Wells Fargo, BofA and PNC among US banks to close 222 branches in just two months this year – setting America on course for a grim total of 1,300 by the end of 2024. Here is the full list…

In the first two months of the year American banks closed some 222 branches.

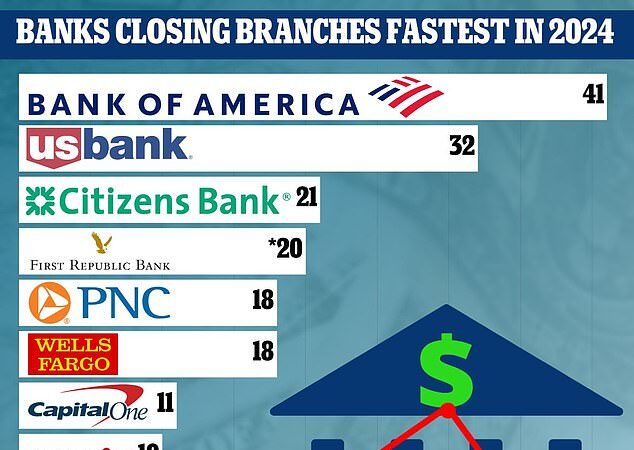

Leading the charge was Bank of America, US Bank and Citizens, which collectively accounted for nearly half of all the closures – 92 over eight weeks. If banks continue at the current rate some 1,300 will close this year.

The closures, reported to federal regulator the Office of the Comptroller of the Currency (OCC) in January and February, are reflective of a broader trend.

Banks are growing increasingly confident in the capabilities of online banking, according to Steven Reider, the founder and president of Bancography, an Alabama-based consulting firm that advises banks on branch planning and strategies.

That confidence can lead to significant savings since the average freestanding bank branch costs around $2.6 million a year. In just two months, Bank of America’s 41 closures might have saved it almost $100 million.

In the first two months of the year, American banks closed some 222 branches. Leading the charge was Bank of America, US Bank and Citizens

‘Banks are willing to close a branch that isn’t really overlapping any other branch on the gamble that customers are willing to drive a little bit further,’ said Reider.

‘I think Bank of America has leaned into that more than the other large banks have,’ he added.

It closed 157 branches last year but opened only 34.

Reider also noted that Bank of America’s merger history has meant it ended up with branches in rural locations while the industry is undergoing ‘an urban to rural conversion’.

‘Every census since 1910 has shown a greater proportion of Americans living in in urban areas than the preceding census, so as we become an increasingly urbanized country the demand in these legacy rural markets just fades away,’ he said.

Ultimately, banks are looking to consolidate the markets they are already in, and that involves placing more focus on dominating in a handful of cities.

For example, Chase is moving into Kansas City with force, Fifth Third is making similar moves into Charlotte and PNC is targeting Austin.

Just this week, Huntington said it would be expanding into Texas through Dallas.

‘These are the high-growth metros that also tend to have favorable ratios of households per branch,’ said Reider.

‘The decision of location is going to be primarily predicated on where they can raise deposits and where they can attract those low cost, non interest bearing consumers.’

Bank of America’s merger history has also meant it ended up with more branches in rural locations but the industry is trending towards consolidating around cities

Though the number of bank branch closures started to ramp up through the 2010s, it was exacerbated by the pandemic, which kept people at home.

Although they have continued, they do appear to be leveling off. ‘We’re still shedding branches as an industry, but the pace has slowed significantly,’ said Reider.

A spokesperson for Bank of America told DailyMail.com last year that it was indeed closing certain branches in response to diminishing customer traffic, but that the rate of closures was likely to plateau in the future.

And now, credit unions are playing a more significant role than ever before – offering very similar services to traditional banks and eating up a share of the market.

Unlike banks, their footprint is expanding and they now account for around 18,000 branches across the US.

‘Credit unions have been in a growth phase for the past 10 years and of course, banks have been in a reduction phase,’ said Reider.

‘They are branching aggressively and moving into markets community or national banks vacated,’ he said.

‘I think in terms of just general consumer share they’re going to continue to be a significant and meaningful competitive force.’

Do you hold money in a credit union? Write to money@dailymail.com