ING Viewpoint October 2021

Tanate Phutrakul, CFO of ING Group

Banking Union: How to improve EU Deposit Guarantee Schemes

Economic success in the Eurozone requires stable financial foundations. To achieve and maintain financial stability, sound and harmonised DGS are indispensable.

The importance of a well functioning deposit guarantee system, as part of the wider EU Crisis Management Framework, can hardly be overestimated. Banks not only have an obligation to financing DGS systems, but are also strongly committed in the unlikely event of a depositor pay out to make the system function smoothly and in the client’s best interest.

As a cross border European bank we experience that important steps are still needed to align between country systems. This is important in order to achieve a truly European approach, first through harmonising existing, national, deposit guarantee schemes, and ultimately by establishing true mutualisation of deposit guarantees in the Eurozone.

Tanate Phutrakul

CFO of ING Group

Introduction

ING has long supported the development of a fully fledged Eurozone wide Deposit Guarantee Scheme, or EDIS (see our 2016 viewpoint). We consider it a necessary condition for a fully integrated and functioning Eurozone banking market, together with the free flow of intra group funds across borders (see our 2017 viewpoint) and a harmonisation of the macro prudential framework (see our 2016 viewpoint). A fully mutualised EDIS is the best way to safeguard financial stability, break feedback loops between national sovereigns and banks, bolster the competitiveness of the Eurozone and encourage cross border bank consolidation.

We however recognise the political challenge of reaching this goal in the short term. In this viewpoint, and in light of the planned review of the Deposit Guarantee Schemes (DGS) Directive in 2022, we outline practical steps that could strengthen existing, national, Deposit Guarantee Schemes in the EU. Targeted changes to the functioning of these DGS could be a powerful intermediate step towards EDIS.

ING is active in multiple EU countries both through subsidiaries and branches. We experience wide divergences in the functioning of the multiple national DGS we contribute to. Importantly, we see significant discrepancies in the contributions banks pay into local schemes, that cannot always be explained by the actual or targeted size of DGS funding. This contributes to undue competitive differences that can be alleviated by a harmonised approach to national DGS today, and a common DGS in the future.

Our four key recommendations to EU policy makers:

- Harmonise the financing target levels of Member States’ individual Deposit Guarantee Schemes.

- Mandate the strict segregation of DGS funds from the general public treasury.

- Allow a proportion of bank payments into DGS in the form of irrevocable payment commitments (instead of outright cash transfers).

- Allow for transferability of funds payed into different EU DGS.

Four ways to improve the current DGS set up

1. Harmonise the financing target level

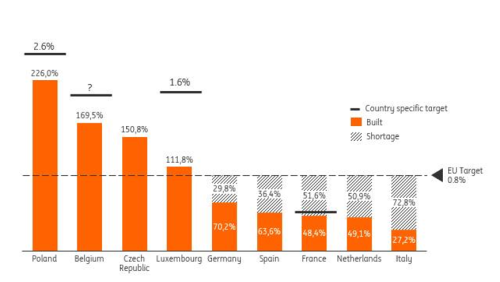

The DGS Directive sets a clear target level for DGS funding: 0.8% of covered deposits held by the member banks of a national scheme. In practice however, this target barely serves as an indication for the target (see figure 1). We see three reasons for the strong divergences between Member States:

- There are Member States that do not set target levels at all. This creates particular uncertainties for participating banks, given it is impossible to estimate the cost of participation in the long term.

- There are Member States that set a target level above 0.8%. It is understandable that countries want to set high buffers to provide additional protection. However, a balance is needed as to how much is considered sufficient, especially since there are other safeguards in place to prevent depositor losses (including capital & MREL/TLAC buffers, and the Single Resolution Fund).

- There are Member States that set a target below 0.8%, which is permitted for concentrated markets under the Directive upon approval by the European Commission.

Our concrete suggestion: The DGS Directive should set a harmonised target range between which Member States should set a stable target level. This will help reducing unjustifiably large differences between DGS contributions in different Member States and ensures predictability for DGS participants.

Figure 1: Size of Deposit Guarantee schemes in selected EU countries (end 2020 data)

2. Segregate DGS contribution from the general budget

Contributions to the DGS serve to credibly promise savers that their deposits up to €100.000 will be immediately reimbursed if a troubled bank is not able to do so itself. This is core to the credibility of the banking sector, and is a key defense against bank runs in times of crisis.

We observe however that in some Members States, the line between the DGS funds and the general government budget is blurred. This is problematic for three reasons:

- When DGS funds are placed with the public treasury, the funds can be used to statistically lower the government debt. This seems to go against the Banking Union’s core goal of breaking the bank sovereign doom loop, as the use of DGS might contribute to a public debt crisis

- In some Member States, DGS funds are held in the Treasury and not segregated from the government budget. This is problematic as it means that the deposit guarantee can be perceived as a claim on the sovereign, not on the fund itself. In addition, collected funds might not be immediately available when needed.

- The integration of DGS into public budget can create doubts about seniority ranking. Clarity is crucial as a key function of the DGS is to provide credibility and trust.

Our concrete suggestion: Mandate a clear operational, functional, and accounting separation between the DGS and the public treasury. Outlaw the use of DGS funds to statistically lower the Debt/GDP ratio.

3. Allow contributions in the form of irrevocable payment commitments

We support the possibility of making part of the contributions into the DGS in the form of irrevocable payment commitments. The DGS Directive allows this up to a limit of 30% of the total contributions.

Unfortunately, not all Member States currently allow the use of payment commitments. This is counterproductive because payment commitments, backed by unencumbered low risk collateral, provide a strong claim to the DGS, while it doesn’t require an outright cash payment by the participating banks.

Our concrete suggestion: the limited use of irrevocable payment commitments should be allowed in all jurisdictions.

4. Transferability of funds between DGS

When a bank wants to switch between EU DGS, for example because of a changing corporate structure or a merger, the DGS Directive determines that only the contributions paid in the previous 12 months can be transferred to the new DGS.

All other funds paid into the DGS cannot be transferred. This means that the bank moving to another DGS will be asked to

build up years of DGS financing as fast as possible, as competent authorities will rightly want to enlarge their DGS to cover for an increase in covered deposits. This means a bank will finance the guarantee for its depositors twice. This provision strongly disincentivises cross border consolidation as well as branchification strategies.

Our concrete suggestion: allow for contribution transfers from one EU DGS to another, based on the risk being transferred.

The role of DGS in bank crisis management

The EU would benefit from more alignment of existing national insolvency procedures, including by clarifying the

role of DGS in these procedures.

The role of DGS in financing bank recovery, insolvency and resolution should be limited to (1) compensating depositors and (2) financially contributing to alternative measures to prevent bank failures, such as transferring assets and liabilities, on a least cost basis.

The DGS Directive should be amended to harmonise and clarify these powers, so the role of the DGS is the same across Member States.