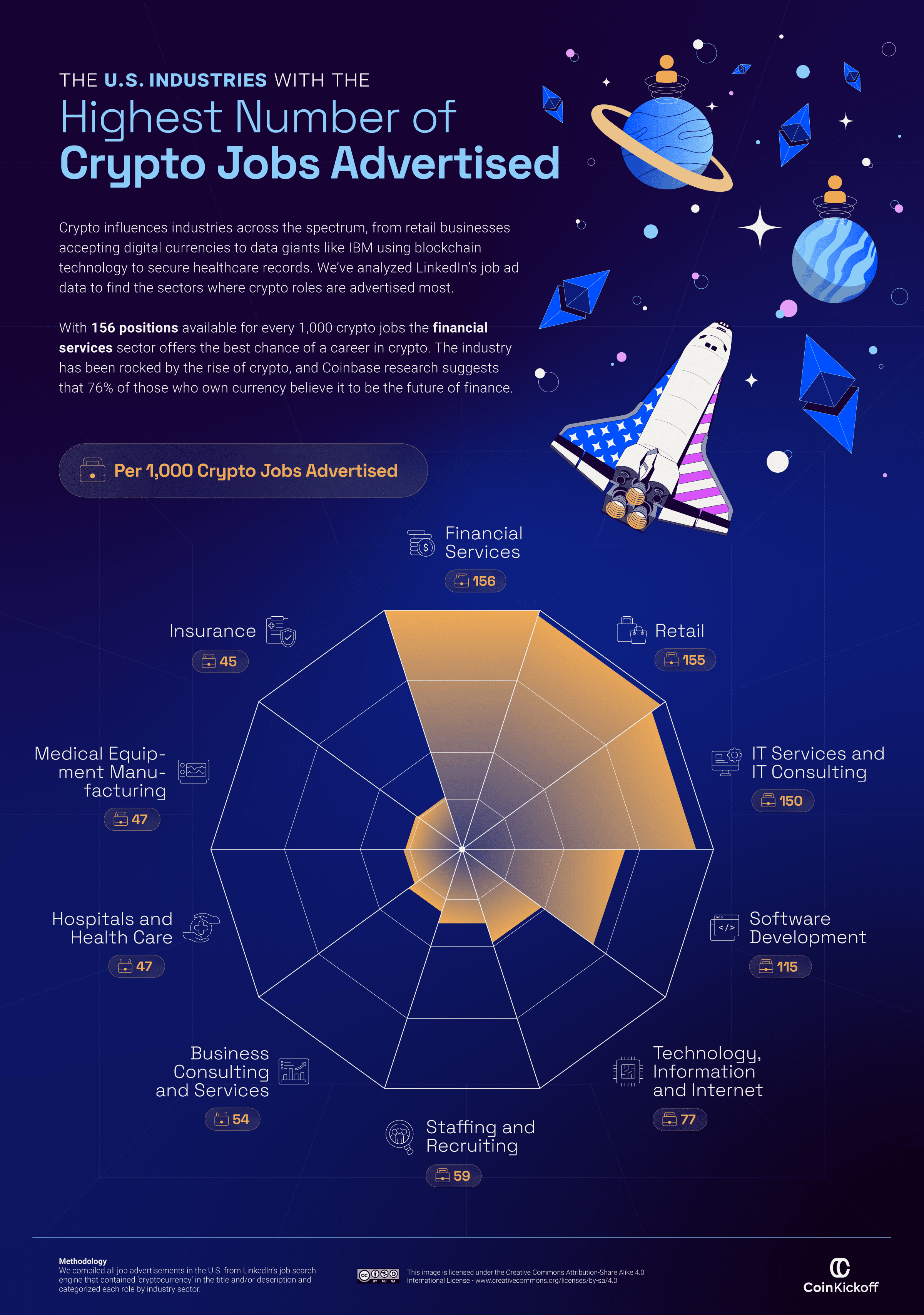

The industries advertising the most crypto jobs

The retail industry and financial services are the biggest hirers in the crypto space right now. Out of 1,000 vacant crypto jobs, 161 are available in retail, while 150 require filling in financial services.

Banks and retailers appear to be preparing for the future of finance, and it looks like they think it will be digital.

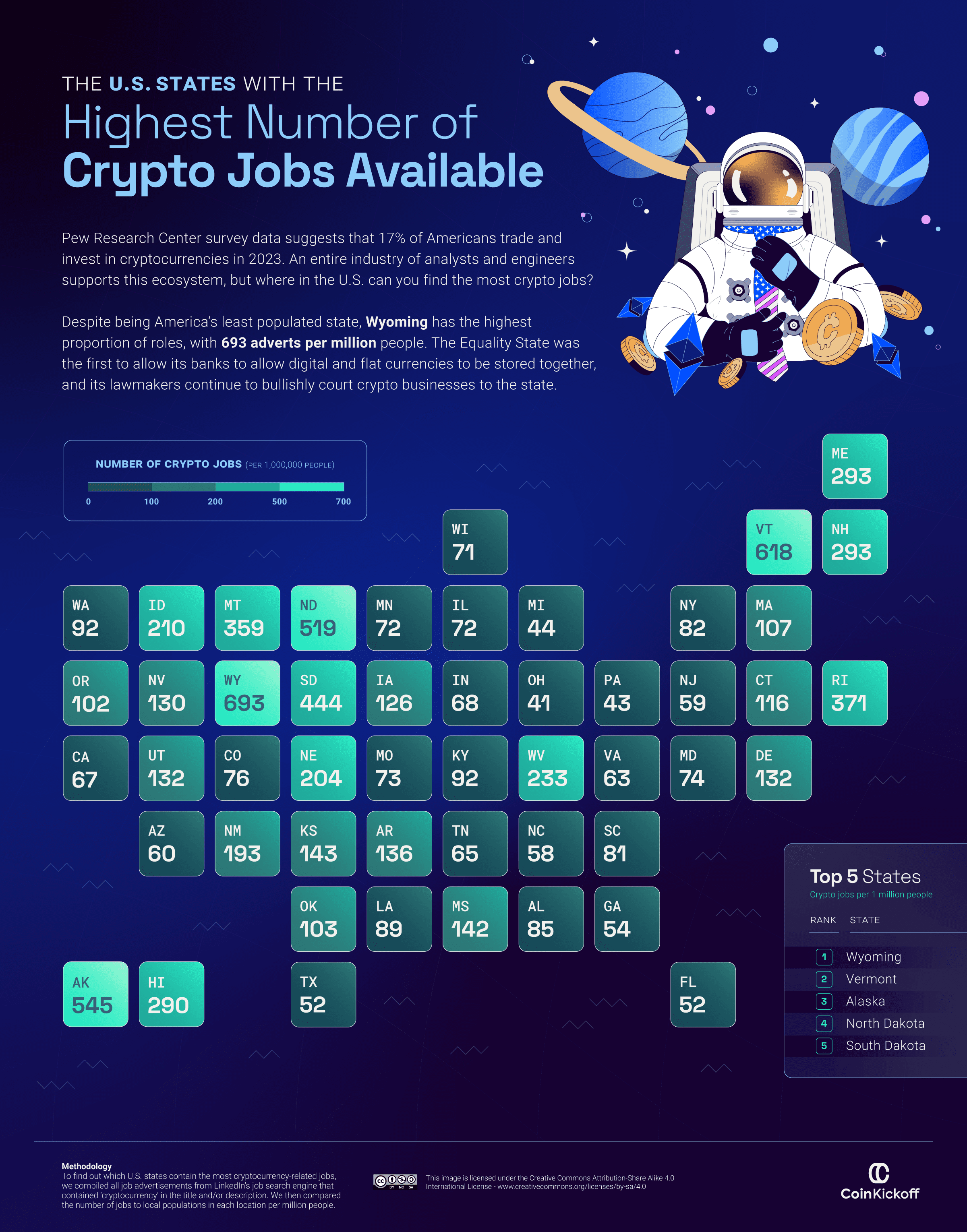

US states with the highest number of crypto jobs

Wyoming is the most crypto-friendly state in the USA. CoinKickoff’s analysis found 693 crypto job adverts for every 1 million citizens in the state. That’s higher than anywhere else in the USA.

This news will come as no surprise to Bitcoin enthusiasts. Wyoming has fully embraced decentralized finance, largely thanks to its Bitcoin-pro senator, Cynthia Lummis.

Lummis is a prominent advocate for Bitcoin and sees huge potential in cryptocurrencies as a new asset class, particularly as a store of value. She’s argued for digital currency as a hedge against inflation, stating in various interviews that she’s concerned about the US dollar’s future value due to fiscal policies.

Senator Lummis owns Bitcoin, making her one of the first U.S. senators to have a direct financial stake in the asset class. Her support is seen as a significant step toward bridging the gap between the crypto industry and governmental understanding and regulation.

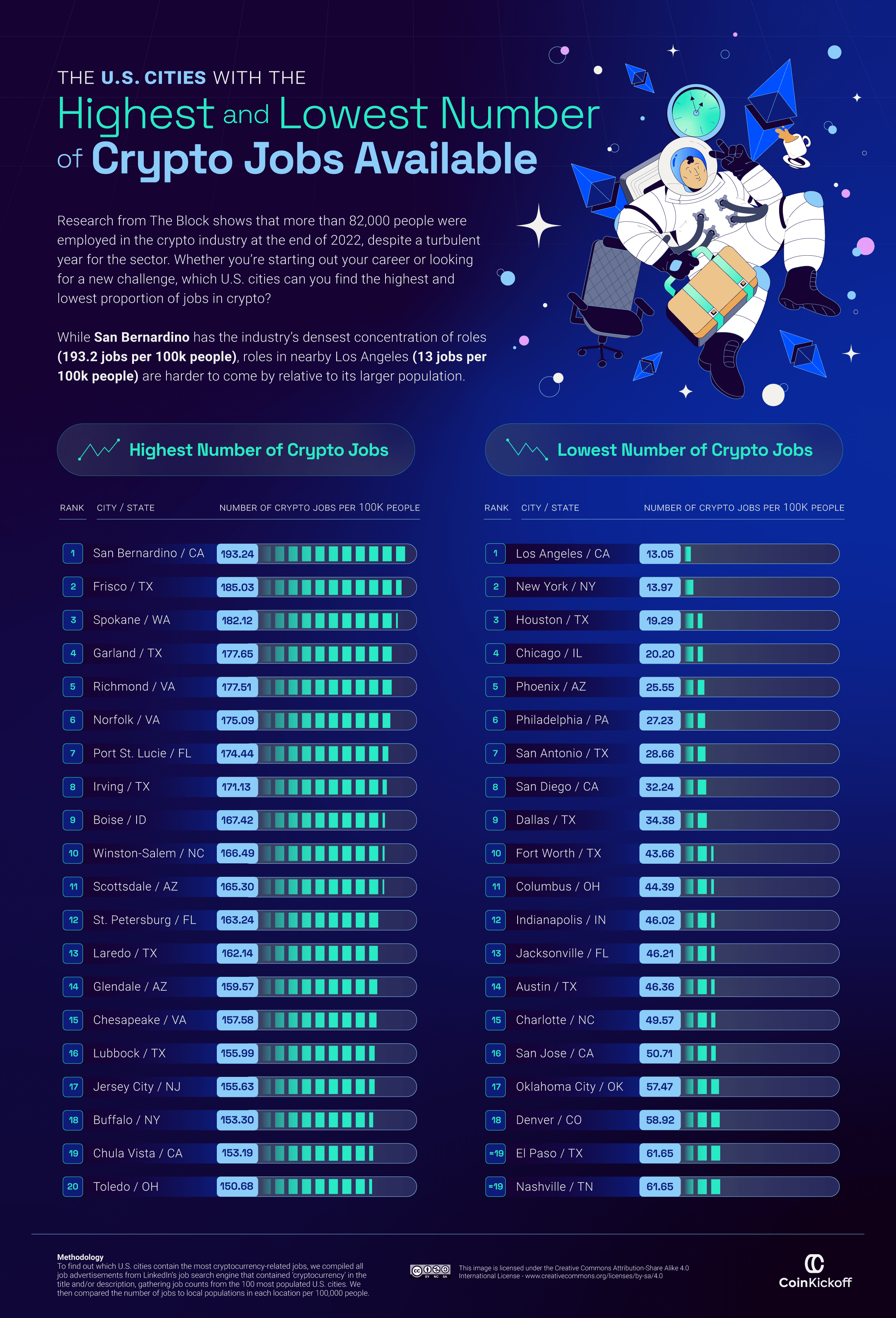

The USA’s most (and least) crypto-friendly cities

Data collected by CoinKickoff reveals that Los Angeles and New York have among the lowest concentrations of crypto-related employment opportunities in the USA, with 13.05 and 13.97 jobs per 100,000 people, respectively.

San Bernardino, located in Los Angeles, has a considerably higher proportion of roles—193.24 crypto jobs per 100,000 people. Two suburbs of Dallas, Frisco and Garland, have emerged as hotspots for employment in the crypto sector, with over 150 industry-related jobs for every 100,000 people.

Crypto jobs in the U.S.

The U.S. financial services industry is onboarding thousands of new crypto hires yearly. And the big banks, insurance companies, and investment firms are hungry for more crypto talent. Of every 1000 crypto jobs advertised in the U.S., 156 are in financial services.

It signals that crypto regulation in the USA is coming. And that’s exciting news for holders of Bitcoin and other cryptocurrencies. Regulations would encourage the kind of clarity that big players and institutional investors want before allocating parts of their massive portfolios to crypto. A research report by crypto trading NYDIG’s states that regulation could bring an additional $30billion into crypto.

The cryptocurrency industry is moving further away from the periphery and inching closer to mainstream acceptance. The implications it will have on the financial ecosystem remain questions for the future, but the trajectory indicates a transformative role for cryptocurrencies in the years to come.

Read next: One In Three Americans Make Use Of Password Managers As Per This New Report