The reaction is a blow for Sunak – but, given Bank of England officials have repeatedly hinted at summer cuts, traders also risk being too pessimistic.

Yael Selfin, chief UK economist at KPMG, said the numbers mean the Bank’s Monetary Policy Committee (MPC) is unlikely to cut rates next month, even though inflation is now in “striking distance of the Bank of England 2pc target”.

“This may still not be enough to convince more cautious MPC members to commit to a rate cut in June,” she said, “especially while wage growth remains elevated and economic growth momentum is strong.”

The election also introduces a very political element.

Since becoming independent in May 1997, the Bank of England has never cut rates immediately before a general election. There have been six over that time.

When Tony Blair was re-elected for his second term as Labour prime minister in June 2001, the Bank’s rate-setting panel met the day before the election. Policymakers voted to hold rates steady after having delivered three cuts already that year and then resumed cutting in August.

This year inflation is expected to pick up again in the second half of the year to around 2.6pc, while pay growth is expected to cool. July may be as good as it gets for the economy.

Markets have been particularly spooked by inflation in the dominant services sector, which only dropped from 6pc to 5.9pc compared to the Bank’s own prediction of 5.5pc.

However, Selfin believes traders may be too pessimistic in their predictions.

There is another month of inflation data before the Bank’s next rate decision on June 20, which keeps the door open for a summer cut – albeit in August. By then, Downing Street may have a new occupant.

Governor Andrew Bailey has said he is “optimistic” the inflation crisis is at an end. Ben Broadbent, the deputy governor, said this week that “if things continue to evolve with MPC forecasts… then it’s possible Bank Rate could be cut some time over the summer.”

Selfin believes an August rate cut is therefore still very much in play – months sooner than the market bets suggest.

“Our forecast sees further declines in headline inflation, which could for a time bring the annual rate below 2pc, potentially picking up slightly early in 2025,” she said.

“That could leave enough margin for the [Bank] to start easing rates in August while keeping the overall monetary policy stance tight for at least another year.”

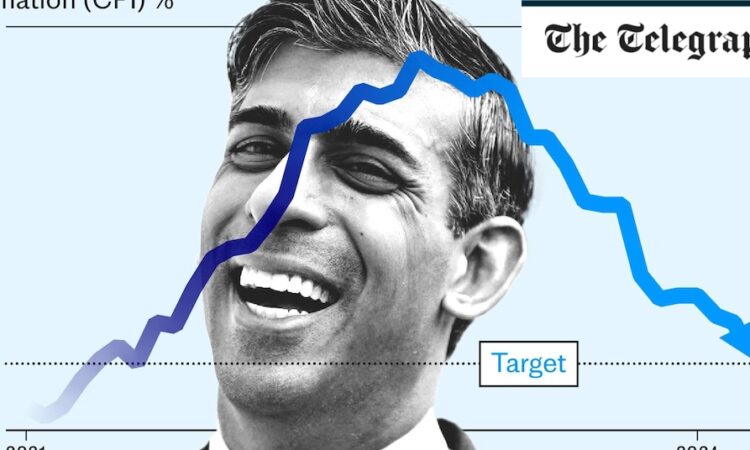

Today’s drop in inflation was not as big as forecast by economists, who had been expecting a fall to 2.1pc.

However, analysts were more concerned by the fine print than the headline figure.

Rob Wood, chief UK economist at Pantheon Macroeconomics, described the rise in services prices – which the Bank is watching closely – as a “shocker”.

“Upside surprises were widespread, not focused on a few erratic components,” he said.

Inflation in restaurants and hotels rose to 6pc in April from 5.8pc in March, while the price of cinema and concert tickets rose by 8.3pc from 5.4pc.