Banks employ various strategies to attract and retain their customer base, such as cheap overdrafts, in-credit interest and no withdrawal charges. While the number of new and active customers can be easily observed, customer satisfaction is trickier. Knowing how customers feel about the service received can help banks adjust to the dynamics of an increasingly competitive market.

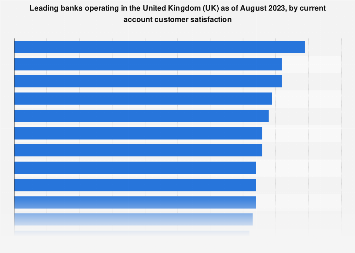

Customer satisfaction for leading banks in the United Kingdom (UK)

According to the Which? customer satisfaction survey, as of August 2023, approximately 89 percent of customers of Starling were satisfied with the banks’ services and products, and willing to recommend them to their friends. Another online-only bank, Monzo Bank, completed the top together with First Direct, both with 82 percent.

Investment in selected European countries

Among the services that aim at making banking more customer-oriented and effortless is the current account switch service (CASS). CASS allows customers to change their bank account hassle-free, redirecting transactions and transferring payment arrangements. As of the second quarter of 2023, five out of 20 banks observed increased their customer base following the CASS process. The highest gain-to-loss ratios were recorded by Tesco and HSBC, gaining respectively 0.7 and 0.6 times more new customers than the ones lost to other banks.