UK’s Shooting Industry Battles Debarking: Banking Woes Threaten Livelihood

Shooting businesses in the UK, encompassing clubs, syndicates, and gun shops, are grappling with a significant banking hurdle known as debanking. Major banks have been abruptly ending their relationship with these businesses, often without sufficient warning or explanation. This issue was acknowledged by the Financial Conduct Authority (FCA), drawing parallels to the challenges encountered by the adult entertainment industry.

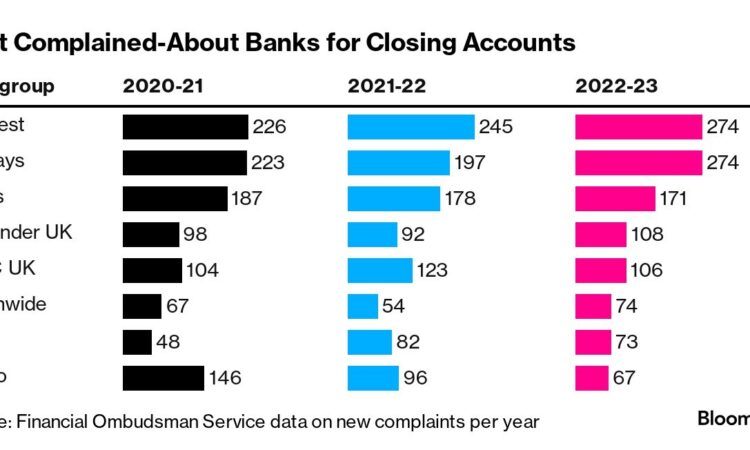

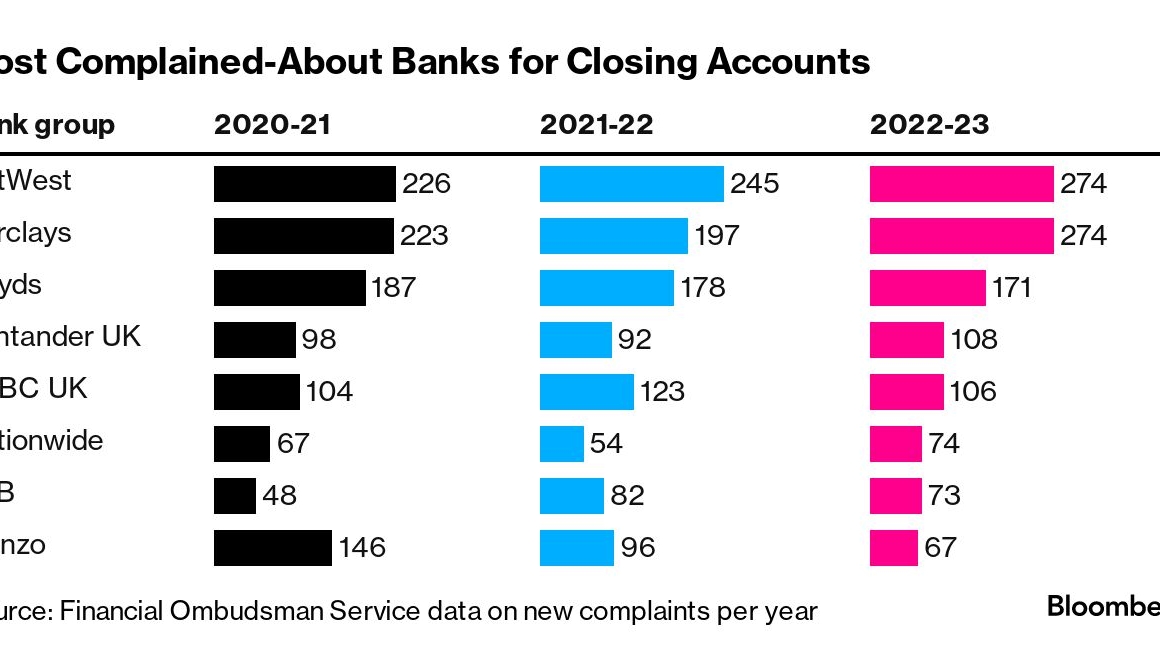

The Unsettling Figures

The British Association of Shooting and Conservation (Basc) has been at the forefront, voicing the unfair banking practices. The association revealed that approximately one in every three shooting businesses have had their accounts closed. Moreover, a staggering 65% have faced obstacles in establishing new accounts. This has resulted in a considerable financial strain and emotional distress for these businesses, particularly those in rural areas.

Case Study: Mill Farm Clay Pigeon Club

An illustrative example is Mill Farm Clay Pigeon Club, which had its Barclays account terminated without notice. This sudden closure not only caused considerable distress but also threatened the continuity of the club’s operations. Banks, such as HSBC, have instituted stringent requirements for opening new accounts, demanding documents like lease agreements and firearms certificates for club members.

FCA to Launch Detailed Report

The FCA has received submissions from the shooting industry, detailing the hurdles they face in maintaining or obtaining a payment account. The authority is slated to release a more comprehensive report later this year, incorporating the industry’s submissions. While the FCA recognized its limited jurisdiction over access to bank and payment accounts, it hinted at the need for policymakers to ponder whether there should be a right to an account for all individuals and organizations.

The Shooting Industry’s Appeal

Basc, representing the shooting industry, contends that the banks’ actions are discriminative against legal businesses, jeopardizing their livelihood. The industry is rallying for equitable access to banking services, particularly in light of the support taxpayers extended to banks during financial crises. Banks like HSBC and Barclays assert that their decisions regarding accounts are in accordance with legal and regulatory obligations and are made following thorough deliberation.