Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

U.S. Bank offers personal and business savings accounts that pay interest, though interest rates vary by ZIP code. Generally, U.S. Bank’s savings interest rates are much lower than national averages, though they can still add a few dollars to your account over time if you hold a large enough balance.

Whether you currently hold a U.S. Bank savings account or are thinking about signing up, here’s everything you need to know about U.S. Bank savings account interest rates.

Rates are accurate as of Feb. 1, 2023, for the New York ZIP code of 10001. Check U.S. Bank’s website to find rates in your area.

How To Find U.S. Bank Savings Account Interest Rates

Whether you’re shopping for a savings account as a consumer or a business owner, U.S. Bank’s savings rates are easy to find.

U.S. Bank Savings Rates for Consumers

U.S. Bank savings account interest rates are published on the bank’s website, but they can be a bit tricky to find if you don’t know where to look. From the savings account product page, scroll down until you see the options for account types. Select “Learn more” under the relevant account to bring up the product page.

You may be asked to enter your ZIP code to view savings account interest rates in your region. Once you’ve entered your ZIP code, or if you previously provided it, you’ll see the current U.S. Bank savings account interest rates.

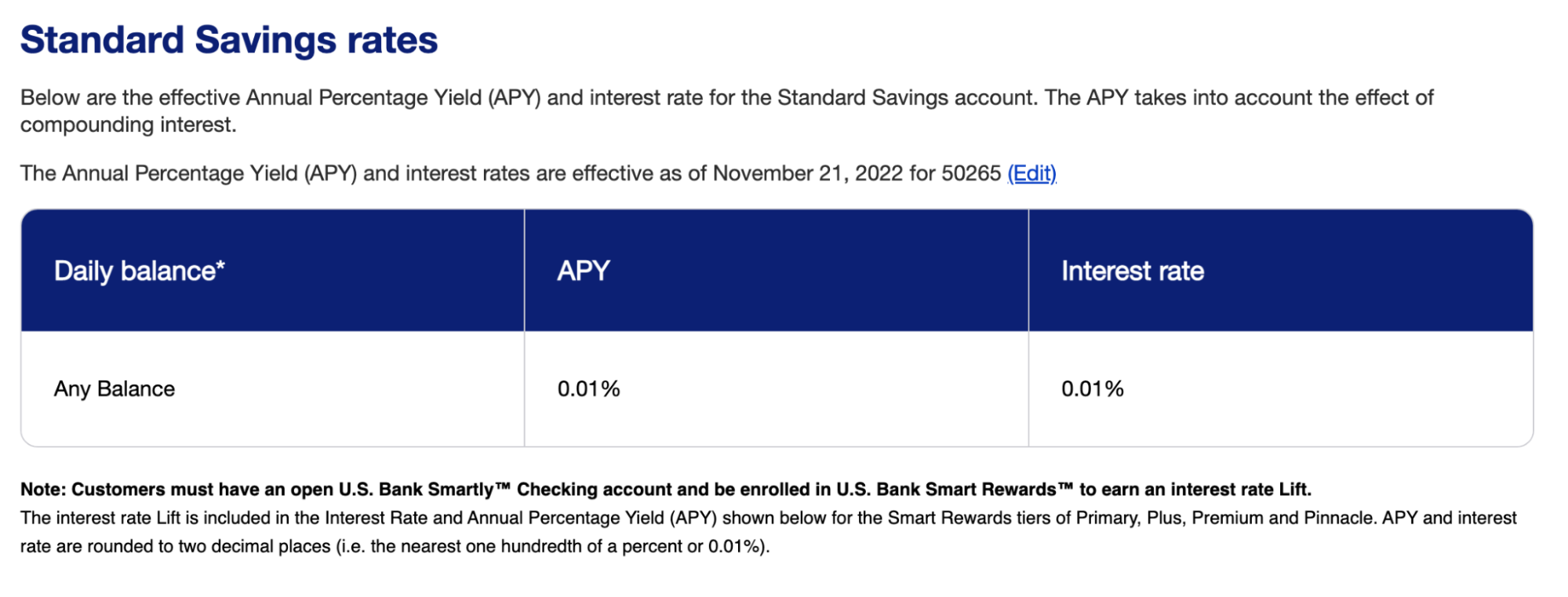

Depending on where you live, here’s what you’ll see when looking for interest rates for a Standard Savings account. U.S. Bank pays a single interest rate tier, regardless of your savings account balance.

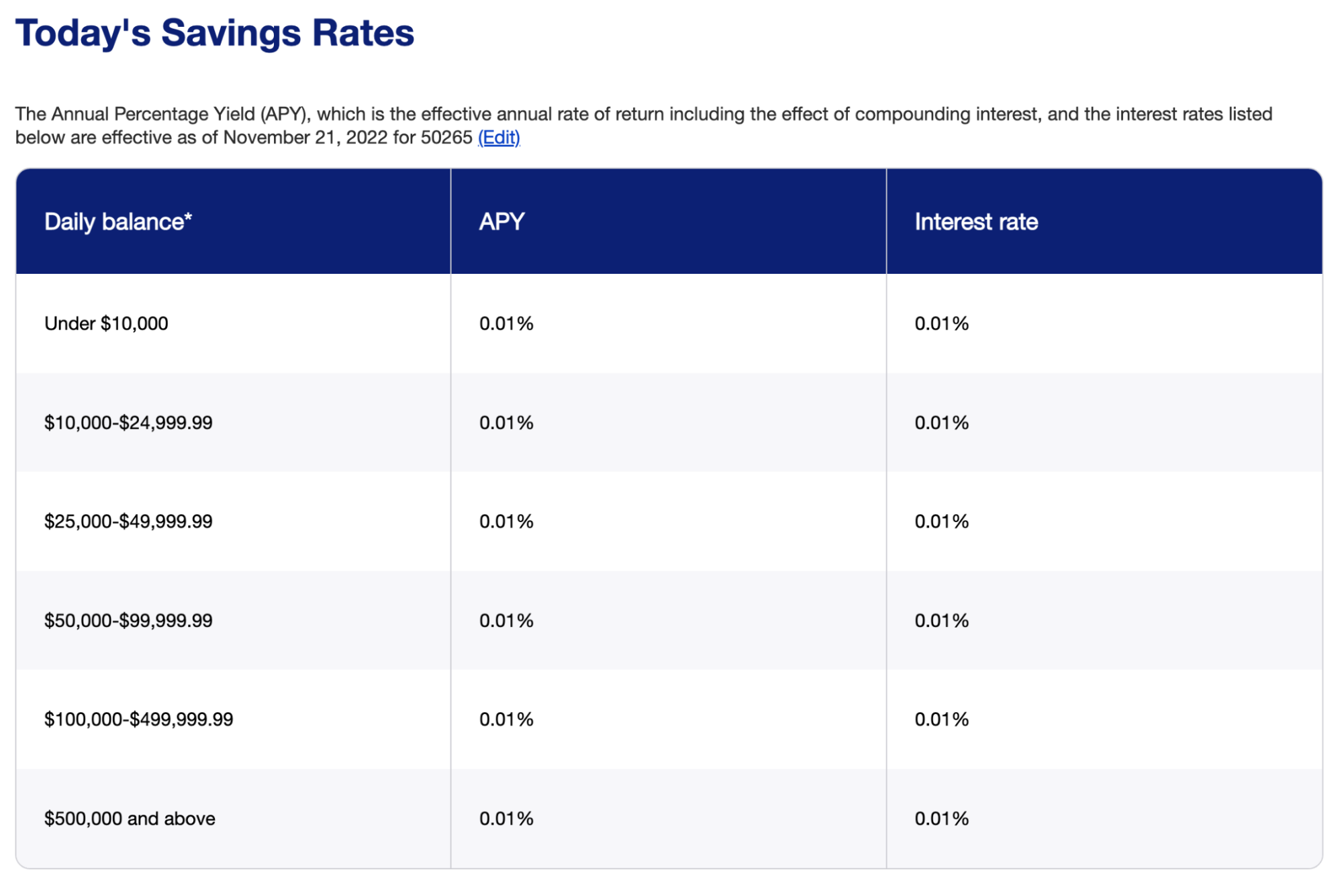

And here’s what you may see if you look for savings rates on the U.S. Bank Elite Money Market Savings Account, which offers tiered interest rates based on your daily balance.

If you have an existing U.S. Bank account but aren’t sure about your APY, you can call the bank’s customer service and ask for your account’s current interest rate.

U.S. Bank Savings Rates for Business Customers

To find U.S. Bank’s savings account interest rates for business accounts, visit the business savings rates page, enter your ZIP code if prompted and you’ll see current savings rates for small business savings and money market accounts.

All of U.S. Bank’s savings accounts for business customers offer a tiered rate structure. Below is an example of the rates you might see on U.S. Bank business savings accounts.

How U.S. Bank Savings Rates Compare

At 0.01% APY, U.S. Bank interest rates on savings accounts are extremely low. That’s well below the national average rates on savings accounts. What’s more, the best online banks sometimes offer rates of 3% or more on savings accounts, which is 300 times greater than what U.S. Bank offers.

If you want to earn more on your savings, consider one of the best high-yield savings accounts. With savings rates predicted to go up in 2023, moving money from an account earning little interest into a high-yield savings account is wise.

How To Open a U.S. Bank Savings Account

You can open a new U.S. Bank savings account online, over the phone or in person at a branch. To open an account online, visit the U.S. Bank savings account landing page, choose the account you want and select “Start saving” to begin an online application.

If you currently bank with U.S. Bank, you can access a quicker application process by logging into your account. When you apply for a U.S. Bank savings account online, you’ll be prompted to log in if you have an existing account.

Finally, U.S. Bank frequently offers promotional bonuses to new customers who open checking and savings accounts. Check out current U.S. Bank bonus offerings if you’re considering opening a U.S. Bank savings account.

Find The Best Online Savings Accounts Of 2023

How Often Is Interest Compounded on U.S. Bank Savings Accounts?

All U.S. Bank savings accounts compound interest daily. The bank calculates interest earned using a daily periodic rate applied to your daily balance. Although interest is compounded daily on all U.S. Bank savings accounts, it is generally paid monthly.

How Do I Close My U.S. Bank Savings Account?

If you currently hold a U.S. Bank consumer savings account, you can close your account over the phone or via a written request. To close your account over the phone call 1-800-US-BANKS (872-2657) and speak with a customer service representative. There’s no option to close your account using the automated phone system, so you must speak with a representative.

Alternatively, savings customers can submit a written request to close an account. Include your account number and signature and send the request to:

Customer Care Unit

PO Box 64991

Saint Paul, MN 55164-9505

Small business owners can close a savings account by calling the small business customer service line at 1-888-329-7179.

Finally, both consumers and small business customers can close accounts by visiting a U.S. Bank branch location.

How To Find Your U.S. Bank Savings Account Number

Following these steps to access your U.S. Bank savings account number.

- Log into your account at usbank.com.

- Select “My Accounts” at the top of the page to view a list of your accounts.

- Select your savings account.

- Select “Show” in the “Account Overview” section to view your full account number.

You can also find your savings account number using the U.S. Bank mobile app. First select your account, then tap “Account options” and “View account information.” Finally, select “Account number” to view your routing number and account number.

If you don’t have access to U.S. Bank’s online banking portal or mobile app, you’ll need to go into a branch to retrieve your account number. U.S. Bank representatives are not able to provide account numbers over the phone.

Bottom Line

U.S. Bank savings account interest rates lag behind the national average. If you’re relying on the interest paid on your U.S. Bank savings account, it might be time to move your funds into a high-yield savings account at another bank.

Interested in an American Express High Yield Savings Account?

Learn About Benefits and Fees – Terms Apply.

On American Express National Bank’s Website, Member FDIC