The World Bank has issued its World Economic Outlook October 2023 report, titled ‘Navigating Global Divergencies’.

Chapter 3, titled “Fragmentation & Commodities Markets: Vulnerabilities and Risks” contains analysis of the changing global patterns in Russia’s oil exports, and asks the question that since the Ukraine conflict began, “Russia’s oil exports have been subject to sanctions and have been voluntarily shunned by the West. But what has been the impact on oil trade flows?”

The World Bank has used granular real-time data on tanker shipping patterns from the Automatic Identification System to uncover significant shifts in routes, resulting in economic inefficiencies.

The Automatic Identification System is a mandatory self-reporting system for all ships above 300 gross tons. It has been used to construct real-time trade indicators. PortWatch is an online platform that monitors trade disruptions and assesses spillovers through port-to-port links.

This is what the report has to say (I have edited slightly it to remove political worded nuances):

“The European Union, United Kingdom, and United States banned most imports of crude oil and petroleum products from Russia after the Ukraine conflict began. Western restrictions on dollar payments have been reported to be a barrier to shipments. The Group of Seven (G7) members also prohibited transportation and insurance services to tankers carrying Russian commodities above certain price thresholds.

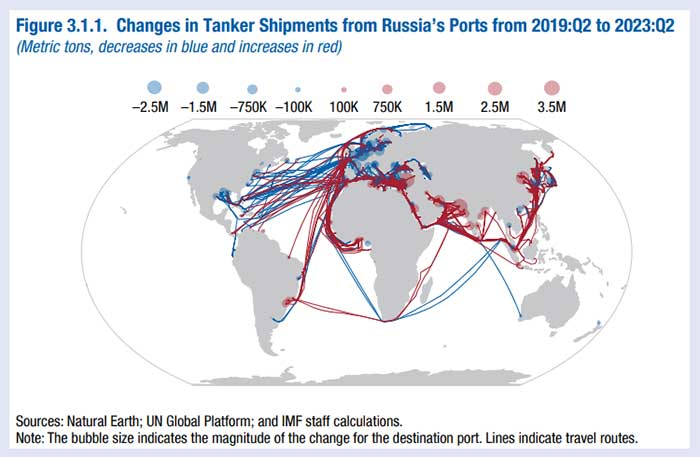

Automatic Identification System data reveals that the traffic patterns of Russia’s tankers have since changed substantially. Tanker shipments from Russian ports to Japan, the United States, and the European Union declined between April–June 2019 and the same period in 2023. Other countries are also now providing oil supplies. For example, the European Union now receives more shipments from countries such as Norway, the United Arab Emirates, and the United States, but this has extended the length of tanker routes by 20%. UNCTAD (2022) documents a rise in tanker freight rates following the outbreak of Russia-Ukraine hostilities.

Russia’s oil shipments rose after the Ukraine outbreak of hostilities, increasing to countries such as China, India, Türkiye, and the United Arab Emirates. About 35% to 40% of India’s crude oil imports came from Russia during April–June 2023, a significant rise from less than 5% before the Ukraine conflict began. While India’s oil exports (mostly petroleum products) are small relative to its oil imports (mostly crude oil), India has substantially increased its oil exports to the European Union.”

There are a couple of takeaways from what the World Bank is saying here. Firstly, that getting alternative oil supplies to the European Union has increased the tanker journey lengths by 20%. That has two main impacts: it increases the shipping time, and energy costs, and is far less eco-friendly. The environmental effects of shipping include air pollution, water pollution, acoustic, and oil pollution. Ships are responsible for more than 18% of nitrogen oxides pollution, and 3% of greenhouse gas emissions. Of the world’s top ten oil shipping lines, five are European, four are located by US affiliated offshore jurisdictions (such as Bahamas and the Marshall Islands) while the largest, Mitsui, is Japanese.

The World Bank’s final point is perhaps the most interesting, as it implies that India is re-selling Russian oil to the European Union. If so, this also means that the EU is unlikely to ever wean itself off Russian fossil fuels and that the true impact of imposing energy sanctions upon Russia has probably been overstated. Russian originated oil is still making it way to European markets, all that has changed is that the EU is buying Russian oil from India, rather from Russia directly. That will also increase the cost, as although India is adding value in terms of processing the product, middle-man costs will still amount to part of the sales price. This also implies that the EU’s energy costs have inevitably increased and will not reduce to pre-2021 levels.

Joseph Borrell, the EU Commissioner, has stated that EU imports of refined products such as jet fuel or diesel from India had risen from 1.1 million barrels in January 2022 to 7.4 million by April 2023. This is an increase of 572%.

The key takeaway however is the following map, which documents the shifting routes of Russia’s oil exports from Q2 2019 to Q2 2023 with significant declines to the West and substantial increases to the East.

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. He co-wrote the 2021 report “Russia’s Pivot to Asia” which predicted much of these changes. That can be downloaded on a complimentary basis here. He may be reached at [email protected] or connected with via Linked In.

Related Reading

About Us

During these uncertain times, we must stress that our firm does not approve of the Ukraine conflict. We do not entertain business with sanctioned Russian companies or individuals. However, we are well aware of the new emerging supply chains, can advise on strategic analysis and new logistics corridors, and may assist in non-sanctioned areas. We can help, for example, Russian companies develop operations throughout Asia, including banking advisory services, and trade compliance issues, and have done since 1992.

We also provide financial and sanctions compliance services to foreign companies wishing to access Russia. Additionally, we offer market research and advisory services to foreign exporters interested in accessing Russia as the economy looks to replace Western-sourced products. For assistance, please email [email protected] or visit www.dezshira.com