Bank failures in the US may accelerate Japanese banks’ move to yen bonds after Japanese lenders dumped foreign bonds, especially Treasurys, at the fastest pace in almost two decades.

The collapse of Silicon Valley Bank and Signature Bank has increased uncertainties around the US Federal Reserve’s monetary policy, analysts said. At the same time, expectations are rising that the Bank of Japan, under incoming governor Kazuo Ueda, would further relax its yield curve control policy and allow long-term government bond yields to rise to 1.0% from the current 0.5% limit. That will make Japanese government bonds (JGBs) more attractive.

“Taking a marginal return from yen bonds would be better than losing money in the holding of foreign bonds,” said Makoto Kikuchi, CEO of Myojo Asset Management. “For Japanese banks, yen bonds are relatively better than foreign bonds.”

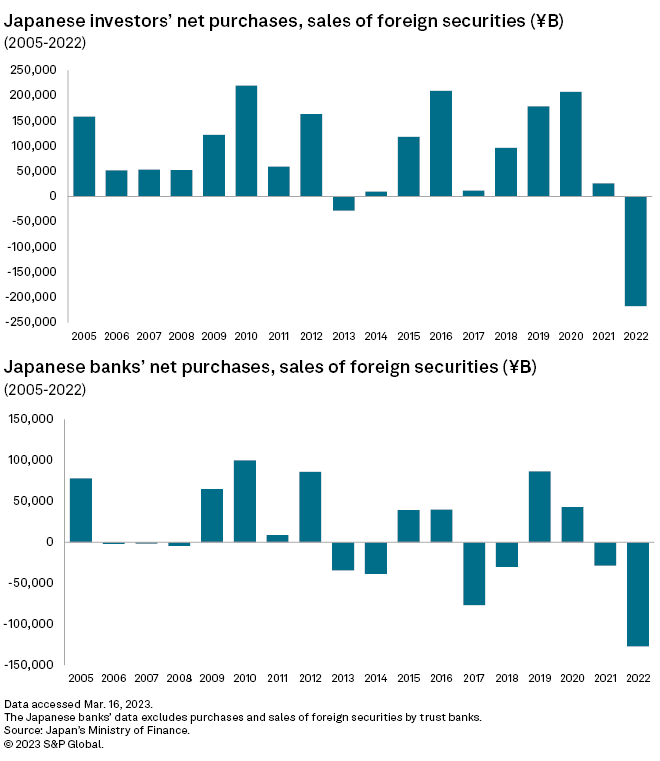

Japanese banks sold a net ¥12.690 trillion of foreign debt in 2022, the largest amount since the tracking of comparable numbers began in 2005, according to Ministry of Finance data. Before Silicon Valley Bank collapsed, the Fed started indicating that policy tightening would likely continue for a while longer as inflation remained high. However, the banking turmoil has prompted calls for the Fed to pause.

READ MORE about the liquidity crunch and the fallout for the financial sector in our new Issue in Focus.

Negative returns

“I doubt [Japanese investors] will make a big bet on foreign bonds this year just because they would continue to suffer a negative return,” Yasunari Ueno, chief market economist at Mizuho Securities Co. “Given that, they will likely incline toward yen bonds.”

Japanese investors have been hit by higher US interest rates that increase financing and currency hedge costs, squeezing carry trades, in which the investors borrow at low rates and invest in higher-yielding assets.

“We’re taking an interest in yen bonds given a potential rise in interest rate,” said a spokesperson at The Norinchukin Bank, a large institutional investor for agricultural cooperatives in Japan. “But we have a sense of caution about the US market.”

The lender posted an unrealized loss of about ¥1.8 trillion on foreign bonds at the end of its fiscal third quarter in December, while its valuation loss on domestic fixed-income securities was around ¥400 billion.

Treading with caution

Still, Japanese banks will not rush to Japanese government bonds. Japanese investors would consider buying JGBs when the 10-year yield reaches 1%, The Nikkei reported March 3, citing Masamichi Koike, head of the treasury unit at Sumitomo Mitsui Banking.

Investors risk valuation losses on JGBs if yields rise after they buy, just as they are mired in bloated unrealized losses on foreign bonds, analysts said.

The Bank of Japan may decide to amend the yield curve control policy at Ueda’s first policy meeting as governor in late-April, said Takahide Kiuchi, executive economist at Nomura Research Institute. Ueda will likely expand a target band of the 10-year yield to 1.0%, or scrap the yield curve control policy altogether. The central bank surprised markets in December 2022 by widening the tolerance band to 0.5% from 0.25%.

“We’ll consider reinvestment into yen bonds by assessing risk reward when the monetary policy is adjusted to normalize the yield curve,” a Mizuho Financial Group executive dealing with fixed-income investments said on condition of anonymity. “We’ll remain cautious about foreign bonds investment until the Fed’s monetary policy becomes clear and the uncertain prospects for the inflation subsides.”

As of March 17, US$1 was equivalent to ¥132.16.