Among the key news on UK stocks, FTSE 100-listed Rolls-Royce Holdings PLC (GB:RR) received a Buy rating from Deutsche Bank amid the ongoing headwinds in the industry. Yesterday, analyst Christophe Menard from Deutsche Bank raised his price target on RR stock from 465p to 555p, predicting an upside of nearly 20%.

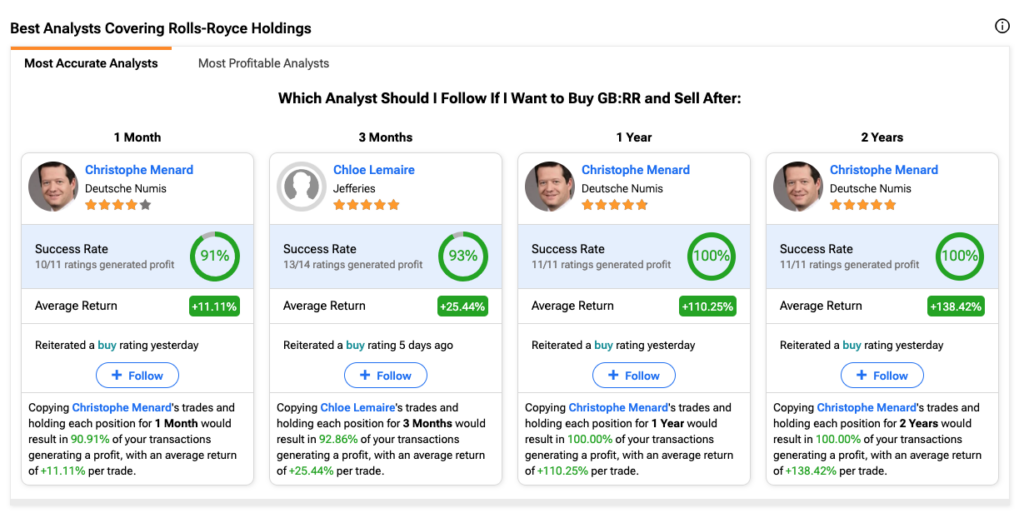

Menard is a five-star-rated analyst as per the TipRanks Star Ranking tool. Through this tool, TipRanks monitors the performance of many financial experts, ranking them based on their success rate, average returns, and statistical significance.

Over the last year, Menard has achieved a 100% success rate, ranking him among the most accurate analysts for Rolls-Royce stock.

Rolls-Royce specializes in designing engines and power systems for the aerospace and defence industries globally.

Deutsche Bank’s Bullish Stance

Menard is bullish on the company’s financial performance and its successful ongoing transformation program. Menard stated that while long-term forecasts remain mostly unchanged, the rating is mainly supported by his increased confidence in Rolls-Royce’s capability to accomplish its transformation objectives.

Meanwhile, Citi analyst Charles Armitage also confirmed his Buy rating on the stock yesterday, implying a growth rate of 19.3%.

RR Shares Fell on Industry Turbulence

RR shares fell by over 2% yesterday after European aircraft manufacturer Airbus SE (EADSY) (FR:AIR) trimmed its FY24 delivery forecast to 770 aircraft, down from the previous guidance of 800 deliveries. Airbus stated that it is struggling with supply chain issues related to its engines, aerostructures, and cabin equipment, resulting in reduced targets. This led to a wave of shock among the European aerospace and defence players.

Airbus added that it is also facing supply issues with the Rolls-Royce Trent 7000 used on its A330neo aircraft. Airbus uses Rolls-Royce engines on its popular aircraft models, including the A330 and A350. The Trent 7000 is a high-bypass turbofan engine designed specifically for use in the Airbus A330neo aircraft.

In its first trading update of 2024, released in May, RR also highlighted industry-wide supply challenges. Nonetheless, it maintained its full-year guidance for 2024, praising its operating profits and cash growth.

Rolls-Royce will publish its first-half results for 2024 on August 1.

Is Rolls-Royce a Good Stock to Buy?

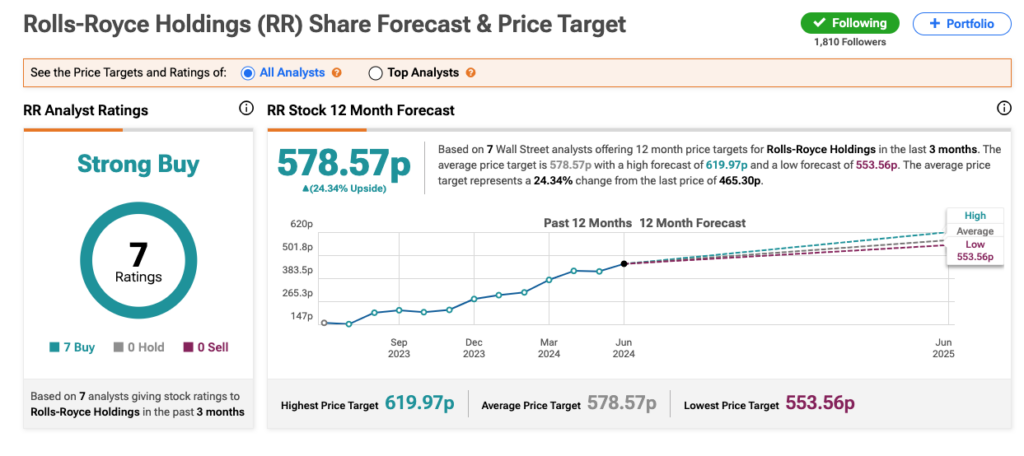

According to TipRanks, RR stock has received a Strong Buy rating based on all Buy recommendations from seven analysts. The Rolls-Royce share price forecast is 578.57p, which is 24.3% higher than the current trading level.