The coronavirus crisis in the United States—and the associated business closures, event cancellations, and work-from-home policies—triggered a deep economic downturn. The sharp contraction and deep uncertainty about the course of the virus and economy sparked a “dash for cash”—a desire to hold deposits and only the most liquid assets—that disrupted financial markets and threatened to make a dire situation much worse. The Federal Reserve stepped in with a broad array of actions to keep credit flowing to limit the economic damage from the pandemic. These included large purchases of U.S. government and mortgage-backed securities and lending to support households, employers, financial market participants, and state and local governments. “We are deploying these lending powers to an unprecedented extent [and] … will continue to use these powers forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery,” Jerome Powell, chair of the Federal Reserve Board of Governors, said in April 2020. In that same month, Powell discussed the Fed’s goals during a webinar at the Brookings’ Hutchins Center on Fiscal and Monetary Policy. This post summarizes the Fed’s actions though the end of 2021.

HOW DID THE FED SUPPORT THE U.S. ECONOMY AND FINANCIAL MARKETS?

Easing Monetary Policy

- Federal funds rate: The Fed cut its target for the federal funds rate, the rate banks pay to borrow from each other overnight, by a total of 1.5 percentage points at its meetings on March 3 and March 15, 2020. These cuts lowered the funds rate to a range of 0% to 0.25%. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term rates, so this move was aimed at supporting spending by lowering the cost of borrowing for households and businesses.

- Forward guidance: Using a tool honed during the Great Recession of 2007-09, the Fed offered forward guidance on the future path of interest rates. Initially, it said that it would keep rates near zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” In September 2020, reflecting the Fed’s new monetary policy framework, it strengthened that guidance, saying that rates would remain low “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.” By the end of 2021, inflation was well above the Fed’s 2% target and labor markets were nearing the Fed’s “maximum employment” target. At its December 2021 meeting, the Fed’s policy-making committee, the Federal Open Market Committee (FOMC), signaled that most of its members expected to raise interest rates in three one-quarter percentage point moves in 2022.

- Quantitative easing (QE): The Fed resumed purchasing massive amounts of debt securities, a key tool it employed during the Great Recession. Responding to the acute dysfunction of the Treasury and mortgage-backed securities (MBS) markets after the outbreak of COVID-19, the Fed’s actions initially aimed to restore smooth functioning to these markets, which play a critical role in the flow of credit to the broader economy as benchmarks and sources of liquidity. On March 15, 2020, the Fed shifted the objective of QE to supporting the economy. It said that it would buy at least $500 billion in Treasury securities and $200 billion in government-guaranteed mortgage-backed securities over “the coming months.” On March 23, 2020, it made the purchases open-ended, saying it would buy securities “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions,” expanding the stated purpose of the bond buying to include bolstering the economy. In June 2020, the Fed set its rate of purchases to at least $80 billion a month in Treasuries and $40 billion in residential and commercial mortgage-backed securities until further notice. The Fed updated its guidance in December 2020 to indicate it would slow these purchases once the economy had made “substantial further progress” toward the Fed’s goals of maximum employment and price stability. In November 2021, judging that test had been met, the Fed began tapering its pace of asset purchases by $10 billion in Treasuries and $5 billion in MBS each month. At the subsequent FOMC meeting in December 2021, the Fed doubled its speed of tapering, reducing its bond purchases by $20 billion in Treasuries and $10 billion in MBS each month.

Supporting Financial Markets

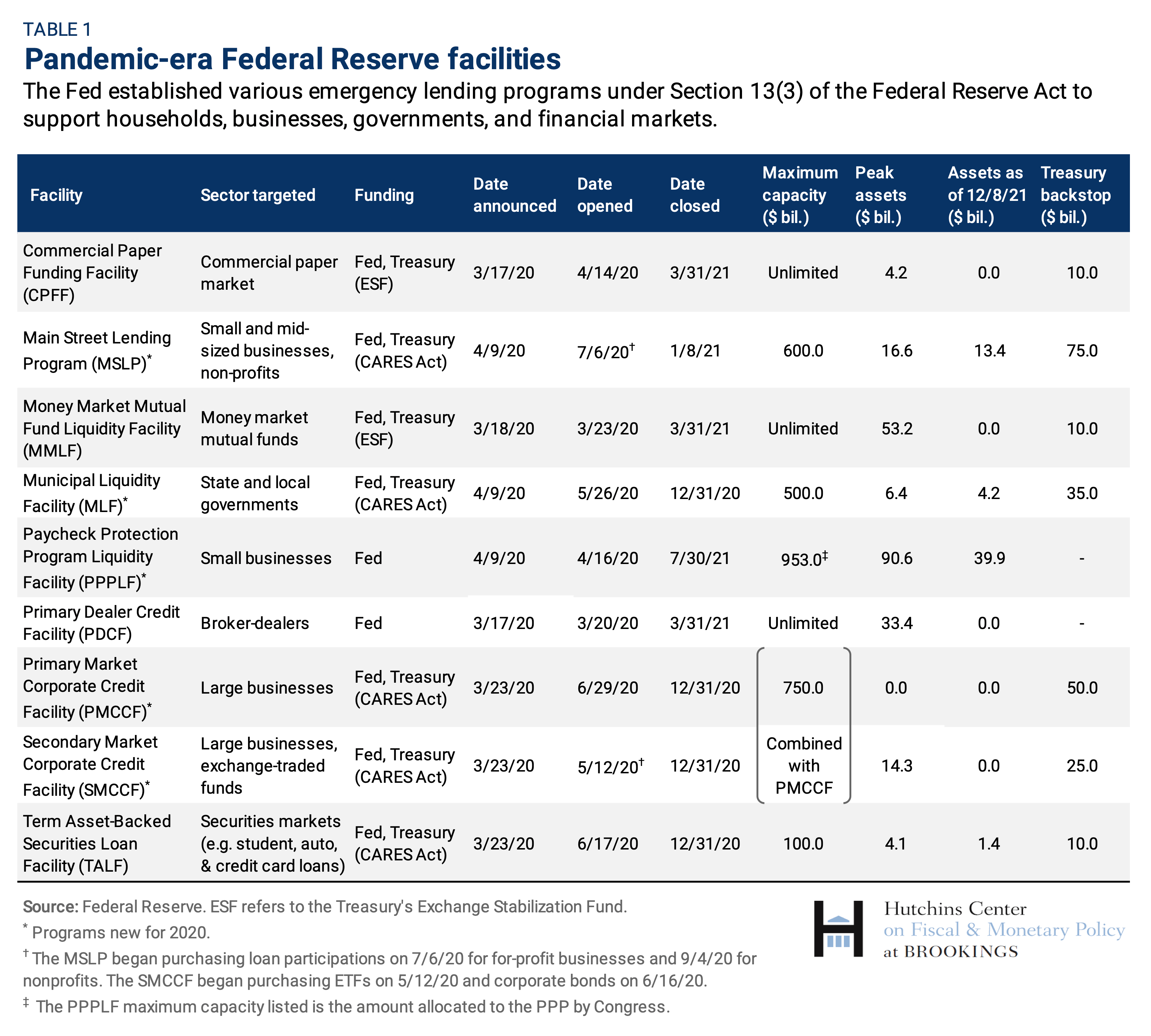

- Lending to securities firms: Through the Primary Dealer Credit Facility (PDCF), a program revived from the global financial crisis, the Fed offered low interest rate loans up to 90 days to 24 large financial institutions known as primary dealers. The dealers provided the Fed with various securities as collateral, including commercial paper and municipal bonds. The goal was to help these dealers continue to play their role in keeping credit markets functioning during a time of stress. Early in the pandemic, institutions and individuals were inclined to avoid risky assets and hoard cash, and dealers encountered barriers to financing the rising inventories of securities they accumulated as they made markets. To re-establish the PDCF, the Fed had to obtain the approval of the Treasury Secretary to invoke its emergency lending authority under Section 13(3) of the Federal Reserve Act for the first time since the 2007-09 crisis. The program expired on March 31, 2021.

- Backstopping money market mutual funds: The Fed also re-launched the crisis-era Money Market Mutual Fund Liquidity Facility (MMLF). This facility lent to banks against collateral they purchased from prime money market funds, which invest in Treasury securities and corporate short-term IOUs known as commercial paper. At the onset of COVID-19, investors, questioning the value of the private securities these funds held, withdrew from prime money market funds en masse. To meet these outflows, funds attempted to sell their securities, but market disruptions made it difficult to find buyers for even high-quality and shorter-maturity securities. These attempts to sell the securities only drove prices lower (in a “fire sale”) and closed off markets that businesses rely on to raise funds. In response, the Fed set up the MMLF to “assist money market funds in meeting demands for redemptions by households and other investors, enhancing overall market functioning and credit provision to the broader economy.” The Fed invoked Section 13(3) and obtained permission to administer the program from Treasury, which provided $10 billion from its Exchange Stabilization Fund to cover potential losses. Given limited usage, the MMLF expired on March 31, 2021.

- Repo operations: The Fed vastly expanded the scope of its repurchase agreement (repo) operations to funnel cash to money markets. The repo market is where firms borrow and lend cash and securities short-term, usually overnight. Since disruptions in the repo market can affect the federal funds rate, the Fed’s repo operations made cash available to primary dealers in exchange for Treasury and other government-backed securities. Before coronavirus turmoil hit the market, the Fed was offering $100 billion in overnight repo and $20 billion in two-week repo. Throughout the pandemic, the Fed significantly expanded the program—both in the amounts offered and the length of the loans. In July 2021, the Fed established a permanent Standing Repo Facility to backstop money markets during times of stress.

- Foreign and International Monetary Authorities (FIMA) Repo Facility: Sales of U.S. Treasury securities by foreigners who wanted dollars added to strains in money markets. To ensure foreigners had access to dollar funding without selling Treasuries in the market, the Fed in July 2021 established a new repo facility called FIMA that offers dollar funding to the considerable number of foreign central banks that do not have established swap lines with the Fed. The Fed makes overnight dollar loans to these central banks, taking Treasury securities as collateral. The central banks can then lend dollars to their domestic financial institutions.

- International swap lines: Using another tool that was important during the global financial crisis, the Fed made U.S. dollars available to foreign central banks to improve the liquidity of global dollar funding markets and to help those authorities support their domestic banks who needed to raise dollar funding. In exchange, the Fed received foreign currencies and charged interest on the swaps. For the five central banks that have permanent swap lines with the Fed—Canada, England, the Eurozone, Japan, and Switzerland—the Fed lowered its interest rate and extended the maturity of the swaps. It also provided temporary swap lines to the central banks of Australia, Brazil, Denmark, Mexico, New Zealand, Norway, Singapore, South Korea, and Sweden. In June 2021, the Fed extended these temporary swaps until December 31, 2021.

Encouraging Banks to Lend

- Direct lending to banks: The Fed lowered the rate that it charges banks for loans from its discount window by 2 percentage points, from 2.25% to 0.25%, lower than during the Great Recession. These loans are typically overnight—meaning that they are taken out at the end of one day and repaid the following morning—but the Fed extended the terms to 90 days. At the discount window, banks pledge a wide variety of collateral (securities, loans, etc.) to the Fed in exchange for cash, so the Fed takes little (or no) risk in making these loans. The cash allows banks to keep functioning, since depositors can continue to withdraw money and the banks can make new loans. However, banks are sometimes reluctant to borrow from the discount window because they fear that if word leaks out, markets and others will think they are in trouble. To counter this stigma, eight big banks agreed to borrow from the discount window in March 2020.

- Temporarily relaxing regulatory requirements: The Fed encouraged banks—both the largest banks and community banks—to dip into their regulatory capital and liquidity buffers to increase lending during the pandemic. Reforms instituted after the financial crisis require banks to hold additional loss-absorbing capital to prevent future failures and bailouts. However, these reforms also include provisions that allow banks to use their capital buffers to support lending in downturns. The Fed supported this lending through a technical change to its TLAC (total loss-absorbing capacity) requirement—which includes capital and long-term debt—to gradually phase in restrictions associated with shortfalls in TLAC. (To preserve capital, big banks also suspended buybacks of their shares.) The Fed also eliminated banks’ reserve requirement—the percent of deposits that banks must hold as reserves to meet cash demand—though this was largely irrelevant because banks held far more than the required reserves. The Fed restricted dividends and share buybacks of bank holding companies throughout the pandemic, but lifted these restrictions effective June 30, 2021, for most firms based on stress test results. These stress tests showed that banks had ample capital to support lending even if the economy performed far weaker than anticipated.

Supporting Corporations and Businesses

- Direct lending to major corporate employers: In a significant step beyond its crisis-era programs, which focused primarily on financial market functioning, the Fed established two new facilities to support the flow of credit to U.S. corporations on March 23, 2020. The Primary Market Corporate Credit Facility (PMCCF) allowed the Fed to lend directly to corporations by buying new bond issues and providing loans. Borrowers could defer interest and principal payments for at least the first six months so that they had cash to pay employees and suppliers (but they could not pay dividends or buy back stock). And, under the new Secondary Market Corporate Credit Facility (SMCCF), the Fed could purchase existing corporate bonds as well as exchange-traded funds investing in investment-grade corporate bonds. An orderly secondary market was seen as helping businesses access new credit in the primary market. These facilities allowed “companies access to credit so that they are better able to maintain business operations and capacity during the period of dislocations related to the pandemic,” the Fed said. Initially supporting $100 billion in new financing, the Fed announced on April 9, 2020, that the facilities would be increased to backstop a combined $750 billion of corporate debt. And, as with previous facilities, the Fed invoked Section 13(3) of the Federal Reserve Act and received permission from the U.S. Treasury, which provided $75 billion from its Exchange Stabilization Fund to cover potential losses. Late in 2020, after the recovery from the pandemic was under way, and despite the Fed’s misgivings, Treasury Secretary Steven Mnuchin decided that the final bond and loan purchases for the corporate credit facilities would take place no later than December 31, 2020. The Fed objected to the cutoff, preferring to keep the facilities available until there was a firmer assurance that financial conditions would not deteriorate again. The Fed said on June 2, 2021 that it would gradually sell off its $13.7 billion portfolio of corporate bonds, which it completed in December 2021.

- Commercial Paper Funding Facility (CPFF): Commercial paper is a $1.2 trillion market in which firms issue unsecured short-term debt to finance their day-to-day operations. Through the CPFF, another reinstated crisis-era program, the Fed bought commercial paper, essentially lending directly to corporations for up to three months at a rate 1 to 2 percentage points higher than overnight lending rates. “By eliminating much of the risk that eligible issuers will not be able to repay investors by rolling over their maturing commercial paper obligations, this facility should encourage investors to once again engage in term lending in the commercial paper market,” the Fed said. “An improved commercial paper market will enhance the ability of businesses to maintain employment and investment as the nation deals with the coronavirus outbreak.” As with other non-bank lending facilities, the Fed invoked Section 13(3) and received permission from the U.S. Treasury, which put $10 billion into the CPFF to cover any losses. The Commercial Paper Funding Facility lapsed on March 31, 2021.

- Supporting loans to small- and mid-sized businesses: The Fed’s Main Street Lending Program, announced on April 9, 2020, aimed to support businesses too large for the Small Business Administration’s Paycheck Protection Program (PPP) and too small for the Fed’s two corporate credit facilities. The program was subsequently expanded and broadened to include more potential borrowers. Through three facilities—the New Loans Facility, Expanded Loans Facility, and Priority Loans Facility—the Fed was prepared to fund up to $600 billion in five-year loans. Businesses with up to 15,000 employees or up to $5 billion in annual revenue could participate. In June 2020, the Fed lowered the minimum loan size for New Loans and Priority Loans, increased the maximum for all facilities, and extended the repayment period. As with other facilities, the Fed invoked Section 13(3) and received permission from the U.S. Treasury, which through the CARES Act put $75 billion into the three Main Street Programs to cover losses. Borrowers are subject to restrictions on stock buybacks, dividends, and executive compensation. (See here for additional operational details.) Secretary Mnuchin, again over the Fed’s objections, decided that the Main Street facility would stop taking loan submissions on December 14, 2020, as it was set to make its final purchases by January 8, 2021. The Fed also established a Paycheck Protection Program Liquidity Facility that facilitated loans made under the PPP. Banks lending to small businesses could borrow from the facility using PPP loans as collateral. The PPP Liquidity Facility closed on July 30, 2021. According to a December 2023 Government Accountability Office report: Of the 1,830 loans made through the Main Street Lending Program, 1,175 (or 64%) remained outstanding as of the end of August 2023, the most recent data available at the time of the report. These loans total $11.3 billion. Since required interest payments began in August 2021, most borrowers have been making them on time. However, delinquent payments increased to about 7.6% in August 2023. This, the GAO said, may reflect the effects of increased interest payments as rates on Main Street loans rose from less than 0.2% at the program’s start to 5.33% in August 2023. GAO reported that 610 loans (or about 3%) had been fully repaid, and 45 loans (or about 2.5%) had recorded losses.

- Supporting loans to non-profit institutions: In July 2020, the Fed expanded the Main Street Lending Program to non-profits, including hospitals, schools, and social service organizations that were in sound financial condition before the pandemic. Borrowers needed at least 10 employees and endowments of no more than $3 billion, among other eligibility conditions. The loans were for five years, but payment of principal was deferred for the first two years. As with loans to businesses, lenders retained 5% of the loans. This addition to the Main Street program lapsed with the rest of the facility on January 8, 2021.

Supporting Households and Consumers

- Term Asset-Backed Securities Loan Facility (TALF): Through this facility, reestablished on March 23, 2020, the Fed supported households, consumers, and small businesses by lending to holders of asset-backed securities collateralized by new loans. These loans included student loans, auto loans, credit card loans, and loans guaranteed by the SBA. In a step beyond the crisis-era program, the Fed expanded eligible collateral to include existing commercial mortgage-backed securities and newly issued collateralized loan obligations of the highest quality. Like the programs supporting corporate lending, the Fed said the TALF would initially support up to $100 billion in new credit. To restart it, the Fed invoked Section 13(3) and received permission from the Treasury, which allocated $10 billion from the Exchange Stabilization Fund to finance the program. Without an extension, this facility stopped making purchases on December 31, 2020, at Secretary Mnuchin’s order.

Supporting State and Municipal Borrowing

- Direct lending to state and municipal governments: During the 2007-09 financial crisis, the Fed resisted backstopping municipal and state borrowing, seeing that as the responsibility of the administration and Congress. But in this crisis, the Fed lent directly to state and local governments through the Municipal Liquidity Facility, which was created on April 9, 2020. The Fed expanded the list of eligible borrowers on April 27 and June 3, 2020. The municipal bond market was under enormous stress in March 2020, and state and municipal governments found it increasingly hard to borrow as they battled COVID-19. The Fed’s facility offered loans to U.S. states, including the District of Columbia, counties with at least 500,000 residents, and cities with at least 250,000 residents. Through the program, the Fed made $500 billion available to government entities that had investment-grade credit ratings as of April 8, 2020, in exchange for notes tied to future tax revenues with maturities of less than three years. In June 2020, Illinois became the first government entity to tap the facility. Under changes announced that month, the Fed allowed governors in states with cities and counties that did not meet the population threshold to designate up to two localities to participate. Governors were also able to designate two revenue bond issuers—airports, toll facilities, utilities, public transit—to be eligible. The New York Metropolitan Transportation Authority (MTA) took advantage of this provision in August, borrowing $451 million from the facility. The Fed invoked Section 13(3) with the approval of the U.S. Treasury, which used the CARES Act to provide $35 billion to cover any potential losses. (See here for additional details.) The Municipal Liquidity Facility stopped purchases on December 31, 2020 when it lost Treasury support, per Secretary Mnuchin’s decision. The New York MTA secured a second loan from the facility on December 10, 2020, borrowing $2.9 billion before lending halted.

- Supporting municipal bond liquidity: The Fed also used two of its credit facilities to backstop muni markets. It expanded the eligible collateral for the MMLF to include municipal variable-rate demand notes and highly rated municipal debt with maturities of up to 12 months. The Fed also expanded the eligible collateral of the CPFF to include high-quality commercial paper backed by tax-exempt state and municipal securities. These steps allowed banks to funnel cash into the municipal debt market, where stress had been building due to a lack of liquidity.

WHY WERE THE FED’S ACTIONS IMPORTANT?

Steps taken by federal, state, and local officials to mitigate the spread of the virus limited economic activity, leading to a sudden and deep recession with millions of jobs lost. The Fed’s actions ensured that credit continued to flow to households and businesses, preventing financial market disruptions from intensifying the economic damage.

In many other countries, most credit flows through the banking system. In the U.S., a substantial amount of credit flows through capital markets, so the Fed worked to keep them functioning as smoothly as possible. As one of our colleagues, Don Kohn, former Federal Reserve Vice Chair, said in March 2020:

“The Treasury market in particular is the foundation for trading in many other securities markets in the U.S. and around the world; if it’s disrupted, the functioning of every market will be impaired. The Fed’s purchase of securities is explicitly aimed at improving the functioning of the Treasury and MBS markets, where market liquidity had been well below par in recent days.”

But targeting the Treasury market proved insufficient, given the severity of the COVID recession and the disruption of flows of credit across other financial markets. So the Fed intervened directly in the markets for corporate and municipal debt to ensure that key economic actors could raise funds to pay workers and avoid bankruptcies. These measures aimed to help businesses survive the crisis and resume hiring and production when the pandemic ebbed.

Banks also needed support to keep credit flowing. When financial markets are clogged, firms tend to draw on bank lines of credit, which can lead banks to pull back on lending or selling Treasury and other securities. The Fed supplied unlimited liquidity to financial institutions so they could meet credit drawdowns and make new loans to businesses and households feeling financial strains.

The authors did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this article. They are not currently an officers, directors, or board members of any organization with a financial or political interest in this article. Prior to his consulting work for Brookings, Dave Skidmore was employed by the Board of Governors of the Federal Reserve System.