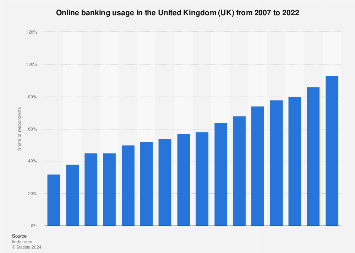

Online banking usage in the UK increased steadily between 2007 and 2022. In 2007, around one third of the British population used online banking, which increased up to over 90 percent as of 2022. Banking and financial services are typically among the first industries to embrace technological advances; starting as far back in time as the appearance of automated teller machines (ATMs) and credit cards. Ever since the first secure Internet systems for financial operations became available on a large scale, accessing of one’s bank account online to carry out transactions, pay off credit cards, establish credit lines or invest savings became one of the fastest growing areas of Internet activities.

Leading online banks in the UK

There are several online banks headquartered the UK, including Revolut, Monzo, Starling, Monese, and Atom Bank. As of 2022, Monzo was the most well-known, popular, and used online bank, followed by Starling and Revolut. Established in 2015, Monzo is one of a growing number of disruptor or challenger banks which run accounts online through mobile apps. As of 2023, Monzo customers were concentrated in the UK, as 82 percent of all downloads of the banking app originated from there.

Online banking in Europe

Across Europe, online banking penetration varied greatly by country. Nordic countries including Norway, Icelad, Finland, and Denmark all had online banking penetration rates of over 90 percent. In stark contrast, Albania, Montenegro, and Bosnia and Herzegovina had penetration rates lower than 15 percent.