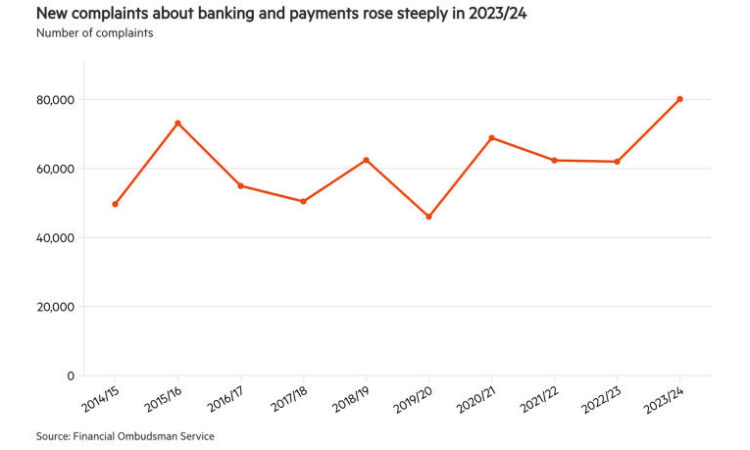

Banking sector complaints in the UK have reached their highest levels in more than a decade, according to data from the Financial Ombudsman Service, with current accounts being the most complained-about product.

The FOS recorded 80,137 customer complaints about banking and payment products for the year ending March 31 2024, compared with 61,995 during the preceding 12-month period. The watchdog upheld 36 per cent of complaints received, with complaints over prepaid cards — 49 per cent of which were upheld — the most likely to be upheld.

Complaints about current account and credit cards, as well as growing fraud and scam concerns among customers, contributed to pushing up the numbers over the past financial year.

“It’s always concerning when you see cases rise so significantly, particularly when so many people are struggling in the current economic climate,” said Abby Thomas, chief executive and chief ombudsman of the Financial Ombudsman Service, in a press release.

The Financial Ombudsman found that current account complaints rose to 30,635 from 26,039 the previous year, once again securing the top spot as the most complained-about product.

Meanwhile, credit card complaints surged from 14,504 in 2022/2023 to 24,402 in 2023/2024, with complaints over perceived irresponsible and unaffordable lending more than trebling to over 13,000 during the period.

Furthermore, fraud and scam complaints reached their highest-recorded levels during the past financial year, with 27,312 cases registered. The FOS noted that around half of the complaints mentioned authorised push payment scams, which showed a 28 per cent increase compared to the previous year.

Rocio Concha, director of policy and advocacy at consumer body Which?, said in a press release that the figures show how consumers are being “let down” by their banks.

“It is particularly concerning to see such an increase in the number of complaints about fraud — underlin[ing] the importance of new rules due to come into force soon that will make it mandatory for the vast majority of scam victims to be reimbursed and treated more fairly and consistently,” she said.

New mandatory reimbursement rules brought forward by the Payment Services Regulator will come into force on October 7. They require all national payment service providers to reimburse their clients who were subjected to APP fraud.