Most Popular Currencies in 2024

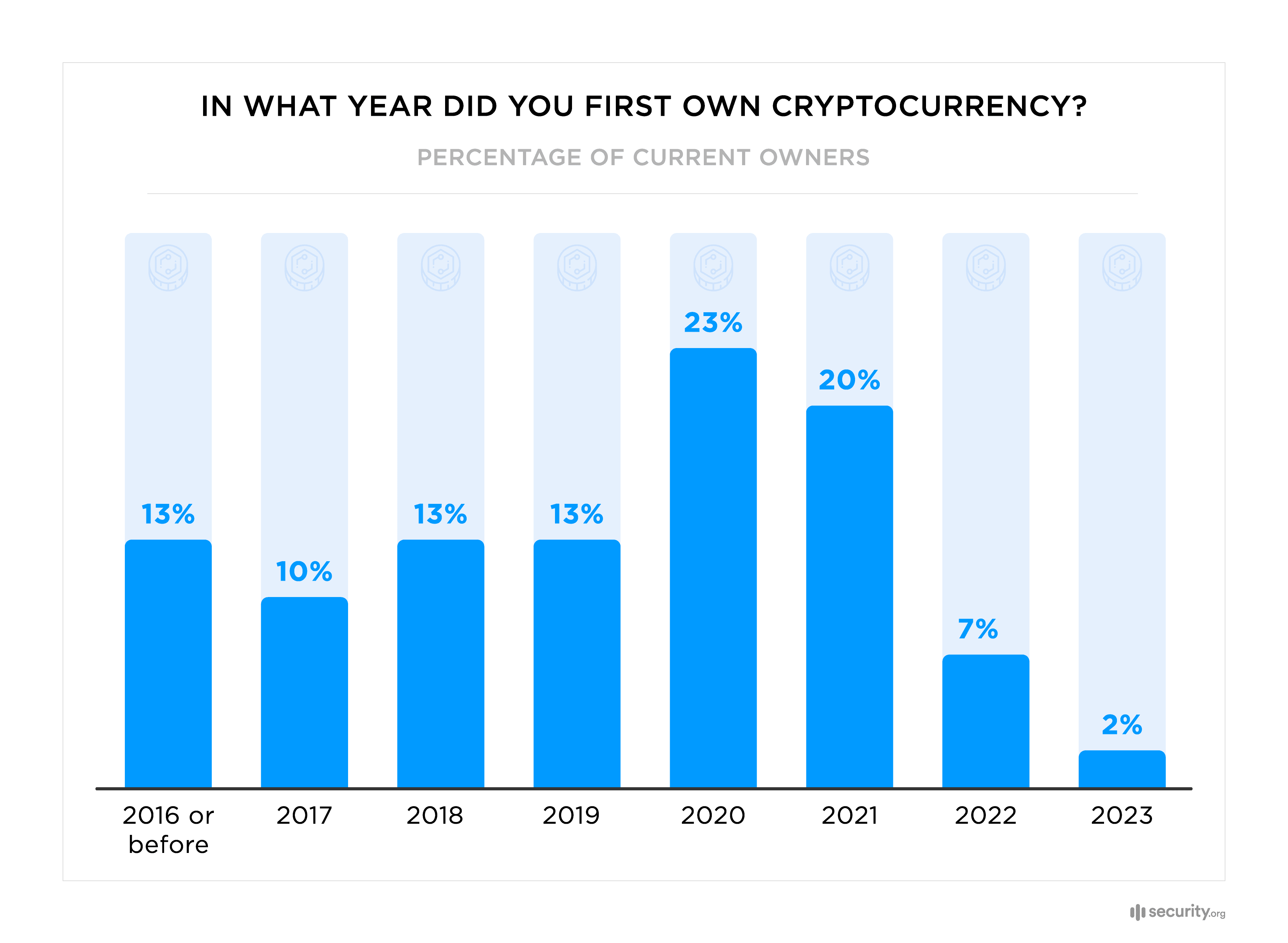

Most of our research respondents bought crypto for the first time in 2020 and 2021, but fewer people joined the market since then due to poor performance in 2022. Blockchain adoption gained pace in 2020 and 2021 due to the impressive price performance on crypto exchanges driven by Bitcoin’s third supply halving on May 11, 2020.

Supply halvings are programmed into Bitcoin’s software to occur every four years. As the name implies, the new supply of Bitcoin issued every ten minutes on average is cut in half. The 2020 halving cut new Bitcoin supplies from 12.5 BTC on each new block of transactions down to 6.25 BTC. The 2024 halving will cut new supplies to 3.125 BTC.

Another critical factor in 2020 and 2021 was an investor flight to Bitcoin and other deflationary blockchain currencies to hedge global inflation and geopolitical risk during the pandemic.

As the new supply of Bitcoin fell by 50 percent, the Federal Reserve increased the dollar supply by 20 percent in the first six months of 2020 for emergency monetary stimulus to contain the pandemic recession. As a result of supply and demand, Bitcoin appreciated rapidly against the dollar.

Because Bitcoin is the original cryptocurrency launched in 2009 and maintains over 50 percent of the crypto market share by market capitalization, it remains the center of gravity for the going exchange rates of other cryptos such as Ethereum, Ripple, Dogecoin, and Shiba Inu.

What are the most popular cryptocurrencies in 2024?

Percent of current owners holding various currencies, by year

| Which cryptocurrencies do you currently own? | 2024 | 2023 | 2022 |

|---|---|---|---|

| Bitcoin (BTC) | 76% | 78% | 77% |

| Ethereum (ETH) | 54% | 58% | 65% |

| Dogecoin (DOGE) | 26% | ||

| Shiba Inu (SHIB) | 12% | 18% | 19% |

| Cardano (ADA) | 12% | 14% | 19% |

| U.S. Dollar Coin (USDC) | 12% | 10% | 12% |

| Stellar (XLM) | 12% | 14% | 16% |

| Solana (SOL) | 11% | 10% | 11% |

| Binance Coin (BNB) | 10% | 6% | 6% |

| Ripple (XRP) | 9% | 7% | 6% |

| Tether (USDT) | 7% | 5% | 5% |

| Avalanche (AVAX) | 5% | 6% | 5% |

| Terra (LUNA) | 4% | 2% | 3% |

| Other | 9% |

In our 2024 study, we found the rate of Bitcoin ownership has remained the popular favorite with around three in four crypto owners holding some BTC.

While it remains the second most popular crypto, Ether (ETH) ownership rates have markedly fallen from 65 percent at the end of 2021 to 54 percent as we round out 2023. Because of widespread interest in the Ethereum Merge completed on Sept 15, 2022, to change how Ethereum secures ETH, many crypto adopters saw it as a good year to own Ether.

But competition since then from other smart contract cryptos like Solana (SOL) and Binance Coin (BNB) — plus stubbornly high transaction fees — have led to falling ETH ownership rates.

Meanwhile, we found Ripple (XRP) ownership rates among crypto adopters bumped from seven percent to nine percent throughout 2023 after Ripple Labs prevailed in court against an SEC lawsuit. Despite a significant victory, the suit still hasn’t concluded and goes to trial in April 2024.

Among current crypto owners, around 63 percent hope to obtain more cryptocurrency over the next year. Here are the top currencies they plan to invest in:

- Bitcoin: The supply falls by half this year just as an expected ETF product creates an on-ramp for the mainstream market of regulated investors and piques their interest.

- Ethereum: Crypto consumers anticipate another Ethereum upgrade to boost speed and lower fees while awaiting a spot Ethereum ETF launch by BlackRock, Inc.

- Dogecoin:– DOGE doesn’t have halvings like BTC, but the same industry-leading 256-bit encryption technique secures it.

- Cardano: ADA has been an ETH competitor since adding smart contracts in September 2021. In 2024, the project plans to formalize its governance ideals as smart contract code.