Storing Crypto Safely Using Wallets

While the above steps can help to protect you against an exchange attack, you are ultimately not in control as long as the exchange has your crypto. That’s where crypto wallets come in.

What Is a Crypto Wallet?

A crypto wallet is like a literal wallet where you can store your cryptocurrencies, only, since cryptocurrencies are digital, crypto wallets are virtual as well. They are a piece of software you can use to prove that you are the owner of a particular crypto account or address. You can use a wallet to store cryptocurrency securely or to authorize crypto payments to employees or merchants.

Unlike exchanges, wallets live on your device, so the only way for an attacker to get crypto out of your personal wallet is to attack your personal device. While it is always possible that your device can be hacked, it is generally going to be less enticing of a target than your exchange is. So the most effective strategy you can use to protect your crypto is to move it into a private wallet.

>> Also check out: Is Crypto.com Safe?

Cryptography and How It Figures Into Crypto Wallets

Cryptography plays a huge role in cryptocurrency. Wallets use cryptography to authenticate transactions. When you create a wallet, it generates a hash of your “address,” which uniquely identifies your wallet. To send someone crypto, for instance, you’ll ask for their hashed address, and if someone is to send you crypto, you’ll give them your address.

The hash transmitted during transactions contain vital information – for example, the amount being transferred and the receiver’s address, signed using the sender’s private key – in code (encrypted). To interpret the code, validators will have to use a public key generated by the sender’s wallet, and for the transaction to push through, all the pieces of information must match.

That’s an over-simplification of the process. There’s a lot more that goes on in the background, but the bottom line is clear: Cryptography in wallets and the blockchain plays a major role in crypto security.

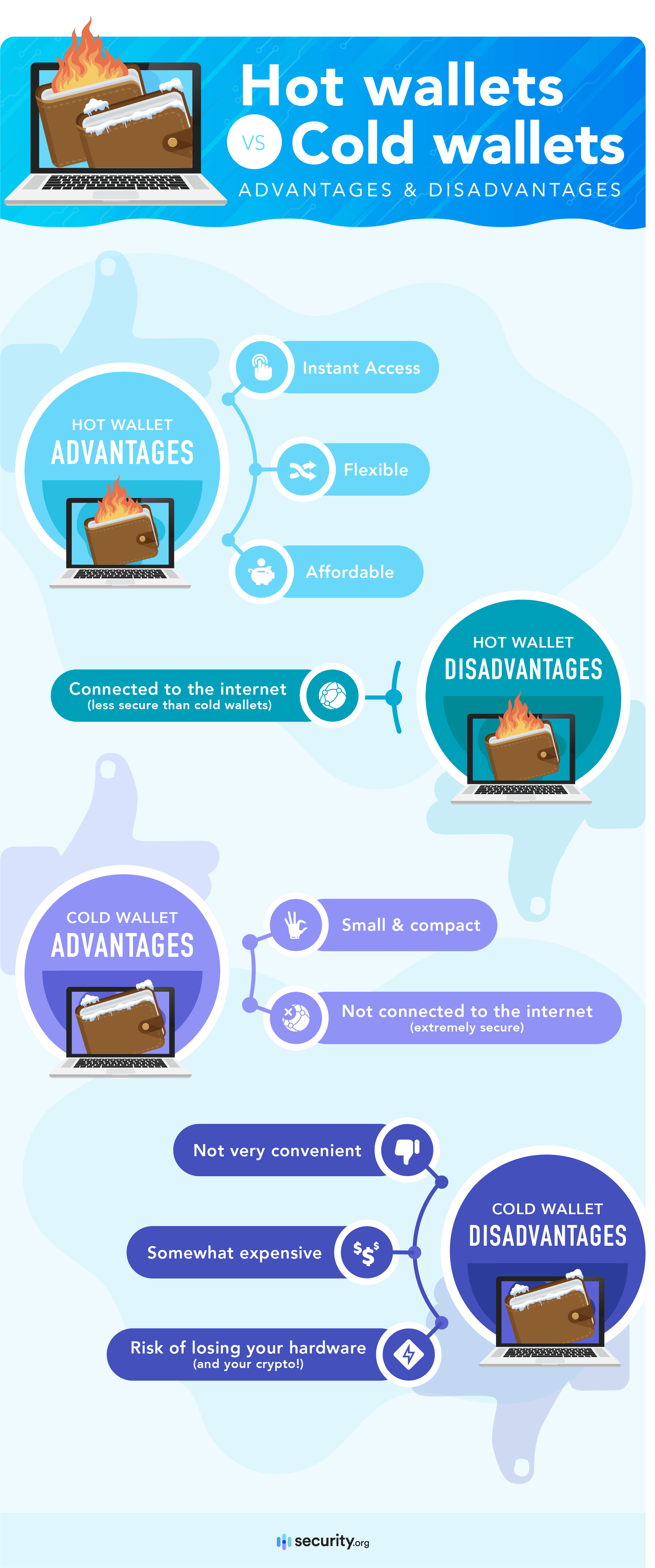

Hot wallets vs. cold wallets

Now, about the different types of crypto wallets, there are two you should absolutely know about before getting started: Hot wallets and cold wallets.

A hot wallet is a piece of software that runs on a device connected to the internet, such as a desktop or mobile wallet. You can download hot wallets from websites or from mobile app stores.

A “cold wallet,” on the other hand, is a wallet that is not connected to the internet. This includes paper wallets and hardware wallets. Cold wallets can’t be downloaded; they can only be purchased or created.

If you are going to be using your crypto on a daily basis, you may want to keep it in a hot wallet. But if you are just buying and holding, a cold wallet is the safer option.

Using a hot wallet to store crypto

To store your crypto in a hot wallet, first download it from the official website and run the setup file.

Setting up the app (seed words, passwords, and addresses)

When the app opens, it will display a set of seed words. These seed words are used to generate your crypto accounts and addresses.

Write down these words on a physical piece of paper in the order they are given to you. Do not take a screenshot of these words or store them on any kind of cloud service such as Dropbox or Google Drive.

Store your physical backup in a safe place where it cannot get wet, catch fire, or otherwise be destroyed. Don’t tell anyone where it is unless you intend for them to have access to your crypto.

Passwords

After allowing you to record your seed words, the app will ask you for a password. Use a strong password with numbers, capital and lowercase letters, and special characters if possible.

If you forget your password, you can restore your account using your seed words. So don’t stress about forgetting it. But make sure you don’t lose your physical copy of your seed words.

Addresses

When you finish this process, you’ll see your cryptocurrency address. It’s a long string of characters that is derived from your seed words.

When you withdraw your crypto, your exchange will ask for this string of characters. Make sure you copy and paste the address instead of hand-typing it. If you leave out or change even one character, you will lose the crypto you are sending!

Once your crypto is safely transferred into your wallet, the exchange will no longer have control over it. At this point, even if an attacker gets access to your exchange account, they will not be able to steal your crypto.

Understanding hot wallet security

Now that your crypto is in your hot wallet, you need to make sure it is protected from attacks.

The seed words you copied down on the piece of paper are used to generate an unlimited number of private keys. A private key is a string of characters your device uses to sign transactions and to prove that you’re the owner of the account.

Each private key corresponds to an account or address. You can create as many addresses as you want from a single set of seed words.

Your seed words are stored on your device in a file called a key vault. This file is encrypted with your password. When you make transactions or browse crypto-enabled websites, your wallet will ask for your password in order to decrypt this file.

For an attacker to get your crypto, they need to steal both your key vault and your password. If they only have one of these items, they can’t get your crypto. They need both.

There is a hash of your password on your device. If your password is weak and the attacker gets this hash, they might be able to crack it by guessing millions of random strings of characters until they find one that produces this hash. This is why using a strong password is important.

List of secure hot wallets

Here is a chart showing some of the most secure hot wallets. In each case, we’ve provided a link to the official website where an authentic copy of the software can be downloaded. We’ve also listed the type of wallet (desktop or mobile) and the networks it can be used on.

Software Crypto Wallets

| Wallet | Type | Networks | Official website |

|---|---|---|---|

| Electrum | Desktop | Bitcoin | Electrum.org |

| Mycelium | Mobile | Bitcoin | Mycelium.com |

| Exodus | Desktop and mobile | Multiple | Exodus.com |

| Metamask | Desktop and mobile | Ethereum, BSC, Avalanche, HarmonyONE | Metamask.io |

| Brave Browser | Desktop and mobile | Ethereum, BSC, Avalanche, HarmonyONE | Brave.com |

| Coinbase wallet | Desktop and mobile | Ethereum, BSC, Avalanche, HarmonyONE | Coinbase.com/wallet |

Using a cold wallet to store crypto

Hot wallets can be extremely secure if you use them correctly, but they can still be compromised if your device becomes infected with keystroke logging software. This is where using a cold wallet can help to protect you further.

If used correctly, a cold wallet should be impossible to hack except through physical theft.

Hardware wallets

The most popular form of a cold wallet is a hardware wallet. A hardware wallet is a small USB device that stores a keystore file. If you want to make a transaction with a hardware wallet, you can attach it to your PC or mobile device and send a signature through the USB port.

However, the key vault is stored on a separate memory bank in the device and can’t be transmitted through USB in an unencrypted form. This means that even if an attacker infects your PC with malware, they should be unable to gain access to your crypto.

The biggest risk to using a hardware wallet is physical theft. To further protect against even this possibility, hardware wallets have pin code locks.

Security experts have been able to hack hardware wallets using very sophisticated techniques once they had physical possession of them. So if you lose your hardware wallet, it’s best to transfer your crypto out of the wallet as soon as you realize it’s missing.

The biggest disadvantages to hardware wallets are inconvenience and cost.

If you use a hardware wallet, you have to connect the wallet to your PC and confirm the transaction using both the USB device and the software running on your PC. This can be quite inconvenient if you make a lot of transactions.

In addition, hardware wallets usually cost from $49-$220. So they are not economical for storing very small amounts of crypto.

List of hardware wallets

Here is a list of some of the more popular hardware wallets. We’ve included main features and prices for these as well.

Hardware Crypto Wallets

| Model | Features | Price |

|---|---|---|

| Trezor Model T | Supports all major networks; large, full-color touch screen (no buttons) | $185-$220 |

| Ledger Nano X | Supports all major networks; Bluetooth for mobile devices, large buttons, black & white OLCD screen | $119-$149 |

| Ledger Nano S | Supports 27 different networks; small buttons, black & white OLCD screen | $59 |

| Keepkey | Supports 7 different networks; small buttons, large OLCD screen | $49 |

Paper wallets

Another form of cold wallet is a paper wallet. A paper wallet is a private key and address that are only stored on a piece of paper. Since the key is not stored on any kind of computing device, it should be impossible for a hacker to steal it.

In the early days of Bitcoin, paper wallets were very popular as a method of storage.

But unfortunately, this method turned out to have one big security flaw: in order to generate the key and address, you needed to download an app into your browser. And it was difficult to know if the app was sending your keys to the web server and exposing your account.

Today, paper wallets should not be considered secure.

Now that we’ve got the basics of wallets out of the way, let’s discuss some common crypto scams to watch out for.