UK inflation lower than expected at 4% as Bank of England eyes rate cuts – business live | Business

Mild UK inflation supports interest rate cuts in May, say economists

UK inflation has remained unchanged at 4%, surprising economists who had predicted a small increase to 4.2%.

The figures showed the first monthly fall in food prices for more than two years. Food and non-alcoholic drink prices fell at a monthly rate of 0.4% in January, the first monthly decline since May 2021, driven by price cuts in January for bread and cereals, cream crackers, sponge cake and chocolate biscuits. Furniture and household goods prices also fell.

That offset the rise in gas and electricity costs after the Great British energy regulator raised its price cap.

You can read our full report here:

The lower-than-expected figure gives some relief to the Bank of England, which is expected to start a cycle of interest rate cuts in the coming months. It suggests that inflation is on a downward trajectory.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, said:

Looking ahead, it remains likely that the headline rate of CPI inflation will fall back to about 2.0% in April and then modestly undershoot the 2% target over the following six months.

He cites some key factors ahead for the UK. Great Britain’s energy regulator Ofgem is expected to cut the energy price cap by about 15% in April. The government will probably freeze fuel duty, as it has done for a decade. And food price inflation is expected to remain low as well.

Tombs expects this to persuade the Bank of England’s rate-setting monetary policy committee (MPC) that interest rates can fall in the coming months:

We continue to think that CPI outturns over the coming months will convince the MPC in the second quarter that monetary policy does not need to be quite as “restrictive” as it is currently, though it looks like a toss-up whether the committee will opt to cut bank rate for the first time in May or June.

Martin Beck, chief economic advisor to the EY Item Club, an economic forecaster, said:

The EY Item Club continues to think that CPI inflation should fall to, and perhaps even below, the Bank of England’s 2% target over the next few months. Lower wholesale gas prices mean energy bills are on course to fall by around 15% in April when the Ofgem cap, which governs the typical household energy bill, is recalculated. And if the most recent decline in gas prices (which are now well below levels just prior to Russia’s invasion of Ukraine) is maintained, another double-digit percentage fall in bills could be on the cards for July.

Disruption to shipping due to geopolitical tensions presents a potential risk to inflation’s descent. But with shipping costs only a tiny part of the price consumers pay for goods, that inflationary risk looks modest at present. Overall, the latest inflation data should reassure the MPC that the time to start cutting interest rates is approaching. The EY Item Club continues to expect the first cut in bank rate in May.

Key events

Nobody appears to be dissenting that UK inflation and interest rates are both headed downwards in the coming months.

Simon French, chief economist at Panmure Gordon, an investment bank, has not seen anything from the latest data to go against that:

UK CPI inflation level at 4.0% YoY in January. Unchanged on Dec. Always the hardest month to draw insight from given basket rotation/retailer discounting. Message is that inflation is down by almost 2/3rds from peak – & will come down further over the next couple of quarters.

— Simon French (@shjfrench) February 14, 2024

Indeed, the “softening” of core inflation is the most important number from January’s inflation figures, he argues.

Most important data point from first glance of UK inflation data – seasonally adjusted core CPI softer in January (+0.1% MoM) after an upside blip in December. Continues softening trend – but April remains key for a potential uptick. https://t.co/1Hpp8h2dAc pic.twitter.com/xHsZgRs8qM

— Simon French (@shjfrench) February 14, 2024

Julian Jessop, an economist affiliated with the Institue of Economic Affairs, a right-wing thinktank, said that retail discounts in homeware and furniture shops may have been at play:

#Inflation held down by a further fall in #food price inflation and weakness in ‘furniture and household goods’ and ‘clothing and footwear’ – consistent with the idea that December’s slump in #retail sales has prompted some heavier discounting… pic.twitter.com/OFFAQYNwsF

— Julian Jessop (@julianHjessop) February 14, 2024

Lydia Prieg, head of economics at the New Economics Foundation, a left-wing thinktank, said the Bank of England should switch its focus from fighting inflation to fighting to support the UK economy.

No change in inflation between Jan & Dec despite the energy price cap going up. Bank of England expects inflation to return to 2% target by May. A potential recession is now a greater threat than inflation, and the Bank of England should cut rates sooner rather than later [1/4]

— Lydia Prieg (@LydiaPrieg) February 14, 2024

It looks like the prospect of lower interest rates has helped UK housebuilder stocks, as demand for new housing is helped by cheaper borrowing costs.

Persimmon is the second-biggest riser on the FTSE 100, up 3%, while Taylor Wimpey has gained 1.9%.

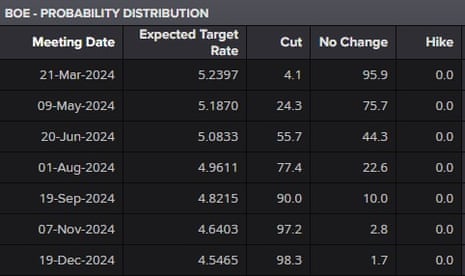

Let’s take a look at what financial markets are saying on the prospects for UK interest rates.

The below table shows the likelihood of interest rate moves at each meeting of the Bank of England’s monetary policy committee – according to the bets of financial traders. It shows that in May traders think there is a one-in-four chance of a rate cut.

However, in June that rises to a 55.7% chance of a rate cut. And by December markets are pricing in almost three rate cuts.

If the Bank goes through with three cuts that would leave interest rates at 4.5% by the end of the year, down from 5.25% now.

Mild UK inflation supports interest rate cuts in May, say economists

UK inflation has remained unchanged at 4%, surprising economists who had predicted a small increase to 4.2%.

The figures showed the first monthly fall in food prices for more than two years. Food and non-alcoholic drink prices fell at a monthly rate of 0.4% in January, the first monthly decline since May 2021, driven by price cuts in January for bread and cereals, cream crackers, sponge cake and chocolate biscuits. Furniture and household goods prices also fell.

That offset the rise in gas and electricity costs after the Great British energy regulator raised its price cap.

You can read our full report here:

The lower-than-expected figure gives some relief to the Bank of England, which is expected to start a cycle of interest rate cuts in the coming months. It suggests that inflation is on a downward trajectory.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, said:

Looking ahead, it remains likely that the headline rate of CPI inflation will fall back to about 2.0% in April and then modestly undershoot the 2% target over the following six months.

He cites some key factors ahead for the UK. Great Britain’s energy regulator Ofgem is expected to cut the energy price cap by about 15% in April. The government will probably freeze fuel duty, as it has done for a decade. And food price inflation is expected to remain low as well.

Tombs expects this to persuade the Bank of England’s rate-setting monetary policy committee (MPC) that interest rates can fall in the coming months:

We continue to think that CPI outturns over the coming months will convince the MPC in the second quarter that monetary policy does not need to be quite as “restrictive” as it is currently, though it looks like a toss-up whether the committee will opt to cut bank rate for the first time in May or June.

Martin Beck, chief economic advisor to the EY Item Club, an economic forecaster, said:

The EY Item Club continues to think that CPI inflation should fall to, and perhaps even below, the Bank of England’s 2% target over the next few months. Lower wholesale gas prices mean energy bills are on course to fall by around 15% in April when the Ofgem cap, which governs the typical household energy bill, is recalculated. And if the most recent decline in gas prices (which are now well below levels just prior to Russia’s invasion of Ukraine) is maintained, another double-digit percentage fall in bills could be on the cards for July.

Disruption to shipping due to geopolitical tensions presents a potential risk to inflation’s descent. But with shipping costs only a tiny part of the price consumers pay for goods, that inflationary risk looks modest at present. Overall, the latest inflation data should reassure the MPC that the time to start cutting interest rates is approaching. The EY Item Club continues to expect the first cut in bank rate in May.

The FTSE 100 has opened up 0.5%, possibly helped by a weaker pound after the inflation data.

London’s blue-chip index has also been helped by strong figures from Coca-Cola Hellenic Bottling Company, a distributor of the soft drink which is up 5% in the opening trades.

Across Europe it has been a less rousing start to the trading day. Here are the opening snap reports on stock markets, via Reuters:

-

EUROPE’S STOXX 600 FLAT

-

FRANCE’S CAC 40 DOWN 0.2%, SPAIN’S IBEX UP 0.2%

-

EURO STOXX INDEX DOWN 0.1%

-

EURO ZONE BLUE CHIPS DOWN 0.2%

-

GERMANY’S DA FLAT

The weaker pound appears to be helping prospects for the FTSE 100 companies, which make the bulk of their earnings in other currencies.

FTSE 100 futures suggest the index will gain 0.5% when they open in about 15 minutes’ time.

The Bank of England is gearing up to cut interest rates. That would generally be expected to push up inflation, so Bank governor Andrew Bailey would be in a tricky position if headline inflation were rising.

As it is, financial markets are looking more comfortable with the idea that several cuts in the main lending rate, bank rate, are on the way.

UK interest rate futures show that markets have increased their bets on rate cuts during 2024. They imply that rates will fall by 0.71 percentage points during 2024, up from 0.58% before the data, according to Reuters.

Bank rate is at 5.25%, so that would suggest nearly three interest rate cuts during 2024 (assuming each cut is 0.25 percentage points).

This is a relief to the government and Bank of England

Core inflation was lower than thought, services inflation edged up less than expected, and monthly price growth was -0.6%, double the forecast drop

£ at a 1-week low – traders were braced for a nasty shock after US CPI

— Lizzy Burden (@lizzzburden) February 14, 2024

Jeremy Hunt may not be the only person feeling somewhat relieved this morning: for the Bank of England it will likely forestall criticisms of its monetary policy stance.

The reaction on financial markets suggests that may be the case: sterling has dipped by 0.14% against the US dollar and 0.2% against the euro. That move usually suggests a bet on lower rates (which are less attractive for investors able to move their money all over the world in search of better returns).

Here is the graph showing the move in sterling as the lower-than-expected inflation reading came in:

The political reaction to the inflation reading has started.

Here is what chancellor Jeremy Hunt had to say:

Inflation never falls in a perfect straight line, but the plan is working; we have made huge progress in bringing inflation down from 11%, and the Bank of England forecast that it will fall to around 2% in a matter of months.

Rachel Reeves, Labour’s shadow chancellor, said:

After 14 years of economic failure working people are worse off. Prices are still rising in the shops, with the average households’ costs up £110 a week compared to before the last election. Inflation is still higher than the Bank of England’s target and millions of families are struggling with the cost of living.

The Conservatives cannot fix the economy because they are the reason it is broken. It’s time for change. Only Labour has a long-term plan to get Britain’s future back by delivering more jobs, more investment and cheaper bills.

We usually quote inflation as an annual number, but the monthly reading also suggests the downward trajectory: on a monthly basis, the consumer price index (CPI) fell by 0.6% in January.

The core measure of CPI also remained unchanged in January, at 5.1% annually. And that was lower than the 5.2% expected by economists. The core measure ignores volatile energy, food, alcohol and tobacco to try to get a more accurate picture of underlying inflationary pressures.

The headline inflation reading supports the interpretation (see opening post) that price pressures are easing in the UK.

Here is the ONS’s graph showing that trajectory, starting in 2014. Inflation spiked in 2022 after Russia’s full-scale invasion rocked global energy markets, before falling back as those increases faded.

Rising energy prices – after Great Britain’s energy regulator raised the price cap – were the main reason that inflation stayed at 4%, according to the UK’s Office for National Statistics (ONS).

But it was furniture and household goods that prevented the expected increase.

It said:

The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from housing and household services (principally higher gas and electricity charges), while the largest downward contribution came from furniture and household goods, and food and non-alcoholic beverages.

UK inflation stays flat at 4% in January

Newsflash: The UK’s consumer price index (CPI) inflation has stayed flat at 4% in January – unchanged from December.

Economists had expected a small increase to 4.2%, so this is a softer reading than expected.

UK inflation expected to rise, say economists

Good morning, and welcome to our live, rolling coverage of business, economics and financial markets.

UK inflation has fallen sharply in the last year as the global energy market has calmed down following the chaos caused by Russia’s full-scale invasion of Ukraine. But inflation may well have ticked upwards in January: we will find out whether that was indeed the case at 7am UK time.

Economists are forecasting a small increase in the UK’s consumer price index (CPI) in January. A poll by Reuters of economists suggests that inflation will rise from 4% in December to 4.2%.

That would be a second consecutive monthly increase, although still well down from its 41-year high of 11.1% in October 2022. The below chart shows the data for the last five years up to December.

Sanjay Raja, senior economist at Deutsche Bank, said:

After headline inflation surprised to the upside in December, we expect a further – albeit marginal – jump in inflationary pressure.

However, Raja warns against getting too excited if inflation does rise as expected. The rate will be “lifted in large part by positive base effects”, meaning that the index was temporarily lower last year than would otherwise be expected. That has partly been caused by increases in January to the government’s energy price cap And factory prices tracked by the producer prices index (PPI) are also softening, which should eventually be passed through to slowing inflation for consumers.

Raja said:

Looking ahead, we continue to see disinflationary pressures build, consistent with slowing survey and PPI data. We see CPI slowing below 2% year-on-year in [the second quarter of 2024], before edging a little above 2% through [the second half of 2024].

Looking ahead, we also have the second estimate for eurozone GDP. The first reading showed 0% growth. That’s hardly something to write home about, but it took economists by surprise, and meant that the bloc avoided a technical recession.

We will be on the lookout for any downward revisions for the fourth quarter, which would mean that the eurozone was, in fact, in a technical recession. Downward revision or not, it would hardly change the situation: Europe’s economy is stuttering as Germany struggles.

The agenda

-

7am GMT: UK consumer price index inflation (January; previous: 4% annual; consensus: 4.2%)

-

10am GMT: Eurozone GDP growth rate (fourth quarter of 2023; prev.: 0.1% quarter-on-quarter; cons.: 0%)

-

10am GMT: Eurozone industrial production (December; prev.: -6.8% year-on-year; cons.: -4.1%)