November 16, 2023

Frédérique Carrier

Managing Director, Head of Investment Strategy

RBC Europe Limited

A struggling economy

Observers breathed a sigh of relief when it was revealed that UK GDP was

flat quarter over quarter in Q3, against consensus expectations of a

contraction. However, any celebrations were short-lived; as for 2023

overall, the economy has hardly grown.

In fact, we think economic data is likely to slip further as the full

impact of much higher interest rates increasingly filters through to the

economy. This could be partly offset by an improvement in real wages as

inflation declines. Much will depend on the labour market. The risk is

that it could weaken should the impact of higher rates put pressure on

corporate margins. For now, the Office for National Statistics estimates

that the unemployment rate stabilised at 4.2 percent over the three months

to September, having been as low as 3.6 percent a year ago. Consensus

expects GDP growth of a mere 0.4 percent in 2024, on par with what it

projects for 2023.

Despite this economic weakness, we believe the Bank of England (BoE) will

likely maintain the Bank Rate, currently at 5.25 percent, elevated for

much of 2024. Inflation excluding food and energy prices has waned but

remains elevated, at 5.7 percent. Over the next couple of months, a more

flattering year-over-year comparison could result in lower inflation. But

RBC BlueBay Asset Management Chief Investment Officer Mark Dowding points

out that the BoE will be alert to long-term inflation expectations

remaining elevated or “de-anchoring.” The government has been very vocal

in its promise to “halve inflation” by next month. Given the starting

point was double-digit inflation, it seems to have directed the public to

expect inflation of some five percent at year end. High inflation

expectations increase the risk of inflation becoming entrenched.

Dowding also surmises that inflationary pressures could be increased if

the UK government announces additional tax cuts at the upcoming Autumn

Statement. The UK finances are in poor shape, but the Conservative

government is in a precarious position, having trailed the opposition

Labour Party in the polls for close to two years. It may be tempted to

shore up its fortunes with feel-good measures ahead of what will likely be

an election year. Though it is not our base case, the risk is that the BoE

may well need to hike again in 2024 to bring inflation lower.

RBC BlueBay thinks the UK is facing a high risk of stagflation, a state

characterized by low economic growth, high inflation, and rising

unemployment.

Will there be a changing of the guard?

Given that the traditionally left wing Labour Party has held a

consistently large lead in the polls for more than a year, we think it is

worth considering how it could govern once in power.

Under Sir Keir Starmer’s leadership, Labour has changed its spots. The

policies of its radical left wing faction, from imposing higher taxes on

high earners to nationalizing utilities, have been abandoned. The party

seems to have moved successfully to the centre, and it has markedly

improved ties with the corporate sector. Overall, we do not think a Labour

win would incite strong negative reaction in financial markets.

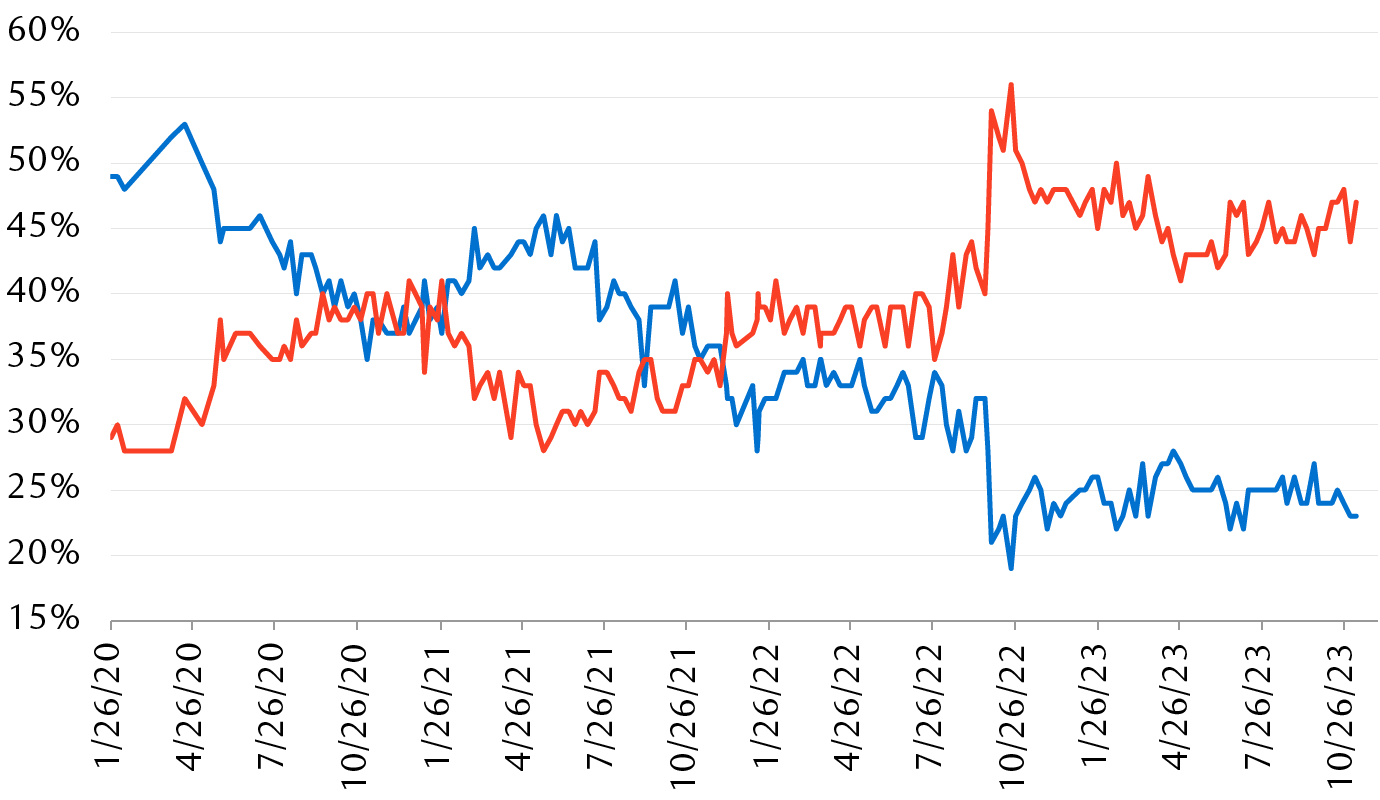

Labour has outperformed the Conservatives for two years

Westminster voting intention tracker

Line chart showing the voting intentions in the UK for the two main parties, the ruling Conservatives and Labour, for the period of January 26, 2020, through November 8, 2023. Since November 2021, Labour has gained an advantage. The gap has markedly widened since September 2022 and Labour now commands 47% of the vote intentions compared to 23% for the Conservatives.

Source – YouGov; data as of 11/8/23

At its recently held Labour Party conference, Starmer stated that the

party aims for a closer relationship with the EU including regulatory

alignment of “certain sectors” and accepting some oversight of the

European Court of Justice. It is also looking to deregulate the planning

process for new homes, to strengthen employment rights, and to forge ahead

with the transition to a low-carbon economy.

Some of these goals may be difficult to achieve. The EU is unlikely to

accept this cherry-picking approach, and planning deregulation may

continue to meet fierce opposition as it threatens to change the

landscape. Importantly, Labour would inherit a country with deep scars—not

only from Brexit, but also from the BoE’s fastest monetary policy

tightening spree in three decades—and heavily indebted with gross debt to

GDP approaching 100 percent. This may limit a new government’s ability to

reboot the economy.

Opportunities in an unloved market

We acknowledge the challenging domestic economic prospects but recommend a

Market Weight exposure to UK equities. We believe the market’s defensive

qualities should hold it in good stead given the more volatile backdrop we

are expecting for the global economy and global equities in 2024. The UK’s

blue-chip equity index, the FTSE 100, has a relatively large exposure to

defensive sectors (e.g., Health Care and Consumer Staples). Moreover, it

has a bias to “old economy” industries, including Energy (approximately 14

percent of the FTSE 100), a sector where the risk-reward is favourable at

present, in our view, given the tight supply-side dynamics, inexpensive

valuations, and improving earnings momentum. Importantly, UK equity

valuations are undemanding, with almost every sector trading on an

abnormally high discount relative to history.

Given the challenging domestic economic prospects, we remain cautious on

domestic stocks. We continue to recommend maintaining a bias for globally

diverse, high-quality businesses. Across the market, the valuation

multiples of many leading UK-listed global companies remain at a notable

discount versus their international peers listed in other markets. We view

this unwarranted “UK market discount” on these global companies as an

opportunity for long-term investors in these stocks.

UK fixed income is an interesting asset class with yields elevated and the

BoE close to the peak of its hiking cycle. We are somewhat concerned about

the heavy Treasury issuance schedule however, so for non-UK-based

investors, we suggest a Market Weight in Gilts with a bias to shift to

Overweight in the near term.

For UK-based investors, the tax treatment of Gilts makes them an

attractive investment. Gilts are exempt from capital gains tax, so no tax

is paid on any profit realized when the Gilt matures—only income tax on

the coupon is paid. This is particularly useful for higher-rate taxpayers,

who would otherwise pay capital gains tax at 20 percent.

With contributions from Thomas McGarrity, CFA

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.

Managing Director, Head of Investment Strategy

RBC Europe Limited