Real-world asset tokens are a growing trend in the cryptocurrency market. They represent tokenized projects with a tangible presence in the physical world – ensuring solid utility and use cases.

This guide explores the best real-world asset tokens to buy right now. Read on to discover top-trending cryptocurrencies that bridge the gap between the blockchain and physical landscapes.

The Top Real-World Asset Crypto Tokens to Buy

Let’s begin with a quickfire list of the best real-world asset tokens for 2023:

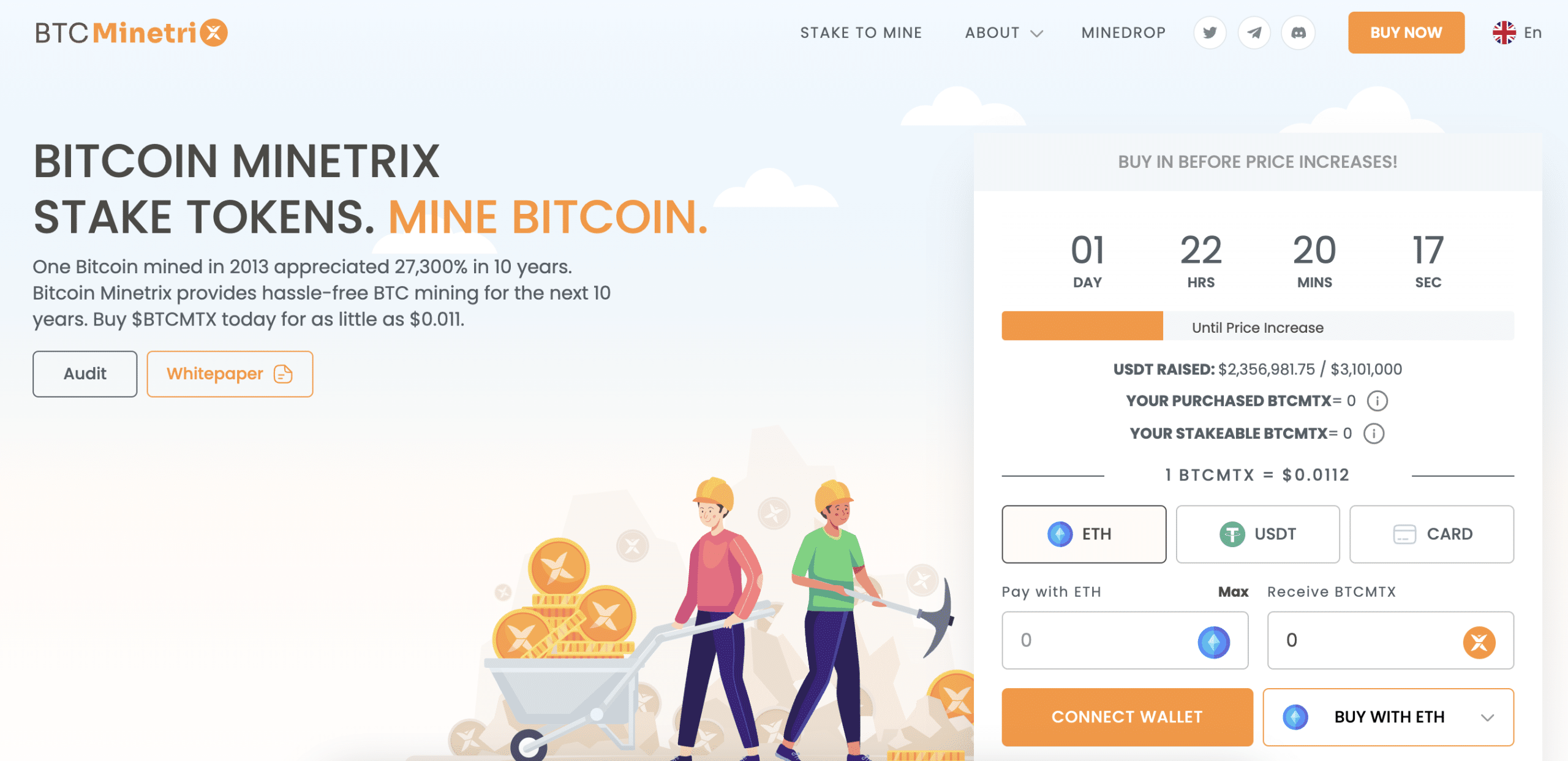

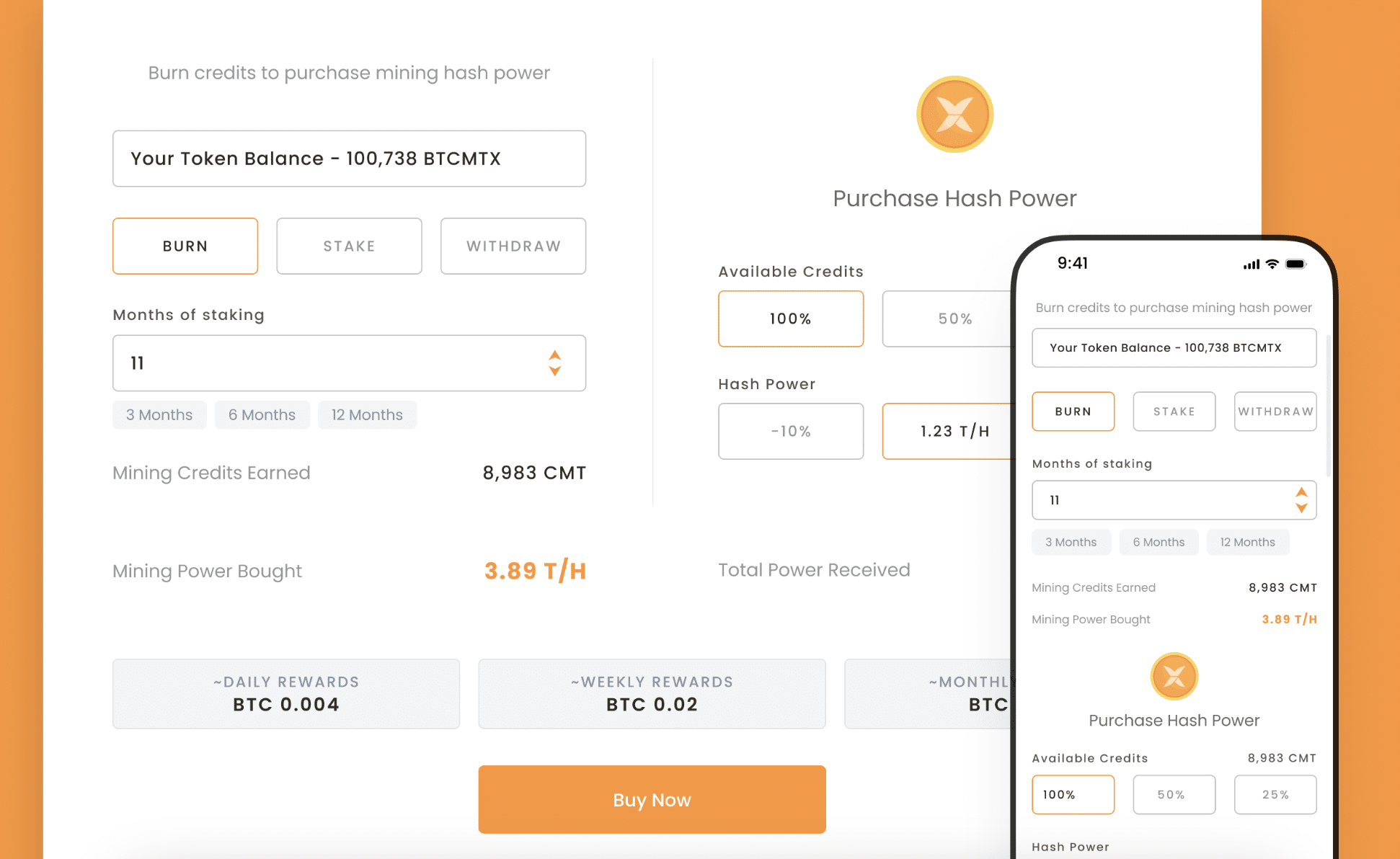

- Bitcoin Minetrix (BTCMTX): This newly launched project has developed the Stake-to-Mine concept. Those staking BTCMTX tokens earn credits – which can be exchanged for Bitcoin mining power. Bitcoin Minetrix users earn passive mining rewards without needing to buy expensive hardware. BTCMTX tokens are now on presale, with over $2.3 million raised so far. A discounted price of $0.0112 per token is still available to early investors.

- Chainlink (LINK): This Web 3.0 project bridges the gap between real-world data and smart contracts. Chainlink leverages Oracle technology to feed smart contracts with real-time information, from verifiable and independent sources. Developers need LINK tokens to access Chainlink Oracles, ensuring the project has real-world utility.

- Maker (MKR): Connects physical asset ownership with the blockchain world. Maker allows users to tokenize real-world assets and use them as collateral. This provides access to financial services within the Maker ecosystem. Maker’s native token, MKR, trades 77% below bull market prices.

- Synthetix (SNX): Tokenizes real-world financial instruments, such as gold, oil, natural gas, and fiat currencies. The Synthetix ecosystem enables users to trade leveraged tokens, offering access to traditional assets without actual ownership. Assets are collateralized and backed by SNX, which currently trades at a 91% discount.

- Internet Computer (ICP): This real-world cryptocurrency project is revolutionizing the internet – removing control from Big Tech and putting it back into the hands of the average user. Internet Computer is building a decentralized version of the web that is open to everyone, with servers distributed across limitless nodes.

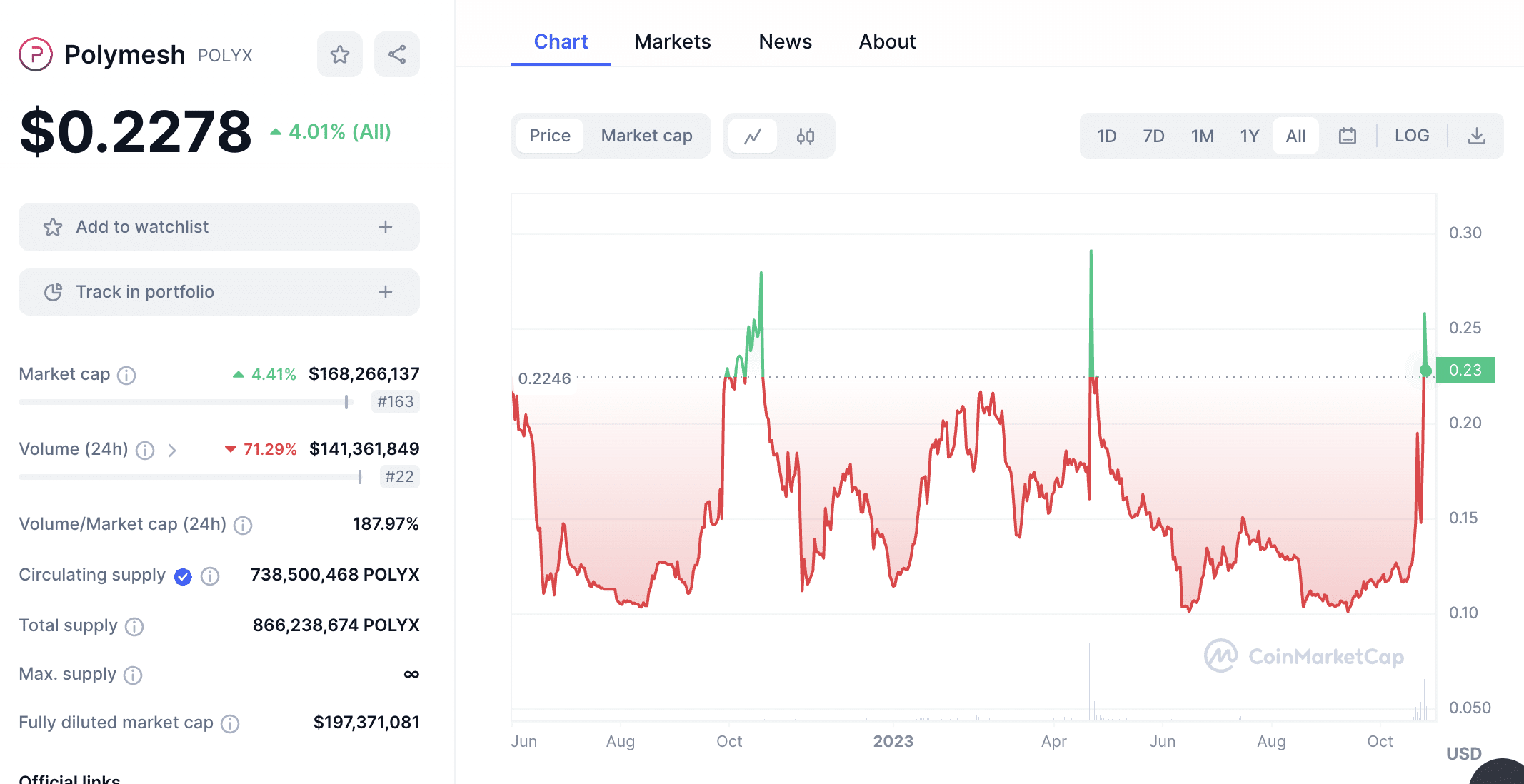

- Polymesh (POLYX): This project is bringing real-world securities to the blockchain. Polymesh tokenizes regulated assets and removes conventional barriers to entry, such as compliance and delayed settlement times. Anything of value can transition to Polymesh, including stocks and bonds.

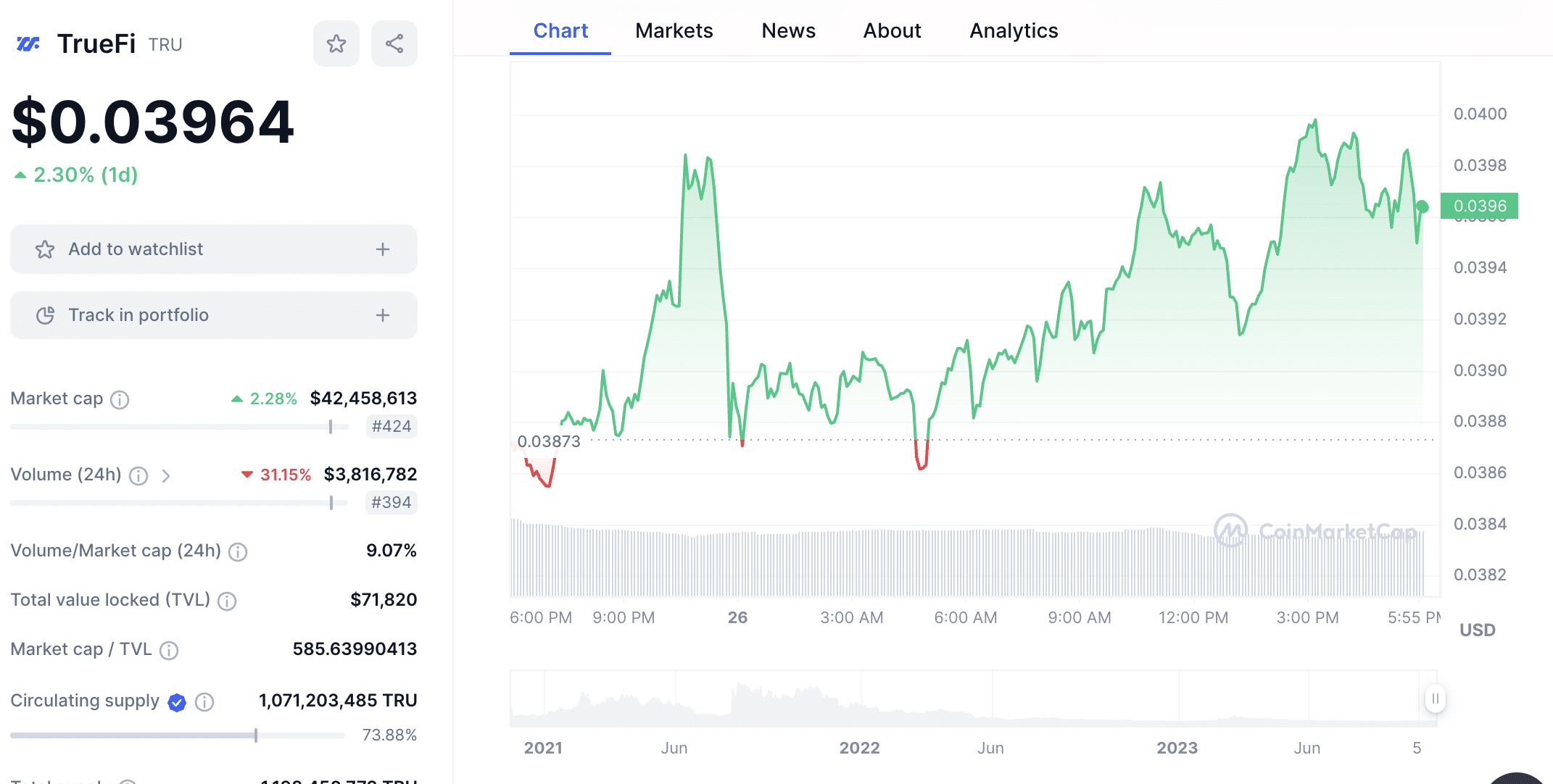

- TrueFi (TRU): Bridges the gap between offline lenders and the blockchain. TrueFi allows traditional lenders to upload loan books to its ecosystem, which investors can gain exposure to. It’s a win-win scenario; investors earn passive yields while lenders can offset some of their risk.

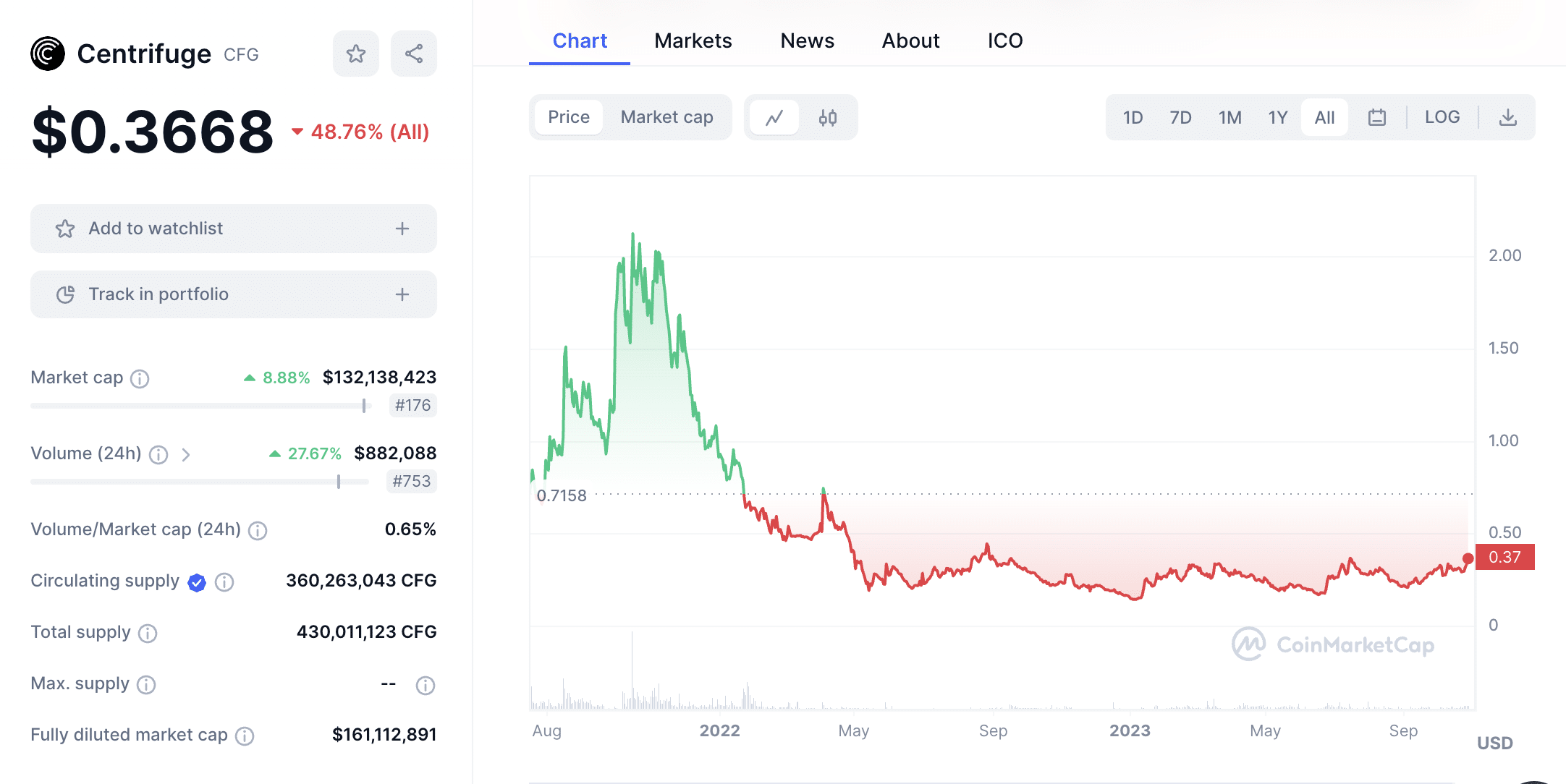

- Centrifuge (CFG): This layer 1 blockchain was developed to tokenize real-world assets. It enables small-to-medium businesses to raise financing by using their inventory and other physical items as collateral. Assets are tokenized via NFTs and used to secure loans from DeFi investors.

Analyzing the Best Real World Asset Tokens

Let’s explore the investment thesis for the real world asset cryptocurrencies listed above.

1. Bitcoin Minetrix – Stake-to-Mine Concept for Remote Bitcoin Mining

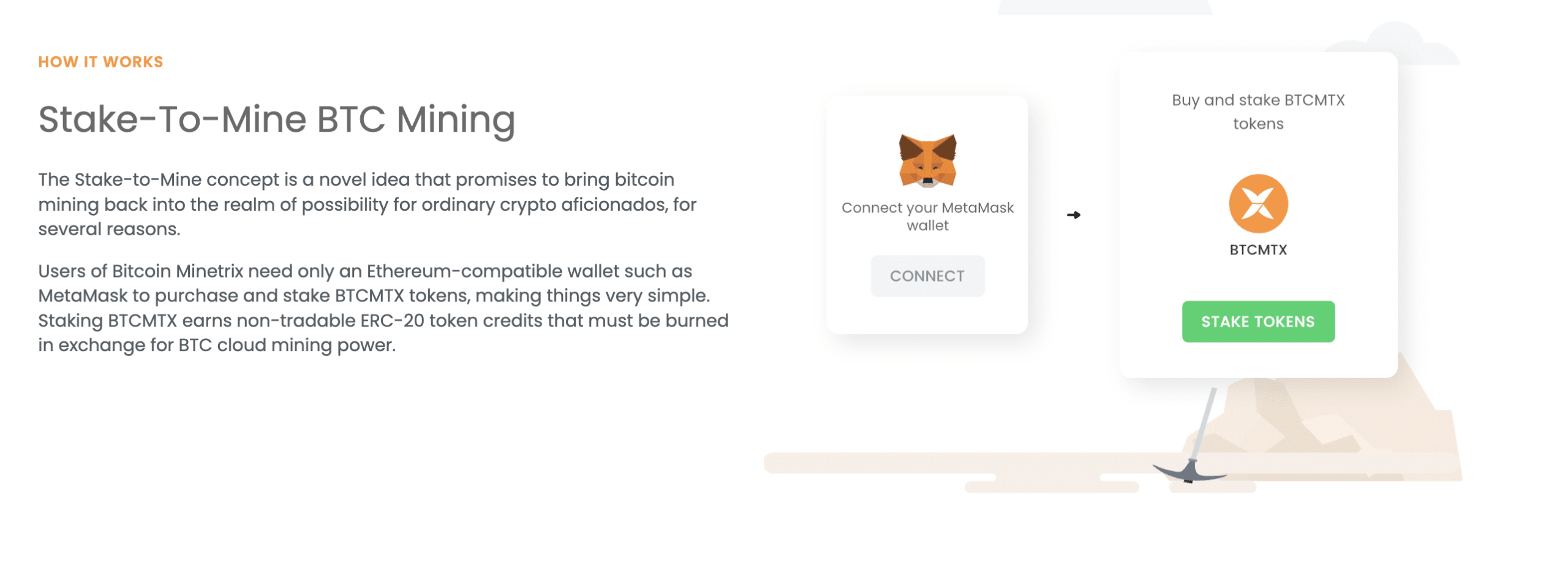

The first real-world cryptocurrency project to consider is Bitcoin Minetrix, which is currently in presale. Bitcoin Minetrix is revolutionizing the Bitcoin mining industry. In its current form, Bitcoin mining is only accessible to those with vast resources. To stand any chance of successfully mining Bitcoin, you’d need an entire rig with countless ASICs. Not to mention a significant outlay on energy.

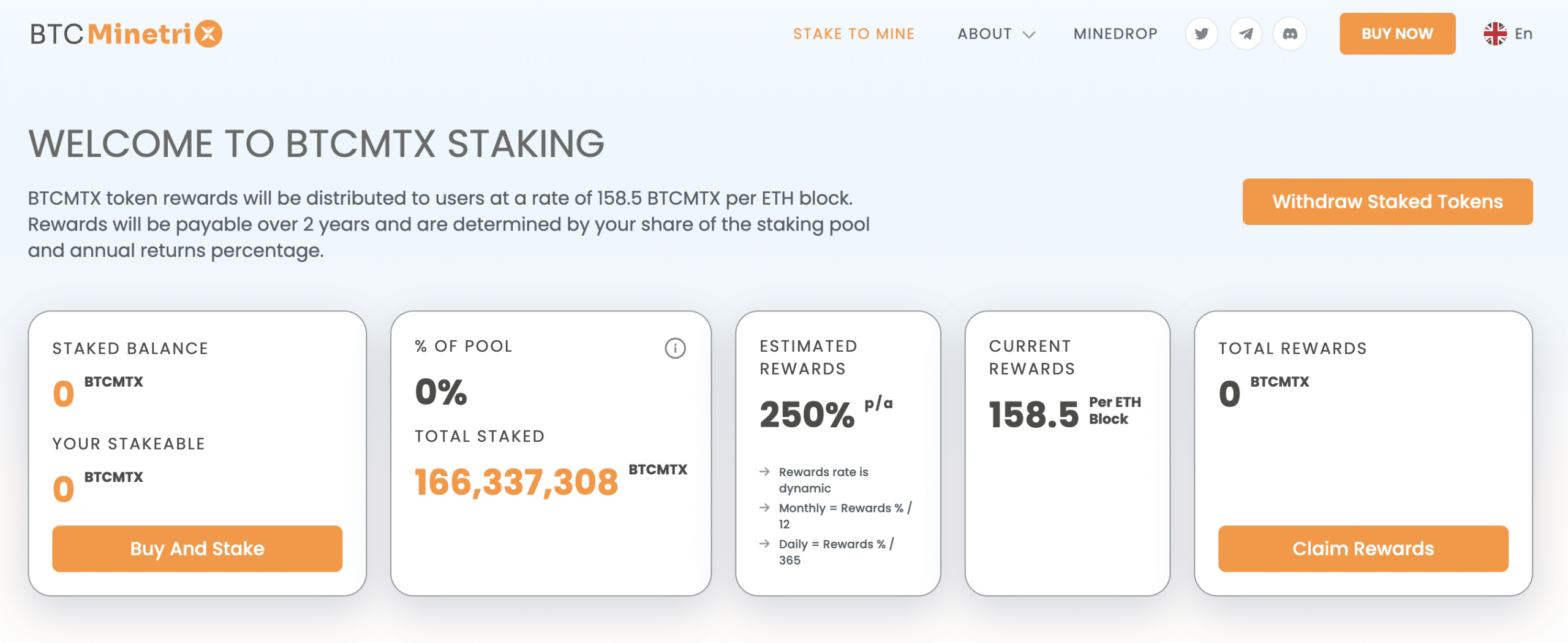

Bitcoin Minetrix is bringing Bitcoin mining back to the people through its stake-to-mine concept. Here’s how it works; Bitcoin Minetrix has First, users need to purchase and stake Bitcoin Minetrix’s native token, BTCMTX. This is an ERC20 token and once deposited into a staking pool, earns Bitcoin Minetrix credits. These credits can then be exchanged for Bitcoin cloud mining power.

It really is that simple. This means that there’s no requirement to buy expensive hardware or consume vast resources on electricity. Instead, the entire process is passive and cost-effective. Most importantly – and unlike conventional cloud mining sites, Bitcoin Minetrix is decentralized. Its mining ecosystem is governed by BTCMTX holders and secured by Ethereum smart contracts.

Another solution is that Bitcoin Minetrix doesn’t lock users into long mining contracts. On the contrary, users can stake and unstake their tokens at any time. As mentioned, Bitcoin Minetrix is currently running its presale campaign, meaning investors can now purchase BTCMTX at a favorable entry price. So far, more than $2.3 million has been raised.

This highlights that Bitcoin Minetrix’s vision is shared by many cryptocurrency investors. The Bitcoin Minetrix presale is currently priced at $0.0112 per token. In the next couple of days, the presale price will increase. Price increases will continue until the presale is over, meaning early investors are rewarded.

Just remember to consider the risks before investing. Even the best crypto presales are known for their volatility and speculation, so ensure you’re well diversified. Should you wish to proceed, the Bitcoin Minetrix presale accepts Tether, Ethereum, and debit/credit cards. The latter requires KYC verification, as fiat purchases must comply with AML regulations.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

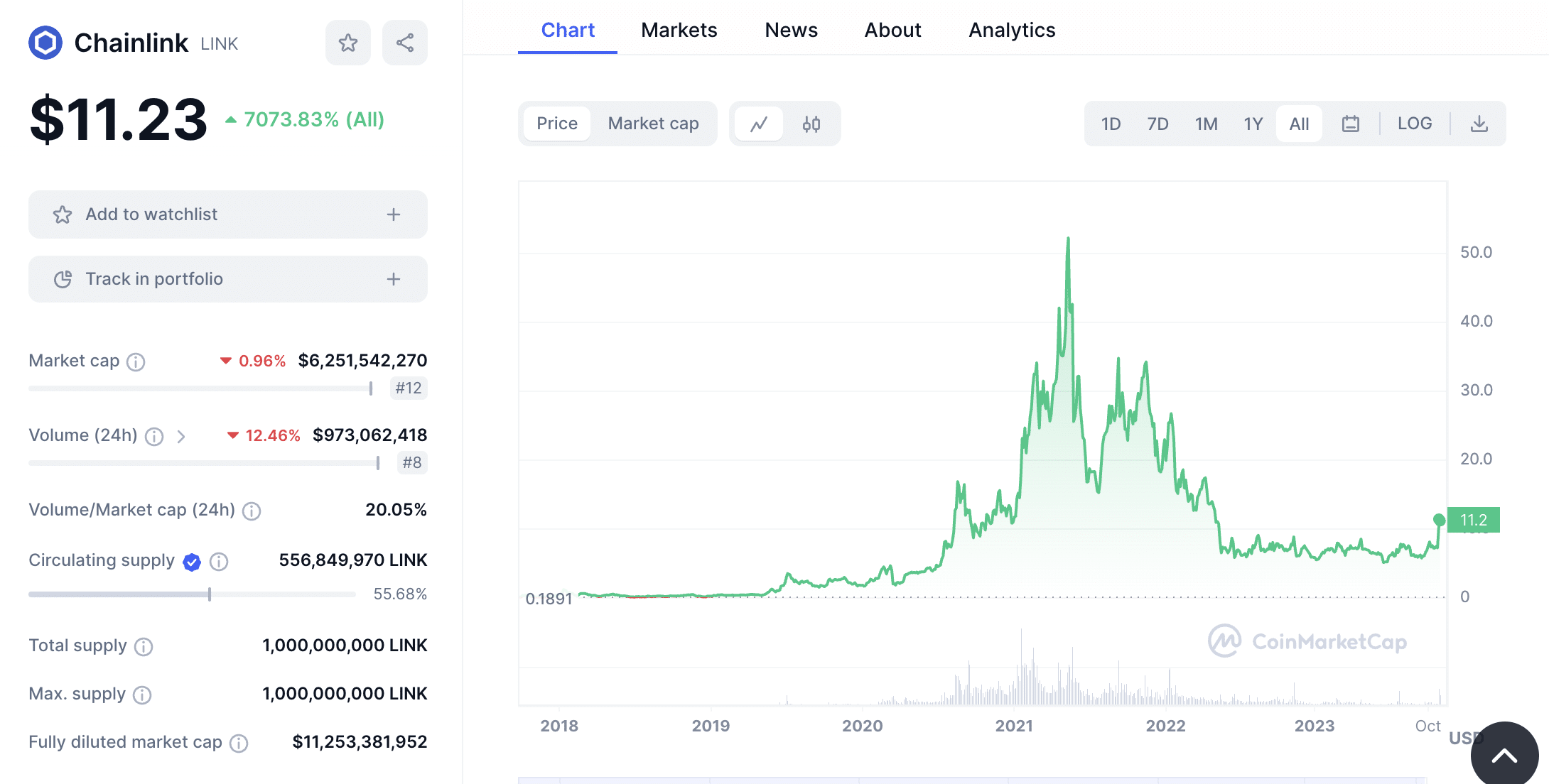

2. Chainlink – Connecting Smart Contracts With Real-World Data via Oracle Technology

Chainlink is also one of the best real-world asset tokens to buy right now. Founded in 2017, Chainlink has solved a pressing issue in the blockchain industry – bridging the gap between real-world data and smart contracts. It has developed Oracle technology that feeds smart contracts with real-time information, extracted from independent sources.

This means that smart contracts can operate autonomously based on real-world events, rather than just blockchain transactions. For example, let’s suppose a decentralized sportsbook offers a betting market on the 2024 US elections. Chainlink smart contracts can scan thousands of news sources every second, with the view of confirming the result.

The smart contract could then pay winning bets automatically once Chainlink Oracles have reached a consensus. This is just one example, but Chainlink has use cases across all industries. This includes anything from healthcare and supply chain management to aviation and financial markets.

The Chainlink ecosystem is fueled by LINK, considered one of the best utility tokens to buy. The reason is simple; LINK is required to use Chainlink Oracles. Over time, as more people leverage the network, this will drive up demand for LINK. Best of all, LINK tokens have suffered from bear market conditions – meaning new investors can secure a huge discount.

Consider that in 2021, LINK hit an all-time high of $52.88. Today, LINK tokens trade nearly 79% below their prior peak. Even so, Chainlink has recorded growth of over 7,000% since its inception, making it one of the best real-world asset tokens to own. The best place to buy LINK is eToro, a regulated crypto exchange supporting fee-free debit/credit card and e-wallet payments.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

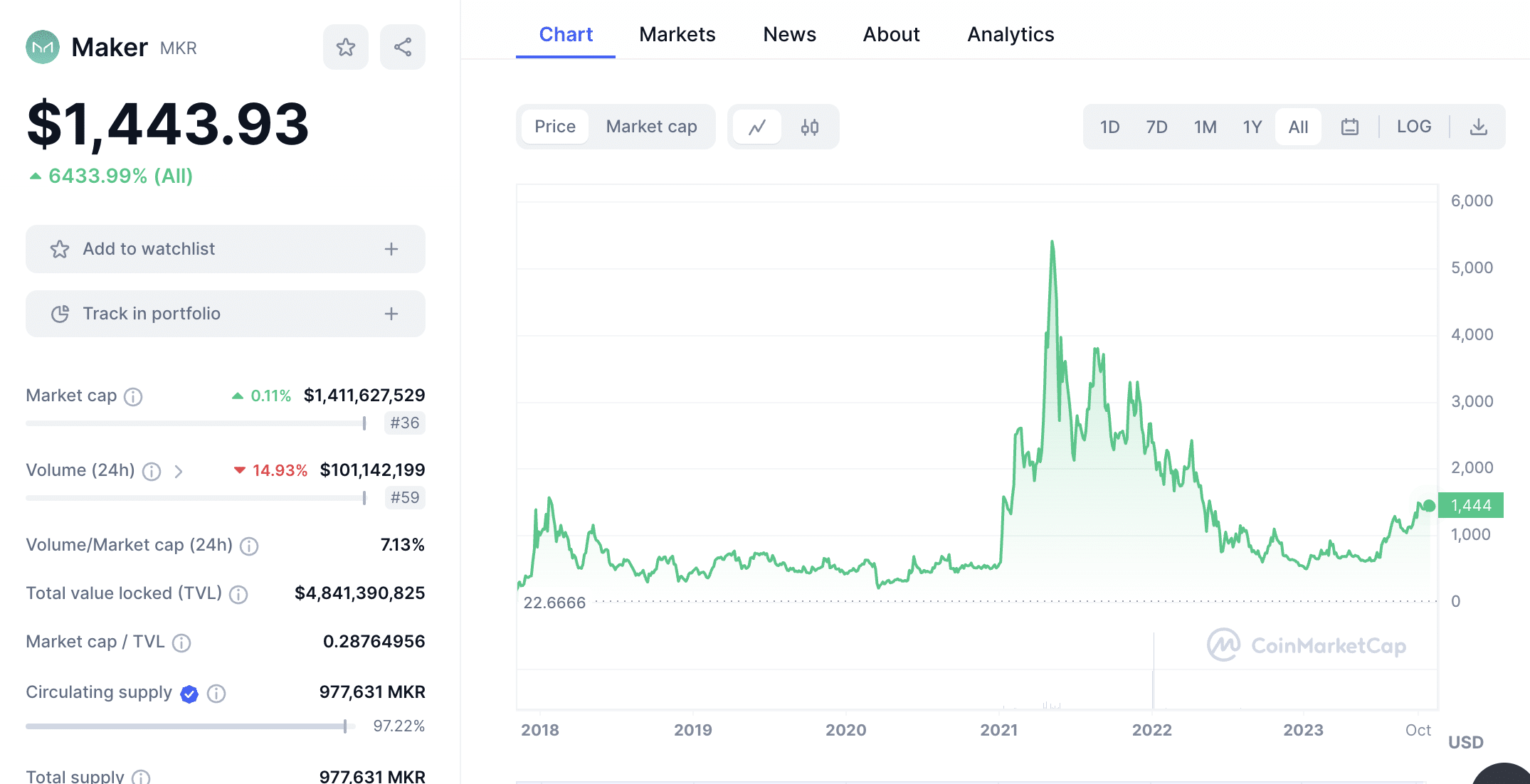

3. Maker – Connects Physical Asset Ownership with the Blockchain World

Launched in 2017, Maker is a decentralized finance project supporting many features and tools. This includes a fully-fledged lending ecosystem, enabling users to take out collateralized crypto loans. This removes the need for centralized lenders like banks, as Maker leverages smart contracts and blockchain technology.

Maker is also one of the best real-world asset tokens. This is because its ecosystem enables users to tokenize physical assets on the blockchain. For example, let’s suppose that you own one of the rarest Pokemon cards available. You want to use your Pokemon card as collateral to access financing.

Maker enables you to do just this, meaning you can tokenize the Pokemon card and access financial services within its ecosystem. Therefore, Maker connects real asset ownership with the blockchain world. Maker also has a native governance token, MKR. Not only does MKR have a limited supply but 100% of tokens are already in circulation.

Right now, MKR tokens trade for nearly $1,500 each. However, MKR was worth $6,339 during the prior bull market, meaning it trades at a 77% discount. Fortunately, you won’t need to risk $1,500 when investing in Maker, as MKR tokens can be fractionized. At eToro, you can buy MKR from just $10, which will appeal to those on a budget.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

4. Synthetix – Decentralized Ecosystem for Tokenizing Real-World Financial Assets

Synthetix also makes our list of the best real-world asset tokens. In a nutshell, Synthetix has created a decentralized ecosystem that tokenizes financial assets. For example, suppose you want to gain exposure to gold. Rather than buying physical gold bars and worrying about storage and security, you could own a synthetic version, known as ‘Synths’.

Synths are somewhat similar to contracts-for-differences (CFDs), as they track the real-world value of the respective asset. However, unlike CFDs, Synths are collateralized and backed by SNX, which is native to the Synthetix network. What’s more, Synths operates on the blockchain via smart contracts, so investors don’t need to trust online brokers or financial institutions.

Synthetix use cases aren’t just exclusive to gold – its ecosystem can tokenize just about anything. For instance, other commodities like silver and oil, fiat currencies, and even other cryptocurrencies. Synthetix also supports inverse assets, meaning users can engage in short-selling.

Just like CFDs, Synthetix offers leveraged derivatives, with users able to amplify their positions by up to 50x. Considering its solid use cases and connection to the real world, SNX is one of the best-emerging cryptocurrencies to buy. This is especially the case in the current market landscape, with SNX trading 91% below its all-time high.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

5. Internet Computer – Revolutionizing the Internet Landscape Through Decentralized Super Computers and Canisters

According to CoinMarketCap, Internet Computer is the second-largest real-world asset token for valuation. Right now, Internet Computer has a market capitalization of over $1.6 billion. Internet Computer is building the next generation of the internet, in what it calls a ‘Super Computer’. It aims to remove control from Big Tech; decentralizing the way that people engage online.

It leverages blockchain networks to distribute internet access without censorship or agendas. Internet Computer has crafted the ‘Canisters’ concept; websites that operate on the new-age internet. Let’s consider a real-world example. Suppose you want to develop an online marketplace that specializes in sports memorabilia.

Traditionally, merchants would need to go through a centralized marketplace like Amazon or eBay. This means giving away control, with merchants needing to abide by the rules of each platform. In contrast, the sports memorabilia marketplace could be built via the Internet Computer.

There are no issues with centralization or control, as servers are distributed globally. What’s more, marketplace rules are dictated by the community, not any single person or entity. This project has plenty of other use cases, including play-to-earn gaming, decentralized finance, and metaverse ecosystems.

Internet Computer’s native token, ICP, is required to access the World Computer, giving it solid utility. Based on current prices, ICP is one of the best crypto winter tokens to invest in. ICP hit all-time highs of $750.73 in 2021. Today, ICP tokens are trading for under $4. This means that investors can secure a discount of over 99%.

6. Polymesh – Institutional-Grade Blockchain System for Digitizing Regulated Assets

Next up is Polymesh, an innovative blockchain project aimed at financial institutions and other regulated entities. Put simply, Polymesh enables firms to digitize regulated securities via the blockchain. For example, stocks and bonds. It helps remove conventional barriers of entry for investors.

This solves issues surrounding delayed settlement times, compliance, and identity verification. Not only that but Polymesh adds a layer of security to regulated assets, as they’re backed by smart contracts. Let’s look at a real-world example. Suppose a development company wants to build a new hotel complex in London.

They want to raise capital from investors via regulated securities. The traditional process is not only fraught with red tape but overly time-consuming. Through Polymesh, the development company can issue tokenized assets, which represent fractional ownership of the hotel complex.

Polymesh has a native cryptocurrency token, which has many use cases. For example, those wishing to issue security tokens need to pay handling fees in POLYX. It also extends as a governance token, with holders able to vote on key proposals. POLYX has a market capitalization of just $165 million, so offers plenty of upside potential.

7. TrueFi – Offline Loan Books Uploaded to the Blockchain for Risk-Mitigation and Investment Opportunities

TrueFi is a cryptocurrency project that connects traditional finance with the blockchain arena. It’s aimed at lending institutions, enabling them to issue credit facilities and manage loans more effectively.

In other words, it enables lenders and borrowers to engage via the blockchain, offering financing and investment opportunities for all stakeholders. For example, consider a lender in Kenya that issues physical loans to local residents.

Its loan book is uploaded to the TrueFi ecosystem, which is then accessible to investors. Anyone with cryptocurrencies can invest in these loans, resulting in passive income. From the lender’s perspective, TrueFi enables them to offset some of the risk.

TrueFi is a small-cap project, currently valued at just $42 million. Its native token TRU, is trading at a significant discount. Investors can now buy TRU 96% below its all-time high.

8. Centrifuge – Layer 1 Blockchain Network Developed for Financing Real-World Assets

Centrifuge is a layer 1 blockchain with its own native cryptocurrency, CFG. Its network was developed with a sole purpose – to finance real-world assets on the blockchain. This project is aimed at small-to-medium businesses that may struggle to raise capital in the real world.

Centrifuge enables them to tokenize their physical assets, which can then be used as collateral. For example, suppose a small clothing store wants to raise finance. They decide to tokenize their current inventory, alongside the store itself.

The assets are represented by NFTs on the Centrifuge blockchain. Then, the business owner could take out a loan against the assets, paying a yield to investors. Centrifuge is currently valued at just $134 million and CFG tokens are trading 86% below their all-time highs.

What are Real-World Asset Tokens?

Real-world asset tokens are cryptocurrencies that have a connection to the physical world. This bridges the gap between real life and the blockchain ecosystem. Cryptocurrency investors view real-world asset tokens as viable investments, as they’re often backed by something tangible.

This gives the respective project solid use cases, giving it a great chance for long-term appreciation. For example, Bitcoin Minetrix brings the traditional Bitcoin mining space to its decentralized community. Those staking BTCMTX tokens earn credits, which can be converted to mining power.

This means that Bitcoin Minetrix users can mine Bitcoin without needing to own any ASICs. Therefore, Bitcoin Minetrix is a great example of how real-world assets can be intertwined with the blockchain. Similarly, Chainlink extracts data from the real world and feeds it into smart contracts.

This enables decentralized applications to make decisions based on real-world events, rather than the blockchain data alone. Then there’s Maker, which allows users to tokenize physical items on the blockchain and use them as collateral. In turn, users can leverage their real-world items to access financial services.

Why Invest in Real World Asset Coins?

Let’s take a deep dive into the investment thesis of real-world asset coins. Read on to explore why real-world crypto coins are the hottest trend right now.

Gateway to Offline Assets and Markets

Real-world asset tokens provide exposure to markets that would otherwise be difficult to access. For example, consider the complexities of investing in a hard commodity like oil.

Unless you have the capacity to store physical barrels, most investors would need to consider alternatives, such as oil stocks or ETFs.

Synthetix solves this issue through ‘Synths’, which can tokenize any real-world asset – including oil. In a nutshell, Synths track the global value of oil in real-time, allowing investors to gain exposure without physically owning anything.

Similarly, consider the issues found with traditional Bitcoin mining. This space is dominated by fully-fledged mining farms with millions of dollars worth of ASICs, rigs, and cooling fans. Not to mention full-time staff and significant expenditure on energy consumption.

Bitcoin Minetrix solves this issue through its Stake-to-Mine framework. This enables users to mine Bitcoin without owning any hardware; all they need to do is stake BTCMTX tokens. As earnings accumulate, BTCMTX tokens can be converted to Bitcoin mining power.

Remove Financing Frictions Found in the Real World

The best real-world asset tokens solve a growing issue – accessing financing in a fair and cost-effective environment. In fact, with interest rates at near-record highs, financing has become unviable for small-to-medium businesses.

This is where Centrifuge comes in. Centrifuge allows companies to tokenize their assets on the blockchain. In doing so, they use their tokenized assets as collateral for financing. For example, consider an Amazon merchant that sells virtual reality (VR) headsets.

The merchant wants to raise financing to expand the business into augmented reality. Through Centrifuge, they can tokenize their current VR inventory to take out a loan. The loan is funded by investors, who are paid interest by the Amazon merchant.

Another project in this space is TrueFi. Put simply, TrueFi connects real-world lenders to the blockchain ecosystem. Lenders can submit their loan books to DeFi investors to offset some of the risk.

This means DeFi investors can gain exposure to real-world loans without leaving the comfort of their home. The possibilities really are endless, which is why real-world asset crypto tokens are increasingly becoming popular with investors.

Huge Upside Potential in the Current Market Landscape

Never before has there been a better time to invest in real-world cryptocurrency tokens. With the exception of Bitcoin Minetrix – which is currently running its presale campaign, all of the projects discussed today at trading at huge discounts.

This is because of broader bear market conditions, which have impacted the majority of the crypto industry.

- Take Chainlink as a prime example. Chainlink has a solid business model, providing real-world data to decentralized smart contracts.

- Although LINK tokens are required to access Chainlink Oracles, their value has plummeted since hitting highs in 2021.

- In fact, LINK tokens are now trading 79% below all-time high prices.

Even bigger discounts are available with other real-world asset tokens. For example, Internet Computer and Synthetix are now trading at discounts of 99% and 91%, respectively. Many investors believe that when the next bull market arrives, quality real-world asset tokens will recover.

Invest From the Ground Up

Although some real-world asset cryptocurrencies are established projects, some are just getting started. Bitcoin Minetrix, for example, hasn’t even been listed on crypto exchanges yet. Its native token, BTCMTX, is currently being sold to presale investors.

This means that you can invest in Bitcoin Minetrix from the ground up. Presale investors get the best price possible, with early-stage purchases receiving a considerable discount. After the presale finishes, BTCMTX will be listed on crypto exchanges.

Although presale investments are inherently risky, they offer unprecedented upside – especially if the project takes off. What’s more, the Bitcoin Minetrix presale will close with a relatively small valuation, making it one of the best low-cap cryptocurrencies for 2023.

How to Decide Which Real World Asset Tokens to Invest in

Read on to discover our suggested best practices when building a portfolio of real-world asset tokens.

Create a Shortlist and Look to Diversify

The best approach is to diversify across many different projects. This means investing in various use cases, markets, and niches. Therefore, you’ll first want to read through some whitepapers and build a shortlist of potential investments.

For example, Bitcoin Minetrix gives you exposure to the real-world Bitcoin mining industry. Its native token, BTCMTX, can be staked for passive rewards. These rewards are exchanged for credits, which give you access to Bitcoin mining power.

In the financial realm, consider Synthetix – which tokenizes tradable assets like gold, oil, and currencies. You could also diversify into Chainlink Oracles, which provide real-world data to blockchain networks.

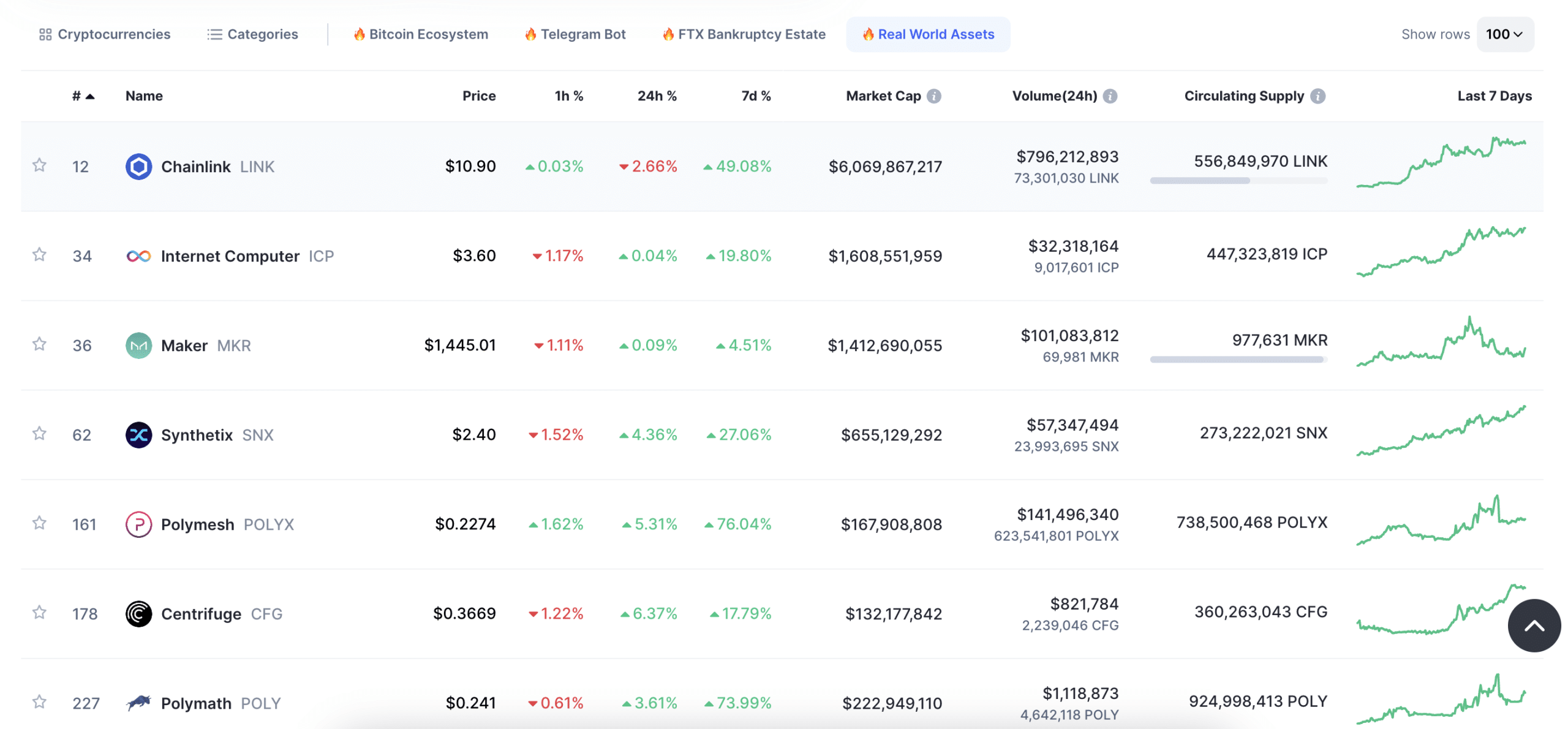

Crucially, investing in as many real-world asset tokens as possible is a solid risk-mitigation strategy. To get the ball rolling, CoinMarketCap has a list of real-world asset cryptocurrencies, which are ranked by market capitalization.

Research Key Metrics – Including Valuation, Volume, and Exchanges

Once you’ve created a shortlist of potential investments, it’s wise to research the key metrics of each project. For example, if you’re looking for large-cap projects, Chainlink could be of interest.

It’s currently valued at over $6 billion; considerably lower than the $21 billion Chainlink was worth during the prior bull market. Nonetheless, Chainlink offers plenty of trading volume and is listed on the world’s largest crypto exchanges.

Some investors prefer real-world asset tokens with much smaller market capitalizations. While the risks are higher, this offers a much greater upside potential. For example, TrueFi is currently valued at just $42 million. Nonetheless, TrueFi still attracts reasonable trading volumes, and it’s listed on many tier-one exchanges, including Binance and KuCoin.

Rather than choosing between large and small-cap projects, consider investing in both. This will help you achieve a well-balanced portfolio.

Explore Token Use Cases

All real-world asset tokens are unique, insofar that they are proprietary to their respective ecosystem. However, this doesn’t mean that the token has any identifiable use cases. For example, many real-world asset tokens are simply used for governance.

Sure, holders can vote on key proposals, but governance tokens don’t have any actual utility.

- Now compare this to a project like Bitcoin Minetrix.

- As we mentioned, its native token, BTCMTX, fuels the Stake-to-Mine framework.

- This means that staking BTCMTX tokens allows you to passively mine Bitcoin.

- Without BTCMTX, mining isn’t possible.

Another project with solid utility is Synthetix. In order to tokenize a real-world asset, it must be collateralized with SNX tokens. This gives the tokenized asset credibility, as it’s backed by actual value.

Load-Up on Quality Tokens With the Biggest Discount

The cryptocurrency markets move in cycles – we’re still in the midst of a bear market. While unfortunate for some, new investors can buy a range of quality tokens at a significant price reduction.

While there are no guarantees, the best real-world asset tokens could see a major revival when the next bull market arrives.

- For example, Internet Computer hit an all-time high of $750.73 in 2021.

- However, today, you’ll pay just $3.64. This represents a 99% discount from its all-time high.

- Suppose that during the next bull cycle, Internet Computer recovers to $750.73. From current prices, this would require an upside of over 20,500%.

- Although not likely, Internet Computer would only need to recover a fraction of its former all-time high to generate significant growth.

You could repeat the same process across other real-world asset tokens that have collapsed since the bull market peak.

Evaluate the Tokenomics – Especially Supply and Circulation

We would also suggest researching the tokenomics before investing in a project. More specifically, evaluate the total supply of tokens that have been created. We prefer projects that set a cap on the number of tokens, meaning the project can avoid inflation.

This is the same concept developed by Bitcoin, which is capped at 21 million tokens. Similarly, Bitcoin Minetrix has created 4 billion BTCMTX tokens – no more will ever exist.

However, some real-world asset tokens haven’t set a limit on the total supply. This means that the developers can keep issuing new tokens, which devalues current holders.

In addition, you should assess how many tokens are in circulation, in relation to the total supply. If only a very small percentage are in circulation, this is risky – especially if the balance is held by the developers. After all, they could dump the tokens on the open market at any time.

Conclusion

In summary, real-world asset tokens are one of the hottest cryptocurrency niches right now. They offer solid utility and use cases, as projects are related to products or services in the physical world.

Overall, we like the look of Bitcoin Minetrix – which is tokenizing the Bitcoin mining space. Bitcoin Minetrix offers a Stake-to-Mine concept, where staked tokens are converted to mining power. With over $2.3 million raised, the Bitcoin Minetrix presale is proving popular with growth inventors.

References

FAQs

What real-world assets can be tokenized?

In theory, any real-world asset can be tokenized on the blockchain. Ownership is simply secured and verified by a unique NFT.

What are real-world assets in crypto?

Real-world asset cryptocurrencies are projects that connect the real and blockchain worlds. They usually represent physical products or services, such as tokenized loans, tradable assets, or mining facilities.

What tokens are backed by real assets?

According to CoinGecko, two of the largest asset-backed tokens are Tether Gold and Pax Gold, which are backed by physical gold.

What is the best real-world asset token to buy?

We like Bitcoin Minetrix, which has developed a Stake-to-Mine concept. It enables token holders to mine Bitcoin without buying hardware or consuming vast amounts of energy.