Where you bank can promote racial equity and inclusion. Supporting Black-owned banks can help economically empower Black communities, who historically have faced discriminatory banking practices and systemic racism, such as redlining.

Today, Black Americans are the most likely of any racial group to be unbanked or underbanked. While 2.1 percent of white Americans are unbanked (have no savings or checking account), 11.3 percent of Black Americans are unbanked, according to the latest FDIC survey.

Additionally, Black individuals face the highest denial rate for mortgages. According to 2021 Home Mortgage Disclosure Act data, 15.3 percent of Black Americans were denied mortgages, compared to 6.3 percent for non-Hispanic white Americans.

As an alternative to larger institutions, Black-owned banks have provided mortgages, loans and accounts to people of color when other banks would not provide those services to them.

“Black banks are typically mission-focused, and they are all community banks,” says Michael Neal, principal research associate for the Housing Finance Policy Center at the Urban Institute.

Key statistics about Black-owned banks

-

Percentage of U.S. banks that are Black owned: Less than 1 percent

-

Percentage of U.S. credit unions that are Black owned: 7.5 percent.

-

States where most black-owned banks are headquartered: Alabama, Georgia, Pennsylvania and the District of Washington, D.C., each have two Black-owned banks based within their borders.

-

Since 2001, the number of Black-owned banks has declined by over 50 percent.

-

Despite the focus on lending to Black borrowers, Black-owned banks account for less than 1 percent of all mortgage lending to Black borrowers.

-

Percentage of Black Americans who are unbanked: 11.3

-

Largest Black-owned bank: City First Bank, with $1.169 billion in assets

-

Total combined Black-owned bank assets: under $8 billion as of Sept. 2022, compared to more than $22 trillion in total assets in the U.S. banking system

-

First Black-operated bank: Capital Savings Bank, in Washington, D.C., in 1888.

Sources: FDIC, Urban Institute, Federal Reserve

What is a Black-owned bank?

Being a Black-owned bank or credit union is a federal designation. The Federal Deposit Insurance Corp, or FDIC, classifies these institutions as Minority Depository Institutions, or MDIs. The federal government defines MDIs as any depository institution in which minority ownership is 51 percent or more, or in which the majority of board members is composed of minority members and the community the bank serves is predominantly minority.

“What makes that more poignant is that Black-owned banks have a fraction of the assets that the mainstream banks have.”

— Stephone CowardCo-founder of Bank Black USA, an organization that formed out of the larger #BankBlack movement to encourage consumers to move their money to Black-owned banks.

The four largest banks in the U.S. each have more than $1.6 trillion in assets. By comparison, only two Black-owned banks have more than $1 billion in assets. That means Black-owned banks have a disadvantage when it comes to competition in the banking industry.

“It is crystal clear that Black banks have not benefited from the same level of support from the government and big business that the ‘Big Banks’ have,” Coward says. “They have significantly fewer resources to pull from to support the communities they serve and beyond.”

The total number of Black-owned banks has steadily declined over the years. In 2001, there were 48 federally insured Black-owned banks. That number has dropped to 20 banks, as of September 2022 — about a 58 percent loss.

Black-owned banks and credit unions

There are currently 20 federally chartered banks classified as Black-owned, the largest being City First Bank in Washington. Meanwhile, over 300 credit unions are at least partially Black-owned, though many of these have total assets of less than $1 million.

Though not federally designated, Black-owned fintech firms are gaining momentum in the minority-focused banking sector. They include Brooklyn, New York-based Breaux Capital and Novae Financing in Conyers, Georgia, among many others.

Banks

There are over 4,000 FDIC-insured banks, but less than 1 percent of them are Black-owned. The number of Black-owned banks has been declining over the years. The oldest Black-owned bank still in business is Citizens Savings Bank and Trust Company, established in 1904.

Today, these are all of the federally chartered banks owned or directed by Black or African Americans, providing essential resources in underserved neighborhoods and to those who have historically been discriminated against.

|

Bank |

Headquarters |

Total assets (in $ millions)* |

|---|---|---|

|

CITY FIRST BANK |

WASHINGTON, DC |

$1,169.7 |

|

LIBERTY BANK AND TRUST |

NEW ORLEANS, LA |

$1,068 |

|

CITIZENS TRUST BANK |

ATLANTA, GA |

$812.6 |

|

CARVER FEDERAL SAVINGS BANK |

NEW YORK, NY |

$756.1 |

|

INDUSTRIAL BANK |

WASHINGTON, DC |

$688.6 |

|

ONEUNITED BANK |

BOSTON, MA |

$627.4 |

|

FIRST INDEPENDENCE BANK |

DETROIT, MI |

$469.3 |

|

MECHANICS & FARMERS BANK |

DURHAM, NC |

$434.2 |

|

OPTUS BANK |

COLUMBIA, SC |

$380.9 |

|

THE HARBOR BANK OF MARYLAND |

BALTIMORE, MD |

$370.7 |

|

UNITY NATIONAL BANK OF HOUSTON |

HOUSTON, TX |

$214.6 |

|

CITIZENS SAVINGS BANK AND TRUST COMPANY |

NASHVILLE, TN |

$140 |

|

CARVER STATE BANK |

SAVANNAH, GA |

$80 |

|

GN BANK |

CHICAGO, IL |

$74.1 |

|

FIRST SECURITY BANK AND TRUST COMPANY |

OKLAHOMA CITY, OK |

$74.1 |

|

TIOGA-FRANKLIN SAVINGS BANK |

PHILADELPHIA, PA |

$63.4 |

|

UNITED BANK OF PHILADELPHIA |

PHILADELPHIA, PA |

$61.9 |

|

COMMONWEALTH NATIONAL BANK |

MOBILE, AL |

$61.5 |

|

COLUMBIA SAVINGS AND LOAN ASSOCIATION |

MILWAUKEE, WI |

$26 |

|

ALAMERICA BANK |

BIRMINGHAM, AL |

$15.5 |

*As of September 30, 2022

Source: FDIC

Credit unions

As of Sept. 30, 2022, there were 4,813 federally insured credit unions. About 7.5 percent of these — 361 in total — are at least partially Black-owned.

The largest 10 credit unions at least partially owned or governed by Black Americans (by asset size):

|

Credit union |

Headquarters |

Total assets in $ millions* |

|---|---|---|

|

MUNICIPAL |

NEW YORK, NY |

$4,195.1 |

|

ANDREWS FEDERAL CREDIT UNION |

SUITLAND, MD |

$2,487.1 |

|

HAWAIIUSA |

HONOLULU, HI |

$2,270 |

|

SELF-HELP |

DURHAM, NC |

$2,124 |

|

MECU |

BALTIMORE, MD |

$1,349.2 |

|

LOS ANGELES FEDERAL CREDIT UNION |

GLENDALE, CA |

$1,242 |

|

TROPICAL FINANCIAL |

MIRAMAR, FL |

$990.3 |

|

RAIZ FEDERAL CREDIT UNION |

EL PASO, TX |

$941 |

|

RESOURCE ONE |

DALLAS, TX |

$802.2 |

|

USC |

LOS ANGELES, CA |

$755.9 |

*As of September 30, 2022

Source: National Credit Union Administration

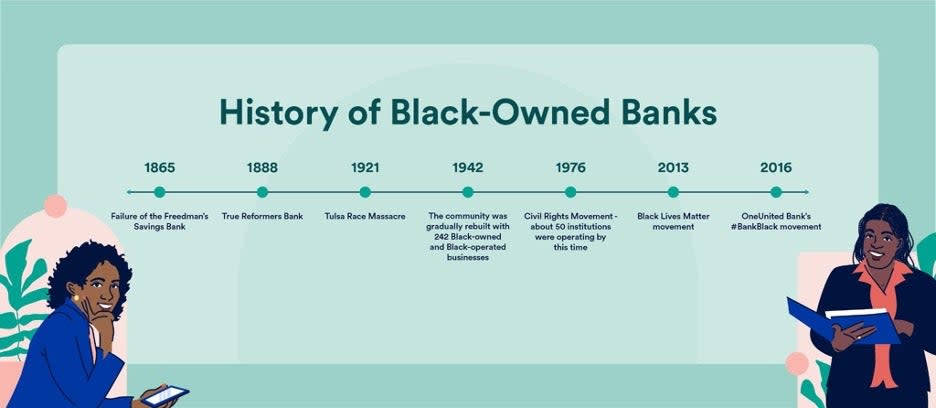

History of Black-owned banks

Black-owned banks have been around for more than 130 years. In March of 1888, True Reformers Bank was the first Black-owned bank to be chartered in the U.S., and Capital Savings Bank was the first to open, just a few months afterward. The banks came into existence after the failure of the Freedman’s Savings Bank, which the U.S. government established in 1865 to offer financial services for newly freed African Americans.

“Unfortunately, it [Freedman’s Savings Bank] was not run by African Americans, so there was a disconnect in terms of the investments made by those managers,” says Kenneth Kelly, former chairman of the National Bankers Association, the trade group for minority banking, and CEO and chairman of First Independence Bank in Detroit.

Freedman’s Savings went bankrupt in less than a decade.

Black Wall Street

The Greenwood district of Tulsa, Oklahoma, was a vibrant African American community that developed in the early 1900s. Also known as Black Wall Street, it comprised thousands of houses and thriving Black-owned businesses. In the spring of 1921, social and economic unrest led to the Tulsa Race Massacre in which an angry mob killed up to 300 African American residents and destroyed millions of dollars’ worth of property.

The 35-block community was gradually rebuilt and thrived again, with 242 Black-owned and Black-operated businesses by 1942. In the decades that passed, however, it subsequently declined, due to factors such as the aging of its pioneers, redevelopment and the building of a highway.

Civil rights movements

Black-owned banks flourished during the civil rights movement of the 1950s and ‘60s, and about 50 institutions were operating by 1976. Those numbers shrunk during the savings and loan crisis of the 1980s, and again during the Great Recession. Only about half of the Black-owned banks that existed in the early 2000s remain today.

The Black Lives Matter movement helped raise awareness about Black-owned banks, with initiatives like OneUnited Bank’s #BankBlack movement — which started in 2016, after deadly police shootings in Black communities — challenging more consumers to open accounts with these institutions.

“This is an opportunity for everyone to consciously include a sector or financial institution that historically they may not have,” the Urban Institute’s Neal says.

How you can support Black-owned banks

One of the primary ways to support Black-owned banks is simply by doing business with them, either by opening an account or taking out a loan or line of credit. Another approach is to become an equity stockholder in a Black-owned financial institution.

Some banks are seeing an increase in deposits in response to the #BankBlack movement, according to the Federal Reserve Bank of St. Louis. Companies that have chosen to invest in Black-owned banks include Netflix, which fulfilled its pledge to deposit about $100 million — 2 percent of its cash holdings — into Black-led banks and other financial institutions in December 2021. PayPal pledged $530 million in support of minority-owned companies and banks in 2020.

A common misconception is that Black-owned banks only lend to minorities, which couldn’t be further from the truth, First Independence Bank’s Kelly says.

“While true that these institutions have a propensity for serving minorities, they also serve the needs of any people who desire to do business with them,” Kelly says.

As community banks, these institutions can provide opportunities to develop a closer relationship with your banker.

Because Black-owned banks serve an essential role in building wealth in minority communities — but have declined in number — these institutions need support on a policy level, too, says Neal of the Urban Institute.

“Calling your member of Congress is one key way of putting that on his or her mind,” Neal says. “It’s an inexpensive, immediate step people can take, particularly since this is an election year.”

Black-owned banks have been dwindling in number, but customers who don’t live near a branch can often take advantage of digital banking services offered by some of the banks. OneUnited is a Black-owned bank with six branches in three states, yet customers throughout the country can open and manage accounts online.

Another digital option is recently formed Greenwood, a financial services company offering online-only banking products. The Black-owned company provides five meals to a food-insecure family whenever an account is opened. Customers can also automatically round up spare change from purchases to support organizations such as the NAACP or the United Negro College Fund (UNCF).

How to switch banks

When deciding to move your money from one institution to another, Bank Black USA’s Coward recommends doing so at a pace that is comfortable to you.

“Making the switch does not mean that you have to move all your money at once,” Coward says. “You can start with savings and build your way up to a checking account.”

Anytime you switch your funds to a new bank account, remember to also move your direct deposits and automated transfers. Make sure to read through disclosures to be aware of any minimum balance requirements, monthly fees, wire transfer fees and other important account details.

Even though not all areas of the country have a Black-owned bank, you can find an institution where you can open an account online. One website to find these banks is Mighty Deposits, which allows you to search for banks based on a number of criteria, including where they operate and whether they’re Black-owned or led.

“Black banks, by themselves, are by no means the panacea to closing the racial wealth gap or ending systemic racism,” Coward says. “However, they can be a tool, an arrow in the quiver and part of a multipronged approach to improving the financial stability and, ultimately, the financial literacy of communities in need.”

Bottom line

A history of systemic racism can be seen in the U.S. banking system, as seen in the disproportionate number of Black- and other minority-owned banks compared to big banks. Black-owned banks also possess significantly fewer assets than larger banks.

Black Americans have historically been denied lending opportunities, are more likely to be unbanked and are disproportionately charged more in banking fees. But supporting and investing in Black-owned banks can help combat some of the disparities in the banking system that affect the everyday needs of Black Americans.

Though much change is needed to bring about equity, initial steps have been made in the right direction, thanks to the #BankBlack movement and investments in minority-owned financial institutions.

–Matthew Goldberg and Rene Bennett contributed to this article.

–With additional reporting by Autumn Cafiero Giusti.