By Brett Lackey For Daily Mail Australia

00:18 19 Dec 2023, updated 01:50 19 Dec 2023

- Westpac electronic banking services went down on Tuesday

- Issue is affecting online, mobile, telephone and ATM banking

- READ MORE: Westpac outage earlier this month

Westpac and St George electronic banking services have been hit by an outage as thousands of customers complain they cannot access their cash including in the online banking app.

The outage was first reported at around 10:50am on Tuesday morning and is just weeks after Westpac’s online services had another widespread outage, going down on December 4.

Some customers said their account balances had ‘suddenly disappeared’ when they logged into internet banking.

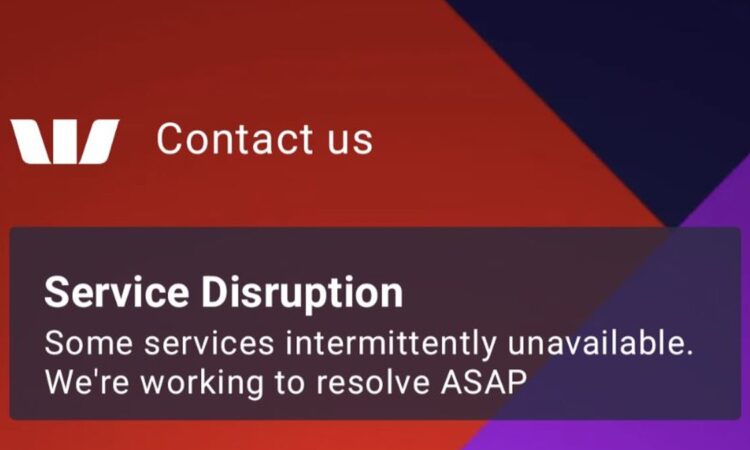

Others reported the app was showing a ‘service disruption’ message.

ATMs also appear to be experiencing the issue with the bank posting signs at some locations that that their ATMs are unavailable ‘due to a nationwide issue’.

Customers unleashed at the bank on social media, with more than 2,600 people reporting the service as down as of 11am Monday, according to DownDetector.

‘Great job at round Christmas time, no internet banking and yet you make billions in profits, screw the customer and close branches ,’ one frustrated user complained.

Other customers said they were annoyed the app had gone offline on multiple occasions in recent months.

‘Get your sh** together. Fourth time in four months your app is not allowing me to access my own money! Taking my money elsewhere. Over it ,’ one said.

A third declared: ‘Leaving Wetspac. Absolutely ridiculous.’

‘Your system is down again. Not just the app. Christmas week and we can’t get our money. I’m done,’ yet another irate customer shared online.

Westpac confirmed in a statement on Tuesday the issue was affecting online, mobile and telephone banking.

‘We’re aware that customers are experiencing intermittent issues accessing online, mobile and telephone banking. Our teams are working to fix the issue.’

‘We’re sorry for the inconvenience and will continue to share updates here.’

The disruptions come as Westpac and other major banks close branches and reduce the numbers of ATMs as Australia moves towards a cashless society.

But the shift to digital transactions has sparked concerns.

Older Australians not familiar with online banking could struggle without access to cash, as could regional communities who may have to wait days for any malfunctioning payment systems to be fixed.

The cashless society also means people have no choice but to be a bank customer and pay them fees, as well as raising privacy concerns in a society where every purchase of any good or service can and will be tracked.

Customers also become at the mercy of technical problems, unable to pay for anything during periods when their bank suffers any technical problems.