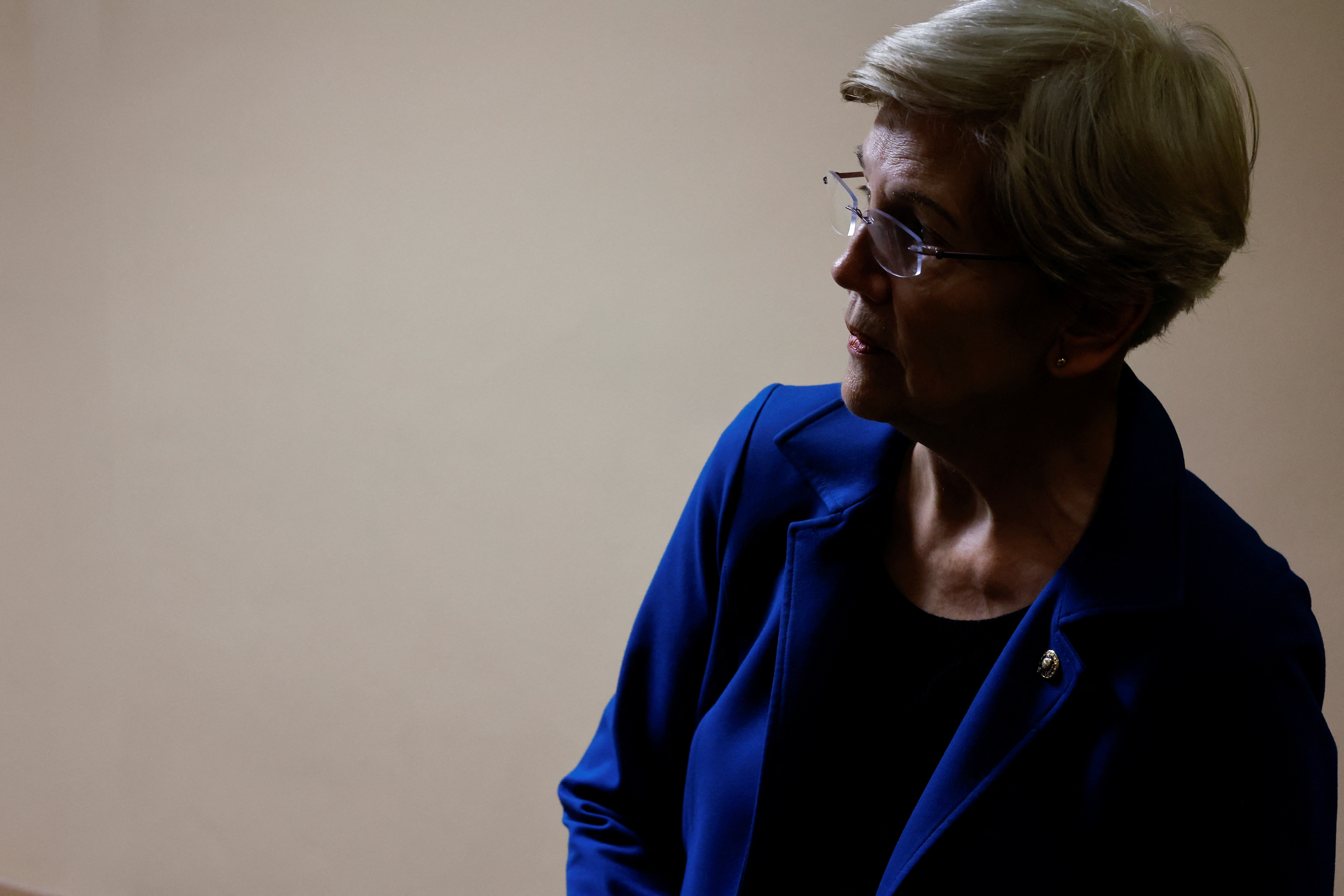

U.S. Senator Elizabeth Warren (D-MA) arrives for the weekly party caucus luncheon at the U.S. Capitol in Washington, U.S. September 27, 2023. REUTERS/Jonathan Ernst/File Photo Acquire Licensing Rights

Sept 28 (Reuters) – A case due to come before the U.S. Supreme Court next week has the potential to expose every federal bank regulator to political inference while also jeopardizing Social Security and Medicare, the federal health insurance program, U.S. Senator Elizabeth Warren said on Thursday.

The court next week is due to hear arguments in a challenge to the constitutionality of the U.S. Consumer Financial Protection Bureau’s (CFPB) funding. The Biden administration has said the case threatens the agency’s ability to function, which would undermine the federal government’s capacity to protect financial consumers.

Trade groups representing the payday lending industry, which brought the case, argue the U.S. Constitution prohibits the current arrangement in which the Federal Reserve supplies the CFPB’s funding. The CFPB regulates and polices consumer finance industries, including payday and title lending, as well as mortgage origination.

“The CFPB’s future is at stake in this court decision, along with the future of every other banking regulator,” Warren, who helped create the CFPB following the 2007-2008 financial crisis, said in prepared remarks.

Warren noted that other banking regulators, including the Fed itself and the Federal Deposit Insurance Corp., as well as Social Security and Medicare, are funded outside Congress’ annual budget-setting process.

“A bad decision by the Supreme Court could wreck the financial security of millions of families and turn our economy upside down,” she said, adding that allowing lawmakers to set budgets for those agencies could “evaporate” their political independence.

Reporting by Douglas Gillison; editing by Michelle Price

Our Standards: The Thomson Reuters Trust Principles.