Crypto exchanges enable UK investors to buy and sell digital currencies like Bitcoin and BNB. The best crypto exchanges in this space are regulated and offer competitive trading fees across a wide number of markets.

In this comparison guide, we review the best crypto exchanges in the UK in the market right now.

The 13 Best Crypto Exchanges in the UK for 2024

The overall best crypto exchanges in the UK for 2024 can be found in the list below:

- eToro – Best crypto exchange for beginners and experts alike.

- MEXC – Best for 0% spot trading fees.

- Gate.io – More than 1,400 crypto assets supported, UK traders accepted.

- Binance – The world’s biggest crypto exchange.

- Coinbase – Popular crypto exchange for the UK and worldwide beginners.

- Kraken – Gain exposure to 185+ crypto markets, UK accepted.

- Kucoin – Top altcoin exchange with more than 700 supported coins.

- Crypto.com – Trade 250+ crypto assets at 0.4% commission.

- Bitstamp – Zero trading fees and monthly volumes of under $1,000.

- Huobi – Top crypto exchange for technical traders.

- Gemini – Solid crypto exchange for serious traders.

- CEX – UK-based crypto exchange operational since 2013.

- Luno – User-friendly crypto app that stores cryptos offline in cold storage.

Our comprehensive reviews in the sections below will enable traders to make an informed decision to select the best crypto exchange in the UK.

The Top 13 UK Bitcoin Exchanges Reviewed

Many UK crypto trading platforms in the online space still operate without regulatory approval. Therefore, in choosing the best crypto exchange in the UK, investors should make it a priority to assess the safety of their funds.

Additionally, UK investors should explore which crypto markets the exchange supported and what fees it charges. Below, we cover these important metrics and more through comprehensive UK crypto exchange reviews.

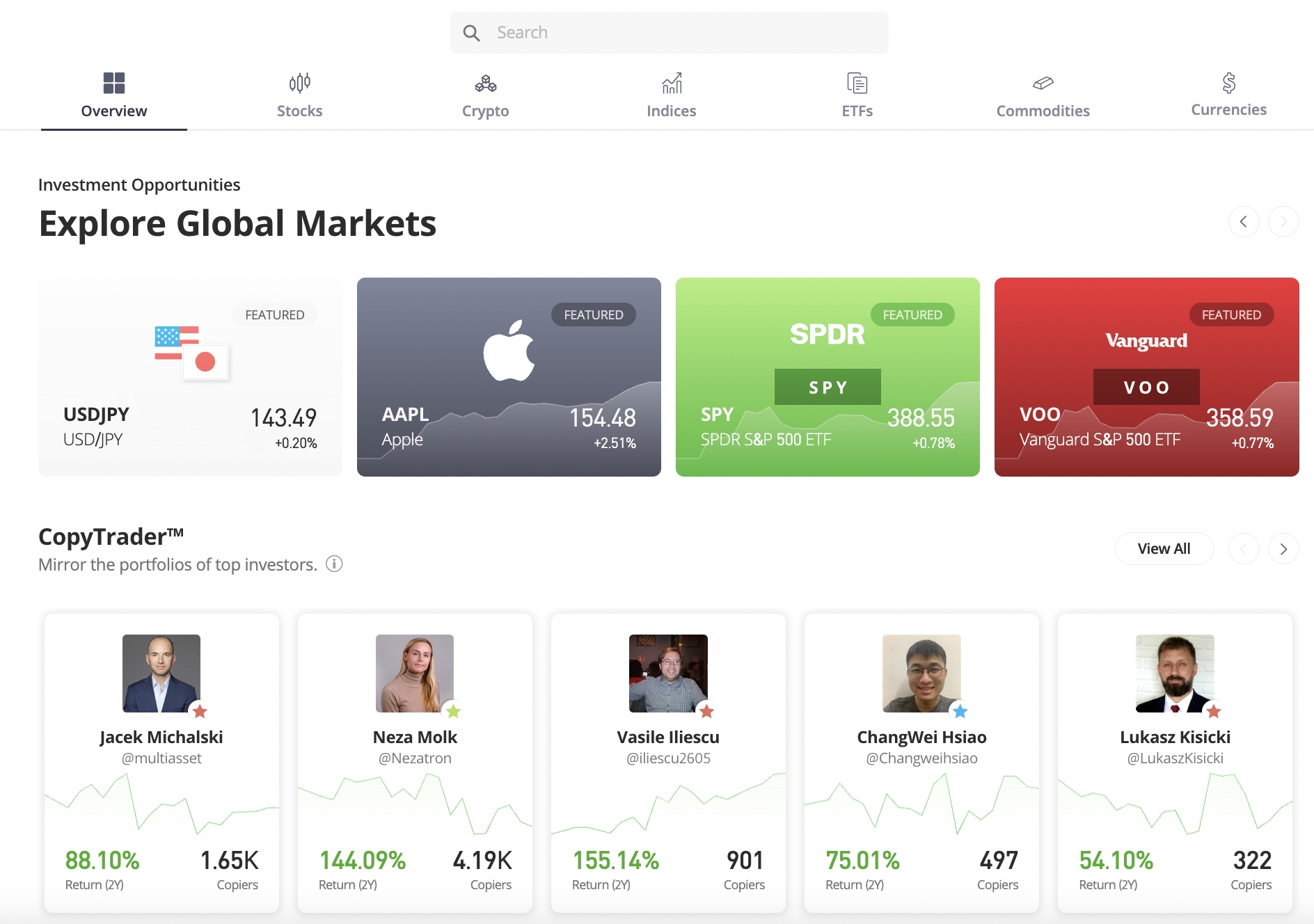

1. eToro – Overall Best Crypto Exchange in the UK

eToro has over 27 million global clients who can access more than 70 cryptocurrencies to buy, trade and hold. That includes large cap coins like Bitcoin, Ethereum, Ripple, BNB, and Cardano, as well as Shiba Inu, Dogecoin, Solana, Decentraland, and the Sandbox. Depending on your country, the minimum deposit on eToro starts from $10.

Traders will pay a commission of 1% per slide when trading crypto at eToro. This means that users can buy Bitcoin in the UK and pay a crypto fee of 1% plus the market spread. This amounts to £1 for every £100 worth of crypto bought or sold.

Past performance is not an indication of future results.

Another option to consider when buying crypto at eToro is to invest in a Smart Portfolio. This offers access to dozens of crypto assets through a single investment and the Smart Portfolio is professionally managed by eToro.

This means that investors in the UK can buy and sell crypto passively, as the Smart Portfolio will be re-weighted and re-balanced regularly. The minimum Smart Portfolio investment at eToro is $500, or about £400. Another option is the eToro Copy Trading feature. Instead of investing in a diversified portfolio, Copy Trading enables users to allocate capital to another trader.

For example, by investing capital into an experienced crypto trader, any buy or sell positions that they entered on eToro will be copied over to the user’s portfolio. The minimum investment per trade when opting for the Copy Trading tool is $200, or about £160. In addition to crypto assets, eToro also supports traditional financial markets.

Past performance is not an indication of future results.

This includes thousands of stocks and ETFs from the UK and international markets, with the latter including the US, Hong Kong, Canada, France, and more. It is also possible to trade stocks at eToro via CFDs with leverage of up to 1:5. eToro also offers CFD markets on forex, commodities, and indices.

Other eToro features include a fully-fledged demo account with $100k in paper funds, one of the best crypto wallets, alongside a mobile app. There are also tools to perform analysis, such as technical indicators and pricing charts.

| Number of coins | 70+ |

| Minimum deposit | starts from $10 but varies across countries |

| Crypto trading fee | 1% |

| Top features | Large user base, Copy Trading, diversified Smart Portfolios, mobile app |

| Proprietary wallet | Yes |

Pros

- 27+million clients

- 1% crypto trading fee

- 70+ other cryptocurrencies to buy alongside BTC

- Supports stocks and ETFs

- Copy trading feature

- Mobile app

Cons

- Better suited for those seeking custodial storage

- $5 (about £4) withdrawal fee

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

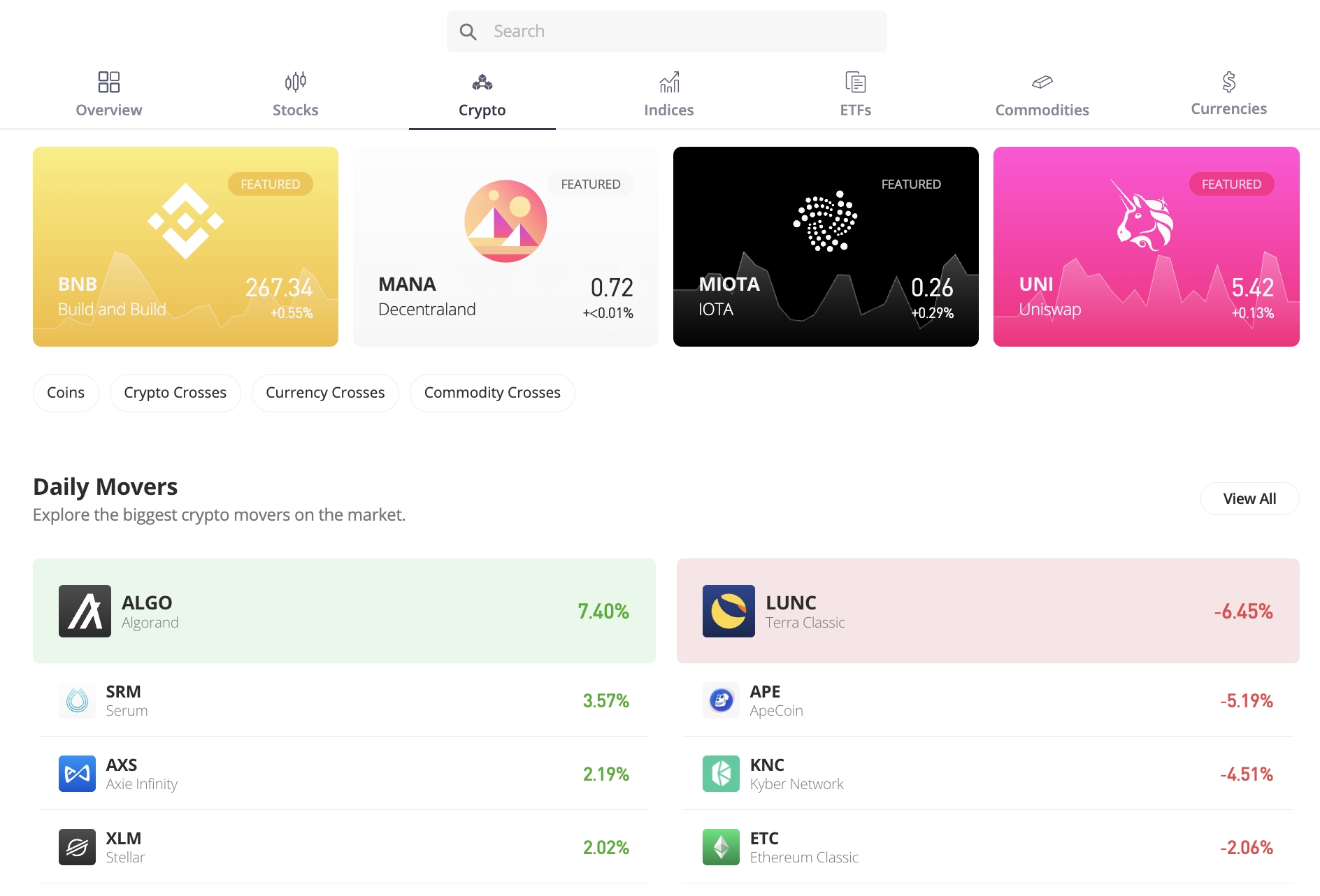

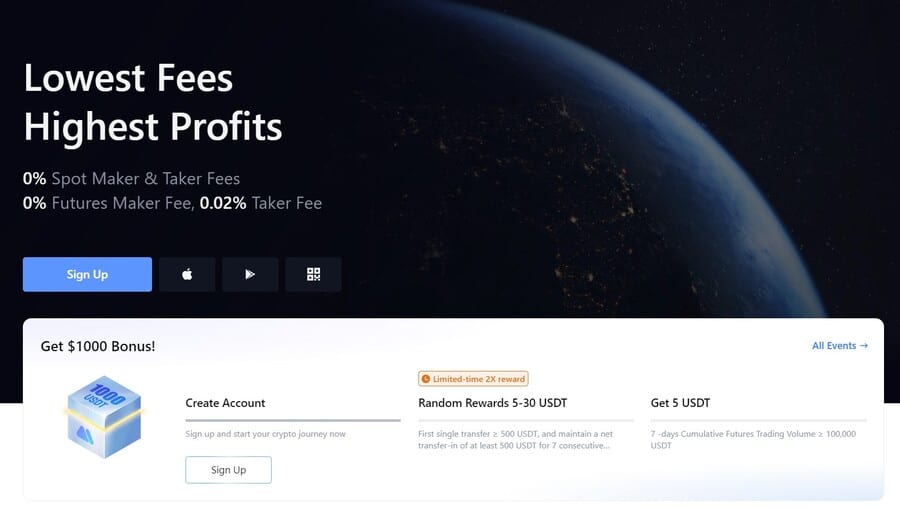

2. MEXC – Top Choice for 0% Spot Trading Fees

MEXC also stands tall as one of the best crypto exchanges to use in the UK. This is a global crypto exchange catering to over 10 million users across 170+ countries.

Offering an extensive range of features and services, MEXC is a platform for traders seeking diverse options and robust security measures.

One of the most striking aspects of MEXC is its extensive range of supported cryptocurrencies. With more than 1,000 options available, investors can trade a wide array of assets ranging from large cap cryptos such as Bitcoin to metaverse projects such as Decentraland.

What sets MEXC apart is its fee structure. Spot trading incurs zero fees, while futures trading starts from an impressively low 0.02%, making it an enticing option for traders seeking a cost-effective solution. Moreover, the platform allows leverage up to 10x on margin trading, amplifying opportunities for users to maximize their gains.

Security takes center stage at MEXC, managing over $500 million worth of crypto deposits through its cold storage option. Advanced security measures such as 2FA protocols, KYC processes, and an anti-DDoS system secure the platform against potential threats.

The exchange’s high-performance mega-transaction matching technology enables swift and efficient trading experiences. Combined with advanced charting tools and indicators, traders can analyze market trends and conduct technical analysis.

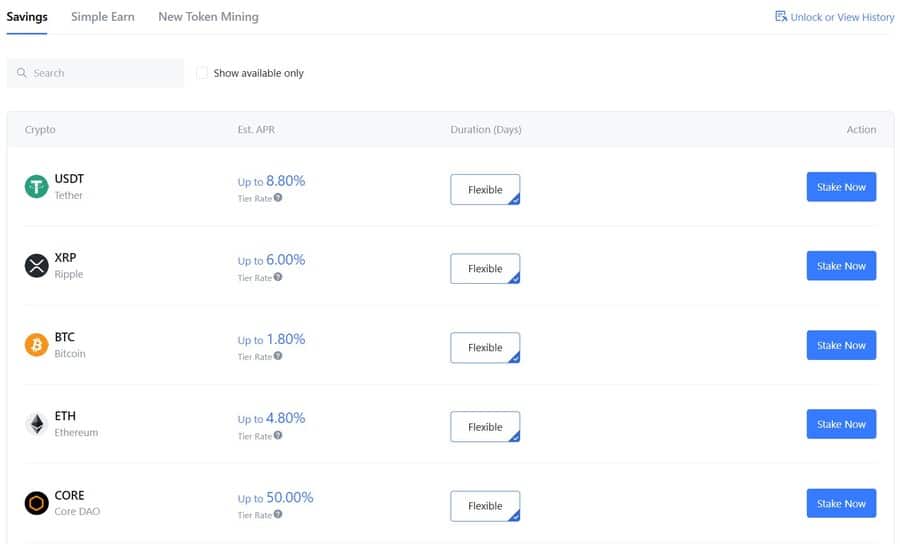

MEXC also offers attractive APYs through its staking mechanism – which can be used on popular cryptos such as Bitcoin, Ethereum, and Polkadot. All these features make MEXC one of the best crypto exchanges in the UK.

| Number of coins | 1,000+ |

| Minimum deposit | £5 |

| Debit card fee | 2% |

| Crypto trading fee | 0% spot trading fee |

| Top features | Over 1,000 tradable coins, crypto staking, cold wallet storage |

| Proprietary wallet | Yes |

Pros

- Offers more than 1,000 tradable coins

- 0% spot trading fees

- High staking returns on cryptos

- Stores funds in cold wallet

Cons

- Charges a 2% debit card fee

3. Gate.io – More Than 1,400 Crypto Assets Supported

Gate.io is the final option to consider on this list of the best crypto exchanges in the UK. The standout feature of this provider is that it supports more than 1,400 crypto assets on its platform – which is huge. Naturally, this means that Gate.io will appeal to investors that wish to diversify across a wide variety of small-to-medium cap projects.

Although Gate.io does not directly support fiat payment deposits, it does connect to several third-party processors. This includes MoonPay, Banxa, and Coinify. As such, UK investors can deposit funds with a debit or credit card. Fees are determined by the chosen third-party provider and will likely average 3-5%.

Trading commissions amount to 0.2% per slide for casual traders. Volumes of over $60,000 per month will have access to lower commissions. Finally, Gate.io also offers DeFi services, inclusive of lending and interest accounts.

| Number of coins | 1,400+ |

| Minimum deposit | Not stated |

| Debit card fee | Depends on chosen third-party processor |

| Crypto trading fee | 0.2% |

| Top features | Supports more than 1,400 coins, low trading commissions, DeFi services |

| Proprietary wallet | Yes |

Pros

- Huge number of markets at over 1,400 coins

- DeFi services and native wallet app

Cons

- Not regulated in the UK

- Debit/credit cards only supported via a third-party processor

- More suited for experienced crypto traders

4. Binance – Low-Fee Exchange Offering 600+Coins

As noted above, Binance was for a long time the cheapest crypto exchange in the UK, with commissions starting at just 0.1% per slide. Although Crypto.com is slightly more competitive, Binance is still hugely competitive. After all, at a commission of 0.10%, this amounts to a fee of just 10p for every £100 worth of crypto traded.

Furthermore, and perhaps most importantly, Binance offers a 25% fee reduction for those holding BNB. This is the native coin of the Binance ecosystem. Moreover, depositing funds into a Binance account via a UK bank transfer will attract a fee of just £1. Debit and credit card payments are supported too but this will cost 1.8% in transaction fees.

In addition to offering competitive fees, Binance is perhaps the best crypto exchange in the UK for supported markets. It offers access to more than 600 coins across a wide variety of projects. Moreover, this extends to more than 1,000 tradable markets. There is also a conversion facility that enables traders to swap coins at the click of a button.

However, the more cost-effective way of trading coins is to use the Binance exchange. This will see UK investors trading with other market participants through a highly sophisticated platform that comes packed with analysis tools and features. Binance also offers a decentralized wallet called Trust, which comes in the form of a mobile app.

| Number of coins | 600+ |

| Minimum deposit | £15 when using a debit card |

| Debit card fee | 0.018 |

| Crypto trading fee | 0.001 |

| Top features | 600+coins and 1,000+markets, 0.1% commission, largest exchange for trading volume |

| Proprietary wallet | Yes |

Pros

- Trading commission of just 0.1%

- Minimum debit card purchase of £15

- Supports more than 600 coins

- Huge liquidity levels

Cons

- Debit/credit cards attract a fee of 1.8%

- Not regulated by the FCA

- Faster payments option is often suspended

5. Coinbase – Popular Crypto Exchange for Beginners

Coinbase offers more than 100 markets on its user-friendly crypto exchange. This provider offers great security features and it has been active in the crypto industry for over a decade. Traders in the UK will pay 1.49% to buy and sell crypto at Coinbase. This is much higher than other UK Bitcoin trading platforms in the market, so do bear this in mind.

Moreover, crypto orders of under $200 will attract a flat fee. This invariable amounts to an even higher commission percentage. To buy crypto with a debit card at Coinbase, this will cost 3.99% of the transaction amount, albeit, this includes the commission. This crypto exchange does, however, also accept fee-free UK bank account transfers.

Coinbase accounts are protected by two-factor authentication and IP address whitelisting. The latter means that when an account holder logs in from an unrecognized IP address, Coinbase will execute an additional security check. 98% of client digital assets are kept offline at times in cold storage wallets. Coinbase also offers a DeFi wallet, which offers non-custodial storage.

| Number of coins | 100+ |

| Minimum deposit | £50 is recommended, but not enforced |

| Debit card fee | 3.99% |

| Crypto trading fee | 1.49% |

| Top features | Solid security and regulation, popular with beginners, supports UK debit/credit cards |

| Proprietary wallet | Yes |

Pros

- One of the best crypto exchanges for beginners

- More than 100 cryptocurrencies listed

- Strong commitment to regulation and security

Cons

- Debit/credit cards attract a fee of 3.99%

- High trading commissions

- No support for BNB or Ripple

6. Kraken – Gain Exposure to 185+ Crypto Markets

Kraken is an established provider and one of the best crypto exchanges in the UK for trust. It was founded in 2011 and has been offering crypto services since 2013. UK investors can open an account with Kraken in a matter of minutes and proceed to make a deposit with a UK bank transfer. This will not attract any deposit fees.

The other option is the make a debit/credit card payment to buy crypto instantly. This will attract a fee of 3.75%, plus 25p. In total, Kraken offers access to more than 185 cryptocurrencies. There is a spot trading fee of 0.26% to pay when exchanging coins on the Kraken Pro suite. This comes with advanced charting tools and technical indicators.

Although Kraken is considered safe, this crypto exchange does not offer its own proprietary wallet. Therefore, UK investors should consider withdrawing their coins out of the Kraken exchange after completing their purchase. Those looking to improve their crypto trading knowledge will find the free Kraken educational department valuable.

| Number of coins | 185 |

| Minimum deposit | £8 |

| Debit card fee | 3.75%, plus 25p |

| Crypto trading fee | 0.26% via Kraken Pro |

| Top features | Established in 2011, 185+coins supported, free UK bank transfers |

| Proprietary wallet | No |

Pros

- More than 185 cryptocurrencies supported

- Great reputation for customer safety

- Beginner-friendly trading platform

Cons

- Debit/credit cards attract a fee of 3.75%, plus 25p

- Fee schedule is confusing

- No proprietary crypto wallet

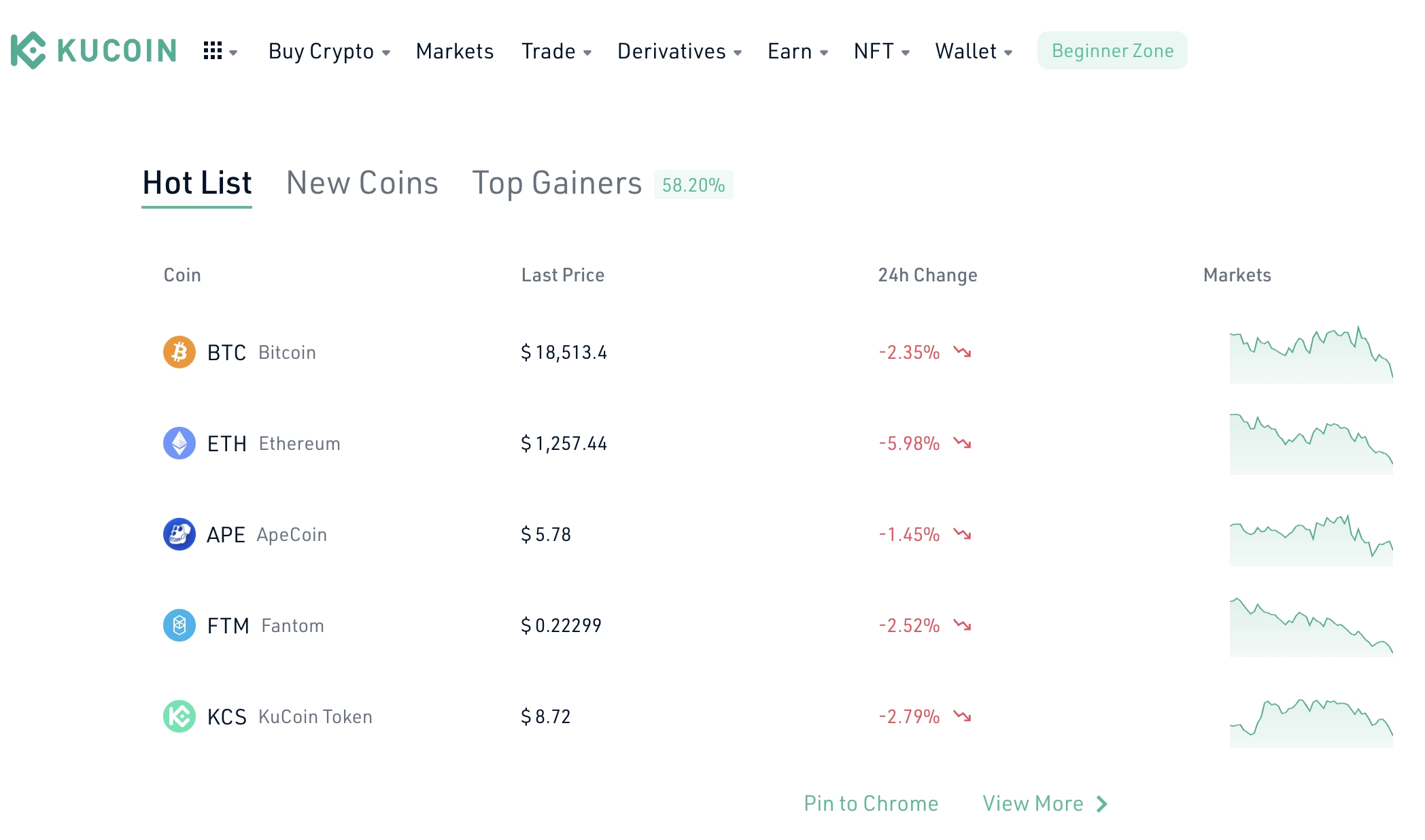

7. Kucoin – Top Altcoin Exchange With More Than 700 Supported Coins

Kucoin is a global crypto exchange that accepts clients from the UK in addition to 200 other countries. This provider is perhaps the best crypto exchange in the UK for altcoins, with more than 700 markets supported. In particular, Kucoin is often the go-to place to invest in newly launched crypto assets that carry a small market capitalization.

Kucoin also offers social trading features that enable users to share market insights and discuss potential trading opportunities. Kucoin users can trade via the exchange’s web trading suite or mobile app. The latter is free to download on both Android and iOS smartphones. Spot trading commissions operate on a maker-taker pricing model at Kucoin.

For monthly volumes of under 50 BTC – which amounts to more than £800,000 as of writing, the commission stands at just 0.1% per slide. When holding and paying commissions in Kucoin’s native token – KCS, fees are reduced by 20%. Kucoin also offers crypto lending and interest account services, in addition to NFTs.

| Number of coins | 700+ |

| Minimum deposit | £10 |

| Debit card fee | Only stated on the order confirmation page |

| Crypto trading fee | 0.1% |

| Top features | Very competitive trading commissions, buy crypto with a debit/credit card from £10, more than 700 coins supported |

| Proprietary wallet | Yes |

Pros

- One of the best crypto exchanges in the UK for altcoins

- More than 700 coins supported

- Low minimum deposits from just £10

Cons

- Not transparent on debit/credit card fees

- Not regulated by the FCA

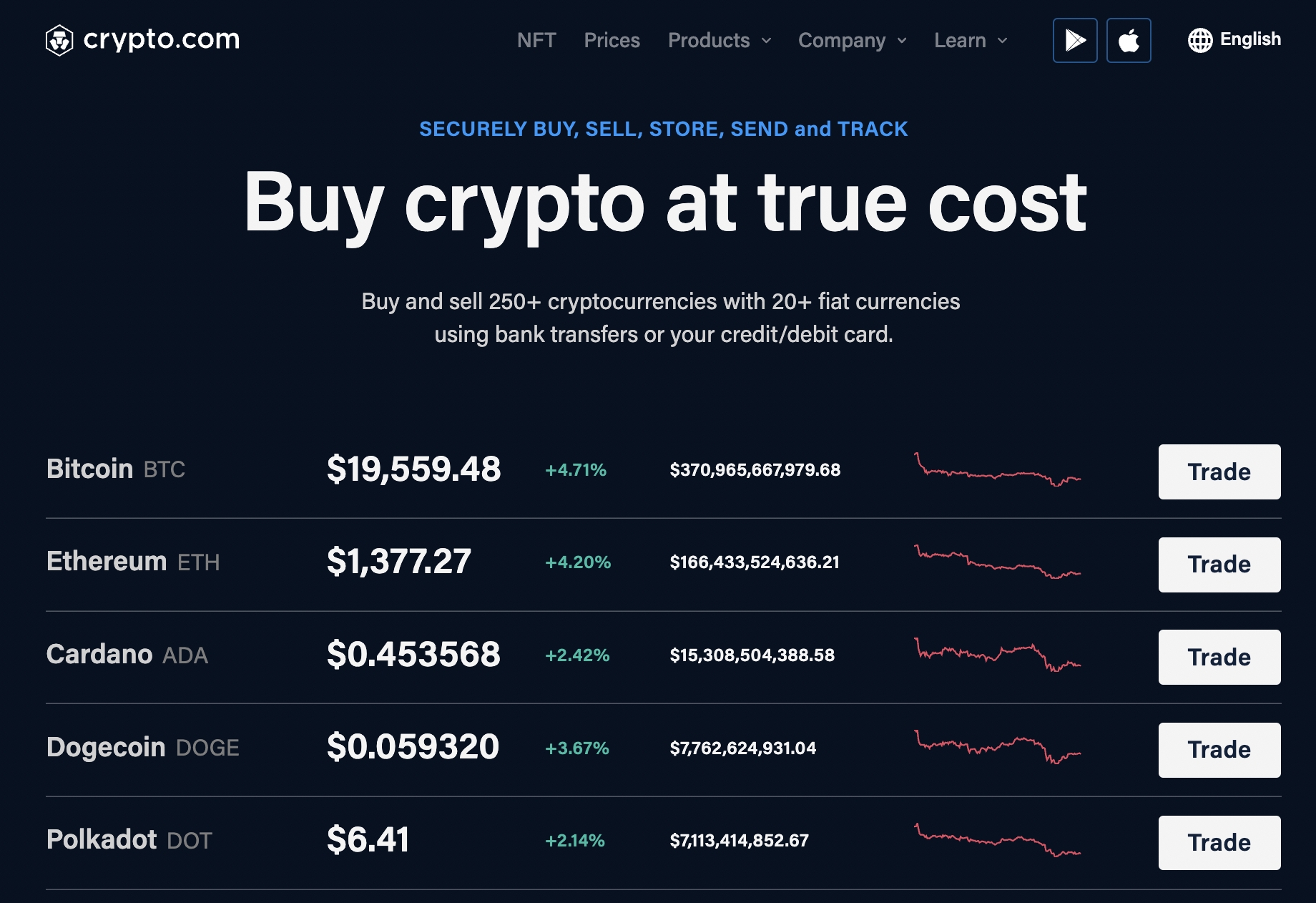

8. Crypto.com – Trade 250+Crypto Assets at 0.4% Commission

Crypto.com is one of the best crypto exchanges in the UK for diversification purposes as well as gaining exposure to new cryptos. After opening an account with this provider – which typically takes 5-10 minutes, UK investors will then have access to more than 250 coins. Not only that, but Crypto.com offers competitive trading fees. For example, the highest rate that UK investors will pay to trade is just 0.075% per slide.

This means that buying £100 worth of crypto would attract a commission of just 7.5p. This means that Crypto.com is now cheaper than Binance, which historically was regarded as the best Bitcoin exchange in the UK for low commissions. Moreover, the Crypto.com maker-taker pricing model means that those trading larger volumes will be offered even lower fees.

Lower fees are also possible when staking CRO tokens, which is the native digital currency of the Crypto.com ecosystem. To get money into a newly created Crypto.com account, UK investors can transfer funds from a bank account without paying any deposit fees. Those in a rush might consider using a debit/credit card – which is processed by Crypto.com instantly.

However, this will attract a fee of 2.99% of the transaction amount. Furthermore, do note that GBP deposits can only be made via the Crypto.com app. Once the account is funded, investors can then buy and sell coins via the Crypto.com web trading interface, which comes packed with tools and features.

It is also possible to generate a yield on idle coins through the Crypto.com Earn platform. For example, by depositing crypto on a 3-month term, investors can earn up to 14.5%. Shorter-term investors might opt for a flexible account which, although yielding a lower interest rate, offers instant withdrawals. Crypto.com also offers loans, NFTs, and a DeFi wallet.

| Number of coins | 250+ |

| Minimum deposit | $20 (about £16) |

| Debit card fee | 2.99% |

| Crypto trading fee | 0.075% |

| Top features | Free UK bank transfer deposits, 250+supported coins, crypto interest accounts |

| Proprietary wallet | Yes |

Pros

- Lowest crypto trading fees in the industry

- More than 250 cryptocurrencies supported

- User-friendly mobile app for iOS and Android

- DeFi services including interest accounts and loans

Cons

- Debit/credit cards attract a fee of 2.99%

- Purchases made with GBP are only available on the app

9. Bitstamp – Zero Trading Fees and Monthly Volumes of Under $1,000

Bitstamp is a popular crypto exchange that offers access to 78 coins. Investors in the UK can trade via the Bitstamp website or mobile app, which is compatible with both Android and iOS smartphones. There are plenty of trading tools supported by Bitstamp across both device types, including real-time crypto charts and technical indicators.

When it comes to fees, deposits are free when transferring funds from a UK bank account. Debit and credit card payments, however, will attract an instant buy fee of 5%. As such, bank transfers – although slower to process, represent the better option. Commissions are very competitive at Bitstamp.

For monthly trading volumes of under $1,000 (about £800), no commissions are charged. Anything traded above this figure within a 30-day period will attract a commission of 0.4%. After buying crypto at Bitstamp, the coins can be left in the web/mobile wallet. 95% of client digital assets are kept in cold storage at all times.

| Number of coins | 78 |

| Minimum deposit | £10 minimum trade |

| Debit card fee | 5% |

| Crypto trading fee | 0% up to the first $1,000 (about £800) each month |

| Top features | 95% of client funds kept in cold wallets, established in 2011, no commission on the first $1,000 traded each month |

| Proprietary wallet | Yes |

Pros

- 0% commission on the first $1,000 traded each month

- Established in 2011 and 95% of client tokens are kept offline

- No fees to transfer funds via a UK bank account

Cons

- Debit/credit cards attract a fee of 5%

- Only two coins are supported by its staking tool

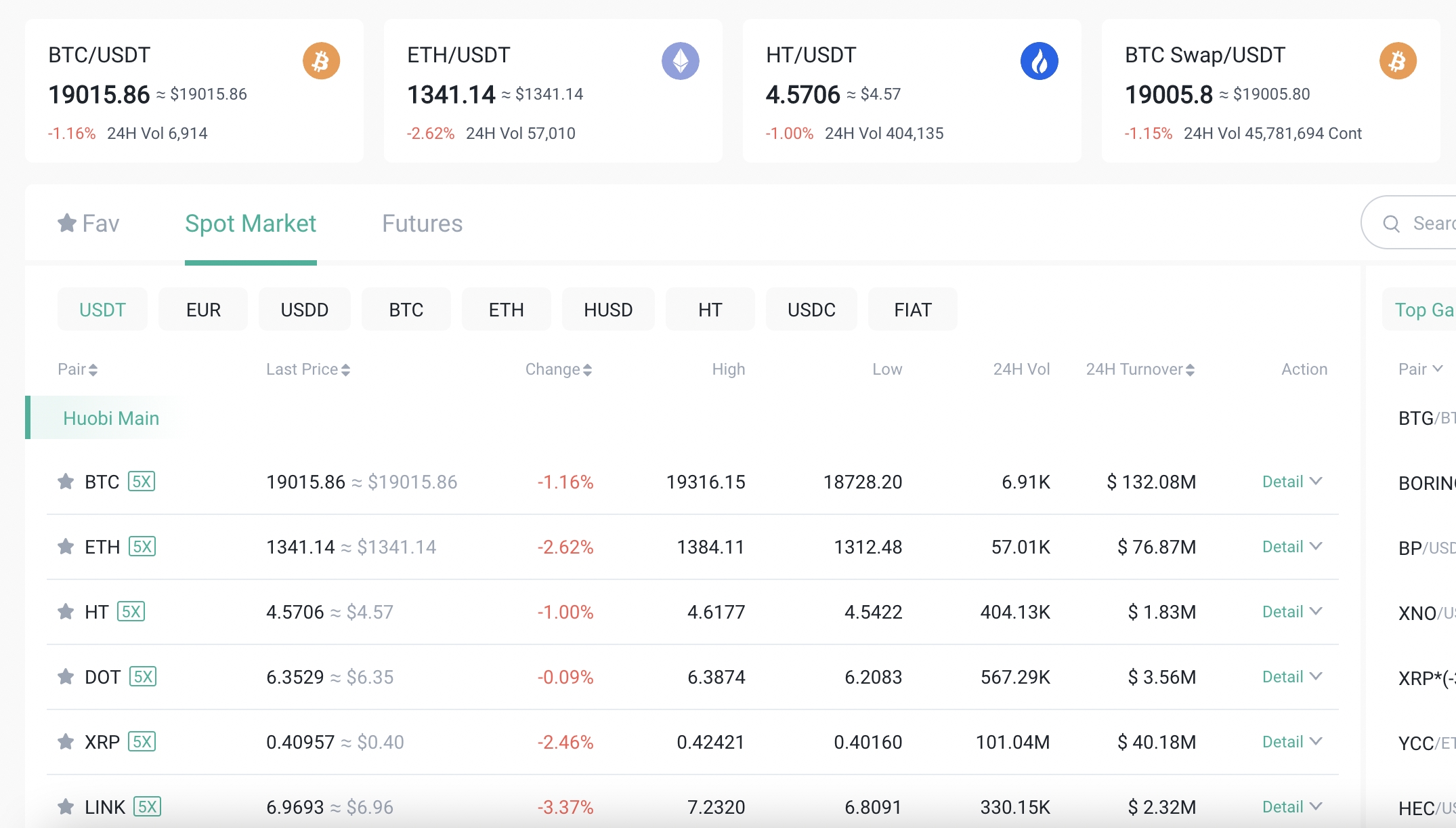

10. Huobi – Top Crypto Exchange for Technical Traders

Huobi is one of the best crypto exchanges in the UK for advanced traders. After choosing a suitable market across more than 500 supported coins, traders will have access to a highly intuitive charting area. This can be customized to the trader’s liking in terms of timeframes, colors, and market depth.

There are comprehensive order books updated in real-time in addition to drawing tools and technical indicators. Multiple order types are supported too, including triggers, stop-limits, and take-profits. Huobi offers a competitive maker-taker pricing model, where the highest commission charged is just 0.2% per slide.

Although Huobi isn’t FCA regulated, its exchange is protected by a 20,000 BTC security fund. This is in place to cover account holders in the event the exchange is hacked. Huobi traders are also protected by cold storage. Huobi supports UK debit/credit cards and bank account transfers for a smooth deposit and withdrawal process.

| Number of coins | 500+ |

| Minimum deposit | £8 |

| Debit card fee | Varies depending on Visa/MasterCard and debit/credit card |

| Crypto trading fee | 0.20% |

| Top features | 20,000 BTC security fund, competitive commissions, 500+coins supported |

| Proprietary wallet | Yes |

Pros

- Trade Bitcoin and 500+other crypto assets

- Pay just 0.2% per trade in commission

Cons

- Confusing debit/credit card fees

- More suited to experienced crypto traders

- Many Huobi products are not accessible to UK clients

11. Gemini – Solid Crypto Exchange for Serious Traders

Gemini is perhaps the best crypto exchange in the UK for serious, large-scale traders. This exchange is heavily regulated and it is home to high-level security features that are institutional-grade. On the flip side, accounts at Gemini can be slow to open considering the provider’s cumbersome KYC (Know Your Customer) process.

Nonetheless, once the account is set up and fully verified, the investment experience is smooth. In total, Gemini supports more than 100 crypto assets, most of which are either large or medium-cap. Standard trading fees at Gemini amount to 1.49% per slide. Moreover, investments of under $200 attract a flat fee – much like the previously discussed Coinbase.

Buying crypto instantly on this exchange via a debit or credit card will attract an all-in fee of 3.49%. UK bank transfers offer a cheaper alternative, as no transaction fees are charged. Gemini also has its own native stablecoin – the Gemini Dollar. This is pegged to the US dollar and through Gemini Earn, offers a way for UK investors to generate passive income.

| Number of coins | 100+ |

| Minimum deposit | Not stated |

| Debit card fee | 3.49% |

| Crypto trading fee | 1.49% |

| Top features | Heavily regulated broker, top security tools, 100+ coins supported |

| Proprietary wallet | Yes |

Pros

- Has a great reputation in the crypto brokerage industry

- Plenty of high-level security tools

- Supports over 100 coins

Cons

- UK investors will be charged 3.49% to use a debit/credit card

- Buy and sell orders attract a fee of 1.49%

- KYC process is often slow

12. CEX – UK-Based Crypto Exchange Operational Since 2013

CEX is a UK-based crypto exchange that was first launched in 2013. The platform claims to have more than 4 million clients and a 0% hacking rate to date. When it comes to buying crypto, CEX supports several UK payment methods. This includes Visa, MasterCard, Skrill, Paypal, and bank transfers. Fees will depend on the preferred payment type.

For example, UK-issued debit cards attract a fee of 1.49% when making a deposit. Withdrawals, however, attract a service charge of 3% + $1.20 (about £1.10) and a commission of $3.80 (about £3.35). Skrill deposits and withdrawals cost 3.99% and 1%, respectively. The best option is a UK bank transfer, which is fee-free across both deposits and withdrawals.

In terms of commissions, CEX charges 0.15% on each buy and sell order. For monthly volumes of over $10,000 (about £8,000), the commission is reduced slightly to 0.13%. CEX also offers crypto savings accounts that enable investors to generate interest on their coins. There is also a CEX wallet app for iOS and Android, which connects to the main web account.

| Number of coins | 70+ |

| Minimum deposit | £20 on bank transfers, $20 (about £16) on debit/credit cards |

| Debit card fee | 1.49% |

| Crypto trading fee | 0.15% |

| Top features | UK-based exchange trading since 2013, free bank account deposits and withdrawals, 0.15% trading commission |

| Proprietary wallet | Yes |

Pros

- Based in the UK and operational since 2013

- Over 70 coins supported

- Supports debit/credit cards, e-wallets, and bank transfers

Cons

- Some payment methods come with high transaction charges

- Does not support non-crypto assets like stocks

13. Luno – User-Friendly Crypto App

Luno offers a user-friendly trading app for iOS and Android smartphone users. Users based in the UK can deposit funds via a bank transfer without paying any fees. Debit/credit cards are not supported in the UK market. There is a standard trading commission of 1.5% to pay when buying and selling digital currencies on the Luno app.

Although Luno is popular with beginners, this crypto exchange app only supports 9 coins. This means that unless the investor is looking to buy a specific coin that is supported by Luno, they will need to have an account with another exchange in order to properly diversify. Nonetheless, Luno supports automated buy orders, which will appeal to those looking to dollar-cost average.

| Number of coins | 9 |

| Minimum deposit | Not stated |

| Debit card fee | Not available for UK clients |

| Crypto trading fee | 1.5% |

| Top features | Simple and user-friendly mobile app, no fees on UK bank transfers, all-in-one exchange and wallet |

| Proprietary wallet | Yes |

Pros

- Deposit GBP via a UK bank transfer without paying any fees

- User-friendly interface

Cons

- Commissions of 1.5% per trade

- UK investors cannot deposit funds with a debit/credit card

- Only 9 crypto assets supported

14. Gate.io – More Than 1,400 Crypto Assets Supported

Gate.io is the final option to consider on this list of the best crypto exchanges in the UK. The standout feature of this provider is that it supports more than 1,400 crypto assets on its platform – which is huge. Naturally, this means that Gate.io will appeal to investors that wish to diversify across a wide variety of small-to-medium cap projects.

Although Gate.io does not directly support fiat payment deposits, it does connect to several third-party processors. This includes MoonPay, Banxa, and Coinify. As such, UK investors can deposit funds with a debit or credit card. Fees are determined by the chosen third-party provider and will likely average 3-5%.

Trading commissions amount to 0.2% per slide for casual traders. Volumes of over $60,000 per month will have access to lower commissions. Finally, Gate.io also offers DeFi services, inclusive of lending and interest accounts.

| Number of coins | 1,400+ |

| Minimum deposit | Not stated |

| Debit card fee | Depends on chosen third-party processor |

| Crypto trading fee | 0.2% |

| Top features | Supports more than 1,400 coins, low trading commissions, DeFi services |

| Proprietary wallet | Yes |

Pros

- Huge number of markets at over 1,400 coins

- DeFi services and native wallet app

Cons

- Not regulated in the UK

- Debit/credit cards only supported via a third-party processor

- More suited for experienced crypto traders

Comparing The Best UK Crypto Exchanges

The table below highlights the key features of the 12 crypto exchanges reviewed in the sections above:

|

UK Crypto Exchanges

|

Total Coins

|

Min Deposit

|

Debit Card Fee

|

Crypto Trading Fee

|

Top Features

|

Proprietary Wallet

|

|

eToro

|

70+ | Starts from $10 but varies across countries | N/A | 1% | Copy Trading, diversified Smart Portfolios, mobile app |

Yes

|

|

MEXC

|

1000+ | $5 | 2% | 0% spot trading fee | Crypto staking, anti DDOS system, cold storage wallet | Yes |

|

Gate.io

|

1400+

|

Not stated

|

Depends on chosen third-party processor

|

0.25

|

Supports more than 1,400 coins, low trading commissions, DeFi services

|

Yes

|

| Binance | 600+ | £15 when using a debit card | 1.8% | 0.1% | 600+coins and 1,000+ markets, 0.1% commission, largest exchange for trading volume | Yes |

| Coinbase | 100+ | £50 is recommended, but not enforced | 3.99% | 1.5% | Solid security and regulation, popular with beginners, supports UK debit/credit cards | Yes |

| Kraken | 185+ | £8 | 3.75%, plus 25p | 0.26% via Kraken Pro | Established in 2011, 185+ coins supported, free UK bank transfers | No |

|

Crypto.com

|

250+

|

$20 (about £16)

|

2.99%

|

0.4%

|

Free UK bank transfer deposits, 250+ supported coins, crypto interest accounts

|

Yes

|

|

Bitstamp

|

78

|

£10 minimum trade

|

5%

|

0% up to the first $1,000 (about £800) each month

|

95% of client funds kept in cold wallets, established in 2011, no commission on the first $1,000 traded each month

|

Yes

|

|

Huobi

|

500+

|

£8

|

Varies depending on Visa/MasterCard and debit/credit card

|

0.20%

|

20,000 BTC security fund, competitive commissions, 500+coins supported

|

Yes

|

|

Gemini

|

100+

|

Not stated

|

3.49%

|

1.50%

|

Heavily regulated broker, top security tools, 100+ coins supported

|

Yes

|

|

Cex

|

70+

|

£20 on bank transfers, $20 (about £16) on debit/credit cards

|

1.49%

|

0.15%

|

UK-based exchange trading since 2013, free bank account deposits and withdrawals, 0.15% trading commission

|

Yes

|

|

Kucoin

|

700+

|

£10

|

Only stated on the order confirmation page

|

0.10%

|

Very competitive trading commissions, buy crypto with a debit/credit card from £10, more than 700 coins supported

|

Yes

|

|

Luno

|

9

|

Not stated

|

Not available for UK clients

|

1.50%

|

Simple and user-friendly mobile app, No fees on UK bank transfers, All-in-one exchange and wallet

|

Yes

|

Conclusion

Each exchange offers unique features such as deposit options, cryptocurrency variety and fees, which will cater to variety of crypto investors and traders. Make sure to compare each exchange to find the right one for your needs.

Our top pick for a crypto exchange is MEXC – a popular platform offering more than 1,000 tradable coins. MEXC stands out since it offers 0% spot trading fees, and just 0.02% fees on futures trading. This platform also provides high staking APYs, and uses multiple robust security protocols to secure investor’s funds.

References

- https://www.coindesk.com/price/kucoin-token/

- https://www.veriff.com/blog/what-is-kyc-in-crypto

- https://chain.link/education/nfts

FAQ

Which crypto exchange is best UK?

MEXC is our pick for the best UK crypto exchange because of the strong cryptocurrency offering, 0% spot trading fees and robust security measures.

What is the safest crypto exchange in the UK?

eToro is the safest exchange in the UK since it stores a high portion of user’s funds in cold storage, uses two-factor authentication, and an anti-DDOS system to protect against hackers.

What is the cheapest way to buy crypto in the UK?

Cheapest way to buy crypto in the UK is to use an exchange with low deposit and low trading fees like MEXC.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.