US Office CRE Mess Is Spread Far and Wide across Investors & Banks Globally. US Banks Eat only a Portion of the Losses

Japanese, Canadian, and European banks started to confess. And for over a year, huge losses have hit investors, not banks.

By Wolf Richter for WOLF STREET.

What’s amazing about the mess of the office sector of commercial real estate (CRE) is just how far and wide these mega-losses – by some estimates, they may ultimately amount to $1 trillion, or whatever – are spread in diced and sliced form globally. Which is a good thing for US banks.

Some US banks have started to reveal the damage in bits and pieces and warn about office CRE loans. But foreign banks are also up to their ears in this stuff – Canadian banks, Japanese banks, European banks…. And some warnings have emerged. But a big portion of the office CRE loans are held by investors, not banks, and they have gotten the short end of the stick.

We have discussed this phenomenon here for a year – how the biggest office CRE losses haven’t hit the US banks as much, but have hit investors in Collateralized Loan Obligations (CLOs) and Commercial Mortgage-Backed Securities (CMBS) which are held in big baskets of relatively small slices by institutional investors, such as bond funds, pension funds, insurance companies not just in the US but around the world.

And losses have hit publicly traded and private property REITs and mortgage REITs whose investors span the globe; they’ve hit PE firms and hedge funds and other nonbank entities whose investors span the globe – to the point that we espoused the theory that US banks had been able to sell their riskiest worst office property debt, back during the “office shortage” when times were good and money was free, by securitizing it or selling it outright to institutional investors around the globe.

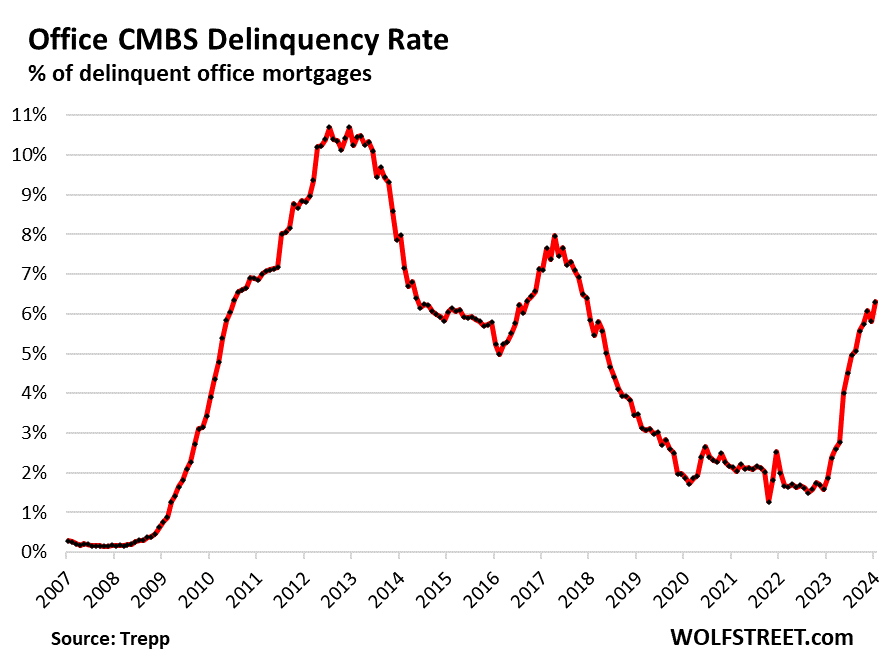

The delinquency rate of office mortgages that had been securitized into CMBS spiked to 6.3% by loan balance in January, having more than tripled year-over-year (up from a delinquency rate of 1.9% in January 2023), according to Trepp, which tracks and analyzes CMBS. This is a ferocious deterioration:

The office CRE losses are split among lenders and landlords. Landlords lose their equity in the property – even giant landlords such as private equity firm Blackstone and private equity firm Brookfield have walked away from office properties.

It’s the older office towers that are emptying out, or that have emptied out, that take the biggest beating. The latest and greatest office towers benefit from a flight to quality, as companies are abandoning older towers.

Lenders have lost between a substantial portion to nearly all or all of their loan value when they sell the office tower they’d seized via foreclosure or deed-in-lieu-of-foreclosure.

At the high end of losses was a 12-story, 50% vacant, old (read “landmark”) office tower at 300 W. Adams St., in Chicago, which recently sold for $4 million. This was the value of the building only – the “leasehold interest.” Land and building had been separated.

Alliance HP had bought the property for $51 million in 2012 and then divided it into a leasehold interest in the building and a 99-year ground lease. Alliance defaulted on the loan on the leasehold interest (the building). That loan had been securitized into CMBS, and the special servicer representing the bondholders then seized the building via a deed-in-lieu-of-foreclosure, and now sold it for $4 million. But Alliance HP still controls the ground lease, and still collects rent on it. No hard feelings, this is just CRE.

At the high end of losses was also the vacant 46-story office tower, built in 1985, in downtown St. Louis, which sold for $4.1 million in an April 2022 foreclosure sale, which after fees and expenses, left nothing for CMBS holders, and they took a 100% loss.

Now it’s the banks turn to confess.

So now the credit losses at banks are coming out of the woodwork.

When the three regional banks collapsed last year – Silicon Valley Bank, Signature Bank, and First Republic – it wasn’t because of bad credit; it was because of their unrealized losses on their Treasury securities and MBS, whose market prices had tanked because yields had shot up, and uninsured depositors got spooked and yanked their money out all at once. These unrealized losses among all banks have exploded.

New York Community Bancorp [NYCB], which had bought from the FDIC some of the Signature Bank assets, caused a stir a few days ago when it disclosed a slew of issues: a Q4 loss, falling interest income, the new regulatory headache of having become a bank with over $100 billion in assets, and net charge off that rose to $185 million in Q4, mostly due to two loans, including, well, an office loan that had defaulted in Q3. And it has set aside $552 million in loan loss reserves to digest future loan losses, largely from its CRE portfolio. It holds $3.4 billion in office loans.

There have been and there will be other US banks to disclose in bit and pieces the issues in the office loan portfolios.

Oh, the foreign banks gorged on US office loans?

Aozora Bank, a mid-sized Japanese bank, disclosed that it had $1.9 billion in US office loans, mostly in large cities such as Chicago and Los Angeles, accounting for 6.6% of its total loans. And losses at these US office loans will likely lead to a loss for its fiscal year ending in March.

US CRE was a big thing with Japanese banks and other financial firms. With yields in Japan ultra-low due to the Bank of Japan’s decade-plus of interest-rate repression, Japanese firms were chasing yield in US CRE, and now they’re having to deal with the fallout.

The big Canadian banks have been dragged down by exposure to the US office sector and have set aside piles of capital to deal with the expected losses. Canadian regulators have been warning about it – in a soothing manner; yes, earnings will be hit, but banks have enough capital to withstand the losses. Canada’s Imperial Bank of Commerce (CIBC) may be the most exposed to US office sector, with about 1% of its assets tied up in loans backed by US office properties; and according to Bloomberg News, it’s trying to offload some of its US office loans.

And European banks. Deutsche Bank AG more than quadrupled its loan loss provisions for US CRE to €123 million, up from €26 million a year ago. About 1.5% of its total loans are loans backed by office towers in New York, Los Angeles, San Francisco, etc.

A lot of these CRE loans are coming due this year and next year, and need to be refinanced, or extended, but interest rates have jumped, and many of these office properties are dealing with the structural collapse of demand for office space, so refinancing is going to be tough, and extending-and-pretending is going to be tough, and banks are going to have to deal with losses.

The point: Losses are spread around the globe, not just among US banks.

The losses related to office CRE are more or less thinly spread among institutional investors and banks around the globe. US banks have to eat only a portion of those losses. So the losses will hit earnings and dividends, and share prices, and some investors are going to lose their shirts. And it’s going to get worse over the next couple of years, and there will be more confessions from all directions. But thankfully, the US banking system shoulders only a portion of those losses.

The problem is structural and won’t just vanish when the mood changes or rates drop.

There were years when the real estate industry spread the notion that there was an “office shortage,” and companies bought into it and grabbed every office space that came on the market, to be used in the future, and due to this office shortage, developers kept building new office towers, while companies were hogging office space for the future that then didn’t come.

But during Covid, the realization came to corporate headquarters that no one needed this much unused office space, and at that moment the office shortage turned to an office glut, as companies put their existing leased office space on the sublease market and tried to get out of other leases. In many cities, the collapse of WeWork added to the office problems.

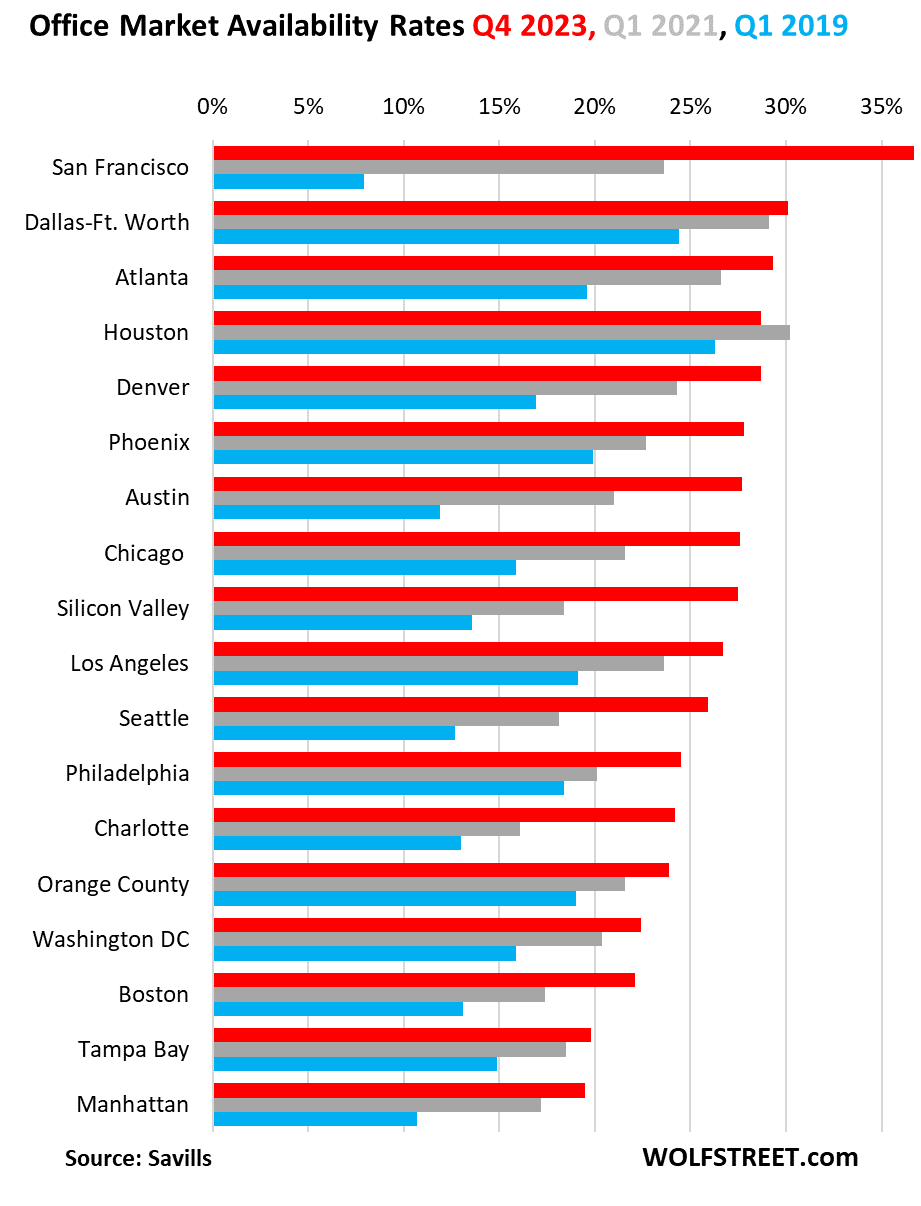

And availability rates – office space that is on the market for lease either by the landlord directly or by a tenant as a sublease – exploded. In San Francisco, the availability rate exploded from the single digits in 2019, when it was the hottest office market in the US, to 36.7% in Q4 2023. Dallas is also over 30%. Atlanta, Houston, et al. are not that far behind (data by Savills):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()