US consumers lost a record $10bn to fraud in 2023, representing a 14 per cent increase from the previous year’s reported losses, according to recently updated data from the Federal Trade Commission. The data was aggregated from the 2.6mn fraud reports submitted by consumers to the FTC last year — a figure comparable to the 2.4mn reports received in 2022 — and supplemented by intelligence provided by US law enforcement.

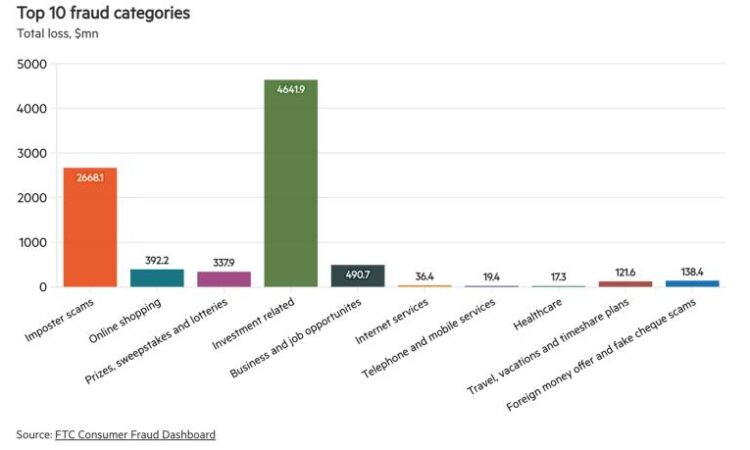

Investment scams were the top fraud category in terms of reported consumer losses, surpassing all others at more than $4.6bn. The amount represents a 21 per cent increase from the $3.9bn reported in 2022. Imposter scams, the most frequently reported type of fraud, followed with reported losses nearing $2.7bn.

The most typical variation of the imposter scam involved business impostors: scammers falsely claiming affiliation with well-known companies or financial institutions. In 2023, consumers reported losses of $752mn to this type of fraud.

Other commonly reported fraud categories included online shopping scams, lottery and competition scams, and fake job opportunity scams.

Losses through credit and debit cards accounted for the highest number of fraud reports, totalling a combined 197,718 out of the 457,832 reports that included payment data. However, bank transfers remained the primary payment method exploited by criminals to perpetrate large-scale scams, accounting for $1.86bn in losses last year.

Cryptocurrency claimed the second spot, with reported losses totalling $1.41bn. More money was lost through bank transfer and cryptocurrency fraud than all the other payment methods combined.

A new trend saw email become the most commonly used method by scammers to reach US consumers in 2023, overtaking text messages, which held the top spot in 2022. Phone calls ranked second, followed by text messages. Nevertheless, social media was the contact method that resulted in the highest proportion of reported losses, amounting to $1.48bn.

“Digital tools are making it easier than ever to target hard-working Americans, and we see the effects of that in the data,” said Samuel Levine, director of the FTC’s Bureau of Consumer Protection.

In response to these trends, the FTC is pursuing various proposals. One such initiative involves revising a trade regulation rule first proposed in 2022, aiming to prohibit the impersonation of government entities, businesses, or their officials.

The FTC has already implemented a ban on AI-generated phone calls and has expressed further concerns that the proliferation of generative AI tools such as ChatGPT has meant that criminals are able to impersonate organisations with greater accuracy.

In a recent public statement, it said it is seeking comment on whether a revised trade regulation rule should also “declare it unlawful for a firm, such as an AI platform that creates images, video, or text, to provide goods or services that they know or have reason to know is being used to harm consumers through impersonation”.